5 Major Mistakes Seller’s Make In A Buyer’s Market

The real estate market is cyclical. Even a long-lasting buyer or seller’s market will eventually come to an end as demand, price and supply change in any particular area.

As the name indicates, a buyer’s market is one in which the real estate market conditions favor buyers. Perhaps the inventory of listed properties is exceeding current demand, and sellers are forced to lower their listing prices. This provides the opportunity for buyers to purchase property at a better price than typical market value.

In all our years in the real estate space in the Inland Empire, we at Windermere have seen sellers make common mistakes that have resulted in them missing out on a profitable sale! If you are thinking about buying or selling a home, it is important to understand the market dynamics that could affect your bottom line.

To help you avoid, our expert team has listed some of the common mistakes that sellers make in a Buyer’s Market.

What Is a Buyer’s Market?

As you might have guessed, a buyer’s market favors buyers, not sellers. But what, exactly, does that mean?

A buyer’s market happens when the number of homes available is greater than the number of potential buyers. Simply put, the supply exceeds the demand in the real estate market. One indicator of a buyer’s market is lower home prices.

During a buyer’s market, homes often sell right around the listing price and sometimes even less. There is little opportunity to demand anything higher without causing buyers to turn to other comparable homes in your area. Sellers are at a disadvantage because of the volume of competition. Instead of waiting for the right buyer to come along, sellers often agree to a sale for less than they hoped when the home was listed.

Another sign of a buyer’s market is seeing homes on the market for longer than average. If you drive through any given neighborhood and notice the same “For Sale” signs staying for weeks or even months, it is likely a buyer’s market. During this type of market, you are unlikely to see a bidding war for a home like you would in a seller’s market. Buyers in this type of market know they have the upper hand and are typically unwilling to spend above the asking price since they have so many homes to choose from.

Signs of a Buyer’s Market

- More properties on the market than in past periods

- 6 months or more of inventory on the market

- Listed properties spending more time on the market

- Current listing prices below previous sales prices

- Lower overall closing percentage

- Falling average house prices

- An increase in real estate ads trying to attract buyers

- Numerous Foreclosures

- Low Interest Rates

5 Seller Mistakes in a Buyer’s Market

Overpricing

When selling your house, it is natural to want the most you can get from the sale but in a buyer’s market, you want to be a bit more conservative when it comes to pricing your property. When you overprice your house, an informed buyer will be able to spot the inflated cost right away.

If the asking price is too high, there is a high probability that your house will remain on the market longer. The problem with this is that buyers see the extended time on the market as the property being less than desirable. To avoid this, make sure the asking price is just right so that you have room to negotiate. This way you will end up attracting more buyers.

Inaccessibility

A serious seller must make the property easy to show for potential buyers. Most of the people looking to enter the real estate market are searching online. As a result, this means that within hours of posting your home online, you may start getting requests from people who want to physically see the property in person. Making your property hard to access will play a major role in reducing the price and the image associated with it.

Not Taking the First Offer

Oftentimes, sellers do not take their first offer seriously. They keep holding out in hopes of a better offer. However, numerous studies have shown that more than 70% of the time, it is the first buyer that ends up buying the property. The first offer may be far lower than what you had expected. There still may be some room for negotiations in a buyer’s market, but keep your expectations lower that you would in a different market.

Offering Credit

If you have a leaky faucet, an unhinged door or the house needs a slight paint job, then it is in your best interest to invest the time and money to resolve these issues before you step foot on the market with this piece of property.

Most people do not want to buy a property in poor shape, especially in a buyer’s market. Competition is too high. Buyers that are investing in real estate property during a buyer’s market tend to be more selective. They want to look for the best simply because they can find the best. Thus, it is essential to get your property in its best shape. Locate the problems and fix them based on your discretion. It is wise to prioritize these issues based on their profitability.

A lot of sellers offer credit against such flaws. This just lowers the selling price. Instead of offering credits or a price cut, take out a day or two and get such issues resolved. This will result in your property selling faster and at a higher price.

Highly Personalized Changes

Often, sellers make the mistake of over personalizing the house they are selling. As a result, the probability of something being unuseful or unwanted to the other person increases significantly. If you end up making very specific and highly personalized changes, there is a high possibility that it might not work out for the buyer.

Therefore the highly recommended and fool proof plan here is to think like a buyer and put yourself in someone else’s shoes for a while. This will help streamline a lot of things when it comes to selling a property.

Selling a Home in a Buyer’s Market

Selling a home in a buyer’s market can be an uphill battle, so it’s important to mentally prepare yourself for what can be a stressful process. Make sure you will be able to emotionally separate what you love about your home from the feedback you get from buyers, and remind yourself that it is normal to receive lowball offers in a buyer’s market. Try not to be offended.

If and when an offer does come in, do whatever you can to keep the negotiations going, staying open and flexible. Remember to consider the full package. There is more to selling a home than just the sale price, and entertaining low offers does not make you a desperate seller — it makes you a smart one, as you are making the most of a cool market. If you do not have wiggle room on price, consider other concessions you could make to your buyer, including appliances, offering a convenient close date, or waiving contingencies.

If you are selling and buying at the same time — selling your current home in order to buy a new property—you may want to wait to buy your house until after your current house has sold. Buying is easy in a buyer’s market, so you should be able to find and purchase a new home quickly.

Find the Right Agent

If a buyer has a lot of homes to choose from in the area that he wants to be in, then it's a buyers' market. If there are few homes in that area, then it's a sellers' market. You can figure it out by asking your agent or you can go online and look at the number of homes that are for sale in your area.

Windermere’s community of real estate professionals is our greatest asset. We have experts in all areas of real estate, from your typical starter home to condos, luxury properties, and new construction. While residential real estate is the mainstay of our business, Windermere also has offices and associates who specialize in property management, commercial real estate, and relocation services. To further facilitate the home buying process, Windermere has affiliated partners in certain regions to provide mortgage, title, and escrow services.

Call us today with any questions or concerns. Our professional Real Estate Agents will help you through this exciting process. (951) 369-8002

7 Major Mistakes Buyers Make In a Seller’s Market

The housing market is constantly in flux, and thanks to the market dynamics of supply and demand, it often tilts between favoring buyers or sellers. If you are thinking about buying or selling a home, it is important to understand the market dynamics that could affect your bottom line.

Buying a home always has its challenges. But when you're trying to do it in a seller's market, the difficulty can reach a new level. But do not dismay! Buyers in a seller’s market can get what they want, but they need to have a solid plan in place.

In all our years in the real estate space in the Inland Empire, we at Windermere have seen buyers make common mistakes that have resulted in them missing out on the home of their dreams! To help avoid this happening to you, our expert team has listed some of the common mistakes that buyer’s make in a Seller’s Market.

What Is a Seller’s Market?

In a seller's market, demand for housing is high, but the supply of homes for sale is low. This imbalance in supply and demand can lead to bidding wars and rising home prices. The cause of a seller's market can vary based on economic factors both national and local. For example, certain cities can experience a high demand for homes and low inventory if new businesses open or there is an influx of new residents. On a national scale, low mortgage interest rates can inspire more people to buy, and that increase in demand can trigger a seller's market.

As the name indicates, sellers have a slight advantage when their home is listed during a Seller’s Market, since there are often more buyers than homes available on the market. This is not to say that you should avoid buying in a seller’s market. But if you are planning on buying or selling, it is important to learn how to recognize a seller's market and how to navigate one.

Signs of a Seller's Market

These are housing trends that signal a seller's market:

- Low Inventory. Few homes are listed for sale, leaving limited options for homebuyers.

- Houses Sell Fast. Homes on the market sell quickly since there's a high demand.

- Houses Sell Over Asking Price. Bidding wars with competing offers occur frequently, pushing sale prices above the original asking price.

- Sellers Have More Leverage. Sellers have the upper hand when negotiating home prices and deal terms since there is elevated competition among buyers.

7 Buyer Mistakes in a Seller’s Market

· Not Being Ready and “On-Call”

When we say homes go fast in a seller’s market, we mean it. When a market is hot, properties are moving quickly from “just listed” to “under contract” within a matter of days or even hours. You have to be ready to seize on a good opportunity as soon as it hits the market. It is not unheard of for people to make offers on a home before they even see it in person. You must have an “on call” mindset or you could miss out!

· Not Getting Pre-Approved

You might be confident that you will be approved for a mortgage loan based on your steady income, your low debt-to-income ratio, and your high credit score — but the seller cannot rely on that. The only way to prove to the seller that you are a qualified buyer is to be prequalified from a lender. A pre-approval letter determines how much you can borrow after submitting your financial information like income and credit. Getting approved ahead of time is the best way to show the seller that you are serious and ready to buy now.

NOTE: Pre-Approved is different than Pre-Qualified! Pre-qualification means that you simply told your lender your financial story. Pre-approval involves submitting a mortgage application, complete with providing verifying documents. Pre-approval from a reputable lender is key. Presenting this shows the seller that the buyer has already set the wheels in motion and is serious about making a deal.

- Not Making Your Best Offer First

Most people want to buy as much as possible for as little money as possible. So when most people see the listing price of a home, they naturally wonder what they can really get the house for. Offering lower than asking price is a reasonable strategy, especially if the house is overpriced compared with other similar homes in the area, or if it is a buyer’s market with lots of available inventory.

But trying to get a deal when you are the buyer in a seller’s market might not be the best tactic. Not only is it important to make an offer quickly, but even more important to make a good, strong offer. In a Seller’s Market, there’s no time for what I call “low-ball” offers. In a seller’s market, you need to go all in with your best offer up front since this market indicates a shortage of inventory and fierce competition. Most sellers in this market have the luxury of waiting to get the price they want, not to mention they could receive multiple offers at one time. Therefore, you should present your best initial offer, giving the seller a reason to work with your offer over another.

- Not Being Prepared for a Bidding War

If there is ever a time when a bidding war could be imminent, it is during a seller’s market. Odds are your offer will be rejected at least once during the home buying process. You may even enter a bidding war, which can cause you to pay over your max budget if you are unprepared. The best way to stay within your budget is to search for homes below your price range. This creates some leeway in case negotiations take place after your initial offer. During negotiations with the seller, your real estate agent will be your best asset.

- Over-Analyzing the Purchase Price

Over-analyzing a home purchase in a seller’s market is ill-advised. When you wait too long, you risk losing the home you have fallen in love with. Once you have finally found a home that meets all your qualifications, make the offer! To give yourself more leverage, be prepared to move quickly by having your finances in order — get a preapproval.

· Expecting a “Great Deal”

It is a hard pill to swallow, but “great deals” do not often exist in a Seller’s Market, unless the homeowner is highly motivated to sell quickly. The words GREAT DEAL in themselves are very subjective. In a market on the rise, most purchases look like a “great deal” a year or two after the transaction.

- Working With an Inexperienced Agent

Choosing the right real estate agent is imperative when buying a home in a seller’s market. If you have a seasoned agent on your side, you will probably have a better chance of getting the home you want. Experienced agents know the ins and outs of the local market and help you save time and money. Plus, in most cases, buyers do not pay real estate agents; sellers do.

Find the Right Agent

If a buyer has a lot of homes to choose from in the area that he wants to be in, then it's a buyers' market. If there are few homes in that area, then it's a sellers' market. You can figure it out by asking your agent or you can go online and look at the number of homes that are for sale in your area.

Windermere’s community of real estate professionals is our greatest asset. We have experts in all areas of real estate, from your typical starter home to condos, luxury properties, and new construction. While residential real estate is the mainstay of our business, Windermere also has offices and associates who specialize in property management, commercial real estate, and relocation services. To further facilitate the home buying process, Windermere has affiliated partners in certain regions to provide mortgage, title, and escrow services.

Call us today with any questions or concerns. Our professional Real Estate Agents will help you through this exciting process. (951) 369-8002

Buying or Selling a Home “As-Is”

A real estate transaction is not typically as easy and straightforward as submitting an offer and buying a property. There can be negotiations and contingencies, all of which can complicate the closing process. However, with “as-is” real estate, properties are sold exactly how they are listed, and surprisingly enough, can offer some interesting benefits for both buyers and sellers.

Selling a house “as-is” means that the buyer will purchase and take ownership of the property in the exact condition it is in currently, warts and all. The seller is stating that they will not make any repairs or home improvements. If a buyer requests that repairs are made, they will be typically be denied and the sale price will not be adjusted through further negotiations after a home inspection.

The expert team at Windermere Real Estate has put this guide together to teach you how to navigate “as-is” real estate to help you decide if this is the right solution for you, whether you are buying or selling.

What Is “As-Is” In Real Estate?

“As-Is” in real estate means the property is being sold in its existing condition, with zero responsibility on the seller to repair anything on the property beforehand. With “as-is”, buyers will also not receive any credits from the sellers, even if improvements are necessary. “As-Is” properties are rarely in perfect condition and often require significant repairs. However, they can also represent a lucrative opportunity for real estate investors or first time buyers with the ability to make the repairs themselves.

Please note that selling your home “As-Is” does NOT mean that you can lie about the condition of the home or property. You cannot and should not intentionally hide or misrepresent defects or other important information to buyers that might cause them to not buy your home. In fact, many states still require you to provide seller disclosures about the condition of your home no matter what the terms or sale price is.

Intentionally hiding or misrepresenting home defects when you sell your house can result in serious legal action against you or your real estate agent if they were involved.

What Does “As-Is” Real Estate Mean To Sellers?

Selling a home “as-is” may sound like a promising opportunity, but the process is actually more complicated than you might think. It is a common misconception that if sellers add “as-is” to a listing, they will not have to participate in closing. This is not the case.

Even “as-is” properties go through a closing process where the sellers are required to participate. As stated above, sellers must disclose if they are aware of any problems with the house, as they are not allowed to misrepresent the property. This can make these properties more difficult to market but there will always be buyers interested in the deal they may get from an “as-is” property.

Sellers who are looking to simply sell their property fast may find this particularly attractive, as there will be no projects to complete before closing.

Pros of Selling a House “As-Is”

Selling “as-is” means you are selling your home fast and in its current state without needing to spend time or money on repairs. Pricing “below market” value due to necessary repairs needed may attract “flippers” and other cash buyers looking to invest, rehab and sell a house at a profit. Cutting out the finance company means they can close on deals faster with less paperwork and red tape. This is a serious benefit when you sell a property “as-is” and is the main reason most people who sell this way choose this option.

Whether due to finances, time restrictions, or simply a desire to avoid the headache of dealing with home improvements, repairs and contractors, selling “as-is” leaves all that to the new buyers.

Cons of Selling a House “As-Is”

“As-Is” properties attract a certain type of buyer. Selling your home “as-is” does two things; it disqualifies buyers looking for “move in ready” properties, thus reducing your potential reach and base of prospective buyers. It also attracts a certain type of buyer: generally, those looking to make an offer that makes sense for their wallet, but not necessarily your bank account. But this is typically a trade off when you sell a property “as-is” that you need to be fully aware of.

Although negotiation is often part of any real estate sale, expect to deal with more of this when selling “as-is”. Houses sold as-is, often attract real estate investors, rehabbers and “flippers” who are looking to scoop up a property as cheaply as possible. This creates an environment ripe for “haggling” at the lowest price possible. If you are using a real estate agent, they will be able to negotiate on your behalf but if you are selling by owner, you will be responsible for these negotiations. Those buying “as-is” are typically adept at negotiating, so an experienced real estate agent could be a great asset to have on your side.

What Does “As-Is” Real Estate Mean To Buyers?

Buyers often interpret “as-is” properties as severely damaged or far from move-in ready. However, given the right circumstances, they should not necessarily be disregarded right off the bat.

It may be true that “as-is” homes require significant repairs or upgrades, but they are often sold for a lower price. This means savvy buyers can make a great deal on a home that they may have otherwise not been able to afford.

The key to buying an “as-is” property is understanding that sellers are still subject to a home inspection. This can act as a safeguard against any repairs buyers may not be equipped to deal with—providing an opportunity to back out of the deal if the property becomes more costly than expected.

In short, buyers should be prepared to make a few significant fixes, but they should never move forward with a deal that does not make financial sense.

Pros of Buying “As-Is”

Perhaps the most attractive benefit of buying an “as-is” home is the chance to secure a lower price. “As-Is” properties are often listed at highly competitive prices, and sellers may even be willing to take a lower priced offer than that in a difficult market. Real estate investors in particular may find this appealing as they can secure good deals properties to rehab.

That being said, another benefit of buying “as-is” properties is the potential land value. If the lot is in a good area, it may make a good candidate for either a fix and flip or new construction project.

Cons of Buying “As-Is”

Though there are several benefits of buying an “as-is” property, buyers should be careful to consider the potential cons. Most notably, “as-is” homes can come with a few surprises. For one, there is no guarantee that all issues with the property will be disclosed. After all, it is entirely possible for there to be problems that even the seller is unaware of. For buyers, this could mean costly repairs and time consuming work. The best way to avoid this issue is to hire a professional home inspector to sign off on the property before purchasing.

The Truth About “As-Is” Real Estate

“As-Is” real estate is not always going to be the right strategy for every investor. Even the most experienced real estate investors can be surprised by a structural problem on an “as-is” home. The truth is, with any piece of real estate, you will not know you are making a sound decision until you have all of the information.

The best thing you can do upon finding an “as-is” property is to approach the situation with caution. Get an inspection, estimate renovation costs, and then go from there.

With the right tools, you may just find yourself at the hands of a great deal.

Find the Right Agent

Before marketing your home in “as-is” conditions, make sure you fully understand what comes with selling your home “as-is.” You are inadvertently sending a message to the buying public that you may or may not want to send. Selling your home “as-is” limits your buying pool and attracts a certain buyer.

If you want to stand firm on not doing home inspection repairs and your house is in average to good condition, telling buyers your house is being sold “as-is” may not be the way to go. When it comes time to sell your home “as-is,” being transparent upfront will go a long way in buyers writing good offers on your “as-is” home.

Windermere’s community of real estate professionals is our greatest asset. We have experts in all areas of real estate, from your typical starter home to condos, luxury properties, and new construction. While residential real estate is the mainstay of our business, Windermere also has offices and associates who specialize in property management, commercial real estate, and relocation services. To further facilitate the home buying process, Windermere has affiliated partners in certain regions to provide mortgage, title, and escrow services.

Call us today with any questions or concerns. Our professional Real Estate Agents will help you through this exciting process. (951) 369-8002

Buying and Selling a House at the Same Time

If you own a home and are planning a move, the prospect of buying another house while you are selling your first one can seem pretty daunting. Do you sell your home first and live in limbo while looking for another, or do you buy now and foot the bill for two mortgage payments until you are able to sell? Can you time it perfectly and do both at once?

In a perfect world, this transition would take place in one day. You would simply sell your old one, then go on to closing on the new one. However, in the real world, it is not typically that simple. If you are wondering how to buy a house while also selling your current house, extensive knowledge of the process is important, and empowering yourself with the information you need can save you a great deal of headache.

So, you may be wondering, can I buy another house while simultaneously selling mine? The answer to that is, yes, you can. But the bigger question is whether you will want to once you understand the entire process.

Consider this key information on how to buy and sell a house at the same time.

Know the Local Market First

Before you start seriously searching for a new home or putting your current home on the market, make sure you have a thorough understanding of the housing market in your area.

Ask your real estate agent if the market is leaning toward buyers or sellers. In real estate, your best plan of action may depend whether sellers or buyers are in the more powerful position. This is known as a Buyer’s Market or a Seller’s Market.

What is a Buyer’s Market?

In a buyer’s market, there are more homes available than people looking to buy. In a buyer’s market, you will likely have an easier time finding your new home than you will with selling your old home. Sellers may be willing to accept a contingent offer, which means you agree to purchase their home contingent on selling yours first.

What is a Seller’s Market?

In a seller’s market, there are more buyers in the marketplace than there are homes available. In a seller’s market, your current home will likely sell more quickly than you will be able to find a new home. Consider asking your buyers to do a rent-back after closing to allow you time to find your new place.

Buying a House Before Selling

There are a lot of advantages to buying your new home first, before selling your old one. Primarily, it makes the move easier since you are able to take your time, move your belongings to the new place on any schedule you like, and avoid living in limbo while you wait for your current house to sell.

On the financial side, buying your new home first takes serious financial resources. Not only will you still have your existing mortgage payment, but you will have the new one as well, plus closing costs, down payment, moving expenses and upkeep and maintenance on both properties. It can be a lot to handle, especially if you are on a tight budget or limited income.

Buying first may also make getting a mortgage harder since you still have the existing mortgage debt to your name, your debt-to-income ratio could be much higher. That could mean a lower available loan balance for your new purchase, higher interest rates, or even not qualifying for a loan at all.

If you choose to buy a second home before selling your current home, here are some ways to make it happen:

- Rent out your old property: Once you have moved into your new house, consider renting or leasing out your old house. You could also list it on Airbnb or another short-term rental platform. This will allow you to generate income to maintain the home and pay its mortgage while you look for a permanent buyer.

- Consider a contingency clause: A home sale contingency clause is an agreement written into the contract that says if you are unable to sell your current home by a certain date — making it financially possible for you to purchase the new home — then you can walk away from the contract, and your earnest money will be returned. Not every seller will agree to these terms, but if the market is slow there is a chance they will consider it.

- Consider a home equity loan or bridge loan: If you have equity in your current home, you could free up cash to cover your down payment, closing costs, and additional expenses while maintaining both properties. A bridge loan makes it possible to finance a new house before selling your current home. Both options may have high interest rates, so take a closer look with a financial advisor before going these routes.

Pros: The Benefits of Buying Before Selling

- The process of house hunting can be less stressful and more enjoyable

- You are less rushed into buying a house in a hurry

- You can move straight into your new home, so you expensive storage fees or doubled moving expenses can be avoided

- If the deal falls through during the process of purchasing the new home, you still have your old home to stay in

Cons: The Negative Aspects of Buying Before Selling

- Your cash will be tied up in the investment in your current home, giving you less opportunity for larger down payment or high offer for the new home

- You might be pressured to accept a lower offer on your house if you are in a rush to sell

- You may end up paying for two residences at once until you sell your home

- You will also be responsible for two sets of taxes

- You may not qualify for a new mortgage when you have your existing one

Selling a House Before Buying

Many people choose to sell their existing house first. This reduces the financial stress and allows you to use the proceeds from the sale when searching for that dream home. It is a more simple, straightforward and easy strategy to budget for.

The biggest downside to this approach is that it leaves you needing a place to stay until you purchase a new house. This can be particularly difficult for families with small children, a family, pets or lots of belongings.

If you have decided to sell your current home first, here are some steps you can take to make the process a bit smoother.

- Arrange temporary housing: Before you list your home, make sure you have a temporary place to live once the property sells. This could mean living with a friend or family member, or it might mean renting a hotel room for a few months while you look for a new house. Whichever option you choose, have a plan (and financial resources) in place to make it happen.

- Know what you are looking for in a new house: Start narrowing down your list of must-haves, and research potential neighborhoods and communities. As soon as you have accepted an offer on your existing house and know exactly what your budget is, you should start hunting for your new property right away to minimize your time in limbo.

- Be ready to buy: Get preapproved for your loan once you choose a mortgage lender. You should also set your budget, preferences and timeline, so you can start viewing relevant properties as soon as your old house sells.

- Consider a lease-back: You may be able to negotiate a lease-back if the buyer of your old house is not on a tight timeline. This allows you to “rent” the property from the new owner for a certain amount of time while you look for a new home. You may need to make payments to the buyer in order to do this, or it might mean reducing the sales price.

Pros - The Benefits of Selling Before Buying:

- You are not paying for two mortgages at the same time

- Cash will be easily accessible for a down payment for your new property

- You will have a more exact budget for buying the new property.

- You may not qualify to carry two mortgages, so this option can be ideal for those with less-than-stellar credit

- You will not have the pressure to reduce your asking price to sell your home quickly

Cons - The Negative Aspects of Selling Before Buying:

- Finding a temporary place to live before settling in a new home can be stressful

- You will have to move twice and pay for storage and additional moving costs for two moves

- Your investment will temporarily be out of the real estate market

Buying and Selling at the Same Time

Finally, you have a third option: you can buy and sell at the same time. There is no way to make the process of buying or selling a home totally predictable, but thinking through your preferred strategy will help you navigate the ups and downs a little bit more easily. You will have to time your two transactions perfectly, negotiating with the buyer for a later closing date and pushing your lender to work fast to prevent any lag time between sales.

When buying a new home and selling an old one at the same time, one transaction always goes first. Sometimes one happens first due to personal preference, while other times, it is a matter of finding the perfect home before you are ready to sell. Each of these moves should be considered carefully and a qualified real estate agent can help strategize based on local market conditions.

For people who need the proceeds from one sale to move forward with an offer on a new house, that’s where an offer contingency comes in. It essentially means the homebuyer has a set amount of time to sell their current home to help finance the new home purchase.

You could also request an extended closing. While most buyers want to move into their new home right away, you still need time to sell yours. As part of your purchase offer, request an extended closing of 60 days to have extra time to find a buyer.

Find the Right Agent

Buying your house should be a fun and fulfilling experience. If you have done your research and evaluated what you can afford and what you truly need, finding a new home can be exciting. Learning more about the purchase process eliminates the fear of the unknown and lets you search for a home with peace of mind.

Windermere’s community of real estate professionals is our greatest asset. We have experts in all areas of real estate, from your typical starter home to condos, luxury properties, and new construction. While residential real estate is the mainstay of our business, Windermere also has offices and associates who specialize in property management, commercial real estate, and relocation services. To further facilitate the home buying process, Windermere has affiliated partners in certain regions to provide mortgage, title, and escrow services.

Call us today with any questions or concerns. Our professional Real Estate Agents will help you through this exciting process. (951) 369-8002

Exploring Your New Neighborhood

When you buy a home in a brand new neighborhood or even a whole new city, chances are you will need to do some exploring on your own. But, that is part of the fun of moving to a new place, right? From the most bustling of cities to the smallest of towns, there are so many things to see, restaurants and shops to visit and people to meet. If you are going to settle down and get comfortable with the landscape you need to take some time in investigating it in detail.

While there is not always time to get out there and immerse yourself right after moving day, make a point of actively engaging with your new community as you settle in. In addition to helping you feel more comfortable in an unfamiliar environment, making an effort to discover your new neighborhood will ultimately make you feel more at home.

The Inland Empire is filled with fun and exciting neighborhoods. From quiet and kickback to lively and filled with activities, there is a neighborhood that is right for any personality.

Here are some tips on how to get started in exploring your new neighborhood.

Meet the Neighbors

The people who live around you are a big part of what defines your community. Meeting your neighbors provides you with an opportunity to ask questions about your new neighborhood and possibly discover some hidden gems (or worthwhile information) you might have missed otherwise.

Some areas are more naturally friendly than others, but you want to make sure you are sending the message that you are open to meeting people. Smile and say hello to neighbors who you come across, ask some light but engaging questions, and build rapport over time.

Take the First Step

These days, the proverbial “welcome wagon” does not necessarily show up on your door with a week’s worth of casseroles and cookies. So if none of your new neighbors have shown up to ring your doorbell, you certainly could bring some to them. You can even host a simple get together as a “housewarming” party; you will be surprised how many neighbors are curious about the new arrivals but intimidated to make the first move.

Take A Walk and Mingle

If you want to know what your neighborhood has to offer, go see it for yourself. Going for a walk is a great way to destress during or after the unpacking process, and will allow you to better visualize your surrounding area. If you have a dog, they can help break the ice with new neighbors on your block. A leisurely after-dinner stroll never seems out of place and gives you the opportunity for a planned “spontaneous” meet up.

Start Exploring!

Even in the age of GPS, you will need to know how to get where you want to go. While you can certainly look it up, there is no substitute for just getting out and about. Challenge yourself to drive or walk different routes each time you leave your house; you might stumble on a brilliant shortcut, a nearby coffee shop you didn’t even know was there.

Check Out Local Clubs and Meet-Ups

Neighborhoods are made up of people, first and foremost. To immerse yourself in the community, start by joining a local club or sports team. Thanks to the internet, meeting new people with similar interests is easier than ever before. Look to sites like Meetup or Meet the Neighbors, which can help you make the connection.

Act Like a Tourist

You do not have to live in a touristy city to approach your new neighborhood from a tourist’s perspective. Just think about what someone visiting your town might seek out – such as museums, local attractions and theater, top rated restaurants – and check those things out for yourself. Usually the things that draw tourists do so for a reason, so go see them for yourself. You do not necessarily have to check everything off your list in one day, but it would be handy to make a list of all the places you are interested to visit and follow through as you can.

Ask for Recommendations

Take a short cut to discovering the best of the best in your new neighborhood by asking for recommendations from people who have been in the area for a while. If your job is local, ask your co-workers where they recommend for live music or the best draft beers on tap. If you do not have anybody you can ask, use a site like Nextdoor, which is basically a forum for individuals in communities to share information, ask advice and get recommendations for new things to try.

Shop Locally

You can find a big box store anywhere you move, but little mom and pop shops sometimes require a little more effort. Shopping locally helps you support your community and what makes it unique. Local businesses bring local flavor to their environments, and the restaurants and shops that also call your neighborhood home can tell you a story about what’s important there and what brings people together.

Get Involved In the Community

There is no better way to become ingrained in the fabric of the community than to jump in with both feet. After all, this is your neighborhood now and you want to know what is going on. Attend upcoming HOA and neighborhood watch meetings. Those who take the time to go to these gatherings are the most-invested homeowners in your community. Listen to the issues and volunteer your feedback as a way to become known in the community. Volunteer to help with projects, like planting flowers in the spring or sprucing up playground equipment.

You also can see if the local parks or library needs volunteers, or check out the community center, where they can probably always use a helping hand. Many towns have community gardens, where you can chat with neighbors. If you have kids, volunteering at the school is an ideal way to get involved immediately. By putting yourself out there, your new town will feel like home in no time.

Find the Right Agent

The day will come when your new neighborhood no longer seems so novel and you have settled in to life in the community. Take the time in the beginning to go the extra step and immerse yourself in where you live, and you will feel a deeper connection and appreciation as the days, months, and years add up. A move to a new neighborhood is an opportunity to explore the world with a fresh set of eyes, so make the most of it and get out there. You will always be glad that you did.

Windermere’s community of real estate professionals is our greatest asset. We have experts in all areas of real estate, from your typical starter home to condos, luxury properties, and new construction. While residential real estate is the mainstay of our business, Windermere also has offices and associates who specialize in property management, commercial real estate, and relocation services. To further facilitate the home buying process, Windermere has affiliated partners in certain regions to provide mortgage, title, and escrow services.

Call us today with any questions or concerns. Our professional Real Estate Agents will help you through this exciting process. (951) 369-8002

Preparing To Buy Your First House

Buying your first home is an exciting yet intimidating experience. The entire journey is filled with emotions and hurdles and victories but it can feel a little bit overwhelming at times. The Inland Empire is full of wonderful cities with so much to offer different types of needs. From the historic districts of Riverside to the horse properties of Corona and everything in between, there really is something for everyone.

Before you take on the challenge of buying your first home, it is helpful to have some first-time homebuyer tips handy to help you navigate the process. If it has been a while since you bought your last home, these tips will bring you up to speed on what it will take to become a homeowner again.

Tips For First-Time Home Buyers

Homeownership means you will be on the hook for repairs and maintenance on your home. And if you need a mortgage to buy a house, make sure your financial house is in order before you start shopping for a mortgage. Your credit score needs to be in good shape while saving for a down payment and looking for your next home. It is a lot of to think about, but you do not have to do it alone.

We have pulled together some of our best tips from our industry professionals to help you get your foot in the door and avoid common mistakes new buyers make.

1. Establish a Realistic Budget

Before you start looking at available homes or talking to a lender, you also need to establish a budget that will work for your current financial situation. Decide how much you would feel comfortable spending on a mortgage.

When qualifying potential borrowers mortgage lenders calculate the borrower’s debt-to-income ratio. Lenders divide your total debt, including your mortgage payment, by your gross income to determine your maximum debt-to-income (DTI) ratio. Although lenders may approve you for a DTI ratio as high as 50%, the Consumer Financial Protection Bureau (CFPB) recommends capping it at 43%, to leave room in your budget for unplanned expenses or reductions in income.

When developing this budget, take into account other factors, like your current bills and savings plan. You definitely still want to put some money aside in case something needs to be fixed around the house. Also, consider additional fees that may come with buying a home, such as Homeowner’s Association (HOA) fees and insurance.

2. Maintain Your Credit

It is important to really tackle your current finances before you begin the long process of buying a home. A buyer’s credit score can affect their interest rate and it can determine the type of loan they qualify for. The higher the credit score, the more favorable interest rates will be. Mortgage lenders use a borrower’s credit score to evaluate how risky it would be to lend that person a substantial amount of money for a home.

Look at your current debts and payments and work on paying off any existing lines of credit. After all, paying down your debts will boost your credit score, thus making you a prime candidate for a loan.

Avoid changing jobs, charging new credit or making large cash deposits before your closing — your loan could be denied before you ever get to the closing table for doing so. When you apply for mortgage pre-approval, lenders will pull your credit report. And they’ll do it again before you actually close on the house and mortgage. If they see a new line of credit or another loan; discover that your credit balance has increased; or realize you are making late payments, you could be at risk of not getting the money you need for the home of your dreams.

3. Save For Your Down Payment and Other Costs

Save as much money as you can right now. Between the down payment, closing costs, and moving expenses associated with buying a home, it is important to save as much money as you can — and as early as you can.

There are several upfront costs involved in buying a home that you might be responsible for besides the down payment, such as:

- Closing costs

- Property taxes

- Homeowners association fees

- Homeowners insurance premiums

- Home inspection payments

4. Research the Available Loan Options Before Applying

Before you make a decision, make sure you have spoken to different banks and compared the costs. Try to do this even before you make a decision so as you’ll have plenty of time to make a comparison. The type of loan that you choose will help determine your down payment and what kind of home you can afford, among other things. There are multiple types of home loan options out there.

If you’re a first-time home buyer, then you have probably never shopped for a good interest rate for a home loan. Like we mentioned before, there are a lot of different types of mortgage loans available to new homeowners. Of course, the cost of service matters, but you’ll also want a lender with good customer service and a variety of mortgage options to choose from.

5. Complete Your Pre-Approval Before Starting the Search

It can be tempting to jump right into hunting for the perfect house, particularly if this is your first time. It’s a really good idea to get a mortgage preapproval before you begin comparing properties. You should have a pre-approval letter from a lender that will tell you exactly how much of a loan you can receive. It is based on your finances, with a lender having a deep look at your W-2s, bank statements, and credit score.

Some people may get a pre-approval letter and the pre-qualification process confused. A pre-qualification is simply an estimate of the amount of a home loan you could receive based on a brief look at your income and other information.

Prequalification letter: A prequalification is an estimate of the amount of home loan you can get. It’s based on an informal evaluation of your income and other information.

Preapproval letter: A mortgage preapproval is a document from a lender that tells you exactly how much loan money you can get. It’s based on your financial information, such as W-2s, bank statements and your credit score.

6. Create a Must-Haves And Deal-Breakers Checklist

You may have always dreamed of a home with three bedrooms, a spacious yard and a white picket fence, but have you thought about what you really need in a home? Before you begin touring houses, take inventory of what you will need in your new home. A list of must-haves and a list of deal-breakers can help you determine the right place for you. In a high-pressure seller’s market, you may feel rushed to make decisions. Keeping detailed notes throughout your home search will help you make better choices for your future.

Below are some ideas you may want to include in your checklist. Share your findings with your real estate agent to make sure they know which homes are hitting the mark and which ones are falling short.

- Number of bedrooms

- Number of baths

- Storage space

- Yard size and layout

- Energy efficiency

- Neighborhood safety

- Nearby businesses

- Commute

- School ratings

- Local ordinances for animals

7. View as many houses as you can

It is perfectly normal to get excited when you view a house that fits your criteria. But we advise our clients to be patient. Make sure you view other houses too before you make a commitment. This will also give you the chance to make a comparison. Make sure you examine the neighborhood properly. Visit the shops and supermarkets. Consider the traffic on your potential street. Is it a quiet area? Are there any parks nearby? Take a long walk around the neighborhood at different times of the day to get a better insight.

8. Have a Home Inspection Done

A home inspection is a vital part of the process. You want a qualified inspector to check out your potential home before you sign anything. A home inspector will check the house for any potential safety hazards or problems that need to be addressed. And, if repairs are needed, they may even be able to give you an estimate of the costs you will be facing should you move forward with your purchase.

The inspector will also have knowledge of home maintenance and what tasks should be done on a monthly, quarterly or annual basis. With that information, you may be able to renegotiate with the seller about any needed repairs — or at least pay to get them done ahead of time. After all, you want to prevent surprises down the road as much as possible.

9. Work With A Trustworthy Real Estate Agent

Most Americans will purchase a home or two in their lifetime, some none at all. A good real estate agent will search the market, find a home that fits your needs, and will assist you with the negotiation and closing process. When speaking to possible agents, inquire about their experience working with first-time homebuyers in your area and how they intend to assist you in your search.

A real estate professional can help by:

- Showing you properties in your area that fit your needs and budget

- Attending showings with you to learn more about your priorities as a homeowner

- Helping you decide how much to offer for a property

- Submitting an offer letter on your behalf

- Helping you negotiate with the seller or the seller’s agent after you submit an offer

- Attending the closing with you to make sure that everything is in order with your sale

Find the Right Agent

Buying your house should be a fun and fulfilling experience. If you have done your research and evaluated what you can afford and what you truly need, finding a new home can be exciting. Learning more about the purchase process eliminates the fear of the unknown and lets you search for a home with peace of mind.

Windermere’s community of real estate professionals is our greatest asset. We have experts in all areas of real estate, from your typical starter home to condos, luxury properties, and new construction. While residential real estate is the mainstay of our business, Windermere also has offices and associates who specialize in property management, commercial real estate, and relocation services. To further facilitate the home buying process, Windermere has affiliated partners in certain regions to provide mortgage, title, and escrow services.

Call us today with any questions or concerns. Our professional Real Estate Agents will help you through this exciting process. (951) 369-8002

Q3 2021 Southern California Real Estate Market Update

The following analysis of the Southern California real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

REGIONAL ECONOMIC OVERVIEW

The job recovery in Southern California continues to be quite the roller-coaster, with solid monthly gains followed by significant drops. In the first quarter of the year, more than 326,000 jobs returned, but that was followed by a less-than-stellar 8,300 increase in the second quarter. The latest third quarter numbers (most recent data is from August) showed that the Southern California region has added more than 27,000 positions, but this is still underwhelming.

The COVID-19 Delta variant is impacting the job market, and a lack of available workers isn’t helping. In aggregate, the region has recovered 1.31 million of the 2.02 million jobs that were shed when the pandemic hit, but this means Southern California is still down more than 700,000 positions. The region’s unemployment rate in August was 8.2%, down significantly from 14.2% a year ago. The most recent data shows the lowest jobless rates were in Orange (6%) and San Diego (6.6%) counties. The highest rate was again in Los Angeles County, where it was 9.7%. Although the current pace of the job recovery is muted, I hope it will pick up in the not-too-distant future, but the likelihood of reaching full employment anytime soon appears to be unrealistic.

SOUTHERN CALIFORNIA HOME SALES

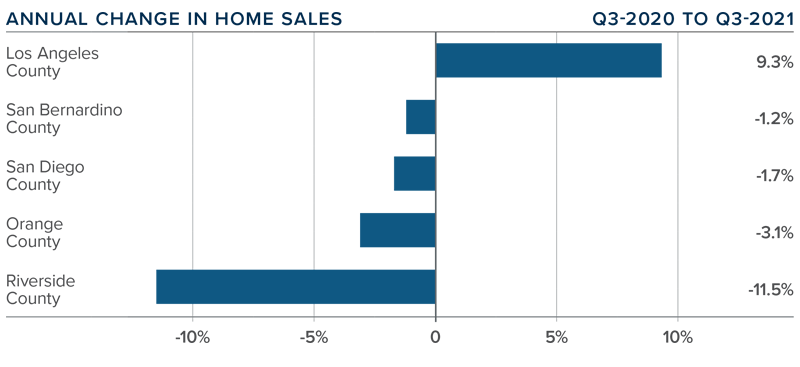

❱ In the third quarter, 50,313 homes sold in Southern California, representing a 0.1% drop from the same period in 2020 and 4.7% lower than in the second quarter of this year.

❱ Pending home sales, which are an indicator of future closings, were 4.5% lower than in the second quarter of this year, suggesting that the final quarter may also be down.

❱ Year-over-year, home sales rose in Los Angeles County, but pulled back in the remaining markets covered by this report. Compared to the second quarter, sales pulled back in all markets other than San Bernardino, where sales rose 6%.

❱ The issue is not demand, rather a lack of supply is holding the market back. Listing activity is down 22.3% from a year ago, and this is impacting sales. That said, listings were 17.1% higher than in the second quarter and, with more choice starting to emerge in the market, we could see sales volumes pick back up.

SOUTHERN CALIFORNIA HOME PRICES

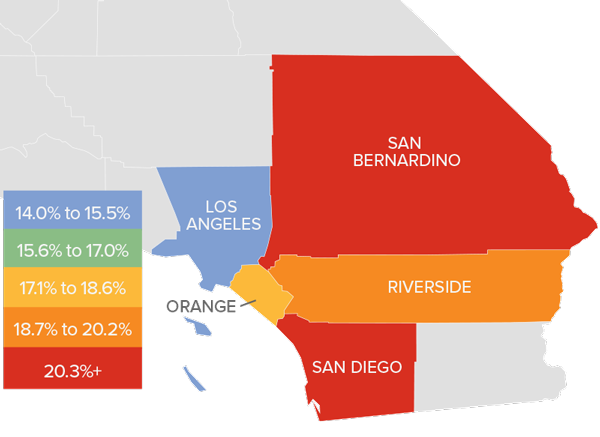

❱ The average price of homes sold in the region was $971,184. This was 19.1% higher than a year ago, but 1.4% lower than in the second quarter of 2021.

❱ Mortgage rates remain remarkably competitive, even if they are off the historic low of last December. Also of note is that jumbo mortgage rates are remarkably competitive—an important factor in expensive markets such as Southern California.

❱ The region saw double-digit price growth across all counties contained in this report. Year over year, prices were up more than 19%, but they were down 1.4% from the previous quarter.

❱ As stated in last quarter’s report, I believe interest rates will rise slowly, which is likely to bring out more buyers. With inventory levels starting to tick up, I am expecting the regional housing market to trend higher, but likely not until the spring.

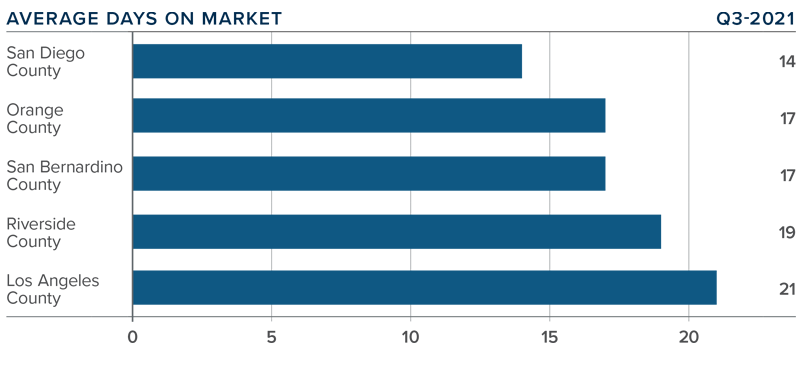

DAYS ON MARKET

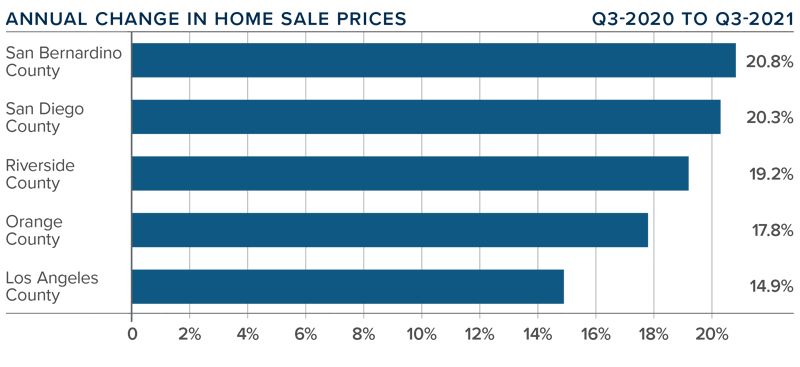

❱ In the third quarter of the year, the average time it took to sell a home in the region was 17 days, which is 16 fewer days than a year ago and 2 fewer days than in the second quarter of 2021.

❱ Three counties saw the time it took to sell a house drop compared to the second quarter of this year: Riverside, Los Angeles, and Orange. Market time was static in San Bernardino County and rose by one day in San Diego County.

❱ Homes in San Diego County continue to sell at a faster rate than other markets in the region. In the third quarter, it took an average of 14 days to sell a home there—9 fewer days than it took a year ago.

❱ With it taking an average of a little more than two weeks for a home to find a buyer, the market remains very tight. That said, with inventory levels rising, it is possible that days on market will start to creep higher, especially as affordability constraints potentially limit the number of qualified buyers.

CONCLUSIONS

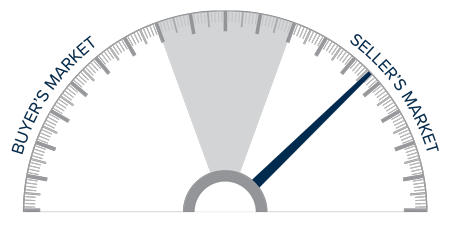

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

The third quarter was quite a mixed bag, with rising inventory levels but lower sales and prices compared to the second quarter. When I look at list prices, which is a leading indicator, as opposed to sale prices, which are a lagging indicator, I notice some softening in San Bernardino, Los Angeles, and Riverside counties. Although not a cause for concern, it may suggest that the market is about to start to cool—albeit modestly.

As such, I have chosen to move the needle a little more in the direction of home buyers, although sellers still have the upper hand.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

10 Mistakes to Avoid When Buying a Home

Whether you’re a first-time homebuyer or have purchased a home before, the same mistakes can rear their head at any point in the buying process. By working closely with your agent, you can identify these pitfalls ahead of time and adjust accordingly. Mistakes in the buying process can lead to higher costs, added stress, and even terminated contracts. Here are ten common mistakes to avoid when buying a home.

10 Mistakes to Avoid When Buying a Home

1. Not getting pre-approved

Getting pre-approved is a key component of the early stages of the buying process and will help to maximize your chances of getting your offer accepted. Getting pre-approved will give you a concrete idea of how much you can borrow, how much house you can afford, the estimated monthly costs of your mortgage and its corresponding interest rates. It also communicates to sellers that you are a serious buyer.

2. Not identifying your price range

Pursuing listings you can’t afford is a surefire way to start your home buying process off on the wrong foot. Buying a home that’s outside your budget will put added pressure on your finances and increases your chances of foreclosing, should your financial situation take a turn for the worse. Use the general rule that your house payment should never be more than 25-30% of your take-home pay, and as you prepare for talks with your lender be sure to account for all the expenses you will incur, including private mortgage insurance (PMI) if applicable.

3. Taking on new credit

Opening new lines of credit at any point in the home buying process will slow things down and can affect your chances of getting a home loan. Adding another credit card to your collection or taking out a loan will change your credit score, causing a ripple effect that can bring the buying process to a halt. Because new credit changes your debt-to-income ratio, lenders will likely want to review your mortgage approval and your risk of non-payment. This forces sellers to wait around for your application while competing buyers speed ahead of you in line.

4. Not purchasing adequate homeowner’s insurance

It’s understood that a home is a valuable asset that needs to be protected, but it is still all too common for homeowners to be under-insured. A homeowner’s insurance policy covers your home, your belongings, living expenses and injury or damage to others that occur on the property in the event of a disaster. Work closely with your insurance broker to make sure you have adequate coverage for the most common risks in your area like flood, earthquake, and more.

5. Not looking for other loans

With a little resourcefulness, you can tap into new sources of financial support that will help to ease the burden of making a home purchase. VA Loans can be a lifesaver for active service and veteran personnel, offering zero down payment and lower-than-average mortgage rates. Other government loan programs such as USDA and FHA loans can greatly aid homebuyers with favorable loan terms. Be sure to thoroughly review the qualifications of these loans before applying.

6. Misunderstanding the down payment

When it comes to down payments, it’s not twenty percent or bust. Granted, with a twenty percent down payment your lender won’t require you to purchase mortgage insurance; but even if you’re short, there are a number of alternatives to private mortgage insurance (PMI) available to you, such as Lender-Paid Mortgage Insurance and a piggyback loans strategy. Work with your agent to identify trusted lenders in their network that can help you secure the right loan.

7. Not working with a buyer’s agent

A buyer’s agent will help you to identify which homes you can afford, work with you on formulating a competitive offer and preparing for negotiations with sellers and listing agents. Buyer’s agents will also handle the paperwork when it comes time to close the deal. A home purchase is an intricate transaction with many moving parts and having an experienced professional by your side who can navigate each step is invaluable. Typically, the buyer’s agent splits the commission of the sale with the listing agent, which is paid by the seller, so generally their services come at no additional cost to you.

8. Underestimating repair and remodeling costs

Regardless of whether you’re buying a fixer-upper or a home that needs a few simple upgrades, you can usually expect some repair and remodeling expenses once the home is yours. Before you start swinging hammers or tearing up drywall, take time to assess the scope of the projects and whether you can do them yourself or need a professional. Talk with your agent about which remodeling projects have the highest resale value for comparable homes in your area.

9. Buying a home without an inspection

Buying a home without having it inspected opens the buyer up to added risk. Without a home inspection, you forego the ability to negotiate repairs and concessions with the seller. Getting a home inspection is a small investment and alerts you of any potential home disasters that may be on the horizon. However, this mistake comes with an aside. In a seller’s market where a high number of buyers are competing for a limited number of available listings, waiving the inspection contingency is a common tactic for buyers looking to make their offer stand out. Work with your agent to figure out what’s best for you and your situation.

10. Forgetting about moving costs

It’s easy to get so focused on the purchase of the home that you forget about what it will cost to move there. Moving expenses can add up quickly, especially if you’ll be traveling across state lines or across the country. If you’re buying and selling a home at the same time, there’s also the question of where you’ll live in between closing on your current home and closing on your new one. If these costs aren’t accounted for, you can quickly be over budget before you set foot in your new home.

For more information on how to make the buying process smoother, read about how you can Increase Your Buying Power.

What is a Seller's Market?

When the housing market favors sellers, a seller can expect ideal conditions for selling their home. However, that’s not to say that a seller’s market doesn’t come with its own unique set of challenges for parties on both sides of the transaction. That’s why it’s critical for buyers and sellers to work with an agent who not only understands their wants and needs but who can also help them navigate highly competitive market conditions.

What is a Seller’s Market?

A seller’s market occurs when demand exceeds supply. When inventory is limited, competition amongst buyers is fierce. Median sales prices increase, days on market decrease, and homes commonly receive multiple offers, often over their original asking price.

Selling in a Seller’s Market

Though demand is high in a seller’s market, staging and making any necessary repairs are still important steps to take before hitting the market. An agent can help a seller make important decisions about which repairs and updates help add value to the home.

When it comes to offers and negotiations in a seller’s market, sellers have the leverage. It’s common for homes to fetch more than their asking price with multiple offers on the table. Though prices are being driven up by demand, a seller may choose to list their home at or just below fair market value with the hopes of starting a bidding war. Because competition is so high, buyers may be willing to waive an inspection contingency to help make their offer stand out. Agents can help sellers decide whether they should conduct a pre-listing inspection, which sometimes helps the seller get more offers and command a higher price.

With multiple offers on the table, it may be tempting to simply choose the one with the highest figure; however, the best offer is also the one that removes risk and aligns with the seller’s goals. Whether that entails waived contingencies, a shorter closing window, or an all-cash offer, in a seller’s market, the seller has the power to choose. Sellers should fully review each offer with the help of their agent before proceeding.

Buying in a Seller’s Market

Buyers in a seller’s market must act fast. Due to the high level of competition, they must be prepared for a frustrating scenario where their offers may not win out. This emphasizes the importance of working with a buyer’s agent. In a seller’s market, it’s more likely that the buying process will include such factors as seller review dates and escalation clauses. A buyer’s agent will help navigate these challenges while working with their client to make their offer stand out. They will formulate a strategy, comparing their client’s wish list and budget against the limited number of homes available and proceeding accordingly. A buyer’s agent will also set the expectation that, due to the competitive nature of the market, finding the right home may take longer than expected.

In a seller’s market, the buyer is at a disadvantage when it comes to negotiations. The chance of getting a contingent offer is minimal and pushing for certain closing dates and specific repairs may do more harm than good to their offer. A cash offer has significant power in a seller’s market. If a buyer can make a cash-heavy or even all-cash offer, it is likely to stand out to the seller. It gives the buyer more buying power and greatly increases their chances of winning a bidding war.

For more information on the conditions of your local market, visit our website for Quarterly Real Estate Market Updates from our Chief Economist, Matthew Gardner. For assistance planning a home sale or purchase, connect with a Windermere Real Estate agent here: Connect With an Agent

Timeless Home Design

When decorating and designing, homeowners often strive for a home that may incorporate vintage and modern elements but remains timeless at its core. Fortunately, certain design principles and elements have stood the test the time and can help you curate the home you desire. Here is your guide to understanding how you can design a home that looks and feels timeless.

Principles of Timeless Home Design

Balance

When designing a space in your home, balance is a key concept to delivering a timeless ambiance. Achieved through a proportionate arrangement of objects and colors, balance will help create a logical pattern in your home that pleases the eye. Experiment with symmetry in your home to build balance. This doesn’t mean that there needs to be two of every object, rather in every space you should utilize the objects and color schemes present to create symmetry.

Focal Point

Imagine a living room without a couch or mantle, or a dining room without a dining table. These images are confusing because we simply don’t know where to focus our attention. A core principle of timeless design is that space should have a focal point to give order to the room. Focal points don’t always have to be derived from a built-in feature of the home, you can create one with furniture, artwork, or some other form of eye-catching décor.

Scale and Proportion

Scale and proportion are two fundamental concepts of interior design and are key to creating a timeless décor. Simply put, proportion refers to the relationship of items and colors, while scale refers to their relationship with the room. For example, if a room in your home has high ceilings, this allows for taller furniture and artwork, while the most spacious rooms in your house are the best home for large décor pieces and furnishings. Proper usage of scale and proportion also means leaving some space between items to let the room breathe, so to speak.

Colors and Patterns

For a timeless look and feel, choose more classic color and pattern schemes. Basketweave is a traditional pattern that helps to create symmetry. Stripes are always in style and can help to reinforce clean lines. Stick to neutral paint colors on your walls as they give you the flexibility to add décor without overwhelming the room. Combinations of off-whites, beiges, grays, and earthy tones will deliver that timeless feel you’re looking for.

Natural Elements

There’s nothing more timeless than nature. Materials like wood, stone, and marble have been a cornerstone of design since antiquity. Whether you utilize these materials in your home as furniture, accent pieces, or focal points, they will help create a trend-free, organic environment in any room.