The Power of Mortgage Pre-Approval

Buying a house in any market is a big decision but entering today’s housing market can feel intimidating. You want to do it right and you want the process to be as stress-free and uncomplicated as possible.

One thing you can do to help you prepare is to get pre-approved.

Getting pre-approved for a home loan is an easy process that provides a realistic picture of what you can qualify for so you do not end up falling in love with a property outside of your budget. It will also help you move more quickly when you find that perfect place, giving you a better chance of scoring your dream home before someone else has the chance.

If you are considering buying a home this year, take the first step and get pre-approved today, or read more about what is involved.

Understanding the Difference: Pre-Qualification vs. Pre-Approval

Pre-Qualification

Pre-qualification is the first step in your mortgage application process. It will help you to understand the approximate loan amount you can expect to qualify for. You will begin by sharing your financial information—debt, income, assets, etc.—with your bank or lender. After reviewing the information, the bank or lender will give a loan estimate. The process is relatively simple, only taking a few business days to process.

Keep in mind that while pre-qualification gives you a rough idea of the mortgage amount you may qualify for, it is not a guarantee. It is more of an informal conversation and does not involve a thorough analysis of your financial documents.

Pre-Approval

On the other hand, pre-approval is a more comprehensive and formal process. Essentially, pre-approval is a snapshot of what you’re likely able to borrow for a home. It’s based largely on information you provide to a lender, so the final amount could change somewhat once you’ve gone through the full underwriting process, where an underwriter verifies all of the necessary information to understand what you’ll be able to comfortably borrow. Pre-approval also usually involves a credit check so the information is more solidly based.

What to Expect During the Mortgage Pre-Approval Process

Pre-approval is the closest you can get to actually taking out a loan without firm commitments on either side (you are not committing to borrow anything, and the lender is not committing fully to lending you anything—yet). So, to get a pre-approval letter that sellers will take seriously, the lender needs to see enough details about your situation to make an accurate estimate of how much they are able to offer you.

The exact personal information you will need to provide may vary, but generally, here’s what you will need to have handy:

- Your full name, address, and contact information

- Employment information, including your employer's name and contact information, job title, and income

- Information about your monthly expenses, including any outstanding debts or other financial obligations

- Documentation of your income, such as pay stubs, W-2s, and tax returns

- Documentation of any assets you have, such as bank statements, investment accounts, or retirement accounts

What Documentation You Need

To get pre-approved, you will need to provide a mortgage lender with a good amount of paperwork. For the typical home buyer, this includes the following:

- Pay stubs from the past 30 days showing your year-to-date income

- Two years of federal tax returns

- Two years of W-2 forms from your employer

- 1099s if you are self-employed

- Bank statements for the past two to three months

- Statements (for the past quarter or 60 days) of all of your asset accounts, including checking and savings, as well as any investment accounts (e.g., CDs, IRAs, and other stocks or bonds)

- Any other current real estate holdings

- Residential history for the past two years, including landlord contact information if you rented

- Proof of funds for the down payment, such as a bank account statement

Why Is Pre-Approval So Powerful?

It is not just about getting a piece of paper. Here are five key benefits that will empower you as a buyer:

- Know Your Budget, Avoid Wasting Time:Knowing how much home you can afford helps you focus on the houses that fit in your budget, saving you time during your house hunt. A lender will review your application and let you know how much they are willing to loan based on your verified income and assets.

- Navigating Multiple-Offer Scenarios:With more buyers than available homes, multiple-offer scenarios are common. Pre-approval becomes your secret weapon, giving you an edge over other buyers. It not only helps you zero in on the right price range but also positions you favorably in the eyes of sellers.

- Speed Up the Process, Close Faster: Once your offer is accepted, you’ll be counting down the days to move in. Unfortunately, the closing process can often drag on, leaving buyers feeling like they’re in post-purchase limbo. Pre-approval will speed up the closing process, since the mortgage approvals have already been taken care of, allowing you to focus on next steps like appraisals and inspections.

- Secure Better Rates, Save Money: Getting preapproved means it's unlikely you'll fail to get financing, and it may also help you pay less in mortgage interest rates. Locking in a favorable interest rate during pre-approval can save you thousands of dollars over the life of your loan, especially if rates are expected to rise. Think of it as an investment in your future financial stability.

How Your Finances Can Affect Your Pre-Approval

When it comes to getting pre-approved for a mortgage, there are several factors that lenders consider, including:

Income: Your lender will check your income to assess the likelihood that you’ll be able to afford the mortgage payment. In general, your lender likely wants to see that your housing costs don’t exceed 28% of your gross income.

Debt: When determining how much you can borrow, a lender will compare your monthly debt payments to your gross monthly income to determine your debt-to-income ratio (DTI). If you have an extensive monthly debt burden – for example, a high DTI ratio – your preapproval amount will be lower. But if you can eliminate some of these debts – such as credit cards or personal loans – from your books, then a lender may be willing to increase your preapproval amount.

Assets: Your assets, such as savings accounts, investment accounts, and retirement accounts, can also impact pre-approval; that’s because lenders want to see that you have enough savings to cover your down payment and closing costs and that you have a financial cushion in case of unexpected expenses.

Credit History: Your credit scores and history help a lender determine whether you qualify for a mortgage within its underwriting structure, as well as the mortgage rate you’ll receive.

Employment History and Income: Your employment history is one part of your background that helps a lender discern your ability to repay the loan. The lender will ask for your employer's name and contact information, your job title, and dates of employment. They may also request a verification of employment from your employer to confirm your income and employment status.

Find the Right Agent

Windermere’s community of real estate professionals is our greatest asset. We have experts in all areas of real estate, from your typical starter home to condos, luxury properties, and new construction. While residential real estate is the mainstay of our business, Windermere also has offices and associates who specialize in property management, commercial real estate, and relocation services. To further facilitate the home buying process, Windermere has affiliated partners in certain regions to provide mortgage, title, and escrow services.

Call us today with any questions or concerns. Our professional Real Estate Agents will help you through this exciting process. (951) 369-8002

Buying a Fixer-Upper: What You Need to Know

If you are relatively handy and do not mind the extra work, buying a fixer-upper could be a great way to save money during the homebuying process. In fact, buying a house that needs work may help you score a home in your ideal location, but be sure the amount of repairs and cost of renovations work for you.

While the process of buying and renovating fixer-upper homes has increased in popularity due to home improvement TV shows, these types of major renovation projects are not for everyone. After all, buying a fixer-upper involves moving into the least desirable home on the block and overseeing its transformation.

So, whether you are considering a fixer-upper as an investment — and you plan to flip it immediately after construction is complete — or you are fixing up a home to make it your own, there is a lot to consider when buying a fixer-upper.

What Is a Fixer-Upper Home?

Fixer-upper homes are houses that are in a livable condition but need some work. The amount of work varies by home and the buyer's intent, although needed repairs are significant enough to warrant a lower sale price. You should note that fixer-upper homes are often listed "as-is" on the market.

Investors buy fixer-uppers to repair and flip them for a profit, while traditional homebuyers may find that the lower sale price is a bargain, provided they budget for repairs and have some DIY plans.

Things to Consider When Buying a Fixer Upper

With that in mind, here’s what it takes to make the purchase of a fixer-upper pay off.

- Cost Analysis

Each home renovation is unique. If you buy a fixer-upper house, the price of rehabbing it can vary tremendously. One house might need new appliances, the walls painted, and the floors sanded. Another might need a new roof and a cracked foundation fixed and maybe even an electrical upgrade. The size of the home, its age, its location, and condition will all impact how much you will need to spend.

It is imperative that you add up all the costs of potential renovations before you buy a fixer-upper house. You do not want the dream of wanting your own home to cloud your judgment about the work that is needed.

Consider the following:

- Assess the upfront cost of the home and add up all potential material and labor needs —plumbers, electricians, roofers, carpenters, all the way down to any new doorknobs you will buy along the way. Then, subtract that from the home’s renovated market value. Would this still be a profitable venture?

- Remember that inflation is currently running high so prices could get higher than what you believe they will cost during the time you are renovating.

- Allow wiggle room in your budget and your timeline for overages. It is not uncommon for home renovations to cost more and take longer than anticipated.

- Pick Projects That Pay

The ideal fixer-uppers are those that require mostly cosmetic improvements — paint touchups, drywall repairs, floor refinishing — which generally cost much less than what they return in market value. It is essential to understand what work should be done for safety reasons and to prevent costly challenges down the road. The best way to do this is to have a professional assess your newly purchased home and use that insight to develop a game plan.

Hire an inspector to look for potential issues or hazards with electrical, plumbing, and the roof. It is a good idea to start with the structure and take care of items like electrical, which can be a potential fire hazard, as well as plumbing issues so that you don't end up with major problems or damage in the future. You will not see a great transformation, but it brings peace of mind.

Once you have finished the safety concerns, choose projects that will give you the biggest bang for your buck. Whether you are flipping it or planning on living in it, things like a fresh coat of paint, new flooring, new appliances and some landscaping will be the biggest and most rewarding changes.

- DIY Whenever Possible

One of the things to consider is how much of the work you are able to do yourself. If you love to work on old houses, you are a step ahead. But those with no DIY skills may be locked into overseeing contractors for every renovation. That can cause some headaches and will certainly cost more than if you can do the work yourself.

Fixer-uppers can be a great investment and allow you to customize a home to your specific needs. But it’s best to have a sense of what you’re signing up for! With some strategic due diligence upfront, you can purchase and remodel your new home with confidence.

- Financing

One of the most challenging aspects of buying a fixer-upper is paying for the renovation. Understandably, most people do not typically have much extra cash after making the down payment and paying closing costs, so coming up with additional money to cover repairs or remodeling can be difficult.

A fixer-upper loan may be a good option to buy a house that needs some TLC and pay for the repairs needed to turn it into your dream home. These loans are designed to give you the money you need to buy and renovate the home at the same time. Understanding how the different fixer-upper loans work will help you decide the best way to finance your fixer-upper.

Benefits of Buying a Fixer Upper

Most often, people buy fixer-upper homes because the cost of purchasing the home plus renovation costs may total less than what they’d pay for a comparable home in good condition.

Here are some of the key reasons buyers decide on buying a fixer-upper:

- Reduced price

- Customizable improvements

- Older home charm

- Make a profit

- Tax incentives

What to Look For When Buying a Fixer-Upper

When shopping for a fixer-upper, prioritize the things you cannot change about a home (like its location), or things that would be too costly to change (like significant structural renovations).

Here are key factors to consider:

- Location

Location is always the most important thing to look for with real estate, because it cannot be changed. Look for a fixer-upper in a desirable or an up-and-coming neighborhood in order to maximize potential resale value. Finding the right location will also ensure that you are happy in the home. Pay attention to things that might be important to you, like school ratings, nearby parks and restaurants and commute times.

The home’s location will also play a part in determining your renovation budget and estimating the home’s post-renovation value. The quality of finishes and upgrades you select should be in line with comparable homes in the same neighborhood if your goal is to recoup costs on resale.

- Layout and Size

A logical layout is important in any home, but it’s especially critical when you are looking at an old home. Older homes are often divided into small rooms, but many people in this decade favor an open floor plan. If you envision needing to knock down walls to create a more open, airy interior, know that the job can be expensive, time-consuming and dusty.

- Strong Structural Elements

A solid structure is ideal for any home, but it is especially critical when you are buying a fixer-upper. If the home has a crumbling foundation or serious roof problems, you will have to decide if you are willing to pay to repair this type of damage.

These are the five important structural elements:

- Roof

- Heating, ventilation, and air conditioning (HVAC)

- Plumbing

- Electrical

- Foundation

Find the Right Agent

Buying your house should be a fun and fulfilling experience. If you have done your research and evaluated what you can afford and what you truly need, finding a new home can be exciting. Learning more about the purchase process eliminates the fear of the unknown and lets you search for a home with peace of mind.

Windermere’s community of real estate professionals is our greatest asset. We have experts in all areas of real estate, from your typical starter home to condos, luxury properties, and new construction. While residential real estate is the mainstay of our business, Windermere also has offices and associates who specialize in property management, commercial real estate, and relocation services. To further facilitate the home buying process, Windermere has affiliated partners in certain regions to provide mortgage, title, and escrow services.

Call us today with any questions or concerns. Our professional Real Estate Agents will help you through this exciting process. (951) 369-8002

The Truth About Down Payments

Many people feel like they are stuck renting because saving enough money for a down payment to buy a house seems unattainable to them. While many people still believe it is necessary to put down 20% when buying a home, that is not always the case. In fact, lower down payment programs are making homeownership more affordable for new home buyers. In some cases, you might even be able to purchase a home with zero down.

What Is a Down Payment?

A down payment is the cash you pay upfront to make a large purchase, such as a home. When making a large purchase, many buyers will pay some of that cost upfront in the form of a down payment in order to reduce the amount of money to be financed. A down payment can significantly reduce the amount the borrower owes to the lender, the amount of interest they will pay over the life of the loan, and monthly payment amounts.

Why Do You Need a Down Payment?

A down payment is typically required on a home to reduce the lender's risk, demonstrate the buyer's commitment, and lower the loan amount, leading to better loan terms and a smaller mortgage. Traditionally, a mortgage down payment is at least 5% of a home's sale price. House down payments are often, but not always, part of the normal homebuying process. If a buyer puts 10-20% down, the theory is that they may be more committed to the home and less likely to default. If there is more equity in the property, the lender is more likely able to recover its loss in the event of foreclosure.

Do You Need to Put 20% Down On a House?

You may have heard that a 20% down payment is always required when buying a home. In fact, that number is really just the threshold many lenders use for requiring mortgage insurance on a conventional loan. When lenders issue mortgages with down payments of less than 20%, nearly all require borrowers to buy private mortgage insurance (PMI) on the loans. Because loans of more than 80% of a home's purchase price are considered risky, lenders require PMI to guard against losing money in case a borrower defaults and they must seize and resell the property.

Just keep in mind that making a lower down payment can help you achieve your goal of homeownership more quickly. However, a higher down payment brings down the principal (and lifetime interest payments), which might cost you less throughout the life of the loan. Weigh the pros and cons to decide what’s best for you.

In 2023, the typical down payment for first-time home buyers was 8%, according to the National Association of Realtors. The typical down payment was 19% for repeat buyers.

Type of Loans

Different strokes for different folks, right? Well, the same goes for loans. Here are the most common loan types to know about and how much each requires for a downpayment:

- FHA loans: Perfect for those with less saved up or lower credit scores, you can go as low as 3.5% down.

- Conventional loans: Typically, these start at 3% down for first timers.

- VA and USDA loans: If you're a veteran or buying in certain rural areas, you might qualify for zero down.

- Jumbo Loans: These loans are for properties that exceed the county's threshold amount for a conventional loan. They typically require 10% to 20% down.

How Credit Score Impacts Your Down Payment

Your credit scores and overall financial situation can significantly impact the homebuying process. Lower credit scores may limit how much money you can borrow and could lead to higher interest rates or PMI premiums. A strong credit score also means lenders are more likely to be lenient in areas where you may not be as strong, such as your house down payment. Your credit score shows you have a proven history of making payments on time and that you’re less of a risk. In these instances, they might allow you to get a great interest rate while making a smaller down payment.

Before you begin the homebuying process, check your credit reports and credit scores to get an idea of our credit health, as well as to review the information being reported by lenders and creditors. Allow yourself enough time to address any information on your credit reports you believe may be inaccurate or incomplete. Some advance planning may make a big difference when it is time to purchase a home.

Benefits of a Larger Down Payment

Larger down payments can seem like a high priority because they typically result in paying less interest over time and eliminating private mortgage insurance (PMI) fees on a conventional loan (assuming the down payment amounts to at least 20% of the purchase price).

But making a larger down payment has advantages that include:

- A better mortgage interest rate. Lenders may shave a few percentage points off your interest rate if you make a larger down payment.

- More equity in your home right away. Your home equity is your home's value minus the amount you owe on your mortgage.

- A lower monthly mortgage payment. Borrowing less of your home's price lowers your principle, which also means you will pay less interest over the life of the loan.

Considerations to Determine Your Down Payment

How much do you need for a down payment, then? Use an affordability calculator to figure out how much you should save before purchasing a home. You can estimate the price of a home by putting in your monthly income, expenses and mortgage interest rate. You can adjust the loan terms to see additional price, loan and down payment estimates.

Here are some steps you can take before determining how much home you can afford and how much you can put down on a house:

Determine how much you can afford

The first step is to figure out how much money you have available for upfront home costs. If you haven’t already, gather your most recent savings and investment statements so you start with an accurate number. As you decide how much you can spend, make sure you still have enough money available for emergency savings, other savings goals, and closing costs.

You might be tempted to put down the maximum down payment that you can afford. However, it’s important to have emergency savings and cash on hand to pay for unexpected expenses and critical home maintenance. A good goal is to build up an emergency fund with at least three months of living expenses before you move in.

Type of Mortgage

The type of mortgage you choose can also impact how much money you put down, because some have down payment requirements. VA loans, for example, can offer zero money down. Some conventional loans can go as low as 3%, while FHA loans can go as low as 3.5%. Jumbo loans typically require a 10% down payment or more.

The size of your down payment will also be influenced by whether this house will be your primary residence or a vacation or investment property.

Consider Your Options

After evaluating your budget and what you need from your home, it is time to consider all your options. You might need to look for a loan option that allows a smaller down payment, or you might want to give yourself more time to save up for a larger down payment on a house.

It can be beneficial to work with someone who knows the answers to all these questions. A home lending advisor can help you understand the different types of mortgages available and go over down payment requirements for each type of loan to find the right one for your financial situation.

Future Goals

Consider your future goals and aspirations. Will a larger down payment deplete your savings and hinder other financial plans? Finding the right balance between homeownership and other financial goals is crucial.

Find the Right Agent

Windermere’s community of real estate professionals is our greatest asset. We have experts in all areas of real estate, from your typical starter home to condos, luxury properties, and new construction. While residential real estate is the mainstay of our business, Windermere also has offices and associates who specialize in property management, commercial real estate, and relocation services. To further facilitate the home buying process, Windermere has affiliated partners in certain regions to provide mortgage, title, and escrow services.

Call us today with any questions or concerns. Our professional Real Estate Agents will help you through this exciting process. (951) 369-8002

Q3 2023 Southern California Real Estate Market Update

The following analysis of select counties of the Southern California real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

The Southern California market areas contained in this report have been experiencing a fairly significant slowdown in job growth. That said, the region has added 164,700 jobs since the third quarter of 2022, representing a growth rate of 1.7%. The end of the writers’ strike will add a little boost to the Los Angeles area, which has still added over 89,000 jobs over the past 12 months. Orange County employment has grown by 34,100 jobs; San Diego County is higher by 31,400; and employment was up 9,700 jobs in Riverside.

The region’s unemployment rate in August was 5.2%, which was up from 4.2% in the third quarter of 2022. The lowest jobless rate was in San Diego County, where it was 4.3%. The highest rate was in Los Angeles County, where 5.8% of the workforce was without a job.

Southern California Home Sales

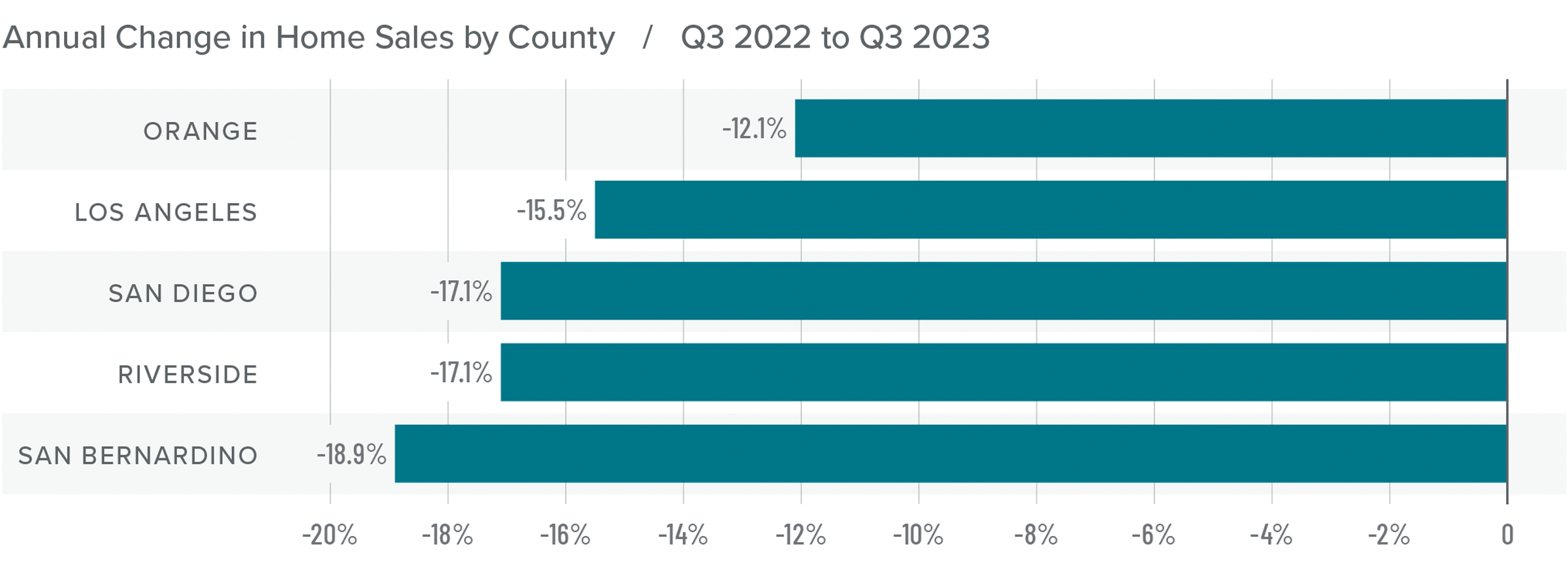

❱ In the third quarter of 2023, 32,398 homes sold, which was 16% lower than in the third quarter of 2022 and down 8.6% compared to the second quarter of this year.

❱ Pending home sales, which are an indicator of future closings, were 8.2% lower than in the second quarter, suggesting that closing numbers may be down in the final quarter of 2023.

❱ Compared to the third quarter of 2022, sales fell the most in San Bernardino County, though there was a significant decline in all markets. The quarter-over-quarter decline was disconcerting given that the number of homes for sale rose more than 14%. Rising mortgage rates are clearly taking their toll on the market.

❱ It’s discouraging that there were fewer sales despite rising inventory levels. Mortgage rates are definitely hobbling the market and until they start to drop, I think things will continue to be lackluster. List prices have started to pull back in response, as sellers realize that the market is not what it once was.

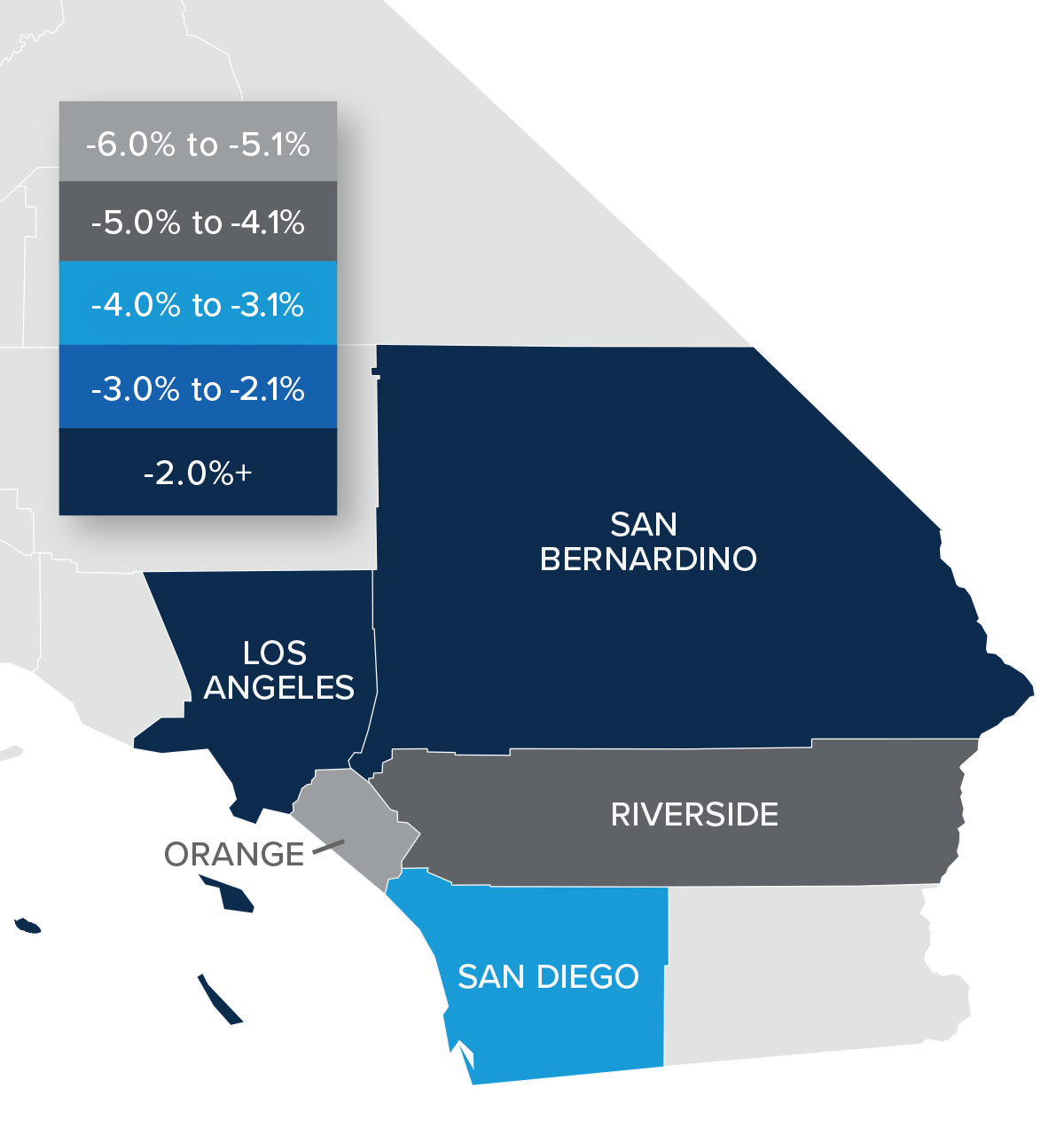

Southern California Home Prices

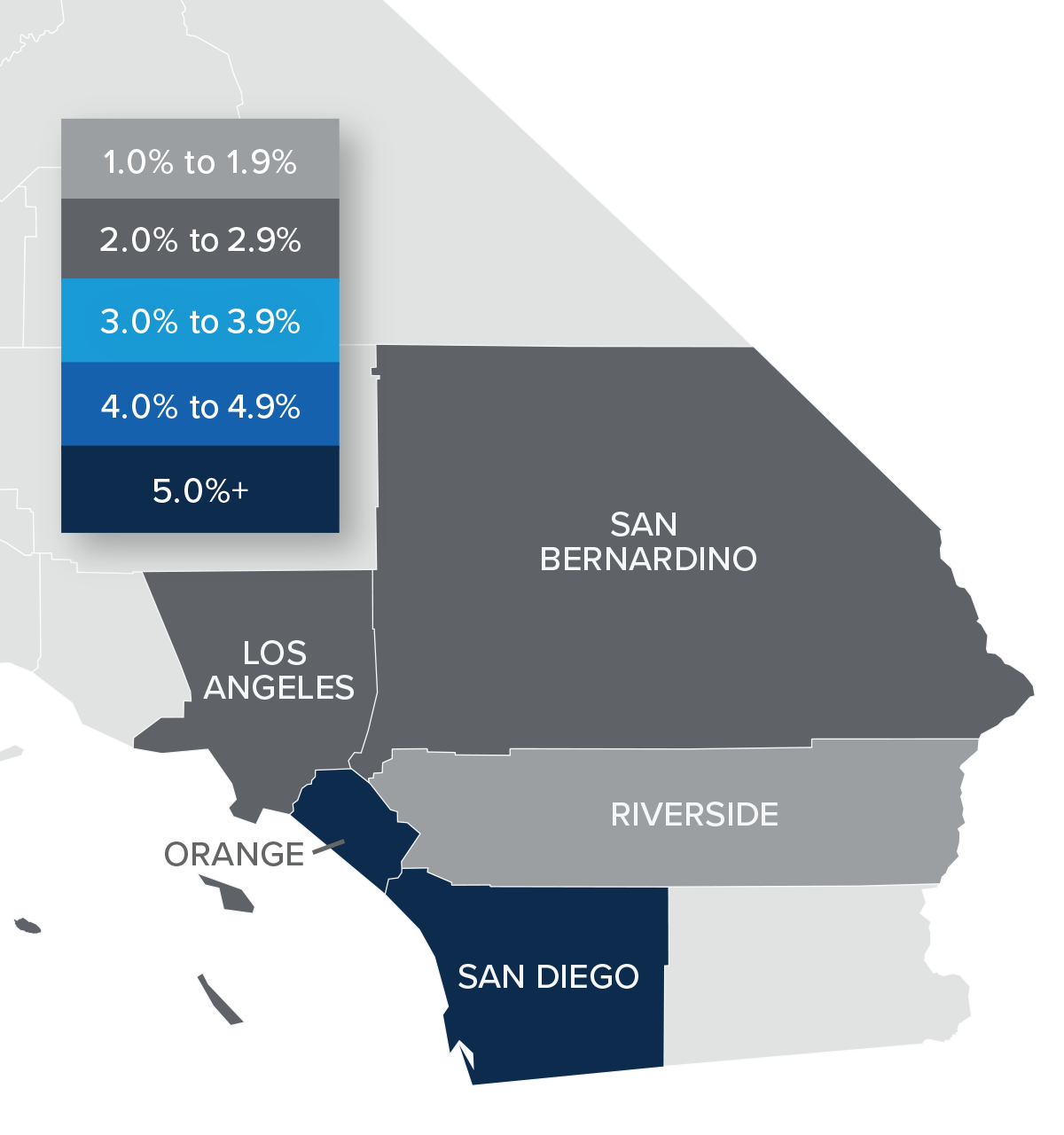

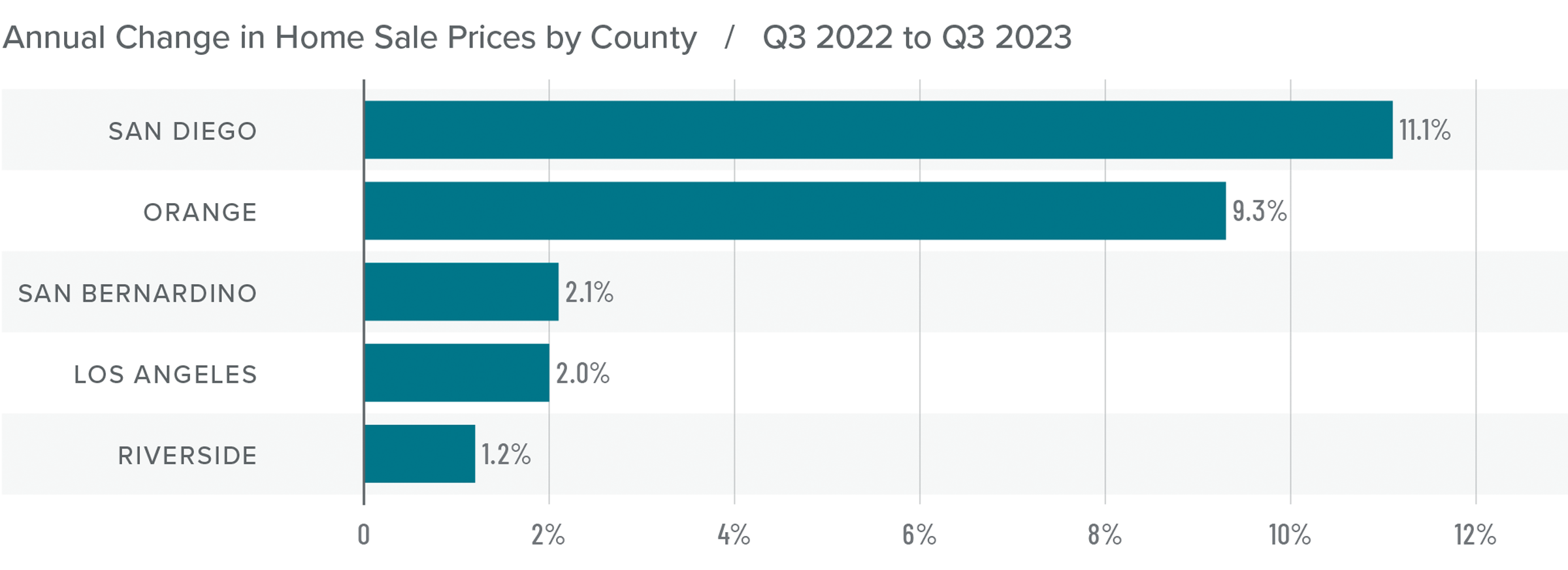

❱ Home sale prices were up 5.7% from the third quarter of 2022 and were 3.8% higher than in the second quarter of 2023.

❱ Affordability continues to be a major constraint in the region, which is being magnified by persistently high mortgage rates. Prices are holding, but growth has slowed significantly.

❱ Year over year, prices rose in all the markets contained in this report, with significant increases in San Diego and Orange counties. Compared to the second quarter of 2023, Riverside County saw prices fall by 5.8%, but they rose in the balance of the market areas.

❱ I expect price growth in Southern California to hold at or near the current pace. However, it’s very possible that home sale prices could drop a little if list prices fall further.

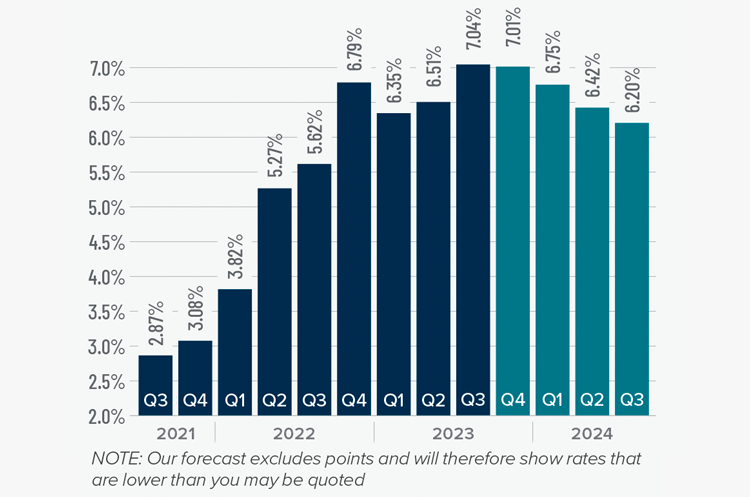

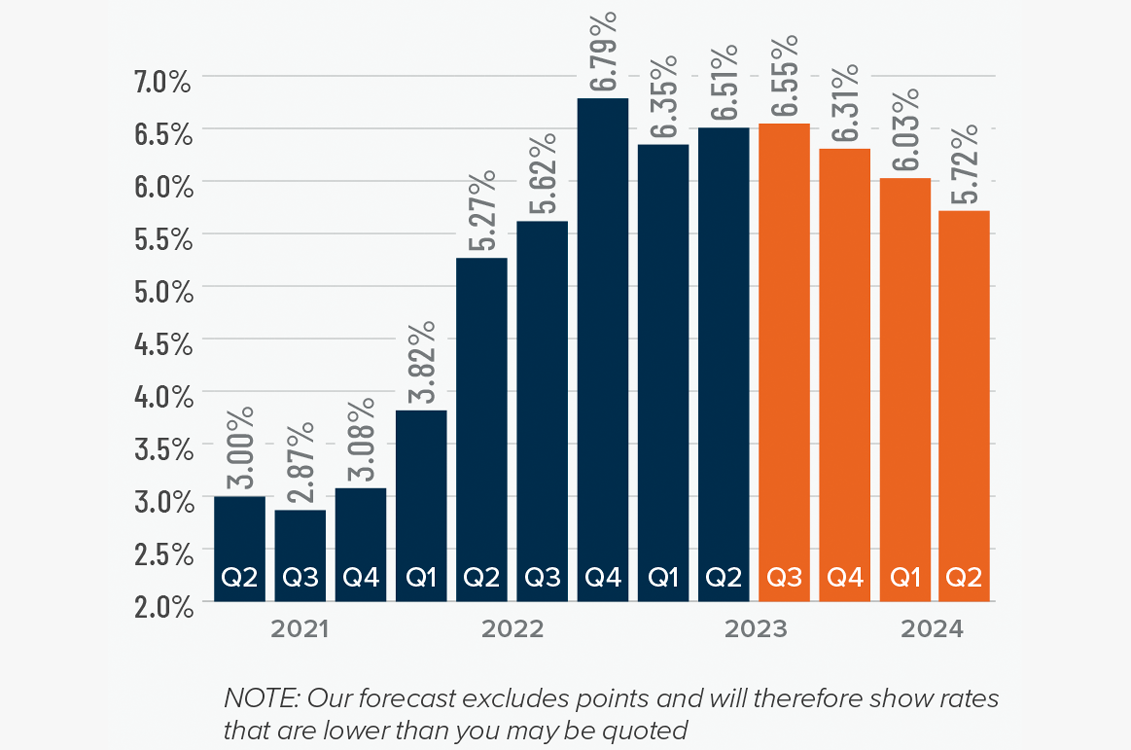

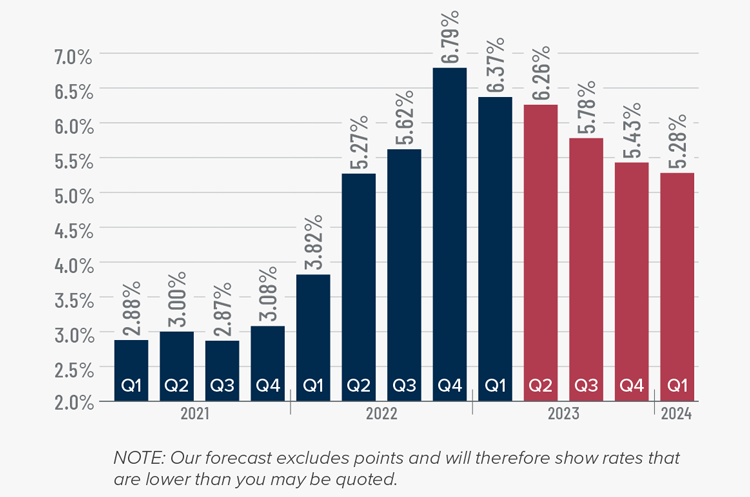

Mortgage Rates

Mortgage rates continued trending higher in the third quarter of 2023 and are now at levels we have not seen since the fall of 2000. Mortgage rates are tied to the interest rate (yield) on 10-year treasuries, and they move in the opposite direction of the economy. Unfortunately for mortgage rates, the economy remains relatively buoyant, and though inflation is down significantly from its high, it is still elevated. These major factors and many minor ones are pushing Treasury yields higher, which is pushing mortgage rates up. Given the current position of the Federal Reserve, which intends to keep rates “higher for longer,” it is unlikely that home buyers will get much reprieve when it comes to borrowing costs any time soon.

With such a persistently positive economy, I have had to revise my forecast yet again. I now believe rates will hold at current levels before starting to trend down in the spring of next year.

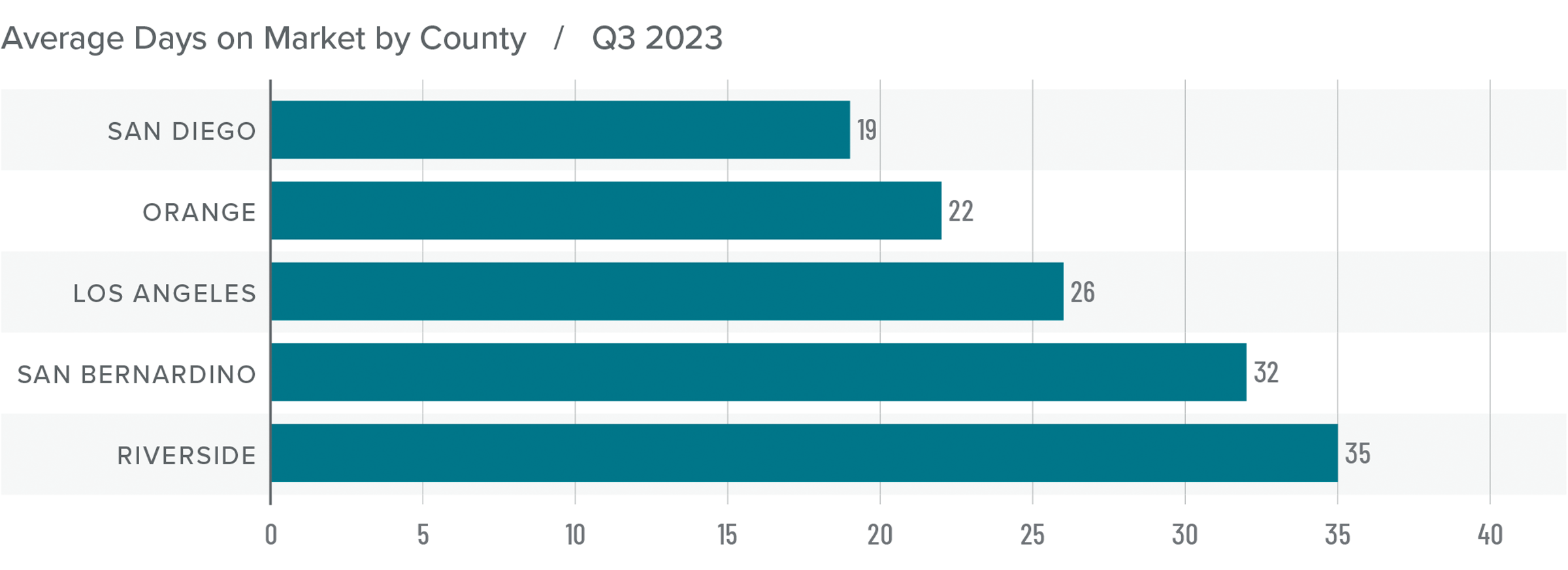

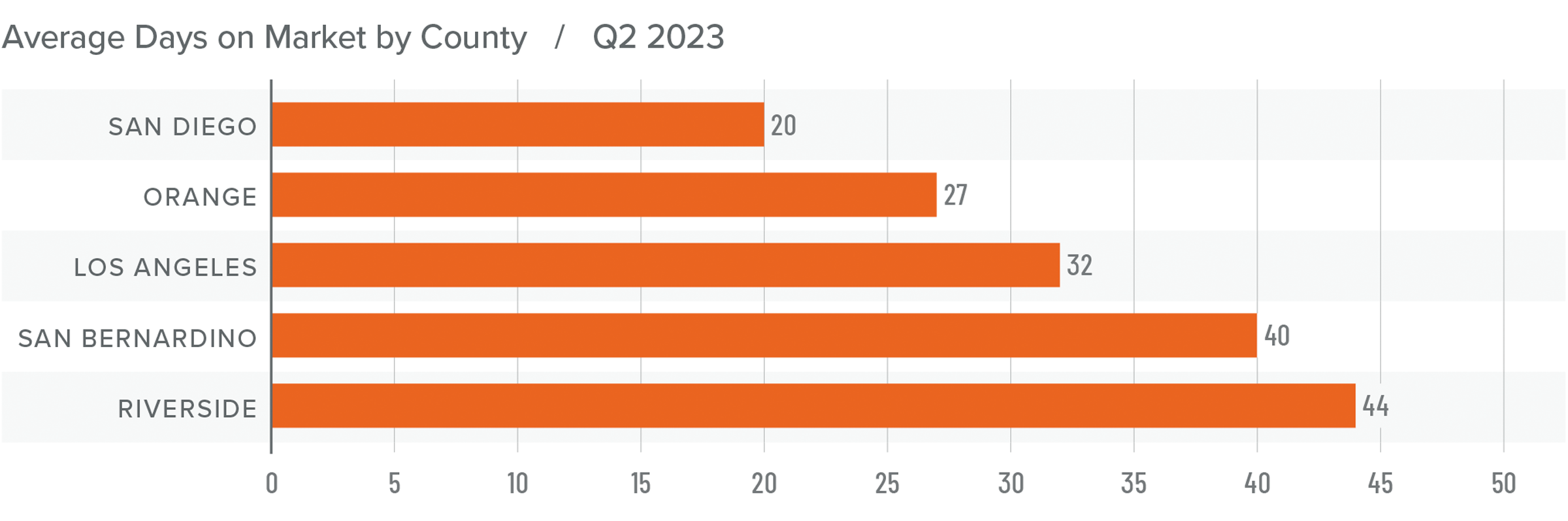

Southern California Days on Market

❱ In the third quarter of 2023, the average time it took to sell a home in the region was 27 days. This was up two days compared to the same period of 2022.

❱ Compared to the second quarter of 2023, market time fell six days and was lower across all counties covered by this report.

❱ Homes in San Diego County continue to sell at a faster rate than other markets in the region, but it took two fewer days to sell a home than it did in the third quarter of 2022. Orange County saw days on market fall by one day compared to the third quarter of 2022, but market time rose everywhere else.

❱ Homebuyers saw rising inventories, and those who chose to make offers did so relatively quickly, even though the total number of sales fell. If the number of homes for sale continues to rise, it may also cause market time to rise as buyers become more selective.

Conclusions

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

With inventory levels rising, and sales and asking prices falling, it would be easy to suggest that home buyers have the upper hand. However, home prices are still rising, albeit slowly, which tends to favor sellers.

The quandary really comes down to the fact that while inventory levels have risen, they remain remarkably low compared to historic averages. It’s also likely that the buyers who are still in the market are looking to move more from necessity than desire, which makes sense given today’s high mortgage rates.

That has put us in a very unusual situation. Although sellers are being a little more competitive, as evidenced by the drop in list prices, they have not totally capitulated. Taking all these factors into consideration, I have moved the needle back to the middle of the speedometer. I simply don’t see either side as having the upper hand at the present time.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

8 Signs You Are Ready to Buy a House

We have all heard the saying that renting is like flushing your money down the toilet. Well, we have heard that nonsense too. The truth is, not everyone should buy a house. Homeownership is a major milestone that many people dream of reaching one day. However, there are a variety of factors to consider when making one of the biggest financial decisions of your life.

So, if you have been thinking about becoming a homeowner, but are not sure if you’re prepared, you’ve come to the right place. We’ve laid out 8 questions to help you decide if you are ready to get the ball rolling on buying a house.

8 Signs You Are Ready to Buy a House

Do you frequently find yourself wondering whether to keep renting or buy a home? Here are eight signs that you are ready to make the switch from renter to homeowner.

1. You Have Dependable Income

Regular, dependable income and stable employment is critical to qualifying for a mortgage. A home is a long-term investment, so your source of income is one of the main factors mortgage lenders look at when assessing your eligibility for a loan. If you do not have proof of steady income or have a shaky employment history, you may find it difficult to qualify.

But even if you can demonstrate financial stability on paper, you should only buy a house if you think your income will remain steady for the foreseeable future.

2. Your Debt-to-Income Ratio is Low

You do not have to be completely debt-free to buy a home. Between car payments, student loan debt and other bills, most lenders understand that it is unrealistic to expect borrowers to be totally debt-free these days. Essentially, they want to know that you will be able to afford your mortgage payment based on how much money you have coming in versus what you need to pay out to other debts.

To figure this out, lenders look at your debt-to-income ratio, or DTI, to determine whether you can afford to take on a new loan in addition to your existing debt. The higher your DTI, the more likely you will be stretched too thin financially.

Your debt-to-income ratio (DTI) is the percentage of your monthly debt compared to your monthly gross income. Credit card payments and loan payments and the payments on your new home are examples of the debts lenders include in your DTI calculations. Your DTI should ideally be below 40% when you include your proposed mortgage payment. Some lenders have stricter requirements. The lower your debt in comparison to your income, the better chance you have of qualifying for a mortgage.

So, before you buy a house, knock out a good portion of your debt as fast as possible. Once debt is under control, get busy stockpiling money in an emergency fund. Then your budget will be secure and you can focus on saving up a down payment.

3. You Have a Good Credit Score

Some renters cannot make the leap to homeownership because they do not qualify for a mortgage. Low credit scores are a common reason why: A history of late payments or too much debt will hurt your score. Your credit score is a number that represents your creditworthiness. Credit scores typically range from 350 to 850 with higher numbers representing better credit. Your credit score is calculated with information from your credit report, including payment history, debt and the length of your credit history.

One of the most common questions first-time buyers ask is, “what credit score is needed to buy a house?” While there is no set number for this, you will likely need a minimum credit score of 600 for approval. Although borrowers with a credit score as low as 500 can qualify for some home loans, they will be required to make bigger down payments and pay higher rates. A good credit score gets you better interest rates and loan terms. To qualify for the most favorable rate, however, work on improving your credit score and wait until you have a score of 700 or higher.

4. You Have a Good Down Payment

It can take a long time to save up enough money for a down payment on a home. Although the common perception is that first-time homebuyers need to have a 20% down payment to purchase a home, that is simply not the case. Depending on the lender and type of home loan, you may be required to put down at least 3% (FHA loans, however, typically require at least 3.5%). For instance, a home that costs $300,000 with a 3% down payment requirement will require you to put down at least $9,000.

It is important to remember that the larger your down payment, however, the lower your monthly payments will be and the less interest you will pay during the life of your loan. Do not forget to factor in closing costs, which can be anywhere from 2 to 5% of the purchase price.

5. You Can Cover the Additional Costs of Buying a Home

When you think about buying a home, many only think about their down payment and monthly mortgage payments. But buying a home carries additional costs you need to factor into your budget. Some of these costs are one-time expenses that you won't have to think about again, while others need to be paid regularly.

Other financial aspects of homeownership may include:

- Property taxes: Local governments raise money through property taxes to fund things like schools, law enforcement, fire departments and (supposedly) fixing potholes.

- Homeowners insurance: Sure, homeowners insurance adds more dollar signs to your house payment. But paying for coverage will be way less expensive than trying to replace all your stuff out of pocket if your house ever burned down. Plus, your mortgage lender will require you to have it.

- Private mortgage insurance (PMI): Remember: You can avoid PMI if your down payment is 20% or more. But if you make a smaller down payment, expect to pay around $75 a month per $100,000 that you borrow.

- Homeowners’ association (HOA) fees: Houses located in specific neighborhoods or gated communities sometimes have homeowner's associations (HOA). Almost all condominiums and townhouses have HOAs. When you belong to an HOA, you pay fees for the services and amenities the association provides. The amount and frequency of HOA payments varies.

6. You Have Savings to Cover Maintenance and Repairs

Owning a home means you will have to maintain your property. While you may have enough to purchase a home, you will need to make sure you can also cover the costs of owning one. When a pipe bursts or the air conditioner goes out in a rental unit, you do not have to worry about paying for it: That is the landlord’s responsibility. The same goes for property taxes and routine maintenance expenses. When you are the owner, though, all those costs are your responsibility — so you need to have enough extra money to handle the added expenses.

Many realtors and insurance companies recommend following the one-percent rule. Tuck away one percent of the value of the home you intend to buy each year to cover maintenance and unexpected repairs.

7. You Plan on Staying Put for a While

Another thing to think about is whether you are at a place in life where you are ready to stay in your city for more than a few years. It takes time to build equity in your home through paying down your loan and home price appreciation. If you plan to move too soon, you may not recoup your investment.

8. You Have an Expert Real Estate Agent You Can Trust

It can sometimes be difficult to find a house you love that is also within your budget, but it is a whole lot easier when you have a top-notch real estate agent on your side. Plus, working with a buyer’s agent brings two other big benefits:

- Saving money: In most cases, the home seller pays the commission for your agent—so you pay nothing to get expert help! Even better, a buyer’s agent can save you thousands of dollars on your dream home by fighting for your best interests at the negotiation table.

- Saving time: Without an agent, you’ll have piles of paperwork to wade through. Life’s too busy for that! Let an expert who knows all the laws and regulations specific to your city take care of the red tape for you.

Find the Right Agent

Buying your house should be a fun and fulfilling experience. If you have done your research and evaluated what you can afford and what you truly need, finding a new home can be exciting. Learning more about the purchase process eliminates the fear of the unknown and lets you search for a home with peace of mind.

Windermere’s community of real estate professionals is our greatest asset. We have experts in all areas of real estate, from your typical starter home to condos, luxury properties, and new construction. While residential real estate is the mainstay of our business, Windermere also has offices and associates who specialize in property management, commercial real estate, and relocation services. To further facilitate the home buying process, Windermere has affiliated partners in certain regions to provide mortgage, title, and escrow services.

Call us today with any questions or concerns. Our professional Real Estate Agents will help you through this exciting process. (951) 369-8002

Q2 2023 Southern California Real Estate Market Update

The following analysis of select counties of the Southern California real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

The Southern California market areas contained in this report added 222,700 jobs over the past 12 months, representing a decent growth rate of 2.4%. Although layoffs in the tech sector and the writers’ strike have been dominating headlines, payrolls in Southern California continue to expand. The Los Angeles market has added over 60,000 jobs through the first five months of this year. This was followed by Orange County, which added 19,000 jobs. San Diego County added 16,600 jobs, and employment grew by 6,700 jobs in Riverside County. The region has seen the pace of employment growth slow, but this appears to be more an issue of labor supply rather than a lack of demand. The region’s unemployment rate in May was 4.3%, up from 3.7% in the same quarter of 2022. The lowest jobless rates were in Orange County (3.2%) and San Diego County (3.5%). The highest rate was in Los Angeles County, where 4.8% of the workforce was without a job.

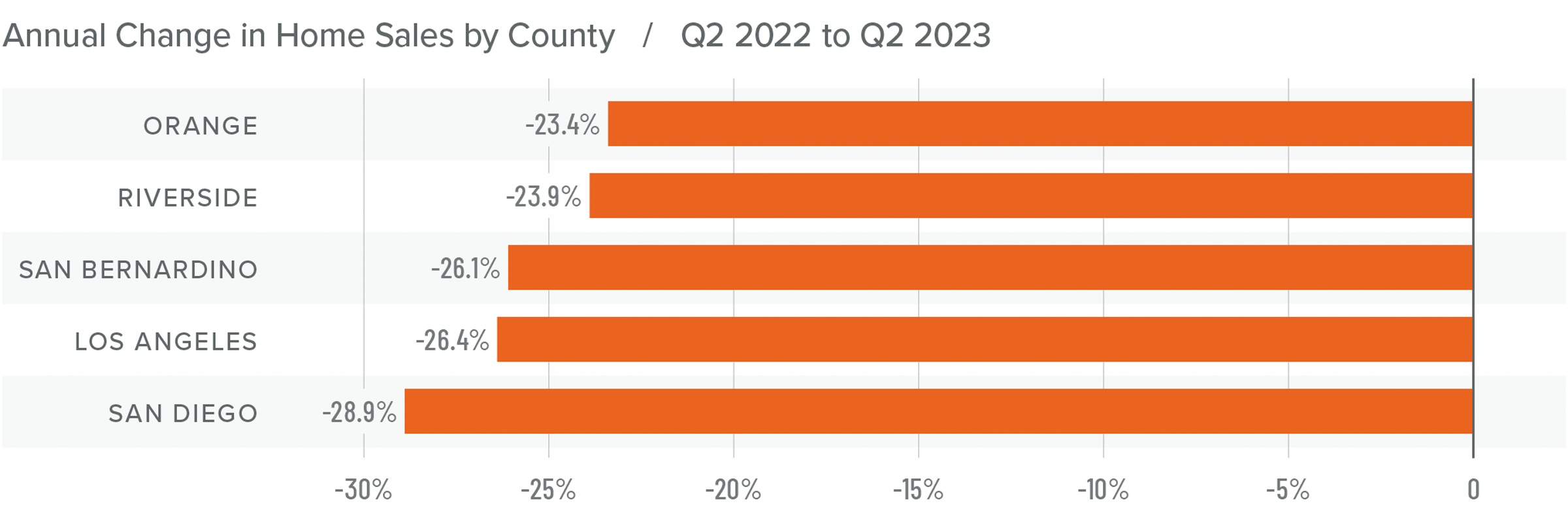

Southern California Home Sales

❱ In the second quarter of 2023, 35,381 homes sold, which was 25.9% lower than in the second quarter of 2022 but up an impressive 27.7% compared to the first quarter of 2023.

❱ Pending home sales, an indicator of future closings, were 13.9% higher than in the first quarter, suggesting that sales activity has room to rise further as we move into the second half of the year.

❱ Compared to the same quarter in 2022, sales fell across the board. However, the market heated up in the second quarter compared to the first quarter of 2023: sales were up 36% in Orange County, 29.6% in Los Angeles County, 28.4% in San Bernardino County, 24.3% in Riverside County, and 20.5% in San Diego County.

❱ The growth in sales was even more impressive given significantly rising financing costs in the second quarter.

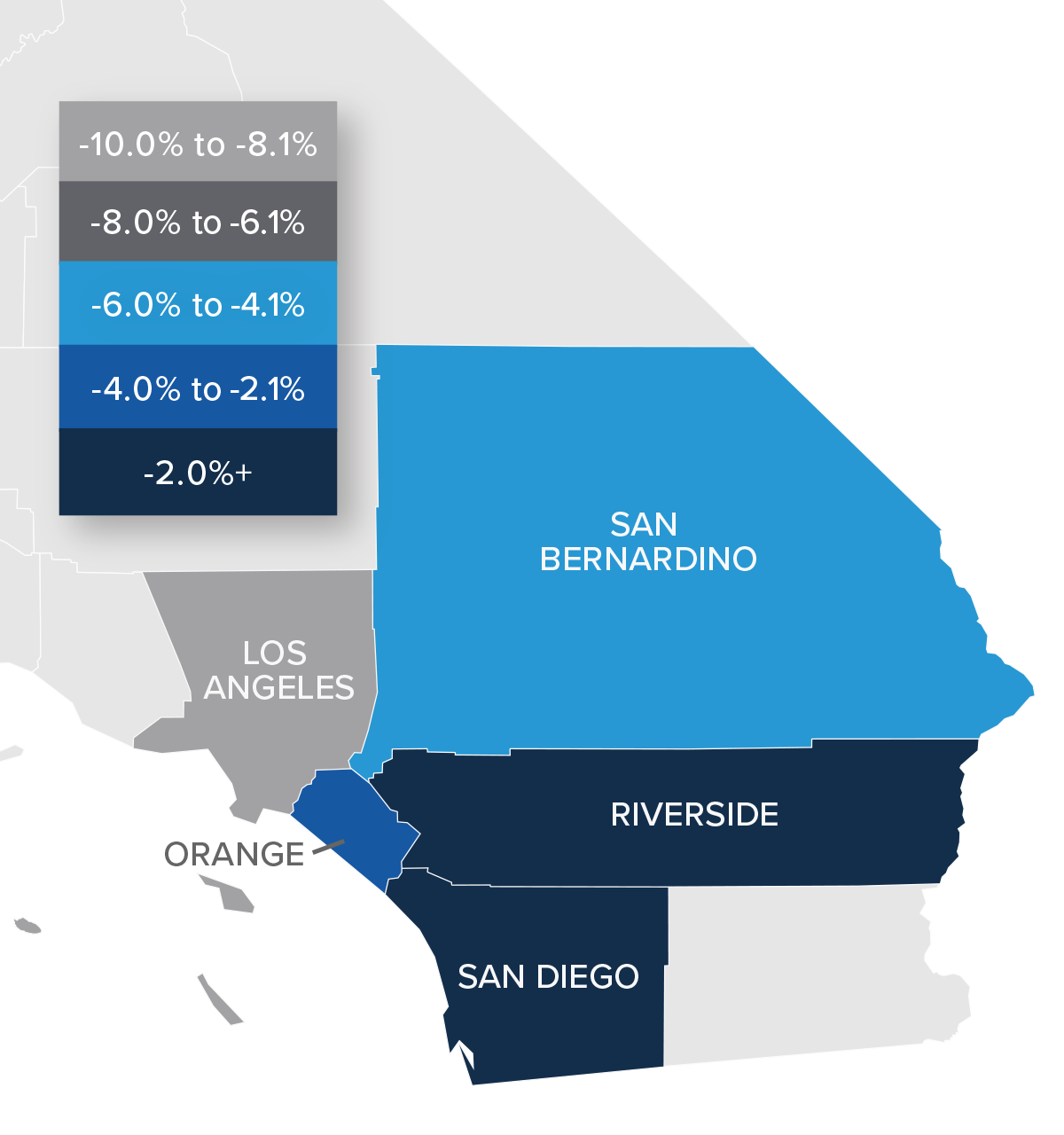

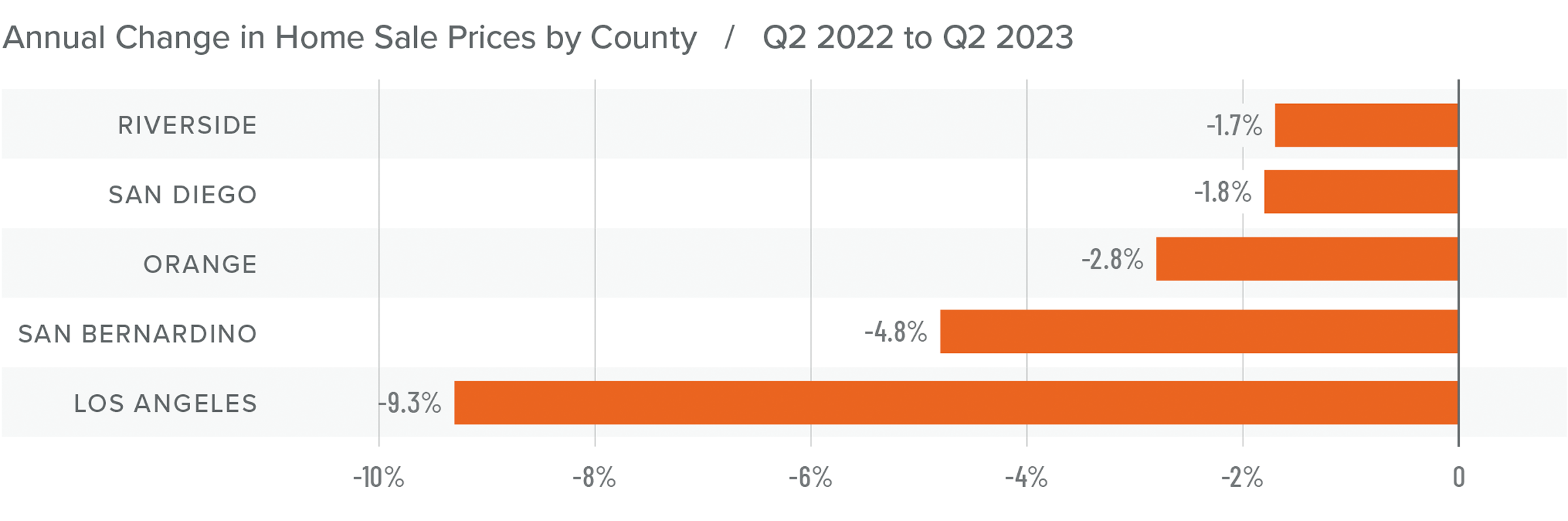

Southern California Home Prices

❱ Compared to the second quarter of 2022, home sale prices were 5.5% lower. However, they were 2.1% higher than in the first quarter of 2023.

❱ Affordability continues to be a significant constraint in the region. With median list prices rising 21% in San Diego County and 20% in Los Angeles County compared to the first quarter, it appears that sellers’ confidence levels continue to rise, which will further impact housing affordability.

❱ Year over year, prices pulled back across the region, with a significant drop in Los Angeles County. Compared to the first quarter of 2023, Los Angeles prices fell 4.1%. Closed sale prices rose in the rest of the market areas.

❱ The region has demonstrated significantly more resilience to higher financing costs than expected. As we move through the balance of 2023, I expect prices to rise further, but at a very modest pace.

Mortgage Rates

Although they were less erratic than the first quarter, mortgage rates unfortunately trended higher and ended the quarter above 7%. This was due to the short debt ceiling impasse, as well as several economic datasets that suggested the U.S. economy was not slowing at the speed required by the Federal Reserve.

While the June employment report showed fewer jobs created than earlier in the year, as well as downward revisions to prior gains, inflation has not sufficiently slowed. Until it does, rates cannot start to trend consistently lower. With the economy not slowing as fast as expected, I have adjusted my forecast: Rates will hold at current levels in third quarter and then start to trend lower through the fall. Although there are sure to be occasional spikes, my model now shows the 30-year fixed rate breaking below 6% next spring.

Southern California Days on Market

❱ In the second quarter of 2023, the average time it took to sell a home in the region was 32 days, which was 16 more than in the second quarter of 2022 but 13 fewer days than in the first quarter of 2023.

❱ Compared to the first quarter of 2023, market time fell in all counties covered by this report.

❱ Homes in San Diego County continue to sell at a faster rate than other markets in the region, but all counties saw market time increase from a year ago.

❱ Home buyers appear to be resigned to the fact that supply levels are unlikely to improve any time soon and believe that prices are not going to fall further. This is leading them to pursue buying a home even if mortgage rates remain very high, with the hope they will be able to refinance when rates eventually fall.

Conclusions

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Home prices have stabilized and are starting to trend higher again. This is counterintuitive, especially given that mortgage rates are higher than the market has seen in over 15 years. However, the reason for this is straightforward: a lack of supply is bolstering home values. It will only be when supply levels rise to match demand that we will start to move toward a more balanced market. The issue, though, is that 85.7% of California homeowners with a mortgage have an average interest rate below 5%, and 30% have rates at or below 3%. I find it highly unlikely that homeowners will give up their current rate unless they absolutely have to, which is holding back supply.

Homeowners who do decide to sell are aware of this and are increasingly confident in their ability to sell their homes regardless of mortgage rates. Given these factors, I have moved the needle into the seller’s sector of the speedometer.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Understanding Seller’s Disclosures in Real Estate

When you are buying a house, you need to be aware of any potential issues with the property. The seller has an obligation to disclose any issues they are aware of. Proper disclosure means the buyer gets a more comprehensive view of the property, and the seller lessens their chance of getting sued by the new owner for hiding information.

A seller’s disclosure is a document that sellers are legally required to provide buyers. This piece of paperwork will include all the undisclosed details related to the property that negatively affect its value.

Familiarizing yourself with the seller’s disclosure form will benefit all parties—buyer and seller alike.

What is a Seller’s Disclosure?

A seller’s disclosure statement form is a standard checklist form containing material defects and features of the property. It provides information about the property that may negatively affect the value of the house.

If there are material defects in a property that may impact the value of the property AND the seller is aware of them, the seller should disclose them. However, sellers should report these defects to the best of their knowledge and in good faith. From pest infestation to pending legal issues, you should disclose any known information. This will help you avoid future disputes.

Remember, every state has different seller’s disclosure laws. So, it is advisable to review the form with your real estate agent or lawyer as per the statutes in your state. Usually, the disclosure form is completed along with the listing paperwork – especially in the Multiple Listing Service (MLS) provided by the listing agent.

Seller Disclosure Basics

Here are four important things to know about property disclosure statements.

They Differ From One State To The Next

While a few disclosures are federally required, most disclosure requirements are state-specific and vary from one state to the next. Therefore, an experienced real estate agent should be familiar with the state's disclosure laws.

They Must Be Written

Real estate disclosures, like all documentation related to the sale or purchase of your home, must be submitted in writing

Inspection Reports Are Not Made From Disclosure Statements

Although disclosure statements are required by law, not all sellers conduct a pre-inspection, and not all buyers opt to have a home inspection.

Disclosures Do Not Require Investigation

You must report all defects or issues in your home. However, you do not have an obligation to search for them. Instead, check the state laws to ensure you understand the details.

Why is a Seller’s Disclosure Important?

A seller’s disclosure protects the buyer by informing them of any issues or defects the home and surrounding property may have. It also safeguards the seller from being sued by the buyer after the transaction if the seller’s disclosure was completed correctly.

For buyers

The goal of the seller’s disclosure is to inform the buyer of the property’s history so buyers can make an informed decision. If the seller’s disclosure reveals a major issue with the home, buyers can back out of the deal without losing earnest money. Any problems documented in the seller’s disclosure can also give the buyer some negotiating power, such as the price of the home or requesting the seller make any necessary repairs.

For sellers

The seller’s disclosure can only protect the seller if done accurately and honestly. If done correctly, this document will protect the seller from being held legally liable for any issues that may develop with the home in the future. This is only the case if the seller made the buyer fully aware of all home defects before the completed purchase. The seller only needs to disclose what is required by their state.

What Should a Seller’s Disclosure Include?

A seller’s property disclosure should include a full list of issues. The exact issues that need to be listed vary from state to state, so make sure to find out your state’s requirements. Some general problems with seller’s disclosures issues across the country include:

- HVAC

- Mold

- Pest infestations

- Water damage

- Leaks

- Foundational integrity issues

- Lead paint

- Asbestos

- Additions and improvement projects (without a permit)

- Any major repairs made by the seller or previous owners

- Insurance claims made

When Do You Receive the Seller’s Disclosure?

In many cases, you will get the seller’s disclosure form before you make an offer on the property. The form will be ready for all prospective buyers. But in some states, the seller must provide the disclosure a certain number of days after your offer is accepted or a certain number of days before closing.

Review the seller’s disclosure notice carefully and talk it over with your real estate agent. Before you move forward, you will need to sign the property disclosure statement acknowledging that you received it.

Can the Buyer Walk Away After Receiving the Seller’s Disclosure?

In many cases, yes — but state law may have a say. You generally have a chance to back out of the sale within a certain number of days after receiving the seller disclosure statement. Also, if you don’t get a seller’s disclosure and the sale doesn’t fall under one of your state’s exemptions, you may be able to cancel the purchase without penalty.

What if the Seller Lies?

If your seller lied on the property disclosure statement, and you have already closed, you need to be ready to prove that information was intentionally withheld in a court of law. The buyer can sue for damages sustained due to omitted information bear in mind that there is a statute of limitations. If too much time has elapsed, you no longer have a case, although you may still be able to sue for fraud.

As a seller, keep in mind that you can be held liable for damages and repair costs if you are caught lying on the seller’s closing disclosure.

Check your state’s guidelines and stay informed. Familiarize yourself with the laws and requirements and do your best to purchase from a reputable seller.

Get a Home Inspection Even With a Seller’s Disclosure

In addition to the seller’s disclosures, the buyer should always have an inspection done. No matter how thorough or trustworthy the seller may be, a seller’s disclosure is no substitute for a thorough home inspection by a licensed and qualified professional. Most buyers are not trained to look for and identify the issues that can affect the average home. Before you buy, it is in your best interest to get an inspection.

Find the Right Agent

Windermere’s community of real estate professionals is our greatest asset. We have experts in all areas of real estate, from your typical starter home to condos, luxury properties, and new construction. While residential real estate is the mainstay of our business, Windermere also has offices and associates who specialize in property management, commercial real estate, and relocation services. To further facilitate the home buying process, Windermere has affiliated partners in certain regions to provide mortgage, title, and escrow services.

Call us today with any questions or concerns. Our professional Real Estate Agents will help you through this exciting process. (951) 369-8002

Q1 2023 Southern California Real Estate Market Update

The following analysis of select counties of the Southern California real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

Following annual revisions to the data, the Southern California market added only 194,000 jobs in 2022, which was far fewer than the over 676,000 added in 2021. The first two months of data for 2023 showed a net loss of 14,800 jobs. Because the data is not adjusted for seasonality, I am not overly concerned by this decline, but I will be watching as we move through the spring to see if declining job growth is becoming pervasive. Total employment in the counties covered by this report is still 266,400 jobs shy of the pre-pandemic peak. Los Angeles County continues to have the largest shortfall of jobs (-260,000), followed by Orange County (-37,100). Job levels in San Diego County match their pre-pandemic peak, while employment levels in the Riverside and San Bernardino markets are each higher by more than 15,000 jobs. The region’s unemployment rate in February was 4.6%, down from 5% at the same time in 2022. The lowest jobless rates were in Orange County (3.4%) and San Diego County (3.7%). The highest was in Los Angeles County, where 5.3% of the workforce was without a job.

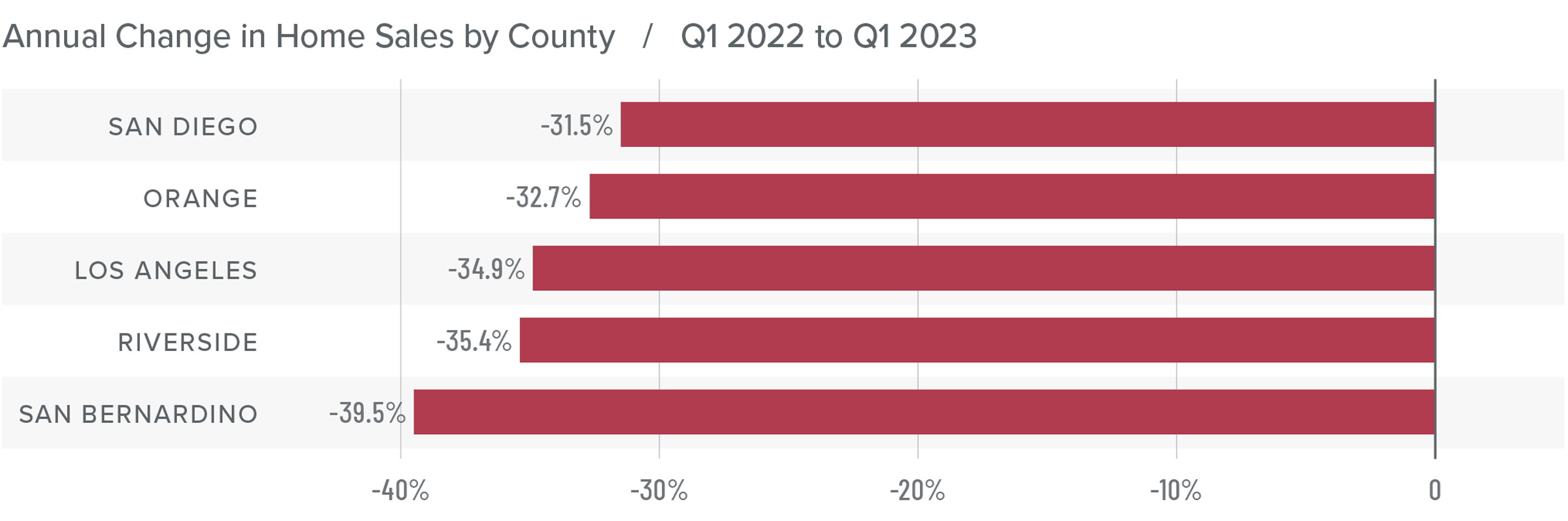

Southern California Home Sales

❱ In the first quarter of 2023, 27,577 homes sold, which is down 34.8% from the first quarter of 2022 and is 5.2% lower than in the final quarter of 2022.

❱ Pending home sales, which are an indicator of future closings, were 25.4% higher than in the fourth quarter, suggesting that sales activity in the second quarter of this year may pick up.

❱ On a percentage basis, sales fell the most in San Bernardino County, but all markets pulled back significantly. Compared to the fourth quarter, sales were higher in Riverside County (+7.1%) but fell across the balance of the market.

❱ The drop in sales can mainly be attributed to a lack of inventory: the number of homes for sale was down 27.6% from the final quarter of 2022. Additionally, mortgage rates rose by more than a full percentage point in February, which likely also impacted sales.

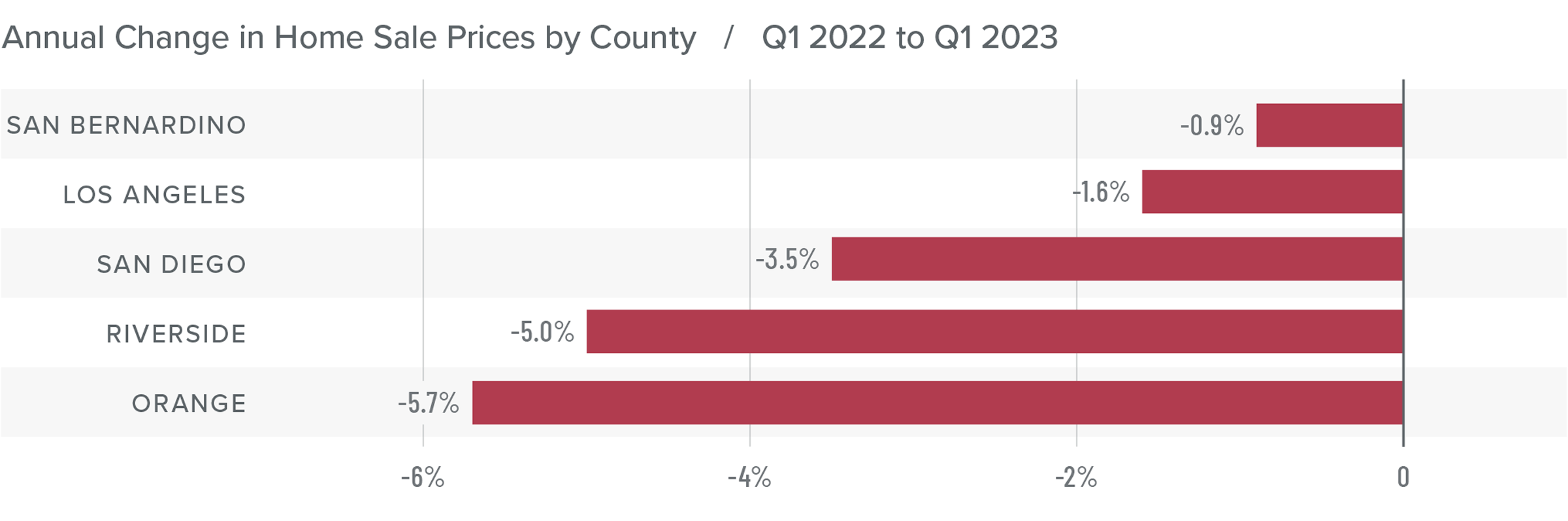

Southern California Home Prices

❱ Compared to the same period last year, home prices fell 2.5%. However, prices were 1.9% higher than in the fourth quarter of 2022.

❱ Affordability remains a significant issue, which has been exacerbated by elevated financing costs. That said, median listing prices in the quarter are up in every market other than San Bernardino, which suggests that home sellers may be starting to think that the worst of the price correction is behind them.

❱ Year over year, prices fell across the region but rose in all markets compared to the final quarter of 2022. Of note is that price growth was very solid in San Diego, Riverside, and Orange counties.

❱ While I expect mortgage rates to start stabilizing as we move toward summer, I think there will be some additional downward pressure on home prices. That said, things should start to turn around again in the second half of the year with a return to rising home prices.

Mortgage Rates

Rates in the first quarter of 2023 were far less volatile than last year, even with the brief but significant impact of early March’s banking crisis. It appears that buyers are jumping in when rates dip, which was the case in mid-January and again in early February.

Even with the March Consumer Price Index report showing inflation slowing, I still expect the Federal Reserve to raise short-term rates one more time following their May meeting before pausing rate increases. This should be the catalyst that allows mortgage rates to start trending lower at a more consistent pace than we have seen so far this year. My current forecast is that rates will continue to move lower with occasional spikes, and that they will hold below 6% in the second half of this year.

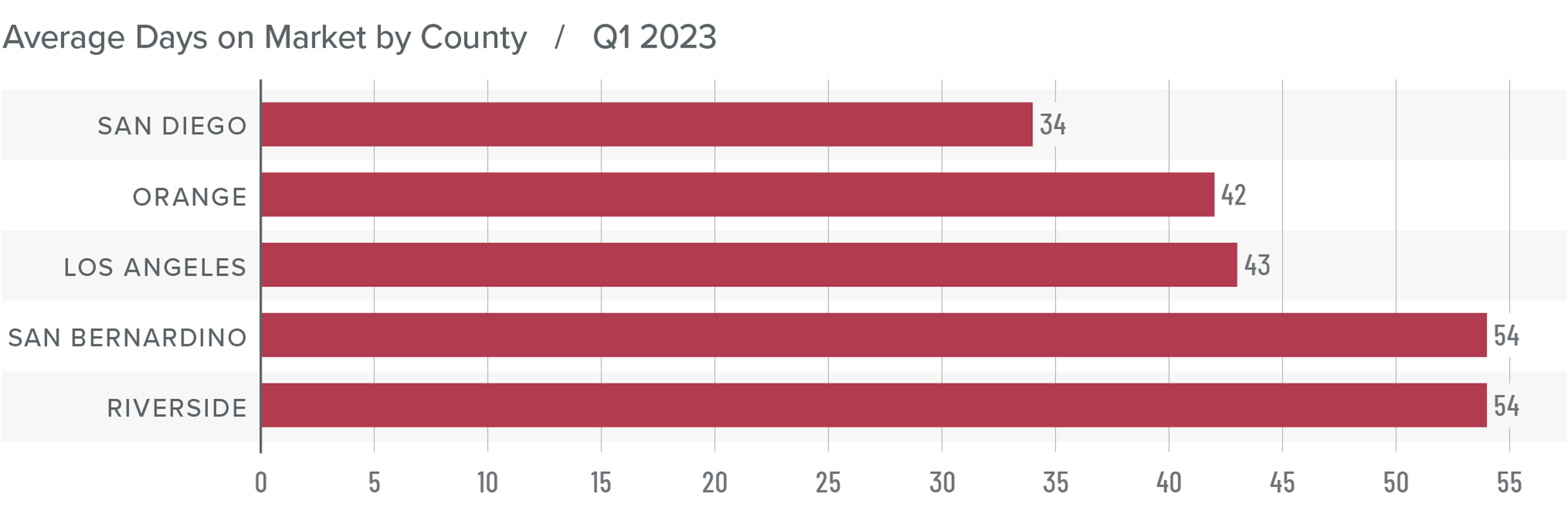

Southern California Days on Market

❱ In the first quarter of 2023, the average time it took to sell a home in the region was 45 days, which is 24 more than in the first quarter of 2022 and 9 more days than in the fourth quarter of last year.

❱ Market time also rose in all counties covered by this report compared to the fourth quarter of 2022.

❱ Homes in San Diego County continue to sell at a faster rate than other markets in the region, but all counties saw market time increase from a year ago.

❱ Higher mortgage rates and lower affordability still have some buyers sidelined. I expect to see increased activity once buyers become confident that mortgage rates have stabilized and that housing values have found a bottom.

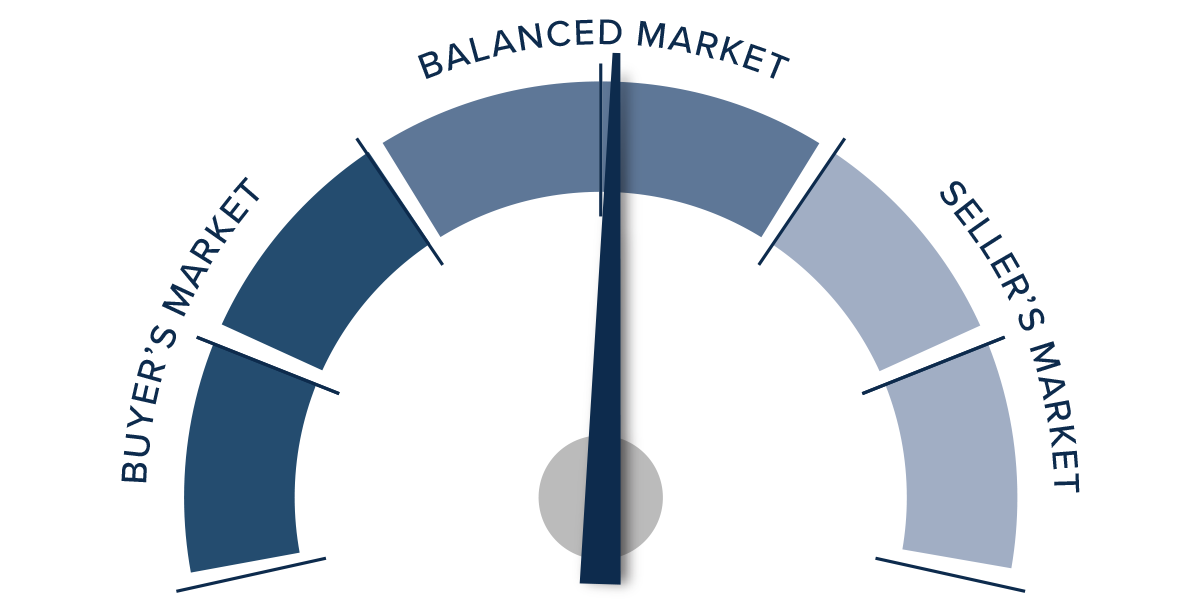

Conclusions

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

The Southern California housing market is still trying to find its footing. Mortgage rates are not only still at elevated levels, but they are also moving erratically depending on events in the broader economy (e.g. inflation, bank failures, etc.) Although sellers seem to be more confident, buyers are remaining cautious, which suggests that the market recovery will take more time.

Lower inventory levels, higher pending sales, higher listing and sale prices, and an improving absorption rate all favor sellers. However, the market is not completely in their favor. As such, I have left the needle in the “balanced” section of the speedometer. I have tilted it slightly toward home sellers though as there continues to be strong demand for appropriately priced, well-located, and well-appointed homes.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Principal and Interest: Defined and Explained

When you take out a mortgage, one of the challenges that people often face is understanding the long list of complicated terms and lingo. Two common terms often used in the world of banking, including mortgages, are principal and interest. First-time home buyers, in particular, may not fully understand how their mortgage payments are determined. Simply put, it all comes down to principal and interest.

Below, we explain the difference between the two and apply these concepts to help you manage your personal finances.

What Is Your Principal Payment?

The principal is the amount of money you borrow when you originally take out your home loan. To determine your mortgage principal, just take the sales price of your home and subtract the amount of your down payment.

For example, if you buy a home for $300,000 with a 20% down payment. In this instance, you would have put down $60,000 toward your loan. Your mortgage lender would then cover the cost of the remaining amount on the loan, which is $240,000, which would be your principal balance. Your principal is the most important factor in deciding how much home you can afford. The principal you borrow accumulates interest as soon as you take it out.

Each month, part of your mortgage payment will go toward lowering your principal balance. It’s important to be aware that the principal starts accumulating interest as soon as you close on your loan.

What Is Your Interest Payment?

The second major part of your monthly mortgage payment is interest. Interest is money you pay to your mortgage lender in exchange for giving you a loan. Lenders charge interest as a way to profit from lending money. That means you have to pay back what you originally borrowed plus some extra. However, the amount of interest lenders charge differs from one lender to the next, as well as between different types of loans.

The amount of interest you pay over the life of your loan will depend on your interest rate. When you apply for a mortgage, your lender will evaluate your eligibility and offer you an interest rate based on factors that include your:

- Credit score

- Income

- Down payment

- Debt-to-income ratio

- Housing market

Interest Rate vs. APR

It is also worth mentioning that the interest rate on your loan is not technically the same as its annual percentage rate (APR). Though these terms are sometimes used interchangeably, they are two different things, and both are important to understand.

- Interest rate on your loan is the cost you pay to borrow the funds from the lender.

- APR reflects the interest rate plus other expenses, like mortgage points, fees and any other charges associated with borrowing the money.

The APR is a broader measure of what it will cost you to pay back the loan, so it is typically higher than the pure interest rate. If you are comparing loan offers from different lenders, be sure to examine the APRs and interest rates separately. Do not compare the interest rate from one lender with the APR of another, for example.

How are Principal and Interest Calculated?

Lenders multiply your outstanding balance by your annual interest rate, but divide by 12 because you’re making monthly payments. So if you owe $300,000 on your mortgage and your rate is 4%, you will initially owe $1,000 in interest per month ($300,000 x 0.04 ÷ 12). The rest of your mortgage payment is applied to your principal.

Is It Better to Pay Off Principal or Interest First?

As a general rule, it is better to pay off your principal first. Although your amortization schedule will outline a plan for paying off your loan, you may be able to pay it off faster and avoid some interest by putting extra money toward your principal. The faster you pay off your loan principal, the less you will pay in interest.

Using a loan principal and interest calculator is a good strategy for helping you make a plan for paying down your principal balance faster. By understanding all of the terms and conditions involved with personal loans, you can get a better idea of the money you’ll ultimately owe.

When you make monthly payments to the lender, everything you pay above the interest payment amount goes toward paying off the principal. The more you deposit into the credit account, the faster you reduce your principal balance, and the less you usually have to pay in interest.

Other Components of Your Monthly Mortgage Payment

While your principal and interest make up most of your monthly mortgage payment, you may also pay money into an escrow account as part of your mortgage payment each month. Your lender will then take the money in your escrow account to pay important mortgage-related expenses on your behalf.

These expenses most often are:

- Property Taxes

All homeowners must pay a property tax, which goes to their local government to fund public services such public schools, roads, recreation fire departments and libraries. Taxes are one of the most overlooked parts of owning a home, and they can also be one of the most expensive. Property taxes go to your local government and fund things like.

The amount you pay in taxes depends on the value of your home and the local amenities your community offers. Part of the reason you get an appraisal when you buy a home is so your local government can correctly calculate your taxes. Taxes can vary from year to year, and your county might require you to get a new appraisal every few years.

- Homeowner’s Insurance

You are not legally required to have homeowner’s insurance to own a home. However, most mortgage lenders will not give you a loan without insurance. Homeowner’s insurance protects you against damage from fires, break-ins and lightning storms, just to name a few examples. You may need an additional policy to protect yourself from damage caused by flooding and earthquakes.

Mortgage insurance is calculated as a percentage of your home loan. The lower your credit score and the smaller your down payment, the higher the lender’s risk, and the more expensive your insurance premiums will be. But as your principal balance falls, your mortgage insurance costs will go down, too.

If the amount you owe in homeowners insurance, property taxes or both changes over the life of your loan, your lender will reassess the amount you pay into escrow each month and raise or lower your monthly payment accordingly to ensure these costs remain covered.

Find the Right Agent

Buying your house should be a fun and fulfilling experience. If you have done your research and evaluated what you can afford and what you truly need, finding a new home can be exciting. Learning more about the purchase process eliminates the fear of the unknown and lets you search for a home with peace of mind.

Windermere’s community of real estate professionals is our greatest asset. We have experts in all areas of real estate, from your typical starter home to condos, luxury properties, and new construction. While residential real estate is the mainstay of our business, Windermere also has offices and associates who specialize in property management, commercial real estate, and relocation services. To further facilitate the home buying process, Windermere has affiliated partners in certain regions to provide mortgage, title, and escrow services.

Call us today with any questions or concerns. Our professional Real Estate Agents will help you through this exciting process. (951) 369-8002

Common Hidden Costs of Buying a Home

A house is often the most expensive investment a person will make in their lifetime. When you buy your first home, it is easy to get caught up in the excitement. When you buy a home, you might be expecting certain costs, such as the earnest money deposit and the actual monthly mortgage payments — but there could also be hidden costs that first-time homebuyers especially may not anticipate.

Mortgage lender requirements, closing costs and other lesser-known fees add up for homebuyers, especially those with little to no experience navigating the real estate market. These hidden costs of buying a home could leave you feeling overwhelmed. And you would not be alone in that feeling. In fact, studies have shown that nearly 20% of buyers underestimated the total expense of owning a home, including taxes, insurance and other unexpected disbursements.

This guide breaks down common hidden costs of buying a home so you can be prepared when it comes to closing on your dream home.

PROCESS COSTS

It takes an average of 45 days to close on a house. Several costs pile up within that nearly two-month window, including:

Earnest Money

When you buy a home, you will pay “earnest money” up front after a seller approves your offer and before you start checking off all the tasks required to buy a home. The earnest money deposit shows the seller that you are serious about your plans to purchase their property. Once the transaction goes through, your earnest money will be applied toward your down payment on your closing date. If you choose to back out of the deal, you may not get your earnest money back. Your contract will outline the rules about your deposit, but earnest money is usually 1% to 3% of the home’s sale price.

Down Payment

The down payment is the part of the home’s purchase price you pay upfront, rather than financing it through a mortgage. If you are buying a $300,000 home, for example, and put 10 percent down, or $30,000, you would be getting a mortgage for $270,000.

If you choose a conventional or FHA loan, a down payment is required. The amount of the down payment that is required is based on the home’s price and property type, as well as the loan product.

For a conventional loan, exactly how much down payment you need depends on the lender and loan type — you might put down 3 percent, 10 percent, 20 percent or more. With an FHA loan, you could be able to put down as little as 3.5 percent.

It is important to note that there are loans without a down payment requirement: USDA loans, for borrowers buying in designated markets (generally rural), and VA loans, for eligible service members and veterans.

Home Appraisal Fees

Your lender will want to ensure that the home you purchase is actually worth what the seller is asking. This requires a home appraisal that you get to pay for.

A designated appraisal management company (AMC) will appoint an appraiser to perform this duty. The total cost of your appraisal will depend upon several factors, including:

- The size and value of the property

- The type of mortgage you are applying for

- The property’s geographical location

Expect to pay at least $300 for an appraisal, but it could be closer to $1,000 depending on your situation.

Home Inspection

While not required, having a property’s systems and overall soundness professionally inspected before a deal goes through is highly recommended and can be worth every penny. Most homebuyers still get an inspection to avoid purchasing a house with serious structural issues. Home inspections save homeowners money on repairs in the long run, but scheduling one will cost you money upfront.

The factors that affect the cost of a home inspection mirror that of a home appraisal — namely, square footage, cost of living, and the state of the housing market. The costs between the two are similar as well, with prices averaging $300–$400 but often costing more depending on where you live and what you are buying.

CLOSING COSTS

You do not want to show up on closing day only to find that you are unprepared for the litany of costs. These costs must be paid before you can take ownership of your house, so come to the table ready to hand over a check.

Loan Origination Fee

Some mortgage lenders will charge a loan origination fee to set up your home loan. Every lender has their own process for how they charge fees, so you may see some lenders split up the origination fee into a processing fee (for reviewing your application and assembling documentation) and an underwriting fee (to determine if you qualify for the mortgage loan).

Lenders base loan origination fees on a certain percentage (usually between 0.5% and 1%) of your total loan amount. If you apply for a $500,000 mortgage and they charge a 1% origination fee, then you’ll need to pay $5,000.

If you come across a lender that does not charge a loan origination fee, take a look at how much interest they charge. More often than not, lenders that do not charge loan origination fees charge higher interest rates which may cost you more in the long run.

Homeowner’s Insurance

During your closing meeting, you will need to prove that you have protected your investment with a homeowner’s insurance policy. Lenders typically require you to have paid for a year of insurance before signing off on your mortgage.

The cost of homeowners’ insurance will vary depending on your location, the type of coverage you’re buying and any discounts you might qualify for, and your insurer.

Broadly speaking, you can expect to pay about $35 a month for every $100,000 in home value. Coverage for rebuilding or repairs after an earthquake or flood is usually not included in standard homeowners’ policies, so you may want to — or in the case of flood insurance, have to — buy a separate policy.

If you are buying with a mortgage, the lender will typically roll the cost of insurance into the monthly mortgage payment and pay the premiums on your behalf.

Property Tax

As a homeowner, you will need to pay property taxes. Property taxes are determined by the township, city, or county in which the home is located. The effective average rate nationwide is 1.1% of the home's assessed value, but it varies widely by state and locality, from an average under 0.4% in Alabama to about 2.2% in New Jersey. Property tax is guaranteed payment in perpetuity. Although you do not have much say in how much it is, as with any tax, strategies exist for lowering it.

Some states, like California, require payments of property taxes in two installments.

Escrow Fees

Sometimes known as closing fees or settlement fees, escrow fees are paid to the title company for handling money, the title transfer, and other paperwork for real estate transactions. These fees vary depending on your area and the title company you choose to work with, and in some cases it may be a percentage of the sale price rather than a flat rate.

Your lender pulls funds from your escrow account, but a third-party escrow company manages and operates it. They do not set it up for free, though. Average escrow fees range between 1% and 2% of a home’s sale price. This cost is often split between the buyer and the seller, though these terms may be negotiated in favor of either party as part of the initial offer.

You might also want to shop around to find a closing services provider with lower fees; your real estate agent can guide you to title and escrow companies they have had success with in the past to get you both a good deal and a smooth transaction.

SITUATIONAL COSTS

Other situations add to your overall home buying cost depending on where and how you are buying your house. These costs do not apply to every purchase situation, which is why they often take homebuyers by surprise.

Homeowner’s Association Fees

Homeowner associations or HOAs are non-profit entities that can establish and enforce rules, provide basic services such as water and tend to the maintenance and repair of community amenities such as pools, roads and landscaping. If you are buying a condo or another kind of home in a community overseen by a homeowner’s association (HOA), you will likely be required to pay a monthly fee, known as an HOA fee. HOA fees are determined by the association, and highly variable. These funds go toward the services the association provides, which may include security, a pool or gym and landscaping and maintenance.

HOAs can also charge occasional special assessment fees for urgent repairs. These financial obligations may be overlooked when buyers tally up the costs of buying a home, but they add up quickly. Dues vary widely, and can change depending on the community needs.

Mortgage Insurance

Mortgage insurance offsets some of the risks a lender takes when it allows people to buy a house without substantial money down. Mortgage companies know that not everyone can afford a sizeable down payment for their homes, but small down payments equal more considerable risks for lenders. If your down payment is less than 20% of your home’s purchase price, your lender will likely require you to purchase mortgage insurance. Mortgage insurance is also always required on FHA loans. This policy protects the lender if you stop making payments on your mortgage loan.