Why Hire a Real Estate Agent When Buying or Selling a Home

You do not technically need a real estate agent to buy or sell a home. You could go it alone. However, the benefits of working with one are significant.

Sellers who sell their home with the help of the realtor generally sell faster and for more money. Buyers who purchase their home with an agent also typically score better prices. But that is just the tip of the iceberg. A qualified agent serves as an advisor in your corner, preparing you for every move in a competitive and often unpredictable real estate market.

Here are our top reasons why you should consider hiring a real estate agent when you’re selling or buying a home.

Why Hire a Real Estate Agent If You Are Selling

1. Help Price Your Home to Sell

Generally, as the seller, your primary goal is to sell your home as quickly as possible at the best price, so you can move on to your next place. But a significant factor in making a quick sale is ensuring that your house is priced appropriately for the market. As the homeowner, it is easy to overvalue your home since you likely did work to it, you loved it for a certain amount of time, but there is likely a bit of subjectivity that goes into your estimate. Real estate agents do not just guess the best price. They use data and market knowledge to set a competitive listing price for your home.

Your listing agent will use a comparative market analysis (CMA) to see what similar houses in your neighborhood have sold for recently. Your listing agent will also consider the unique features of your home when they do a comparative market analysis (renovations, upgrades, and so on) to account for other factors that may raise or lower the price.

2. Likely to Sell Higher

Some sellers believe they can get more money for their property by cutting out the standard agent commission and selling their homes For Sale By Owner (FSBO). However, if the buyer has an agent, the seller will still likely need to pay the buyer’s agent’s commission anyway.

FSBO sellers are walking away from home sales with less, according to a 2021 report by the National Association of Realtors®. When you do the math, homes sold by agents statistically bring in an average of $39,000 more even after accounting for the commission.

3. Likely to Sell Faster

Agents have experience with proven strategies that help sell properties quickly. An expert agent who knows your area will be well-acquainted with the current housing market, knowing what is motivating buyers in your area, and come prepared with a comparative market analysis from similar houses that have recently sold nearby. Some ways agents can help your home sell faster include:

- Setting the right listing price

- Knowledge of area trends

- Suggesting a pre-listing inspection

- Helping prioritize updates, and repairs

- Effective marketing

4. Expert Negotiating Skills

A top real estate agent knows negotiation tactics to help you get the maximum price for your property. But adept negotiation takes knowledge of the current market, research, and expert skill.

“We know the area; we have studied their property, know all the details of the property that makes it go above and beyond for that offer,” explains Dovenbarger. “We can say, hey, this beautiful property has a beautiful yard, beautiful swimming pool, all that. It’s important to say to a buyer it would be to your advantage to pay for the survey and to pay for the closing costs.”

A few other expenses that can be negotiated down include home warranty premiums, repair costs, and cosmetic updates to the home, or the buyer can pay their own closing costs.

One of the trickiest, yet most important, aspects of the selling process is handling negotiations with potential buyers. A good real estate agent will tackle negotiations professionally and work hard to sell your home for the maximum price so you don’t have to give up any additional sale proceeds aside from agent commissions. Real estate agents handle negotiations day in and day out, so you can feel confident in their ability to look out for your best interests.

5. Local Buyer Knowledge

Local listing agents know from experience and research what home features are popular with buyers. This knowledge can end up saving you money when you are preparing your home for sale.

For instance, you might think you need to remodel your bathroom before you list your home. However, your realtor might point out that other houses in the neighborhood are selling quickly as is, so the extra expense might not be worth it.

Conversely, your agent might suggest you repaint some of the rooms in your home with a neutral color to make it more appealing to potential buyers.

If you are selling without an agent, you will not know which home prep projects are most important to local buyers, or you might make the mistake of putting up a for sale sign without preparing your house at all.

6. Access to the MLS

One of the biggest challenges of selling a home without a real estate agent is finding the best way to distribute your home listing to potential buyers. Only licensed real estate agents can list homes on the Multiple Listing Service (MLS) — the online database where houses are listed for sale. Realtors regularly post listings on the MLS, so they will usually include great photographs of your house and a description that piques potential buyers’ interest.

It is vitally important to get your house on the MLS since 97% of all buyers use the internet to search for homes these days.

7. Better Marketing

Marketing your home does not begin and end with the listing. There is much more that goes into it. Successfully marketing a home to potential buyers takes a lot of time and effort. So much effort, in fact, that many people give up. Expert agents are proactive marketers with an arsenal of marketing and sales techniques in their toolbox in which to market properties.

Top agents know how to get more eyeballs on your home with marketing efforts like:

- Advertising on social media

- Hosting an open house

- Hiring a professional photographer

A listing agent wants to make your home look as good as possible for as many people as possible so they can earn commission when it sells.

If you are selling FSBO, it is hard to know how or where to market your home so qualified buyers in your area can see it.

8. Manages the Paperwork

Home sales require dozens of important legal documents, and it can be difficult for inexperienced sellers to keep all of the paperwork straight. It is best (and safest) to have a real estate agent handle the paperwork for you since they know what they are doing and they have the support of a brokerage that can ensure your entire transaction is valid.

Sometimes the industry jargon in contracts and real estate documents can feel like a foreign language. There are financing industry terms, attorney legalese, title company lingo, and real estate vocabulary–– all that can be mind-boggling to sellers as well as buyers.

Real estate agents will take the time to explain the purpose of each document, answer questions you don’t understand, and clarify the terms you’re agreeing to and signing.

Why Hire a Real Estate Agent If You Are Buying

1. No Out-of-Pocket Cost

As a buyer, your real estate agent is paid by the seller using the proceeds of the sale. When you are making one of the largest purchases of your life, it is a huge advantage to be able to work with a professional without getting a bill for it.

2. Find the Right Home Faster

Popular real estate websites like Zillow and Redfin can help you find houses, but the information on these sites can be outdated and the latest listings may not appear on the map.

Your buyer’s agent can notify you of new listings as soon as they hit the market, and they can even tell you about off-market opportunities — houses owned by people who have not officially listed for sale, but who may be open to offers.

Even though you can browse listings online, agents have full MLS access — enabling them to find houses you cannot see with your own search.

3. Helps Create a Competitive Offer

In hot real estate markets, it can be hard to get an offer accepted without overpaying. Buyers sometimes get pressured into submitting offers well above the listing price because they want to outbid everyone else. While it is true that a home purchased with a mortgage loan will be evaluated by an appraiser before all is said and done, there is more to a fair price than a bank’s willingness to loan money.

Real estate pricing varies depending on whether market conditions have created a seller’s market or a buyer’s market. When you are trying to buy a home in a seller’s market, you can expect a limited inventory of available homes and a high likelihood of multiple-offer scenarios when you do find one you would like to purchase.

And this is when it is especially helpful to have a buyer’s agent in your corner — because an agent will have the market expertise to advise you on how to make a competitive offer.

4. Can Spot Red Flags

Unless you are a home improvement professional or an experienced agent, you might miss red flags when viewing a home on your own. Some expensive home repair issues your agent can spot include structural issues, furnace problems, roofing issues, plumbing leaks, mold, and insect infestations. While these issues would likely come up during a home inspection, spotting them early can save a lot of time if these are deal breakers for you.

Find the Right Agent

Windermere’s community of real estate professionals is our greatest asset. We have experts in all areas of real estate, from your typical starter home to condos, luxury properties, and new construction. While residential real estate is the mainstay of our business, Windermere also has offices and associates who specialize in property management, commercial real estate, and relocation services. To further facilitate the home buying process, Windermere has affiliated partners in certain regions to provide mortgage, title, and escrow services.

Call us today with any questions or concerns. Our professional Real Estate Agents will help you through this exciting process. (951) 369-8002

Should You Get A Mortgage Preapproval?

When you start the process of buying a home, the single most important thing you can do is to get a mortgage pre-approval. This step is relatively easy and straightforward, and will give you a clearer picture of your exact budget. But more than that, sellers often look at pre-approval as an indication of how serious the buyer actually is.

In order to get pre-approved for a mortgage, you need to provide your lender with extensive documentation proving your income, assets and debt obligations (we will get into those details later). If you qualify, you will receive a pre-approval letter indicating how much you can borrow to purchase your new home.

Below, we will cover how to get pre-approved for a home loan and why it can be incredibly important.

What Is A Mortgage Pre-Approval?

When a lender preapproves you for a mortgage, it tells you exactly how much they are willing to loan you to pay for a home. The lender makes this determination by reviewing your credit report, income, employment history, assets and debts. Your pre-approval will come in the form of a letter. It will also contain an initial interest rate as well as terms of the loan.

Keep in mind that a pre-approval is not a commitment to lend. Your desired house still has to pass an appraisal to qualify for whichever mortgage option you are requesting. While a mortgage pre-approval is not an ironclad guarantee that your loan will end up closing, having a pre-approval does show sellers that you are serious in your intent to purchase a home and have the financial resources to follow through

Mortgage pre-approval significantly boosts your chances in the housing market. For starters, most real estate agents expect you to be pre-approved for a mortgage before you even request their services. They tend to view it as an affirmation that you are someone they can trust and that you are serious about buying a home. Pre-Approval basically hedges against window shoppers since a lot of time and effort goes into finding and showing properties.

The entire process takes about two-to-four weeks.

What Is A Mortgage Pre-Approval Letter?

If a lender offers you a pre-approval, they will issue you a pre-approval letter. A good pre-approval letter will contain several pieces of information:

- The amount of the pre-approval

- The length of time the letter is valid for

- Which loan option is being used (for example, 30-year conventional)

Is Pre-Qualified the Same as Pre-Approved?

No, a mortgage pre-qualification is not the same as a pre-approval. Pre-approval is a process that includes getting an in-depth review of your finances or a hard credit check. Pre-qualified does not. Pre-qualification offers a relatively informal estimate of how much you can borrow. In a pre-qualification, a lender usually asks for verbal or written estimates of your income and assets to calculate your debt-to-income ratio (DTI) and down payment savings.

When it comes to choosing between getting pre-qualified versus pre-approved, a pre-approval is going to be more comprehensive and give you a more accurate look at the types of mortgages you qualify for.

While pre-qualifications are a good way to come up with a budget and an initial estimate of how much you can afford, in the eyes of sellers and the real estate agents, they do not mean very much because none of the numbers are verified. This can be particularly problematic in markets experiencing low inventory.

How Long Does Pre-Approval Last?

If you are pre-approved, you will receive an approval letter offer that lasts for 60 – 90 days, depending on the lender. After that, you will need to apply again with another credit check and updated paperwork. If there are any major changes to your financial situation, your pre-approval amount might also change.

You can look at a house without pre-approval but getting pre-approved early in the home buying process is most beneficial. This way, you can find out if there are any issues that could prevent you from getting financing.

How to Get Pre-Approved For a Mortgage

In addition to considering your credit score, lenders will want to verify your employment and income. They will also be considering your debt-to-income ratio (DTI), which is a calculation of your total monthly debts, divided by your monthly income. This ratio, expressed as a percentage, helps lenders make sure you have enough income to reasonably cover your debts.

The exact DTI needed for mortgage approval varies by loan type. But generally speaking, you’ll want your debt-to-income ratio to be 50% or lower.

Now that you understand the importance of the mortgage pre-approval, let’s run through the process.

Step 1. Get Financially Ready

If you are looking to buy a home in the near future, your first step should be to make sure you are financially prepared. There are a couple of steps you can take to get ready.

Check Your Credit Score

A good credit score is key to getting pre-approved. Each lender and loan type has a minimum credit score requirement that will apply to both you and any co-applicant. For conventional loans, lenders typically like to see a credit score of 620 or higher. Before applying for a pre-approval, take some time to request a free credit report to ensure there are no errors on your report that could be negatively affecting your score.

Since completing a pre-approval application does affect your credit score, getting a free credit check that will not impact your credit score will give you a rough idea of your current score. You can then use the estimate as a baseline for checking if you meet a lender’s mortgage qualifications.

Pay Down Your Debt

During the mortgage pre-approval process, your lender will also look at your debt-to-income ratio (DTI), which compares your monthly debt obligations to your monthly income. DTI requirements can vary by lender and loan type, but generally speaking, the lower your monthly debt compared to your income, the better. For the best chance of qualification, you want to keep your DTI at 43% or less.

Step 2. Gather Your Documents

Your lender will run a thorough search of your financials. To avoid any future headaches and expedite the process, have the following documents at hand. Keep in mind that this is not an exhaustive list:

- Proof of Identity: You will need to show your driver’s license or government-issued ID, passport, Social Security card and other documents that verify who you are and where your permanent residence is.

- Proof of Employment History: Most mortgage lenders require the last 30 days of pay stubs that also indicate your year-to-date income.

- Tax Documentation: Be sure to bring your last three federal and state tax returns along with your last three W-2 forms. If you are self-employed, you can collect your most recent 1099 forms.

- Bank Statements: Likewise, you will need the last three month’s worth of financial statements for all your accounts. This may include checking, savings, money market, and certificate of deposit (CD) accounts.

- Asset Information: You should also collect statements for brokerage accounts or other taxable investment vehicles. Proving you have assets at hand would serve you well in the mortgage pre-approval process.

- Real Estate Income: If you are earning income from any property, you will need to provide specific paperwork. These documents can include a lease and documentation of rental income for the last three years. You will also need to prove the current market value of the rental property.

Step 3. Shop Around

When you are going through the process of applying for a mortgage loan, shopping around could result in a better rate and higher loan amount. It is not just rates you should be worried about, but also how the lender will treat you, so you need to be comfortable. Do they charge fees for mail-in or phone payments? Will they service your loan after it closes, or will the servicing be sold? Will they proactively reach back out to you if there is an opportunity to get you into a lower rate? All of these things need to be considered.

What to Do After You Get Pre-Approved for a Mortgage?

After a lender pre-approves you for a mortgage, your journey through home buying continues. Pre-Approval usually comes in the form of a letter proving that a lender has verified your information and is willing to give you a specific loan. But remember, you earned pre-approval because you demonstrated your trustworthiness as a responsible borrower. If you fail to in your obligations, your lender may reduce the amount you can borrow, raise your interest rate or revoke the pre-approval if you fail to maintain a good financial standing. Lenders continue to monitor your debt-to-income ratio. So you should avoid making any large purchases without first notifying your lender.

In addition, avoid opening any new lines of credit. Each credit inquiry will knock down your credit score and change your credit capacity. Instead, focus on paying off your current debt and keep paying bills on time to boost your credit score. A different lender may take notice of your improved credit score and offer you a better interest rate.

Once you have found a home you are ready and able to commit to, your lender will move your mortgage pre-approval onto the final application phase. The loan finalizes when an appraisal of the home is completed, and your mortgage is tied to a particular property.

Find the Right Agent

Buying your house should be a fun and fulfilling experience. If you have done your research and evaluated what you can afford and what you truly need, finding a new home can be exciting. Learning more about the purchase process eliminates the fear of the unknown and lets you search for a home with peace of mind.

Windermere’s community of real estate professionals is our greatest asset. We have experts in all areas of real estate, from your typical starter home to condos, luxury properties, and new construction. While residential real estate is the mainstay of our business, Windermere also has offices and associates who specialize in property management, commercial real estate, and relocation services. To further facilitate the home buying process, Windermere has affiliated partners in certain regions to provide mortgage, title, and escrow services.

Call us today with any questions or concerns. Our professional Real Estate Agents will help you through this exciting process. (951) 369-8002

How Important Is School District When Buying A House?

There is so much to think about when choosing a home to buy: location, floor plan, property taxes, whether you will have any nosy neighbors poking around. If you have children, choosing a home in a reputable school district might also be at the top of the list.

But you might not realize that whether or not you’re a parent, school districts can play a major role in your home buying decision. Here’s what you should know about how school districts affect your finances when buying a house.

How to Determine How Good a School District Is

When evaluating a school district, there are a few things to take into consideration. Take a look at the quality, age, and facilities of the schools themselves. Look into how students perform on standardized tests. Check out the student-to-teacher ratio to see how much personalized attention the students receive. The amount of spending per pupil at the school will tell you how much of the budget is allocated for each student.

Most importantly, talk to people who have lived in the area for a while and have children enrolled in the schools. You may even want to schedule an interview with a teacher or administrator at the school. A good school district generally produces good kids. Not only are they academically inclined, but well-behaved as well. As such, areas with good school districts tend to be safer and experience less crime.

Great grades are not all that matter, though. Sometimes the schools that are ranked the highest are the ones with the most rigorous curriculums, and those can sometimes be overly stressful or overwhelming for children or adolescents. For more personalized recommendations, turning back to the community is always a good idea.

If you can, you should check out all of the district’s schools. While your child might be going to elementary school now, he or she will eventually be going to middle school and high school. You want to make sure that they are all suitable for your child.

Understanding School Ratings

According to the National Center for Education Statistics, there have been more than 98,000 public schools in the United States. Even divided by 50 states, that number can feel overwhelming. But each state has School Report Cards, which are federally mandated to be available to the public under the Every Student Succeeds Act (ESSA). These report cards are similar state-to-state.

Although the names of the sections may differ across reports, the information they provide typically is divided into one of five categories:

1. Demographics

This section provides information on the students attending the school. This might be enrollment numbers, teacher and staff information, information on racial or ethnic self-identification, economic standing, learning differences, family backgrounds, and more.

2. Academic Achievement

This broad category covers how students perform on state exams. ESSA allows individual states to set their own parameters for standardized tests. However, to make it easier to compare schools in a consistent way, this section also typically includes performance on nationally standardized exams such as the SAT and ACT.

3. College and Career Readiness

This information might be included within academic achievement, but is often in its own section. Performance in upper-level courses and on national standardized exams is strong indicators here, if they are not covered in in academic achievement.

4. Climate

The Climate section deals with school environment. Many campuses now implement student survey data, asking students their opinion on how high classroom expectations are or whether they feel as though their teachers care about them individually. On a broader scale, this section usually also includes safety and disciplinary information.

5. Accountability

Accountability, another ESSA term, is used to indicate if a school has been identified as needing additional support, and if so, what kind. Often, this information is indicated on the first page of the report, in the “Overview” or “Summary” section. Occasionally, however, this information is given a tab of its own within the report. The accountability score given to schools is determined by individual states, as are the plans of support moving forward.

What a Good School District Means When Buying a Home

If you are in the market for a new home you better be researching local school districts – it could mean all the difference for your family, whether you have children or not. Homes in the best school districts, on average, sell for higher prices than similar homes in less-popular school districts. A simple analysis might say that good schools are wholly responsible for this added value.

Here are four of the main reasons why the quality of school districts is something that you need to keep in mind when you buy your next home.

- Good Neighborhood

A good school district tends to equal a good neighborhood. Great location can mean safer neighborhoods, an abundance of places to eat, ease of access to transportation, proximity to urban, beach or vacation areas and amenities like public parks and services.

- Good Education

If you have children, the biggest reason to buy a home based on the school district is so you can provide them with a quality education. A good district will offer the best education for your children. This is especially important if you have children with unique learning needs. Some districts are more accommodating to children who need additional enrichment or learning opportunities.

- Home Value Stability

Even if you do not have kids, living in a good school district can help increase your home’s value over time. That is because neighborhoods with higher school ratings tend to have higher home values. Homes will go up and down in value, but an outstanding school district can make all the difference during a tough market.

- Higher Resale Potential

Real estate is by nature a venture that carries with it a certain level of risk and never comes with guarantees. While this is true, you do want to do everything in your power to make sure you get the best that you possibly can for your family. Home buyers should think about resale and building home equity when selecting their new home- even if they do not plan to move in the near future.

After all, plans change unexpectedly. You may think a house is your “dream home” and plan to live there forever, but plans change. If you find yourself in a position where you need to move in a few years, you want the resale value to be high.

School Districts Matter Even If You Do Not Have Kids

Even if you do not plan on using the schools, the school district should still be an important part of your home hunt. If you have been browsing online real estate listings or talking with your agent, you have likely seen or heard about local school ratings. School district ratings are one of the neighborhood lifestyle statistics you often find in home-for-sale listings, along with data about walkability, crime, and more.

It might be tempting to skip over this info if you do not have kids, but do not discount this valuable information. If you are not a parent or do not plan to be one, you might still want to consider buying a home in a "kid-friendly" neighborhood with highly-rated schools.

The National Association of Realtors (NAR) found 26% of home buyers said the quality of local schools was important when finding a home and 20% said proximity to schools was a deciding factor. Realtor.com found that homes in good school districts got 26% more online views than comparable homes in average school districts and sold on average eight days faster. When school districts maintain their good rankings, these homes will likely appreciate in resale value.

Find the Right Agent

Choosing a location for a home is dependent on many factors for your individual needs. If you’re looking for better resale value and a safer location for your home, then you should consider buying a home that is located within a high-rated school district. Your realtor can help you choose a home in the perfect location for your needs

Windermere’s community of real estate professionals is our greatest asset. We have experts in all areas of real estate, from your typical starter home to condos, luxury properties, and new construction. While residential real estate is the mainstay of our business, Windermere also has offices and associates who specialize in property management, commercial real estate, and relocation services. To further facilitate the home buying process, Windermere has affiliated partners in certain regions to provide mortgage, title, and escrow services.

Call us today with any questions or concerns. Our professional Real Estate Agents will help you through this exciting process. (951) 369-8002

Matthew Gardner’s Top 10 Predictions for 2023

This video shows Windermere Chief Economist Matthew Gardner’s Top 10 Predictions for 2023. Each month, he analyzes the most up-to-date U.S. housing data to keep you well-informed about what’s going on in the real estate market.

Matthew Gardner’s Top 10 Predictions for 2023

1. There Is No Housing Bubble

Mortgage rates rose steeply in 2022 which, when coupled with the massive run-up in home prices, has some suggesting that we are recreating the housing bubble of 2007. But that could not be further from the truth.

Over the past couple of years, home prices got ahead of themselves due to a perfect storm of massive pandemic-induced demand and historically low mortgage rates. While I expect year-over-year price declines in 2023, I don’t believe there will be a systemic drop in home values. Furthermore, as financing costs start to pull back in 2023, I expect that will allow prices to resume their long-term average pace of growth.

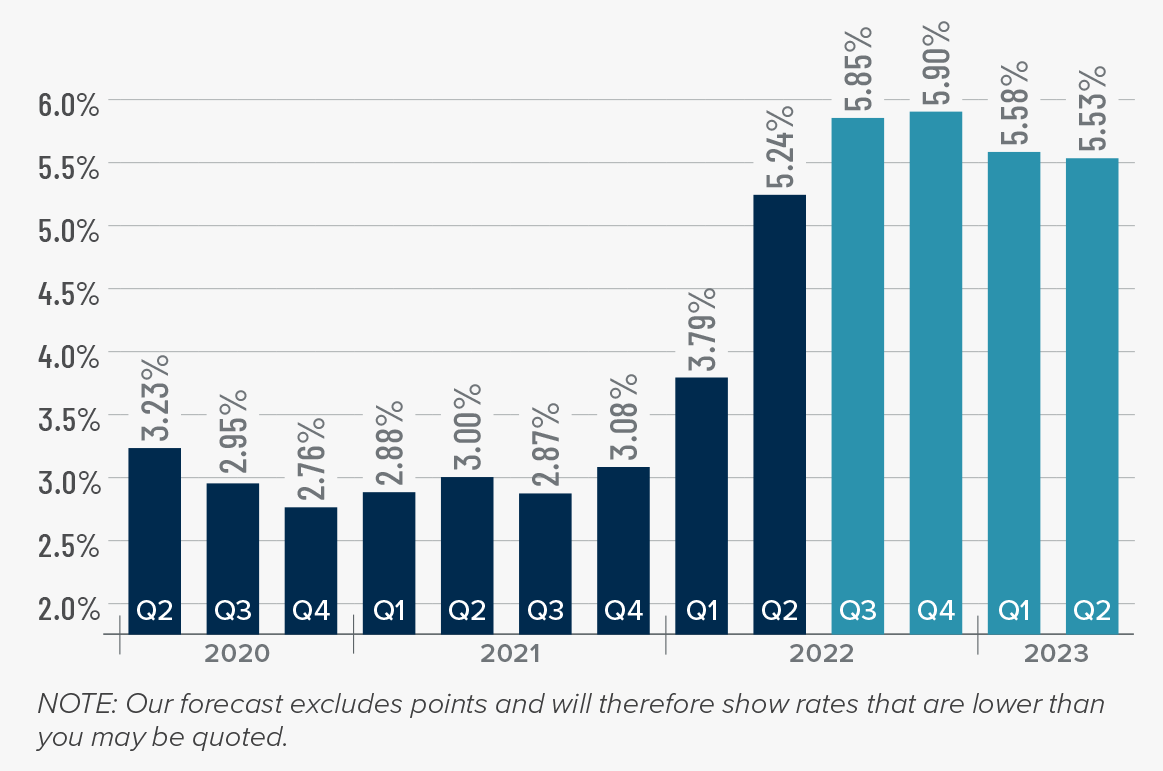

2. Mortgage Rates Will Drop

Mortgage rates started to skyrocket at the start of 2022 as the Federal Reserve announced their intent to address inflation. While the Fed doesn’t control mortgage rates, they can influence them, which we saw with the 30-year rate rising from 3.2% in early 2022 to over 7% by October.

Their efforts so far have yet to significantly reduce inflation, but they have increased the likelihood of a recession in 2023. Therefore, early in the year I expect the Fed to start pulling back from their aggressive policy stance, and this will allow rates to begin slowly stabilizing. Rates will remain above 6% until the fall of 2023 when they should dip into the high 5% range. While this is higher than we have become used to, it’s still more than 2% lower than the historic average.

3. Don’t Expect Inventory to Grow Significantly

Although inventory levels rose in 2022, they are still well below their long-term average. In 2023 I don’t expect a significant increase in the number of homes for sale, as many homeowners do not want to lose their low mortgage rate. In fact, I estimate that 25-30 million homeowners have mortgage rates around 3% or lower. Of course, homes will be listed for sale for the usual reasons of career changes, death, and divorce, but the 2023 market will not have the normal turnover in housing that we have seen in recent years.

4. No Buyer’s Market But a More Balanced One

With supply levels expected to remain well below normal, it’s unlikely that we will see a buyer’s market in 2023. A buyer’s market is usually defined as having more than six months of available inventory, and the last time we reached that level was in 2012 when we were recovering from the housing bubble. To get to six months of inventory, we would have to reach two million listings, which hasn’t happened since 2015. In addition, monthly sales would have to drop below 325,000, a number we haven’t seen in over a decade. While a buyer’s market in 2023 is unlikely, I do expect a return to a far more balanced one.

5. Sellers Will Have to Become More Realistic

We all know that home sellers have had the upper hand for several years, but those days are behind us. That said, while the market has slowed, there are still buyers out there. The difference now is that higher mortgage rates and lower affordability are limiting how much buyers can pay for a home. Because of this, I expect listing prices to pull back further in the coming year, which will make accurate pricing more important than ever when selling a home.

6. Workers Return to Work (Sort of)

The pandemic’s impact on where many people could work was profound, as it allowed buyers to look further away from their workplaces and into more affordable markets. Many businesses are still determining their long-term work-from-home policies, but in the coming year I expect there will be more clarity for workers. This could be the catalyst for those who have been waiting to buy until they know how often they’re expected to work at the office.

7. New Construction Activity Is Unlikely to Increase

Permits for new home construction are down by over 17% year over year, as are new home starts. I predict that builders will pull back further in 2023, with new starts coming in at a level we haven’t seen since before the pandemic.

Builders will start seeing some easing in the supply chain issues that hit them hard over the past two years, but development costs will still be high. Trying to balance homebuilding costs with what a consumer can pay (given higher mortgage rates) will likely lead builders to slow activity. This will actually support the resale market, as fewer new homes will increase the demand for existing homes.

8. Not All Markets Are Created Equal

Markets where home price growth rose the fastest in recent years are expected to experience a disproportionate swing to the downside. For example, markets in areas that had an influx of remote workers, who flocked to cheaper housing during the pandemic, will likely see prices fall by a greater percentage than other parts of the country. That said, even those markets will start to see prices stabilize by the end of 2023 and resume a more reasonable pace of price growth.

9. Affordability Will Continue to Be a Major Issue

In most markets, home prices will not increase in 2023, but any price drop will not be enough to make housing more affordable. And with mortgage rates remaining higher than they’ve been in over a decade, affordability will continue to be a problem in the coming year, which is a concerning outlook for first-time buyers.

Over the past two years, many renters have had aspirations of buying but the timing wasn’t quite right for them. With both prices and mortgage rates spiraling upward in 2022, it’s likely that many renters are now in a situation where the dream of homeownership has gone. That’s not to say they will never be able to buy a home, just that they may have to wait a lot longer than they had hoped.

10. Government Needs to Take Housing More Seriously

Over the past two years, the market has risen to such an extent that it has priced out millions of potential home buyers. With a wave of demand coming from Millennials and Gen Z, the pace of housing production must increase significantly, but many markets simply don’t have enough land to build on. This is why I expect more cities, counties, and states to start adjusting their land use policies to free up more land for housing.

But it’s not just land supply that can help. Elected officials can assist housing developers by utilizing Tax Increment Financing tools, whereby the government reimburses a private developer as incremental taxes are generated from housing development. There are many tools like this at the government’s disposal to help boost housing supply, and I sincerely hope that they start to take this critical issue more seriously.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Q3 2022 Southern California Real Estate Market Update

The following analysis of select counties of the Southern California real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

The employment market grew by 465,000 jobs over the past 12 months. However, the pace of job creation has been slowing and more recently the region has seen total employment levels drop. I am not overly concerned by this, as state data at the county level is not adjusted for seasonality, and I anticipate more jobs will be added as we move through the fall. Total employment in the counties covered by this report is now only 340,000 short of the pre-pandemic peak, having recovered 96.7% of the jobs that were lost. Los Angeles County still has the largest shortfall (-335,700), followed by Orange County (-41,500) and San Diego County (-15,400). Riverside and San Bernardino counties remain well above pre-pandemic employment levels. The region’s unemployment rate in August was 4.2%, down from 7.8% a year ago. The lowest rates were in Orange County (3%) and San Diego County (3.4%).

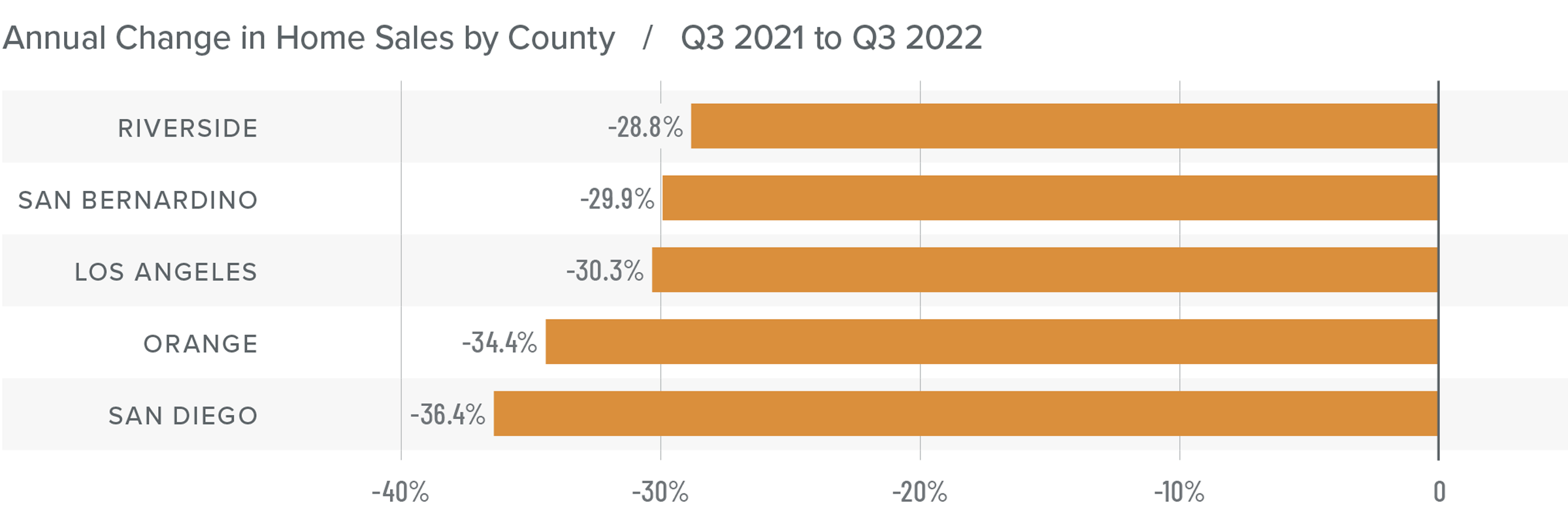

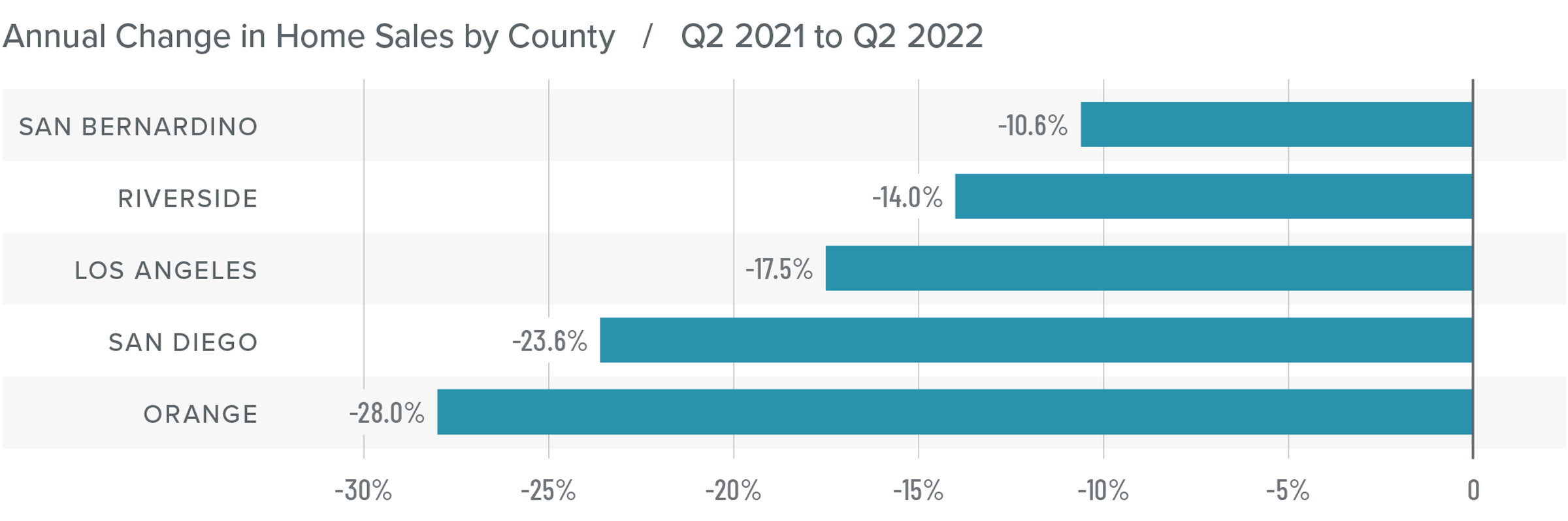

Southern California Home Sales

❱ In the third quarter, 38,356 homes sold, which is down 31.8% from a year ago and 19.4% less than the second quarter of the year.

❱ Pending home sales, which are an indicator of future closings, were down 16.2% from the second quarter, suggesting that closed sales in the final quarter of this year may disappoint.

❱ Sales fell the most in San Diego County, but all markets saw significant declines. Relative to the second quarter, transactions were lower across the board, with Riverside County experiencing the greatest decline (-24.1%).

❱ Listing activity rose an average of 41.6% compared to the second quarter. With more choice in the market and median list prices down 6.8% from the second quarter, it seems that many would-be buyers are sitting on the fence to see if prices will fall further.

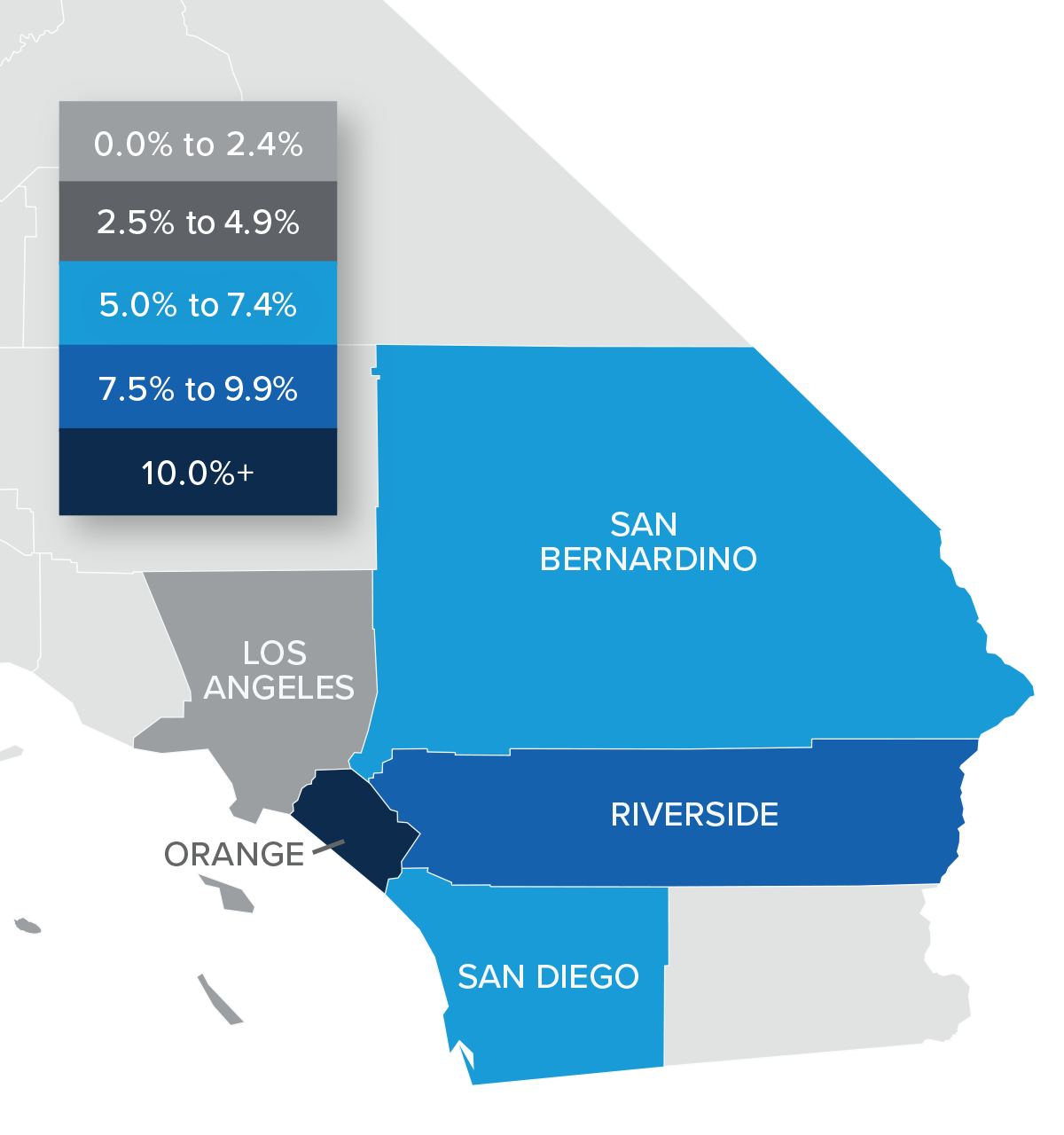

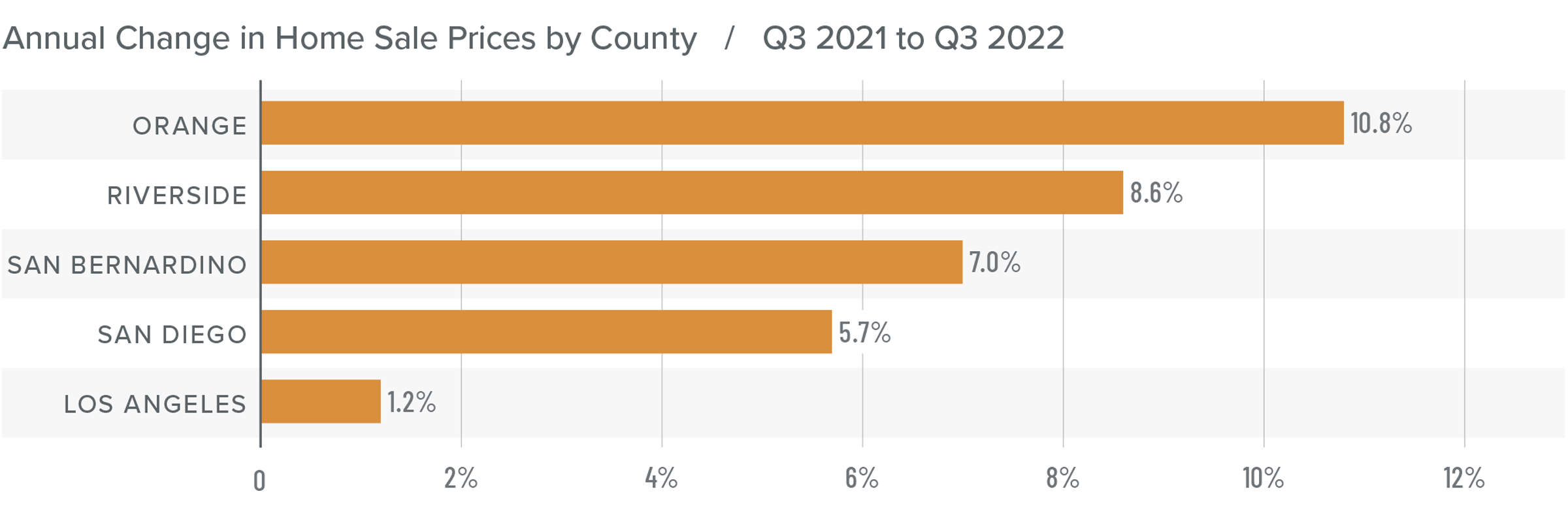

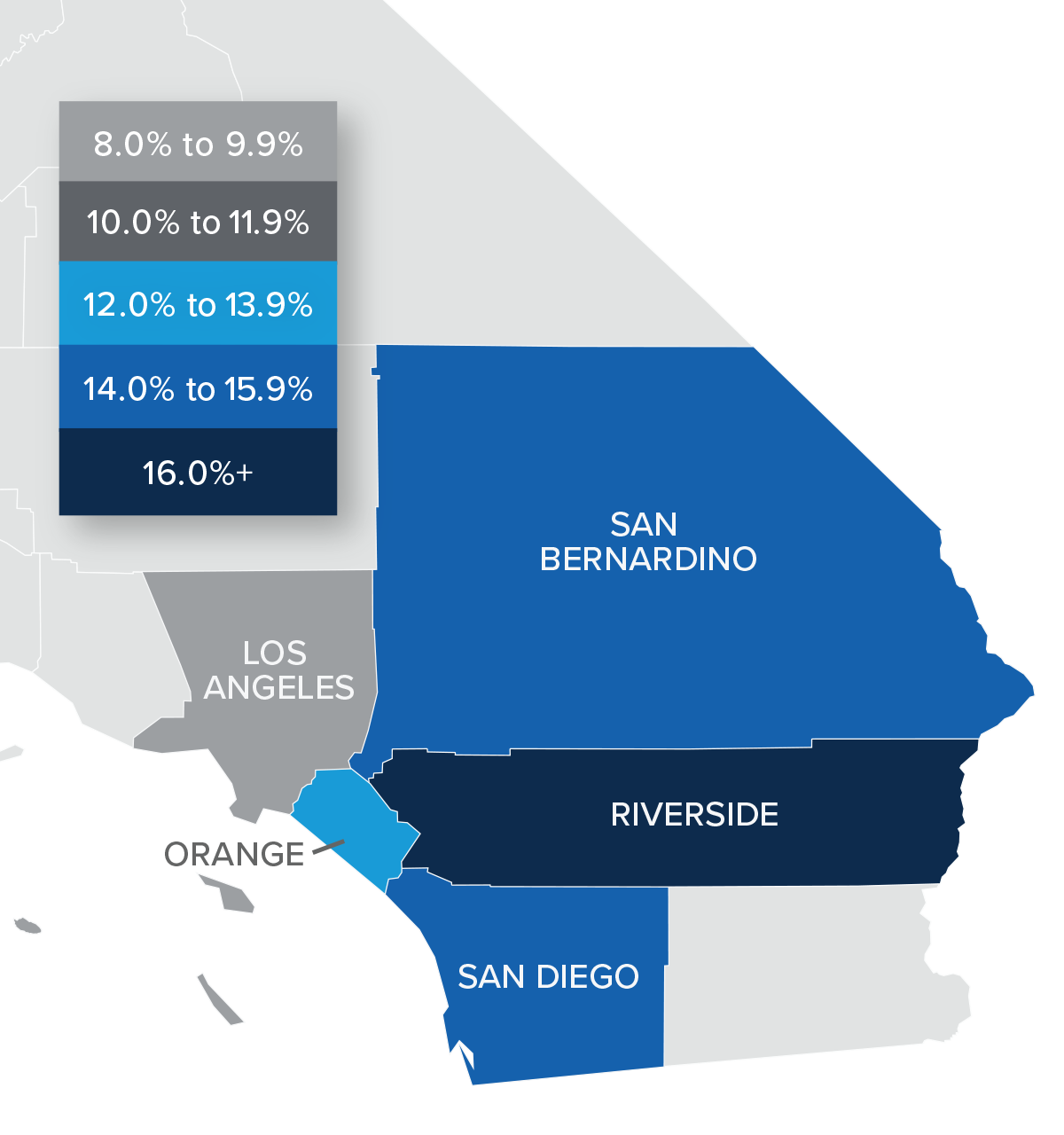

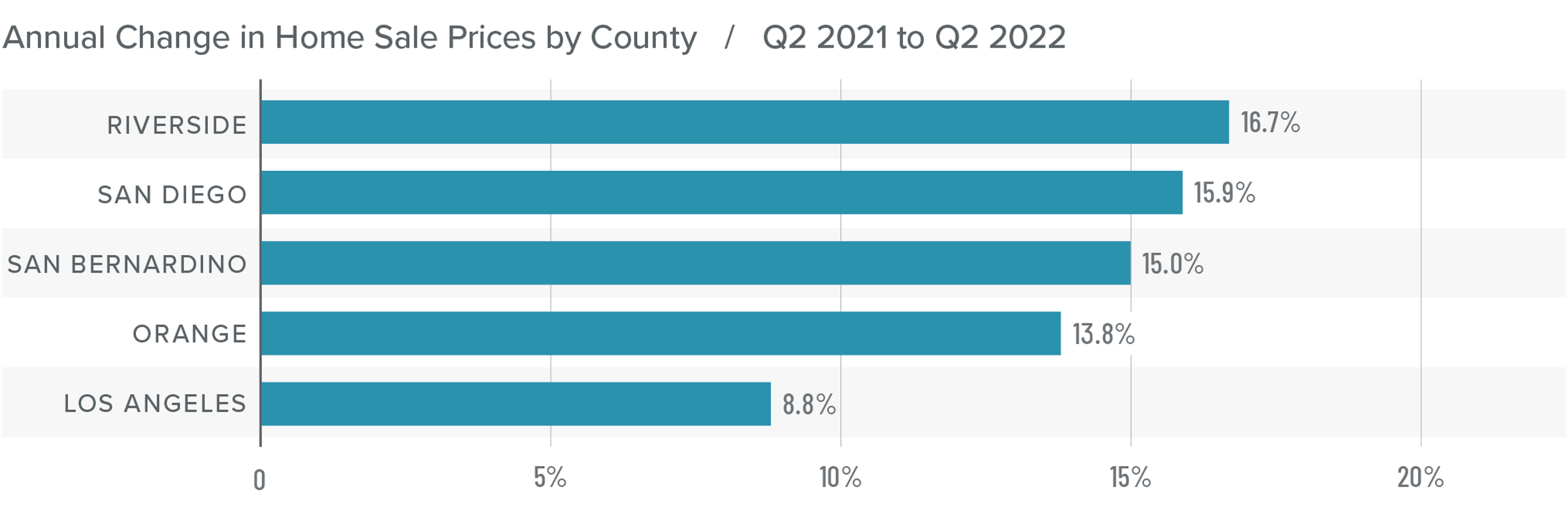

Southern California Home Prices

❱ Home sale prices in the quarter rose 4.6% from a year ago but were 7.1% lower than in the second quarter of this year.

❱ Rising mortgage rates are clearly starting to impact the market. This, combined with higher inventory levels, will lead sale prices to continue pulling back.

❱ The region saw double-digit price growth in Orange County, but the overall trend has shown price growth starting to slow. In fact, prices in Los Angeles County rose by only 1.2% year over year.

❱ A period of reversion was inevitable, especially because artificially low mortgage rates could not continue forever. It’s worth remembering that owners saw home values skyrocket over the past few years. This adjustment to home values will only be temporary, and owners still have ample equity in their homes.

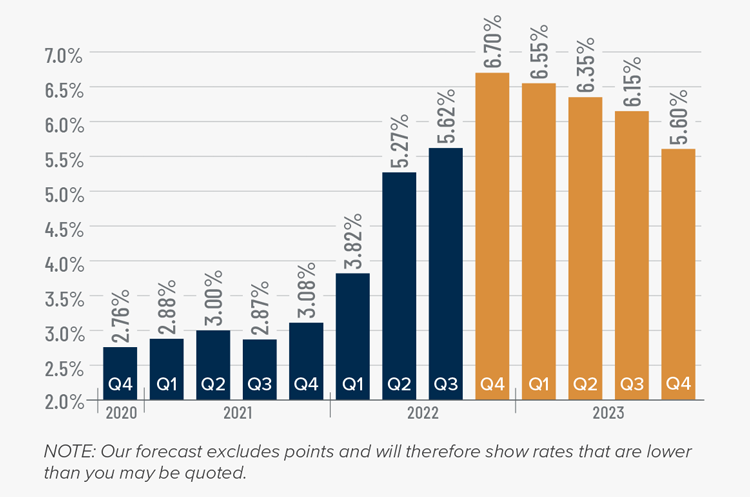

Mortgage Rates

This remains an uncertain period for mortgage rates. When the Federal Reserve slowed bond purchases in 2013, investors were accused of having a “taper tantrum,” and we are seeing a similar reaction today. The Fed appears to be content to watch the housing market go through a period of pain as they throw all their tools at reducing inflation.

As a result, mortgage rates are out of sync with treasury yields, which not only continues to push rates much higher, but also creates violent swings in both directions. My current forecast calls for rates to peak in the fourth quarter of this year before starting to slowly pull back. That said, they will remain in the 6% range until the end of 2023.

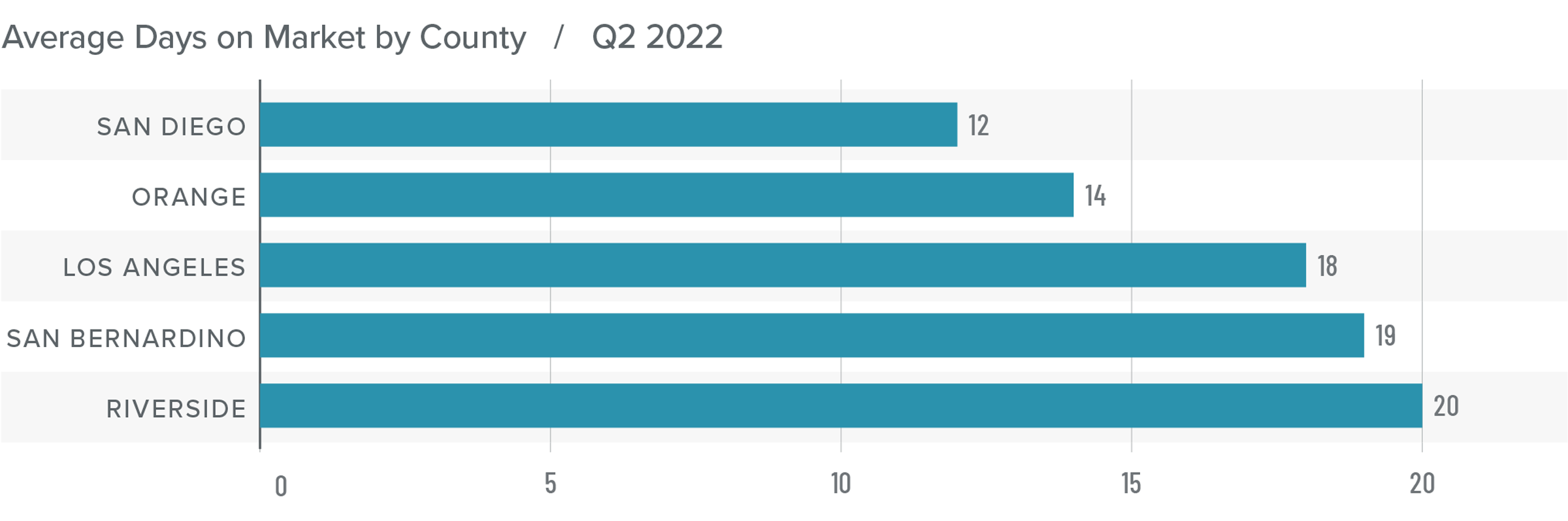

Southern California Days on Market

❱ In the third quarter of 2022, the average time it took to sell a home in the region was 25 days, which is 7 more than a year ago and 9 more days than in the second quarter.

❱ Compared to the second quarter of 2022, market time rose in all counties covered by this report.

❱ Homes in San Diego County continue to sell at a faster rate than other markets in the region. All counties saw market time increase year over year.

❱ More homes for sale and higher financing costs have led to increased days on market. That said, it’s important to put the data into perspective; in the third quarter of 2019, the average market time in the region was 42 days.

Conclusions

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

The housing market has entered a period of transition following the overheated conditions in 2020-2021. Though the headline numbers are far from buoyant, it’s important to understand that the region is only reverting back to where it was before the pandemic. Any belief that the area is going to experience the same meltdown as it went through in the late 2000s is simply inaccurate. There will be an uncomfortable period, but a return to fundamentals is necessary.

As such, I have moved the needle more in favor of buyers as the region continues to trend back toward balance.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Best Ways to Meet Your New Neighbors

Moving to a new home can bring with it a mix of emotions, especially if you are moving to a whole new city. Ensuring healthy relationships with your neighbors is a staple to feeling comfortable in your community. Our homes are more than just the physical space where we keep all of our things. They are the buildings and neighborhoods we inhabit, full of people who we share this larger definition of home with.

We have probably all lived in places where you have met all of your neighbors, and places where you have never once said a word to the people who live next door. Chances are you felt more settled in the homes where you also knew the people around you. Having a friend – or at least a friendly face – nearby goes a long way toward establishing feelings of home and community after moving.

Once you buy a new home and get settled in, you can start meeting your neighbors and building a community. The tips below should you give you a good jumping off point.

How to Introduce Yourself to Neighbors

The easiest way to meet new neighbors is simply to walk up to them and introduce yourself. Hopefully, your new neighbor will be happy to strike up a conversation with you.

1. Spend Time Outside

You might be surprised just how many neighbors you can meet by simply spending time outside in your new neighborhood. After all, you are not likely to meet your new neighbors if you spend all of your time in your house, so make sure that you spend time outside too. Walking the dog or taking your child on a walk is a great way to meet other dog owners or parents in the community. Talking about each other’s dogs or children is an instant conversation starter.

Make a point to do something outdoors every day. Hanging out on your front porch or taking a walk around the neighborhood can make it easy to strike up a conversation with another neighbor who is spending time in their yard. Gardening or beautifying the outside of your home will give you the chance for your new neighbors to come and introduce themselves. Over time, those neighbors you chat with when you are outside can become your friends.

2. Smile and Say Hello

This is sometimes all that it takes; it is as simple as that.

Meeting your neighbors does not have to include your introduction or a full conversation. Instead of thinking about throwing a housewarming party as soon as you unpack and create order in your home, just smile and wave to your neighbors when you see them. It will break the ice for future introductions and the neighbors will pick up your intention. Sometimes, that is all it takes for a good first impression.

If you want to talk, and you think the feeling is mutual, start the conversation. Let them know that you have moved in and let the conversation flow naturally. Remember, you will be able to pick up where you left off the next time you see them.

3. Offer Help

There is no better way to make a good impression on your new neighbors than to offer a helping hand. If you see that your neighbor needs help, offer some. They might need a tool that you can provide, or an extra pair of hands to carry something. This way, you will establish yourself as a person who is willing to help.

Those acts of kindness can help you make friends and show your new neighbors that you want to build a community. And of course, this is a great opportunity to talk to your neighbor and get to know them.

4. Ask For Help or Advice

You might think that it's not the best thing to ask for help from people you do not know. But remember that people love to help other people. It is built into our nature. You don't have to ask them to help you carry your sofa to your apartment, but you can ask to borrow a tool you need to assemble your furniture. When you stop by your new neighbor’s home to introduce yourself, ask them for advice on local activities or community events that you can be involved in. Asking for advice from a new neighbor is a great way to start a conversation.

As you explore the new community, consider asking a neighbor about their favorite local restaurants or coffee shops. You can also ask for recommendations for local service providers for everything from plumbing to the best place gym in town. Showing eagerness to learn about your new neighborhood will help your neighbors to feel at ease talking. This conversation will also give your neighbors the opportunity to tell you about events that happen in the local community.

5. Visit Nearby Public Areas

If you do not see many of your neighbors out in their yard or driveway, try meeting them in other areas of the community. Perhaps they relax at the community dog park or pool or exercise at the local gym. Visit typical meeting spots and you will likely make new friends there. You could also join a local club, group, sports team, or service organization.

6. Turn to Your Pets Or Kids

Kids and pets can be a great way to connect with others. If there are neighborhood kids the same age as yours, you can meet other parents while giving your kids the opportunity to make friends. Children can often make neighborhood friends faster than adults can. Inviting your children’s friends over to your house gives you the opportunity to meet their parents. If you have young children, you could even start a weekly play group where parents and children meet together to socialize and play.

And if you have a dog, you may quickly connect with other dog owners while you are out on your daily walks or at the dog park. Finding these things in common can help create a connection and even help your pets acclimate to the new neighborhood.

7. Host a Housewarming Party Or A Block Party

Nothing brings neighbors together like a party. If you are determined to get to know your new neighbors, consider throwing a housewarming party and inviting them to stop by for coffee or a meal.

You could even work with community members to organize a block party. It doesn’t just benefit you — it gives all your neighbors the chance to meet and get to know one another. A housewarming party does not need to be complicated. Typically, you will give a tour of your new home to your guests. If your house is not put together yet, you could also hold a party on your porch or deck. Barbecue food, play music, and let the kids play in the yard.

8. Attend Neighborhood Events

Perhaps your neighborhood already has an established community with regular block parties and events. Attending these events is a good way to show your neighbors you want to be part of the community. You could even join your neighborhood association group.

9. Attend Community Events

Community events are one of the most fun ways to meet your new neighbors and find out what your local community is passionate about. Look up events in your area, stop by local businesses and take note of events listed on their bulletin boards.

Communities often hold regular local events such as farmers’ markets and festivals. Becoming involved in the community by attending local events is one of the easiest ways to get to know your new neighbors.

Find the Right Agent

The day will come when your new neighborhood no longer seems so novel and you have settled in to life in the community. Take the time in the beginning to go the extra step and immerse yourself in where you live, and you will feel a deeper connection and appreciation as the days, months, and years add up. A move to a new neighborhood is an opportunity to explore the world with a fresh set of eyes, so make the most of it and get out there. You will always be glad that you did.

Windermere’s community of real estate professionals is our greatest asset. We have experts in all areas of real estate, from your typical starter home to condos, luxury properties, and new construction. While residential real estate is the mainstay of our business, Windermere also has offices and associates who specialize in property management, commercial real estate, and relocation services. To further facilitate the home buying process, Windermere has affiliated partners in certain regions to provide mortgage, title, and escrow services.

Call us today with any questions or concerns. Our professional Real Estate Agents will help you through this exciting process. (951) 369-8002

How to Buy a House If You Have Bad Credit

Buying a house is possible with bad credit, but it is harder and more expensive than it is for those with excellent credit. Bad credit can be a result of circumstance or not knowing better. A home is one of the biggest purchases most people will make in their lifetime, and it can be a stressful process, even if you have great finances.

There are private and government-backed loan options that make it possible to become a homeowner even if you have bad credit. Other options include raising your credit score before you begin looking for mortgages. Having a higher credit score makes it easier to get a loan and helps you receive the best rates.

While it may take some work to improve your finances and get your credit rating up, it is certainly within reach. Let’s look at the options.

What Do Mortgage Lenders Consider A Bad Credit Score?

Most borrowers do not know this, but many lenders do not require a specific minimum credit score to buy a house. A conventional mortgage lender is free to set their own requirements when it comes to your credit score. Government-backed loans give mortgage lenders some peace of mind but they do have credit score requirements.

If you have a credit score lower than 500, you might find getting a mortgage a bit hard and will probably need to focus on increasing your score first. The minimum credit score you will need depends on the loan type. Another option that prospective homeowners with bad credit can take is purchasing a home with a co-borrower.

First, let’s take a look at the credit score ranges from FICO:

Exceptional credit = 800 and above

Very good credit = 740 to 800

Good credit =670 to 740

Fair credit = 580 to 670

Poor credit = under 580

How Your Credit Impacts Your Purchasing Power

If you have poor credit rating, it typically means that you will have a difficult time getting approved for loans. The good news is, it is relatively easy to raise your credit score—it just takes some time and due diligence.

One of the biggest things lenders will look at is your payment history. If you have a history of irregular or missed payments, lenders will be more hesitant to approve a loan. It is important to pay credit card bills and other loans on time, and if possible, at higher amounts than the minimum payment due. This will show a lender that you have the capability to pay off debt and manage credit.

Another key area of concern for lenders is your debt-to-income ratio. Debt-to-income ratio, or simply DTI, refers to the percentage of your monthly income that goes toward debt payments. When applying for a mortgage, you will authorize a credit check where lenders examine your credit history, including your current debts and the minimum monthly payments for these debts. They will calculate your total monthly debt payments, and then divide this by your gross income to determine your DTI ratio. So, if you have a gross monthly income of $5,000, and $500 in monthly debt payments, you have a DTI ratio of 10%—which is excellent. But mortgage lenders do not only look at your current debts when calculating DTI ratio. They also factor in “future” mortgage payments to gauge affordability.

Lenders will use this information to determine your ability to manage your monthly payments and repay what you’ve borrowed. If possible, aim to reduce your overall debt—this will help improve your debt-to-income ratio and make it easier for you to get approved for a mortgage.

One thing to keep in mind is that it is wise to keep your credit card balances below 50 percent of your limit. This will show you can manage debt and thus, keep your credit in good standing.

Can You Buy A House With Bad Credit?

Government-backed loans typically have lower credit score requirements, but homebuyers with less-than-ideal credit can still get a private mortgage if they make up for it in some other way. You may be able to put more toward your down payment, which reduces the size of the mortgage you need — and the lender’s risk. This costs more upfront, but you start with more equity in your home. This can be a better financial move than putting down less upfront and paying more in interest.

While it is possible to qualify for a conventional mortgage with a low credit score, government-backed mortgages may be a better option. Ideally, if you are able to reduce your total debt now and increase your income, this will improve your debt-to-income ratio. Having a healthy level of income and few debts shows lenders you are likely to have enough cash to make your monthly mortgage payments.

No two situations are the same, and outside of your actual score, lenders will also be looking at things like:

- How much the borrower has available for a down payment

- The borrower’s overall amount of debt

- How much income the borrower earns

- If the borrower has any debts in collections

How To Buy A House With Bad Credit

If you purchase a home with bad credit, you can always repair your credit and refinance your mortgage for much better loan terms later on.

Let’s check out some of the loan options available and the average credit score requirements for each of them.

Conventional Loans: 620 minimum credit score

Conventional loans are the generic name for mortgages backed by the government’s largest mortgage agency, the Federal Housing Finance Agency (FHFA). The FHFA backs 81 percent of all U.S. mortgages, so your mortgage will probably be backed by the FHFA, too.

There is not a set minimum requirement for income, credit score or down payment to qualify for a conventional loan. However, the minimum credit score required to qualify for a conventional mortgage loan is usually a 620 or better.

USDA Loans: 620 minimum credit score

The USDA loan is a no-down-payment mortgage for buyers in rural parts of the country and lower-density suburbs. The U.S. Department of Agriculture subsidizes the program. It requires home buyers to have a minimum credit score of 620 at the time of purchase, along with other income requirements specific to a USDA loan.

VA Loans: 580 minimum credit score

The U.S. Department of Veterans Affairs guarantees VA loans for service members, veterans and some surviving spouses. VA loans are available to:

- Veterans who meet service length requirements

- Service members on active duty who have served a minimum period

- Certain reservists and National Guard members

- Certain surviving spouses of deceased veterans

If you believe you qualify, you should contact the VA to receive a Certificate of Eligibility. Some lenders may be able to get the certificate on your behalf.

Homebuyer Assistance Programs: 580 minimum credit score

Homebuyer assistance programs rarely enforce credit score minimums. Instead, they adopt the standards of their accompanying mortgage.

For example, if you are a home buyer who uses a conventional mortgage with a 620 credit score requirement, the homebuyer assistance program you use for a down payment will also use the 620 minimum.

FHA Loans: 500 minimum credit score

FHA loans let you put down as little as 3.5% if you have a credit score of 580 or higher. However, you may still be able to get a loan with a credit score of at least 500 — but you will likely need to make a 10% down payment. FHA loans also require you to pay a mortgage insurance premium.

Additionally, you must meet the following requirements:

- DTI ratio of 43% or less

- Steady employment and income (proved with documentation)

- Home must be your primary residence

- The minimum credit score needed to get an FHA loan is 500.

Rent To Own Home Ownership Programs

Another option that is gaining in popularity is the rise of rent to own home ownership programs. There are companies and investors that will purchase a property for you and lease it to you with an option to purchase it from them at a later date. This is a great alternative to traditional mortgage programs if you are having trouble getting approved. This program allows you to purchase a home if you are facing credit and down payment hurdles.

You will not own the home in the beginning. Rather, you will start off as a tenant but you will work your way towards being able to secure the deed of that home with your own financing. The terms are usually set by the owner or investor of the property and do not require perfect credit or a down payment upfront to enter this agreement.

Owner-Financed Programs

Much like rent to own homes, owner financed homes are a direct agreement between you and the owner of a property that allows you to make payments that go towards the purchase of your home. The eligibility requirements, credit standards, and down payment of these types of home-ownership programs will vary from owner to owner.

Improve Your Credit Score

Taking a few steps to improve your credit score before home shopping will improve your homebuying experience exponentially. Getting a mortgage with bad credit is possible, but raising your credit score helps you access larger mortgage loans with lower rates. You will have more overall options if you raise your credit score before you buy a home.

If you have a mortgage already and do not plan on moving, boosting your credit score can help you save money on interest payments and refinance if rates drop.

Here are some tactics for raising your score and positioning yourself for better homebuying opportunities.

- Check your report and score every year

- Dispute errors

- Make your payments on time

- Only use credit cards for essentials

- Do not close unused accounts

- Temporarily avoid new credit

- Get a co-signer

Why You Should Improve Your Credit Score Before Buying

Even improving your credit score by just a few points before buying can still save you thousands of dollars. If boosting your score allows you to be approved for a conventional mortgage instead of an FHA loan, you will save the up-front mortgage insurance premium of 1.75% of the loan amount. Additionally, conventional loans tend to have lower closing costs and interest rates than FHA loans.

While both FHA loans and conventional loans will require monthly mortgage insurance if you put down less than 20%, an FHA loan includes monthly mortgage insurance for the life of the loan that you can only get rid of by refinancing—and paying closing costs on a new loan. For a conventional mortgage, the private mortgage insurance drops off once your loan balance is equal to 80% of the property value.

Find the Right Agent

Buying your house should be a fun and fulfilling experience. If you have done your research and evaluated what you can afford and what you truly need, finding a new home can be exciting. Learning more about the purchase process eliminates the fear of the unknown and lets you search for a home with peace of mind.

Windermere’s community of real estate professionals is our greatest asset. We have experts in all areas of real estate, from your typical starter home to condos, luxury properties, and new construction. While residential real estate is the mainstay of our business, Windermere also has offices and associates who specialize in property management, commercial real estate, and relocation services. To further facilitate the home buying process, Windermere has affiliated partners in certain regions to provide mortgage, title, and escrow services.

Call us today with any questions or concerns. Our professional Real Estate Agents will help you through this exciting process. (951) 369-8002

How to Know If a House Has “Good Bones”

We have all heard a house referred to as having “good bones” but how many of us actually know what that means? On the surface, it sounds great! Good bones… yes, I want that!

As realtors, we have dedicated our careers to helping people find a home that is perfect for their family. Some people assume that the perfect home means they will need to build from the ground up with each detail of their own choosing. Luckily, this is not necessarily the case. If you find a home with “good bones” you can transform it to your dream home.

A home with good bones typically describes a fixer-upper or possibly a home that has great potential. Fresh paint, new carpeting and other cosmetic touch-ups can hide a wealth of defects in a house. When evaluating an older home, buyers need to look beyond the carefully curated facade to discover the house’s underlying qualities—its “bones.”

Of course, whether or not a home has “good bones” is dependent on a number of factors. For instance, construction materials often vary from location to location due to weather concerns (think: hurricanes, earthquakes, flooding, etc). So the type of house that has good bones in one state may not have good bones in another.

In the real estate and construction industries, a house is described as having “good bones” if it doesn’t have any major defects that could lead to expensive repairs. Overall, though, there are a number of features that the majority of homes considered to have “good bones” share.

Keep reading to find out the big indicators that a home has good bones.

What Does “Good Bones” Include?

There are many factors that determine whether a home has good bones. Depending on the location of the property the home may be affected by environmental factors such as hurricanes, flooding, or tornados. Another factor you might want to think about is the age of the home. In reality what determines a home with “good bones” is the opinion of the realtor and buyer.

Here are some possible determining factors:

1) Construction and Foundation

Without a doubt, the first thing people mean when they say “a house has good bones” is that its foundation is solid and its structure is sound. Throughout the years, the materials we use to build houses have changed. Oftentimes, older wood frame homes built in the first half of the 20th century were actually made of higher quality wood construction than the wood frame homes built today. These higher quality materials can decrease the defects present in the home. Other house building materials that are generally considered to be “good bones” also include brick and concrete.

2) Sturdy Roof

One of the most important (and expensive) parts of a house is the roof. In your research, find out what materials were used to construct the roof on your prospective new home (slate, cement tile, and metal will last significantly longer than wood or asphalt shingles) and when it was last replaced.

A proper inspection of the house should be able to tell you whether a roof is in disrepair. Look for visible signs of wear and tear such as sags, rust, leaks, mold, fungi, and any lifting, missing, cracked, or curling shingles. Over time, untended roof problems will trickle down to inside-the-home damage, so it pays to be vigilant, or at the very least to make sure you will not be surprised by the need for repairs. If the roof is relatively new and shows little (if not, zero) wear and tear, you can assume the house has good bones.

3) Natural light

Having plenty of natural light and well-constructed windows is a major plus when buying a home. A bright, airy ambience can also come from a home being optimally situated on the property. Windows that face south typically get lots of light throughout the day, while north-facing windows receive less. Windows on the east and west generally get strong morning or afternoon light, respectively. To get a sense of the home’s natural light and to properly assess these “bones”, you will need to walk through the home in-person during different parts of the day. If the home is light and bright, you can say that the home has good bones.

4) Plumbing

How old is the plumbing and is it in good condition? These are questions that must be asked before purchasing a home. Typically the older the home the more likely you are to have concerns arise. If the pipes are in good shape and the toilets, showers and other plumbing features are up to code and in good working condition, then you can be sure this home has good bones.

5) Coherent Floor Plan

Once you have filtered out all the bad decor, consider the flow of rooms, their size and proportion, and any inefficiencies or wasted space. This is often easiest to do by looking at a floor plan, because you can quickly see adjacencies, odd-shaped rooms, and potential ways to recapture unused square footage.

Consider the number of floors, bathrooms, and bedroom size and location. Do you want the main bedroom to be on a separate floor, or do you need it to be close to a small child’s room? Make sure the location of the laundry room is convenient—and assess the placement of appliances and toilets in the kitchen and bathroom, as changes in plumbing and electrical work are costly.

6) Good Location and Lot Size

There are some things you just cannot change about a property, and where it is located—and how it is oriented on its site—is one of those things. You have heard it from every real estate agent, and they’re right: Location is (often) paramount. A beautifully laid out townhouse is suddenly not as perfect if it is located far away from where you were looking, and a home in the ideal neighborhood that was placed on its lot so that it almost abuts its neighbor can be similarly unappealing.

Here are a couple “bonuses” if you find them in a home!

1) Flooring

Finding a home with good floor or original wood flooring can be a huge bonus to the value of your home. While damaged or low-quality floors are not necessarily a deal-breaker, they are considered to be part of the “bones” of the home. Given that real wood floors are quite expensive to replace, it is always a huge bonus when the house has good flooring, especially if all you need to do is sand them down and add a stain. If a home’s floors are capable of being restored to their former glory, you can consider the house to have good bones.

2) Unique Features

Oftentimes, home buyers adore old, fixer-upper homes for their unique charms and historic features, such as wooden beams, wainscoting, vintage wallpaper, or antique lighting can be a factor of considering the home to have good bones. If you consider these features to be important in a home, then you can say the house has good bones.

3) Bonus Rooms

Whether it is a mother-in-law apartment with the potential for rental income or an oversized basement with extra storage space, a home with a bonus room is always a big advantage. Not only is it good for resale value, but it is also an added convenience and expansion potential. If the home has a bonus room, you can claim it has good bones.

Remember to Overlook Cosmetic Concerns

Even though charming features can be an indication of good bones, do not get too wrapped up in decorative details. While midcentury modern has been back for some time and the shabby-chic style is all the rage, there are definitely trends from the past that just do not speak to us today. Things like shag carpeting, dingy paint, and peeling wallpaper can all be replaced without spending too much money. Do not be deterred by a kitchen full of avocado-colored appliances. Instead, squint and imagine the space with gleaming hardwood floors and bright white walls.

A Professional Inspection is Crucial

While a home may appear to have “good bones,” the only way to truly know for sure is to conduct a professional home inspection. An inspection typically includes a thorough look at the condition of a home’s heating system, central air conditioning system, interior plumbing and electrical systems; the roof, attic, and visible insulation; walls, ceilings, floors, windows and doors; the foundation basement, and visible structure.

In addition to the standard inspection, you might also consider adding on tests for radon, mold, and lead-based paint, as well as a pest inspection and a well and septic inspection, if needed.

Most inspectors will provide estimates on the ‘life expectancy’ of certain items like the roof, furnace, and appliances. That is why it is a good idea for buyers to attend their inspection. Not only can you learn a lot about the home you are buying, but it is also a great opportunity to ask questions and discuss any concerns.

Find the Right Agent

Buying your house should be a fun and fulfilling experience. If you have done your research and evaluated what you can afford and what you truly need, finding a new home can be exciting. Learning more about the purchase process eliminates the fear of the unknown and lets you search for a home with peace of mind.

Windermere’s community of real estate professionals is our greatest asset. We have experts in all areas of real estate, from your typical starter home to condos, luxury properties, and new construction. While residential real estate is the mainstay of our business, Windermere also has offices and associates who specialize in property management, commercial real estate, and relocation services. To further facilitate the home buying process, Windermere has affiliated partners in certain regions to provide mortgage, title, and escrow services.

Call us today with any questions or concerns. Our professional Real Estate Agents will help you through this exciting process. (951) 369-8002

How to Improve Curb Appeal Before Selling

Your house might be immaculate on the inside, but if the outside does not match, your potential buyers may not even make it inside. First impressions make a huge difference when selling your home. In certain markets, you only have one shot to convince a potential buyer to even consider your house.

Curb Appeal is a popular word used in the real estate business to describe the feeling that someone gets when they drive up to a home. We will get into the concept more later, but the term curb appeal refers to how your home, lawn and garden appear from the outside. You want your property to have a “wow” factor to entice them to inquire further. This is why it is important to know how to add curb appeal to your house.

It is not unheard of for buyers to see a home’s exterior and decide to cancel their showing if they do not like what they see. At the very least, poor curb appeal can give a bad first impression that can lead buyers to view the inside of the home with an overly critical eye. After all, a well-maintained exterior implies to the buyers that a home has been taken care of.

Homes with beautiful curb appeal tend to have a higher property value and a higher asking price when they sell. Next time you are driving up to and parking in front of your house ask yourself, "does the curb appeal make the home feel warm, stylish and inviting”... or perhaps the opposite.

When selling a home, most people busy themselves repairing and staging the inside of the house to prepare for showings with prospective buyers. Read on to get ideas on how to make your home stand out in the hot Inland Empire market.

What Is Curb Appeal?

Curb appeal is that undefinable something that draws you to a home at a glance. It is a combination of visual charm, good upkeep and attention to detail. It is the general attractiveness of your home and its surrounding property visible from the front sidewalk, street and/or lawn.

In a nutshell, curb appeal is your home’s first impression on visitors or prospective buyers. It is literally how the property looks when seen from the street. Good curb appeal can serve several purposes, depending on whether the house is for sale or you just want to showcase your home to its best advantage.

When enhancing curb appeal, consider what purpose you want to achieve to make the best choices. Curb appeal is definitely subjective to different tastes, but you want to use different tactics if you are planning to sell your property as opposed to welcoming guests to a holiday party.

Curb appeal can…

- Provide a friendly welcome to visitors and guests

- Entice and impress potential buyers or renters

- Showcase the property’s key features and style

Set a Plan of Action for Improved Curb Appeal

Before you start work on pruning, planting or painting, analyze what needs to be done so you can decide how much you want to spend. This crucial first step will help you determine where you should focus your attention.

A good way to see your property from an outside perspective is to take a photo of the home’s exterior as if this were the photo you will post on your online listing. Evaluate the whole scene and be honest in your assessment. Does anything stand out as a negative? Maybe ask a friend or neighbor to evaluate your home’s exterior and point out the biggest defects. Whether you have peeling paint, a cracked sidewalk or mismatched foliage, you are probably more blinded to the issues than an outsider would be.

How to Give Your Property More Curb Appeal

As you contemplate improvements, stay true to your home’s style and avoid being tempted by trends. Adding or improving curb appeal can be expensive, depending on the scope of the project and the size of your front yard, so some things might just have to be repurposed or cleaned up. Luckily, exterior home improvements usually offer a strong return on investment depending on the preferences of buyers in your market. At the very least, an investment in curb appeal will help you attract buyers and possibly sell sooner.

1. Do a Thorough Cleaning

A marathon cleaning session can also do wonders for your curb appeal. Consider power washing all the surfaces to get the years of dirt and cobwebs down. Clean the decks, carport, siding and pavement. Keep in mind that power washers can damage wood and siding if used incorrectly, so get instructions from your rental company. When cleaning, do not forget to wash down the trinkets and décor you have around your porch and garden. Make sure figurines are clean and standing upright. Spray down and straighten any signs you have on the porch.

2. Create a Welcoming Entrance

Elevate your entryway by adding some decorative elements outside your front door, like a charming welcome mat, potted plants or a decorative wreath. Simple changes can help to make the front entrance of your home appear cozy and inviting. If you have a front porch, add a new outdoor area rug and some charming wooden rocking chairs.

3. Spruce Up Your House Number

Sometimes all it takes is a new set of house numbers in a different style and font to make your home instantly more appealing. A new set of house numbers can modernize an older home or give your home that designer touch. This is great if you want to make your house stand out from the rest on the market.