Q3 2023 Southern California Real Estate Market Update

The following analysis of select counties of the Southern California real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

The Southern California market areas contained in this report have been experiencing a fairly significant slowdown in job growth. That said, the region has added 164,700 jobs since the third quarter of 2022, representing a growth rate of 1.7%. The end of the writers’ strike will add a little boost to the Los Angeles area, which has still added over 89,000 jobs over the past 12 months. Orange County employment has grown by 34,100 jobs; San Diego County is higher by 31,400; and employment was up 9,700 jobs in Riverside.

The region’s unemployment rate in August was 5.2%, which was up from 4.2% in the third quarter of 2022. The lowest jobless rate was in San Diego County, where it was 4.3%. The highest rate was in Los Angeles County, where 5.8% of the workforce was without a job.

Southern California Home Sales

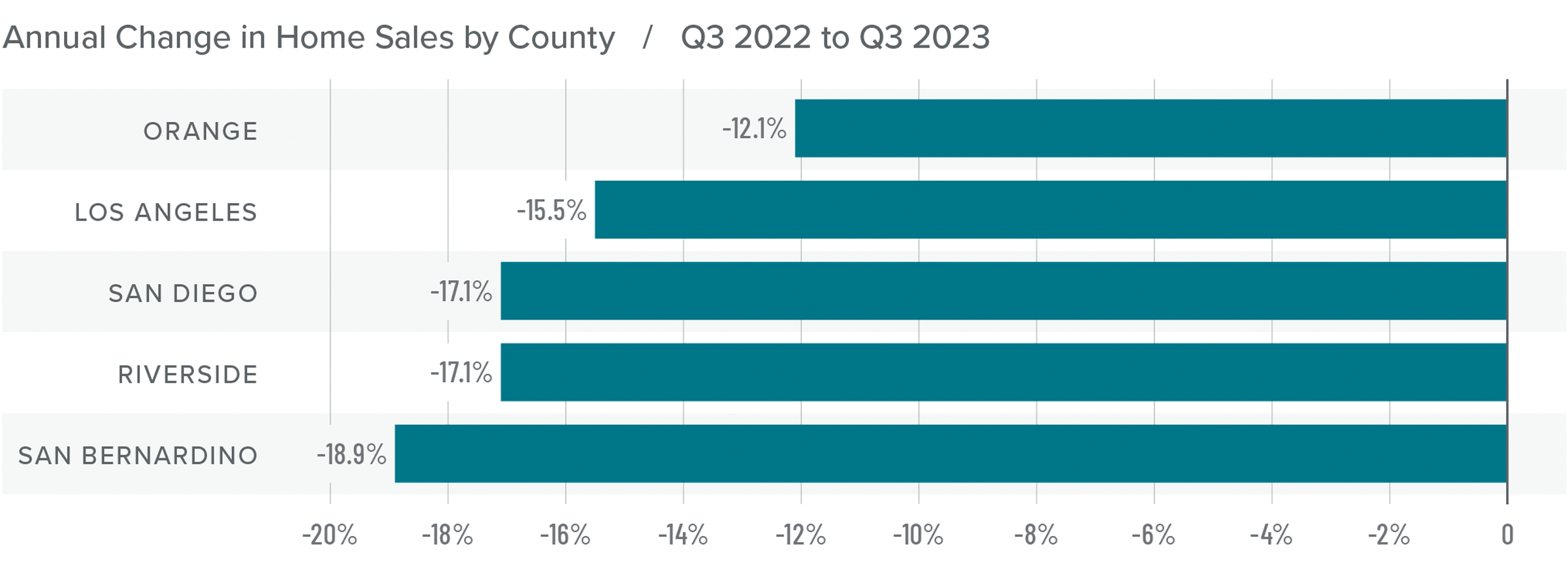

❱ In the third quarter of 2023, 32,398 homes sold, which was 16% lower than in the third quarter of 2022 and down 8.6% compared to the second quarter of this year.

❱ Pending home sales, which are an indicator of future closings, were 8.2% lower than in the second quarter, suggesting that closing numbers may be down in the final quarter of 2023.

❱ Compared to the third quarter of 2022, sales fell the most in San Bernardino County, though there was a significant decline in all markets. The quarter-over-quarter decline was disconcerting given that the number of homes for sale rose more than 14%. Rising mortgage rates are clearly taking their toll on the market.

❱ It’s discouraging that there were fewer sales despite rising inventory levels. Mortgage rates are definitely hobbling the market and until they start to drop, I think things will continue to be lackluster. List prices have started to pull back in response, as sellers realize that the market is not what it once was.

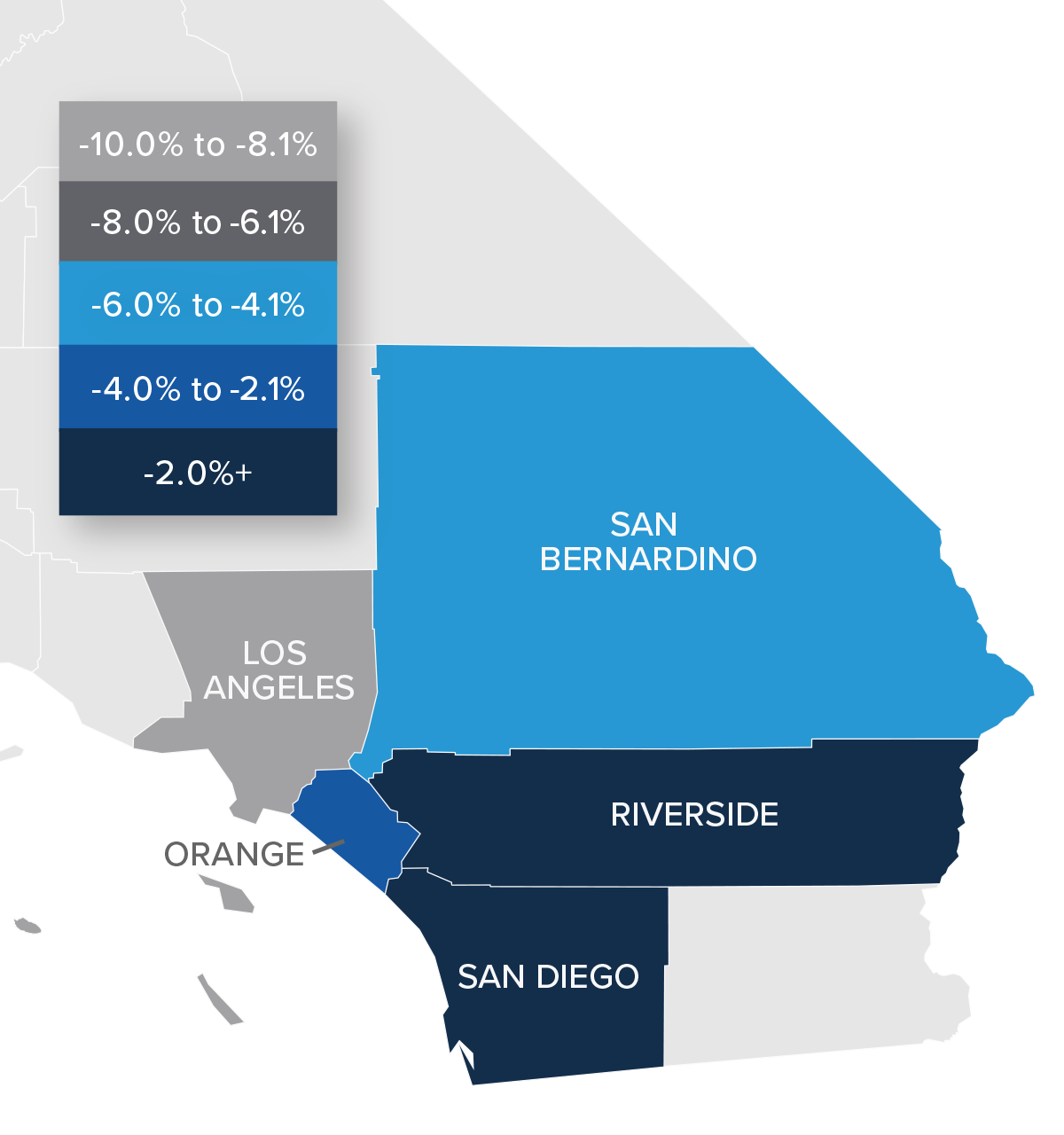

Southern California Home Prices

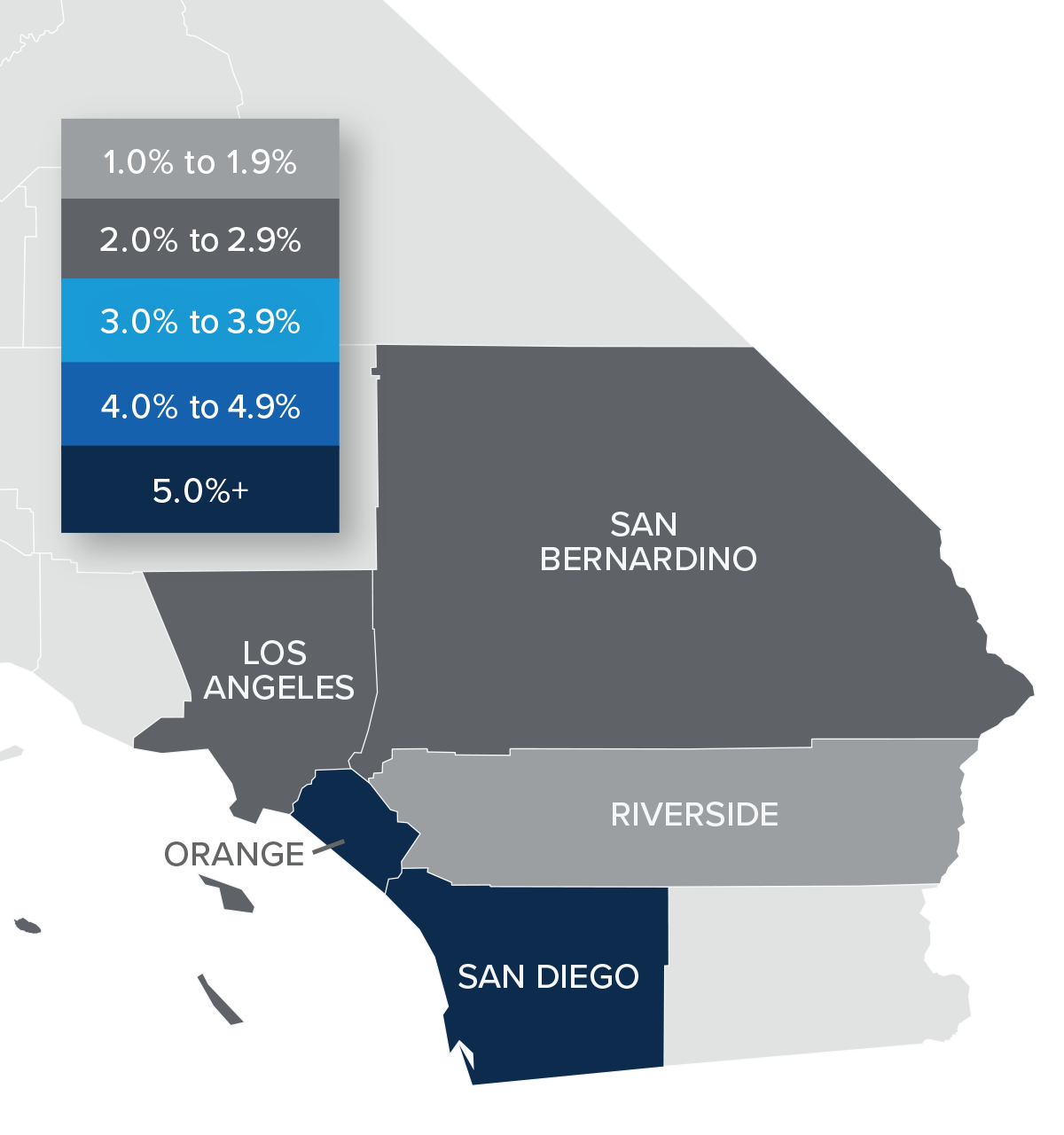

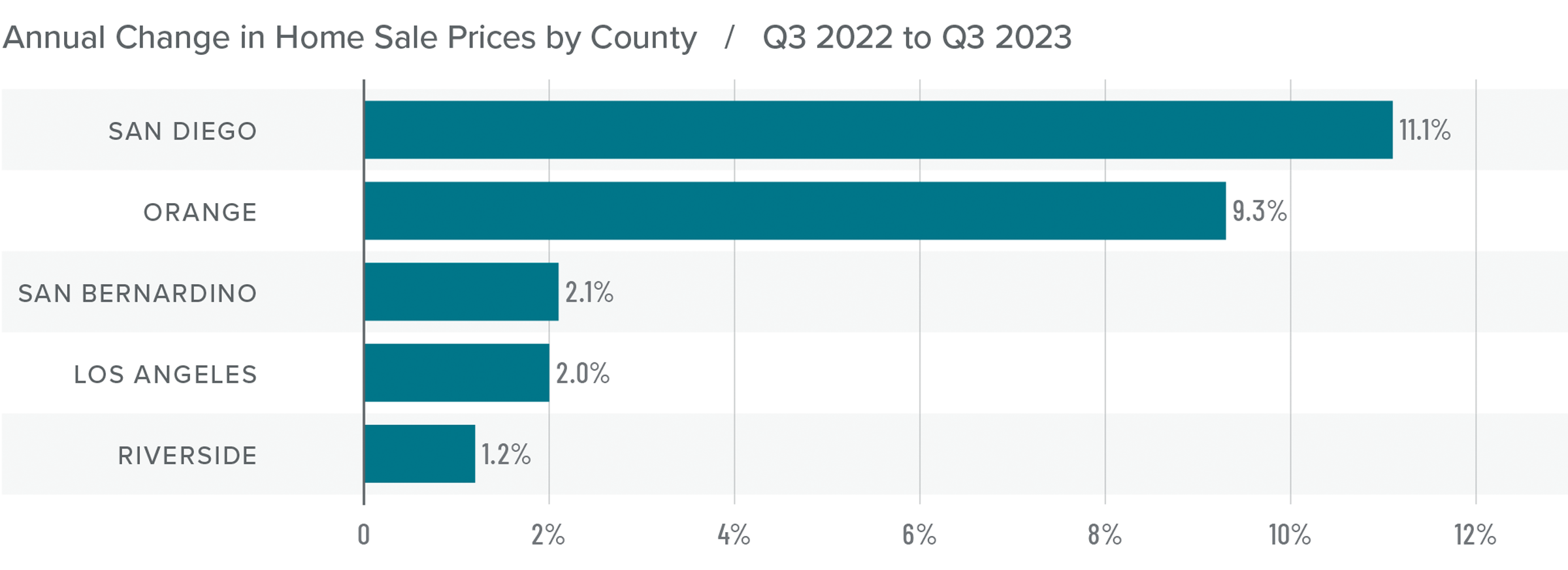

❱ Home sale prices were up 5.7% from the third quarter of 2022 and were 3.8% higher than in the second quarter of 2023.

❱ Affordability continues to be a major constraint in the region, which is being magnified by persistently high mortgage rates. Prices are holding, but growth has slowed significantly.

❱ Year over year, prices rose in all the markets contained in this report, with significant increases in San Diego and Orange counties. Compared to the second quarter of 2023, Riverside County saw prices fall by 5.8%, but they rose in the balance of the market areas.

❱ I expect price growth in Southern California to hold at or near the current pace. However, it’s very possible that home sale prices could drop a little if list prices fall further.

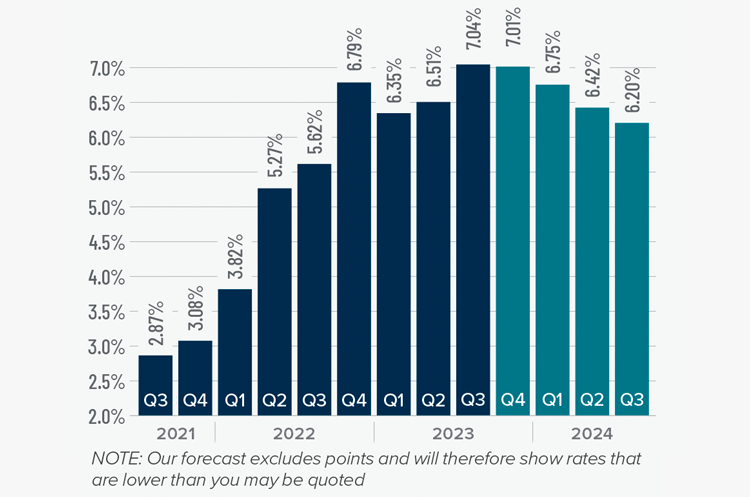

Mortgage Rates

Mortgage rates continued trending higher in the third quarter of 2023 and are now at levels we have not seen since the fall of 2000. Mortgage rates are tied to the interest rate (yield) on 10-year treasuries, and they move in the opposite direction of the economy. Unfortunately for mortgage rates, the economy remains relatively buoyant, and though inflation is down significantly from its high, it is still elevated. These major factors and many minor ones are pushing Treasury yields higher, which is pushing mortgage rates up. Given the current position of the Federal Reserve, which intends to keep rates “higher for longer,” it is unlikely that home buyers will get much reprieve when it comes to borrowing costs any time soon.

With such a persistently positive economy, I have had to revise my forecast yet again. I now believe rates will hold at current levels before starting to trend down in the spring of next year.

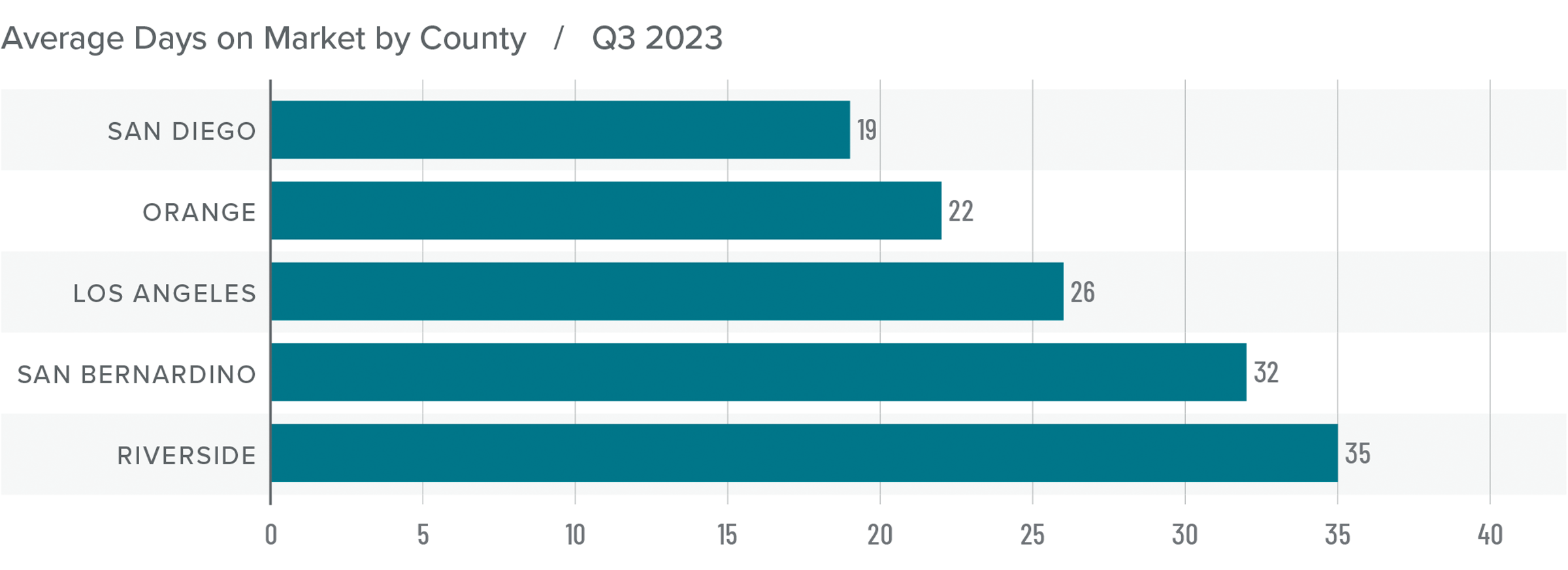

Southern California Days on Market

❱ In the third quarter of 2023, the average time it took to sell a home in the region was 27 days. This was up two days compared to the same period of 2022.

❱ Compared to the second quarter of 2023, market time fell six days and was lower across all counties covered by this report.

❱ Homes in San Diego County continue to sell at a faster rate than other markets in the region, but it took two fewer days to sell a home than it did in the third quarter of 2022. Orange County saw days on market fall by one day compared to the third quarter of 2022, but market time rose everywhere else.

❱ Homebuyers saw rising inventories, and those who chose to make offers did so relatively quickly, even though the total number of sales fell. If the number of homes for sale continues to rise, it may also cause market time to rise as buyers become more selective.

Conclusions

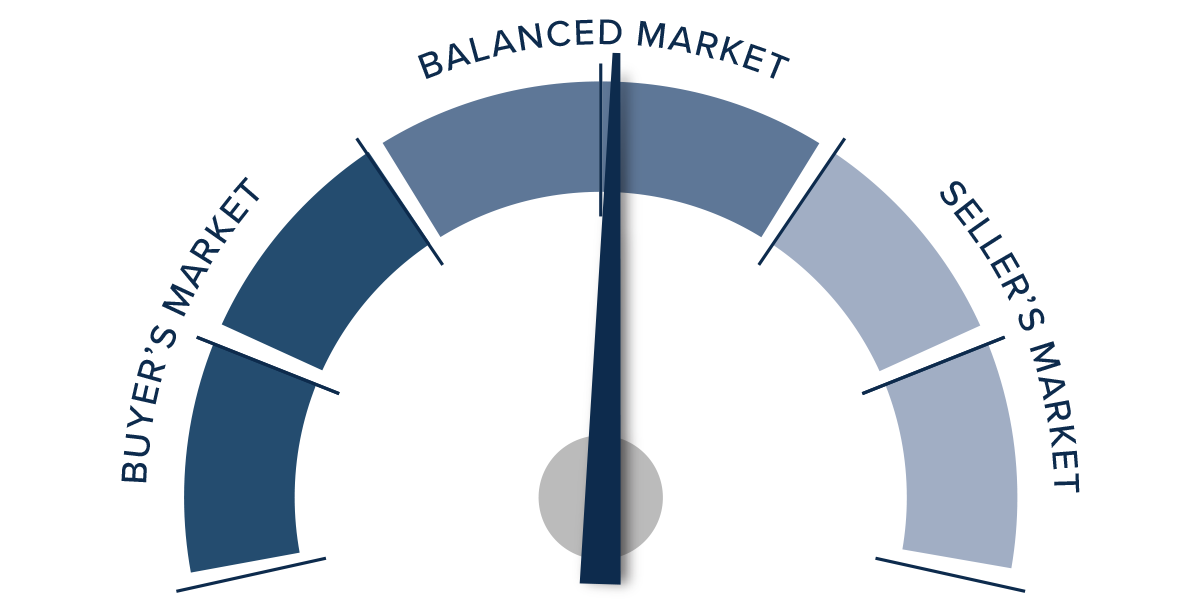

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

With inventory levels rising, and sales and asking prices falling, it would be easy to suggest that home buyers have the upper hand. However, home prices are still rising, albeit slowly, which tends to favor sellers.

The quandary really comes down to the fact that while inventory levels have risen, they remain remarkably low compared to historic averages. It’s also likely that the buyers who are still in the market are looking to move more from necessity than desire, which makes sense given today’s high mortgage rates.

That has put us in a very unusual situation. Although sellers are being a little more competitive, as evidenced by the drop in list prices, they have not totally capitulated. Taking all these factors into consideration, I have moved the needle back to the middle of the speedometer. I simply don’t see either side as having the upper hand at the present time.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Q2 2023 Southern California Real Estate Market Update

The following analysis of select counties of the Southern California real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

The Southern California market areas contained in this report added 222,700 jobs over the past 12 months, representing a decent growth rate of 2.4%. Although layoffs in the tech sector and the writers’ strike have been dominating headlines, payrolls in Southern California continue to expand. The Los Angeles market has added over 60,000 jobs through the first five months of this year. This was followed by Orange County, which added 19,000 jobs. San Diego County added 16,600 jobs, and employment grew by 6,700 jobs in Riverside County. The region has seen the pace of employment growth slow, but this appears to be more an issue of labor supply rather than a lack of demand. The region’s unemployment rate in May was 4.3%, up from 3.7% in the same quarter of 2022. The lowest jobless rates were in Orange County (3.2%) and San Diego County (3.5%). The highest rate was in Los Angeles County, where 4.8% of the workforce was without a job.

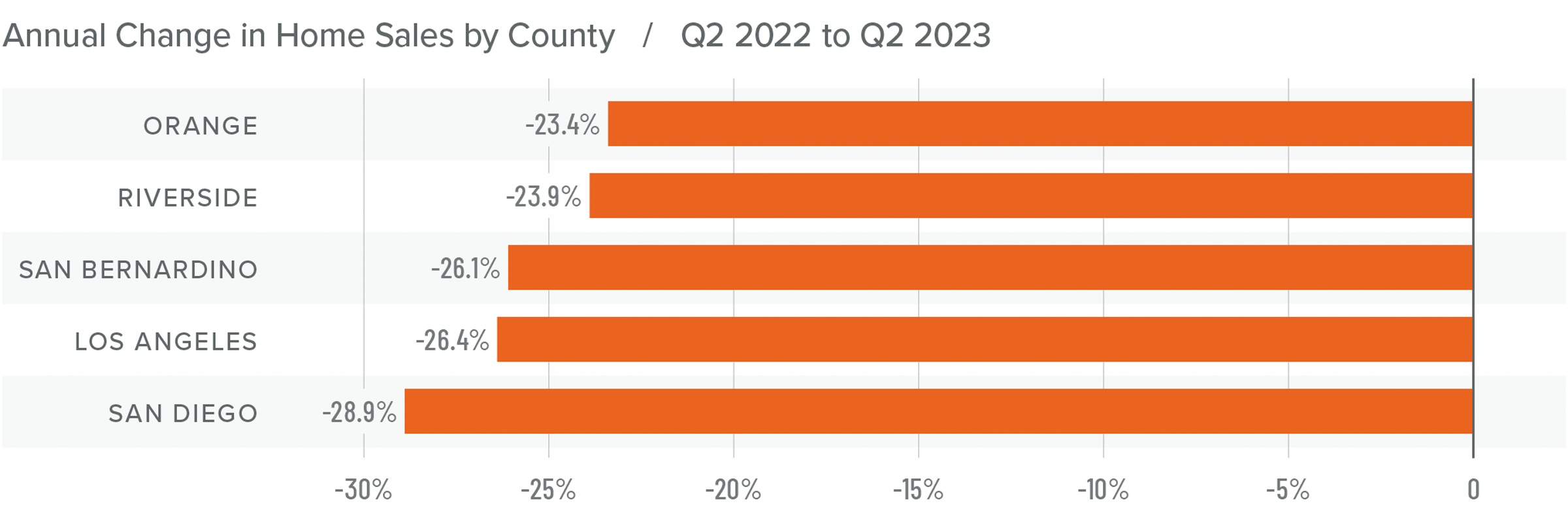

Southern California Home Sales

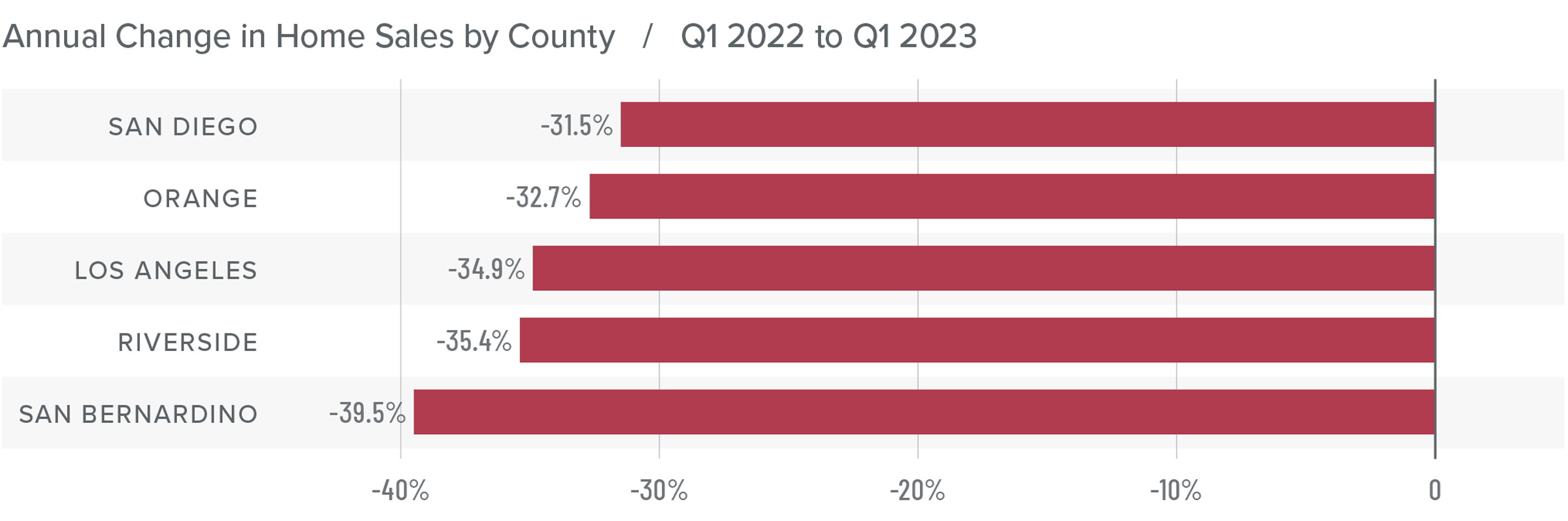

❱ In the second quarter of 2023, 35,381 homes sold, which was 25.9% lower than in the second quarter of 2022 but up an impressive 27.7% compared to the first quarter of 2023.

❱ Pending home sales, an indicator of future closings, were 13.9% higher than in the first quarter, suggesting that sales activity has room to rise further as we move into the second half of the year.

❱ Compared to the same quarter in 2022, sales fell across the board. However, the market heated up in the second quarter compared to the first quarter of 2023: sales were up 36% in Orange County, 29.6% in Los Angeles County, 28.4% in San Bernardino County, 24.3% in Riverside County, and 20.5% in San Diego County.

❱ The growth in sales was even more impressive given significantly rising financing costs in the second quarter.

Southern California Home Prices

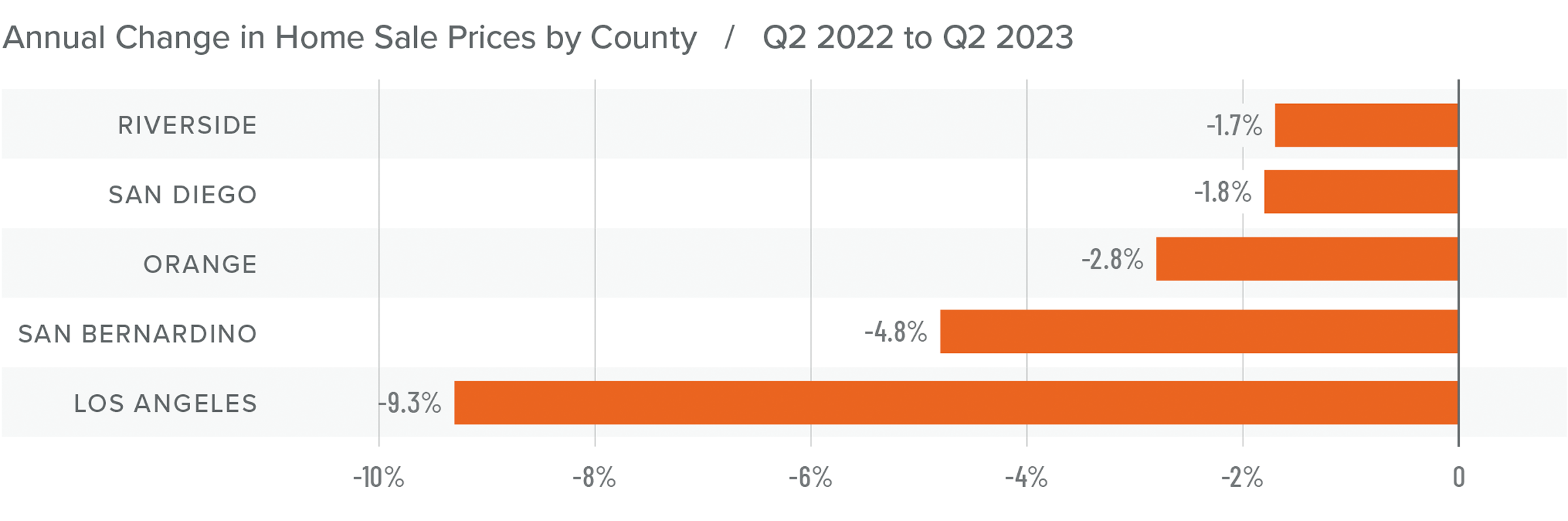

❱ Compared to the second quarter of 2022, home sale prices were 5.5% lower. However, they were 2.1% higher than in the first quarter of 2023.

❱ Affordability continues to be a significant constraint in the region. With median list prices rising 21% in San Diego County and 20% in Los Angeles County compared to the first quarter, it appears that sellers’ confidence levels continue to rise, which will further impact housing affordability.

❱ Year over year, prices pulled back across the region, with a significant drop in Los Angeles County. Compared to the first quarter of 2023, Los Angeles prices fell 4.1%. Closed sale prices rose in the rest of the market areas.

❱ The region has demonstrated significantly more resilience to higher financing costs than expected. As we move through the balance of 2023, I expect prices to rise further, but at a very modest pace.

Mortgage Rates

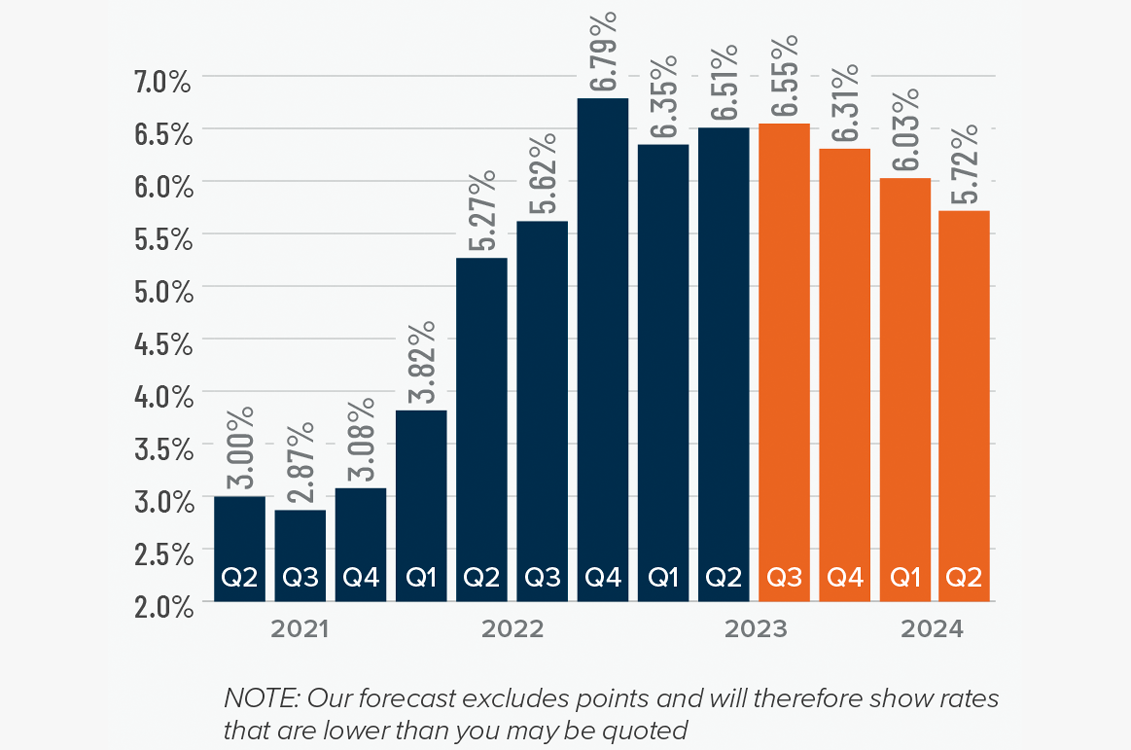

Although they were less erratic than the first quarter, mortgage rates unfortunately trended higher and ended the quarter above 7%. This was due to the short debt ceiling impasse, as well as several economic datasets that suggested the U.S. economy was not slowing at the speed required by the Federal Reserve.

While the June employment report showed fewer jobs created than earlier in the year, as well as downward revisions to prior gains, inflation has not sufficiently slowed. Until it does, rates cannot start to trend consistently lower. With the economy not slowing as fast as expected, I have adjusted my forecast: Rates will hold at current levels in third quarter and then start to trend lower through the fall. Although there are sure to be occasional spikes, my model now shows the 30-year fixed rate breaking below 6% next spring.

Southern California Days on Market

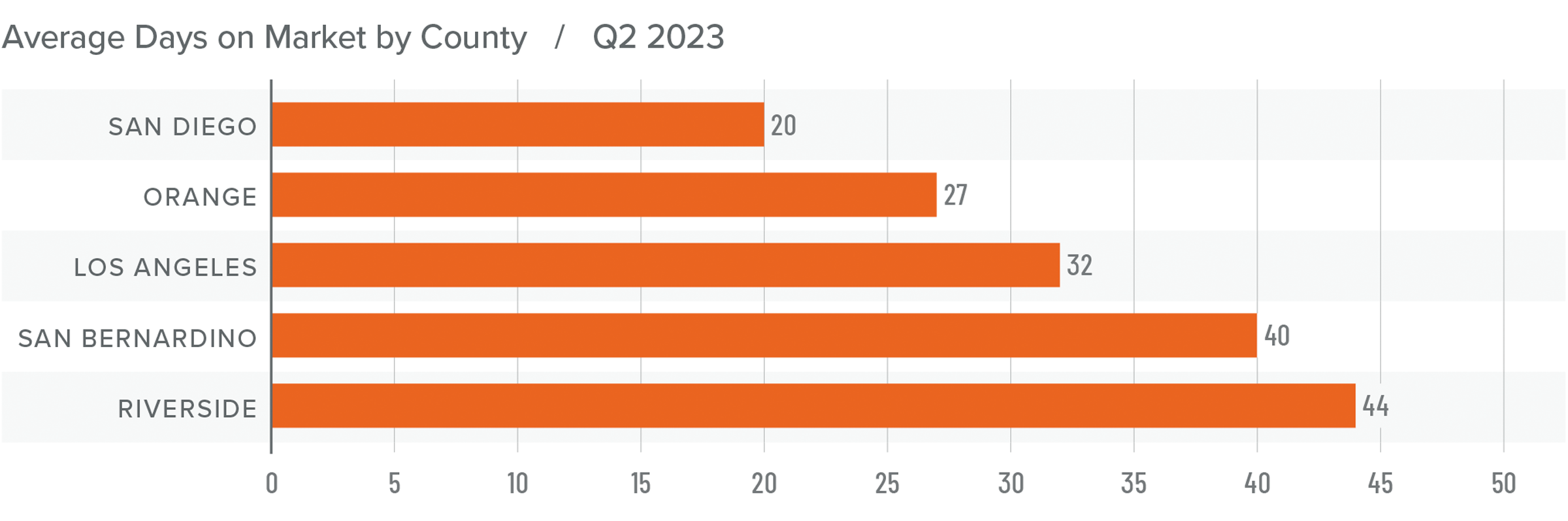

❱ In the second quarter of 2023, the average time it took to sell a home in the region was 32 days, which was 16 more than in the second quarter of 2022 but 13 fewer days than in the first quarter of 2023.

❱ Compared to the first quarter of 2023, market time fell in all counties covered by this report.

❱ Homes in San Diego County continue to sell at a faster rate than other markets in the region, but all counties saw market time increase from a year ago.

❱ Home buyers appear to be resigned to the fact that supply levels are unlikely to improve any time soon and believe that prices are not going to fall further. This is leading them to pursue buying a home even if mortgage rates remain very high, with the hope they will be able to refinance when rates eventually fall.

Conclusions

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Home prices have stabilized and are starting to trend higher again. This is counterintuitive, especially given that mortgage rates are higher than the market has seen in over 15 years. However, the reason for this is straightforward: a lack of supply is bolstering home values. It will only be when supply levels rise to match demand that we will start to move toward a more balanced market. The issue, though, is that 85.7% of California homeowners with a mortgage have an average interest rate below 5%, and 30% have rates at or below 3%. I find it highly unlikely that homeowners will give up their current rate unless they absolutely have to, which is holding back supply.

Homeowners who do decide to sell are aware of this and are increasingly confident in their ability to sell their homes regardless of mortgage rates. Given these factors, I have moved the needle into the seller’s sector of the speedometer.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

12 Common Things That Fail a Home Inspection

Once you have a buyer for your home, you may start thinking the home selling process is basically over, except for finalizing paperwork. But you still have a big step ahead of you. The home inspection!

A home inspection examines the parts of a home, from the roof to the foundation. Inspections are often requested by buyers interested in a property, sellers who opt to do a pre-sale home inspection and homeowners who want some peace of mind. Inspections are not mandatory but recommended for buyers to ensure they are not purchasing a home with major, costly issues.

A home inspector can reveal things that fail a home inspection that may affect the house’s safety, functionality, and value. By being aware of these potential issues, buyers can approach the home buying process with confidence and make informed decisions about their investment.

How Does A Home Inspection Work?

A home inspector should take several hours to complete a detailed walk-through of the home in question. During that time, the inspector will take notes and pictures. Most importantly, the inspector will provide an objective opinion on the home’s condition. A home inspector does not necessarily determine whether your home is compliant with local building codes.

They also will not comment on anything aesthetic, unless it suggests that a larger problem lies beneath. Although inspectors should have a keen eye for detail, they will not be able to detect the unseen. That means hidden pests, asbestos, mold or other potentially hazardous substances might go unnoticed.

Areas that are not readily accessible, like the septic tank, will not be covered, either. Those sorts of issues can require specialized evaluations.

12 Common Home Inspection Fails

These are the 12 most common things that fail a home inspection. Some may surprise you:

1. Foundation Problems

A foundation inspection is when a structural or foundation engineer inspects your home’s foundation. They will walk around your home, checking out key areas that may be showing signs of foundation issues. The goal of this inspection is for the inspector to make you aware of any foundation damage they are seeing in the home, how it could affect your safety and what can be done to rectify the situation. Inspectors will also be aware of any relevant building codes and if the home’s foundation is properly up to code.

What to look for:

- Cracks on the exterior walls of the home

- Leaning or tilting chimney

- Sagging or uneven floors

- Cabinets separating from the wall

- Windows and doors that don’t open or shut properly

- Cracks in interior walls and ceilings

- Bowing walls

2. Roofing Issues

One of the most common things that can result in a failed home inspection is the condition of the roof. If your roof is in bad shape, it can be a major problem for potential buyers. Leaks, missing shingles, and other damage are often signs that the roof needs to be replaced, which is a major expense.

If you are selling your home and you know that the roof needs to be replaced, it is best to replace it before putting your home on the market. This will give you a much better chance of passing the home inspection, and it will also make your home more appealing to buyers.

If you are buying a home and the roof needs to be replaced, you can attempt to negotiate with the seller to have them replace the roof before you close on the house. If they are unwilling to do this, you may be able to get them to give you a credit that you can use to pay for the roof replacement.

What to look for:

- Damage to the shingles

- Missing shingles

- Missing flashing

- Signs of water damage on the roof and in the attic

- Decay

- Signs of sagging or weak spots

3. Water Damage

One of the most serious and financially damaging issues in a home inspection is water damage. It can cause significant problems such as foundation damage and mold growth. Water damage and high humidity can lead to mildew and mold issues in your home. Unfortunately, black mold is expensive to fix and highly dangerous to your health and the health of anyone moving into your home.

What to look for:

- Visible leaks coming from exposed pipes

- Signs of water, including stains and mildew

- Sounds of running water or dripping

- Low water pressure

- A rise in your water bills, but not in your usage

4. Electrical Issues

Safety is perhaps the most important factor when buying a home, and electrical issues can threaten that safety immediately. Home inspectors will typically look for electrical problems that may cause fires, though they cannot always check ceiling interiors. In fact, most house fires are caused by bad electrical wiring. The bad news is that it can cost a massive amount of money to fix. Good inspectors will notate any code violation found during the inspection along with spliced wires which are more easily fixable. If an inspector cites issues, you should hire an electrician to give an estimate.

What to look for:

- Faulty, damaged or exposed wiring

- Outdated or damaged electrical panel

- Overloaded breakers

- Switches or outlets that don’t work

5. Plumbing Problems

Plumbing issues and leaking pipes are frequent reasons for a home inspection to fail. These difficulties might be as basic as a slow drain or a leaking faucet, or they can be more complex, such as cross-connection problems (where water from another source contaminates domestic water).

In some situations, pipes will have to be replaced altogether. Plumbing is a major source of concern because if a hidden leak is left unattended, it can result in mold spreading throughout the home.

To locate leaks, the home inspector will look for signs of mil damage, and fractures around pipes throughout the home. Additionally, they will inspect the ceiling for wet stains or fractures.

What to look for:

- Mold growth on cabinets or walls

- Brown spots on the ceiling

- Unpleasant smells coming from the drains

6. HVAC Problems

HVAC systems and ductwork should be in working order to ensure proper air quality and temperature regulation in the home. Certain HVAC issues can fail a home inspection due to a matter of safety. Your inspector will want to know your system is working properly, has proper ventilation and isn’t leaking carbon monoxide, refrigerant or any other harmful toxins.

What to look for:

- Refrigerant leaks

- Cracks in ductwork

- Loose electrical connections

- Squeaks, noises or bangs coming from your unit

- The smell of gas

- The presence of carbon monoxide (using a detector)

7. Mold

Not all mold is a major health concern, but certain types are: including black mold. If an inspector finds black mold on the property, it is going to become a major issue with completing the sale. Black mold is most commonly detected within crawlspace or basements which can make it go unnoticed to the untrained eye. Aside from the potential health threat, mold can also be symptomatic of structural issues or even plumbing issues. In either case, the source of the problem must be addressed. Depending on the depth of the issue, this process can be a very expensive ordeal.

What to look for:

- Standing water

- Musty smells

- Actual, physical mold

8. Termites and Other Pests

Infestations by pests like termites can cause significant damage to the structure of a home and require costly repairs. According to the University of Kentucky, the estimated annual cost of termite damage is in the billions.

What to look for:

- Rodent droppings

- Scratching and rustling noises

- Nest materials

- Holes or gnaw marks in your wood

- Swarming

- Buckling wood

- Swollen floors or ceilings

- Visible tunnels in your wood

- Mold or mildew smells

9. Windows and Doors Issues

It is important for the windows and doors in your home to function properly for safety’s sake, including making sure that they all open, close, and lock properly. Foundation issues can cause doors and windows to become unstable and unreliable, but other issues might have a hand in this too, such as cracks in the wall or problems with the framework.

While it is not always expensive to replace doors and windows, it becomes a much bigger job if the structure of the home causes the issue. Bear in mind that if a home inspector tells you there’s something wrong with them—you’re likely not seeing the root cause.

What to look for:

- Difficulty opening or shutting doors and windows

- Broken or malfunctioning locks

- Large, uneven spacing at top of closed doors

- Broken windows

- Windows letting in outside air or water

10. Building Code Violations

Building code violations are another common problem that can raise red flags for potential buyers. These violations can range from minor things, like not having the proper permits for your renovations, to major issues, like not having the proper supports in place for your deck.

If you are buying a home that has building code violations, you need to be aware of the potential risks. You may be liable for the costs of repairing the violations, or you may be forced to demolish the offending structure.

Home inspectors are not building code inspectors. However, they tend to find secondary defects in the structures that were not installed properly. Items such as improper electrical or windows too high for emergency situations. It is recommended that buyers check for any permits on alterations or structures that were added prior to the close of escrow.

If you are selling a home with building code violations, you need to disclose them to potential buyers. You may also need to get the violations corrected before you can close on the sale.

What to look for:

- Permits for any additions or other projects done on the home

- Violations based on your specific city’s codes and ordinances

11. Structural Issues

Many houses sustain some, albeit usually minor, structural damage from problems in one or more of the other categories, such as foundation walls, floor joists, rafters, or window and door headers. These issues are more prevalent in older homes.

What to look for:

- Sagging floors, rafters or roof

- Sloping floor

- Cracks in exterior brick or mortar

- Wood rot

- Cracks on walls or around windows and door frames

- Damp subfloors

12. Drainage Problems

This issue is frequently associated with water damage, as improperly graded homes prevent water from draining properly.

The inspector might notice spongy earth around the home’s foundation and basement leaks. Different circumstances can result in a variety of concerns around the house.

When the terrain surrounding the home slopes downward toward the house, this might result in moist or wet crawl spaces, foundation movement, or foundation cracking. Should water wick up the house’s foundation, it can cause rot and mold in the walls.

What to look for:

- Overflowing gutters

- Flooding in your yard

- Water pooling near the home

- Water leaking into the basement

- Musty smells

- Mold and mildew

- Efflorescence on your basement walls

Do You Have To Fix Every Problem Found During A Home Inspection?

A home inspection report is not a to-do list; you do not need to fix everything a home inspector thinks could stand for improvement. Basically inspection repairs fall into three categories: fixes that are pretty much required, according to the inspector; fixes that typically aren’t required; and fixes that are up for debate. Here’s how to know which is which.

There are some repairs that will be required by lenders before they will release funds to finance a buyer’s home purchase. Typically these address costly structural defects, building code violations, or safety issues—sometimes in the attic, crawl spaces, and basement—and others related to the chimney or furnace.

An inspector will also check whether your septic system and heater are in good condition and verify whether there’s a possible radon leak or the presence of termites (homeowners tend to have many questions on these topics). Other conditions of the home that an inspector may report on include those related to the roof, electrical systems, and plumbing lines and the condition of your HVAC system.

If a home inspection reveals such problems, odds are you’re responsible for fixing them. Start by getting some bids from contractors to see how much the work will cost. From there, you can fix these problems or—the more expedient route—offer the buyers a credit so they can pay for the fixes themselves. This might be preferable, as you won’t have to oversee the process; you can move out and move on with your life.

Find the Right Agent

Buying your house should be a fun and fulfilling experience. If you have done your research and evaluated what you can afford and what you truly need, finding a new home can be exciting. Learning more about the purchase process eliminates the fear of the unknown and lets you search for a home with peace of mind.

Windermere’s community of real estate professionals is our greatest asset. We have experts in all areas of real estate, from your typical starter home to condos, luxury properties, and new construction. While residential real estate is the mainstay of our business, Windermere also has offices and associates who specialize in property management, commercial real estate, and relocation services. To further facilitate the home buying process, Windermere has affiliated partners in certain regions to provide mortgage, title, and escrow services.

Call us today with any questions or concerns. Our professional Real Estate Agents will help you through this exciting process. (951) 369-8002

14 Features of Your Home That Turn Off Potential Buyers

Homebuyers can be fickle and a bit snobby. You will see them turning their noses up at the smallest things simply because the house does not fit every point on a dream home checklist.

Once your house goes on the market, you essentially begin living in a museum that needs to stay perfect in case a last minute showing is scheduled. Making sure everything is in place and the staging will attract buyers can help ensure that the house sells fast so you can move on to the next phase. Open houses and private showings are inconvenient and intense for the whole family. If you do not properly prepare for it, odds are good you will not get any offers, or the offers will be for less than you wanted.

Not every home for sale will suit every buyer’s wish list or needs. However, home sellers can take steps to make their property more attractive to potential buyers.

The following are fourteen of the top turn-offs for home buyers you should avoid when putting your home up for sale:

1. Clutter

Decluttering is the first thing we recommend doing before you put your house on the market because it can have an enormous effect on the presentation. Clutter makes any space appear smaller, dirtier, and overall less appealing to buyers. While it’s easy to think buyers can just look past the clutter, it has a subconscious effect on how buyers feel in a space and actually distracts from the positives that are buried beneath it. When a potential buyer walks through the door - or first looks at the listing photos online - you want them to see their home, not your home.

Take the time to declutter the entire house, clearing off all the surfaces, thinning out the decor, and even paring down on how much furniture is in the home to encourage a nice, easy traffic flow and serene setting.

2. Carpet

While carpet reigned supreme for many decades, today’s homebuyer generally prefers hardwood flooring. They are very easy to clean and do not retain dirt like carpets do. Even newer carpet can appear dingy and cheap, especially in high traffic areas.

While lush carpeting feels great underfoot and keeps the room warmer during winter, the majority of buyers now want to see hardwood. They will always be in style, and work with any decor scheme.

3. Bold or Distracting Colors

As a seller, you might love a brightly colored house, but many potential buyers prefer homes with neutral colors. You may love the bright yellow accent wall in your kitchen, but a buyer can see it as unsightly. This does not mean that you have to paint every room beige. But consider painting rooms decorated in themes, in particular kids’ rooms done in bright colors. And consider painting the exterior of your home in a more neutral color that will appeal to a wider range of buyers.

4. Outdated Appliances and Features

Buyers do not want to feel like they time-warped to another decade when stepping into your house. Ditch the shag carpet, tarnished doorknobs, disco-era light fixtures and ancient ceiling fans. Something as simple as updating the cabinet hardware and doorknobs makes a huge difference. The same holds true for dated ceiling fans, light fixtures and kitchen appliances.

Homes that have old fans, lights, ovens, microwaves, ranges and dishwashers can really turn a buyer off. As the seller, you may be tempted to think that the buyers can take care of that but it is going to hinder you from getting the highest price possible for your home."

5. Bad Lighting

The outside appearance of a home can be significantly enhanced by lighting. Illuminating front doors, garden paths and driveways can increase a home's appeal during winter and in the evenings. Make sure your front porch and entryway are well-lit, and consider adding some outdoor lighting to highlight your home's best features.

That holds true for the inside too. Most buyers are turned off by dark spaces because they feel smaller and less inviting. Allow as much natural light into each room as possible with the right window treatments and trim back plants or trees that could be blocking the sun. If any rooms do not have access to good natural light, install attractive artificial lighting to make sure each corner is well-lit. Bright, open homes always show better to buyers.

6. Evidence of Smoking

Smoking is a personal choice. However, many buyers are turned off when the home is permeated with the smell of cigarettes. When they walk into a home that smells of cigarettes, some buyers will walk away immediately. We have found that non-smoking buyers are very unforgiving when it comes to houses that smell like smoke.

If you are a smoker and planning to sell your house, stop smoking in it now. You should also start taking steps now to remove the smoke odor. Washing the walls is an obvious first step, but painting them may be necessary, too. Also wash or steam clean fabrics including drapes, furniture, carpet and the rugs.

7. Lack of Storage

This can be a deal breaker for some, especially if they are moving from a larger home. There may not be enough space to put all of their belongings or they may have to spend extra money on storage units.

It is important to organize your home before putting it on the market so that potential buyers can see the full potential of the space. If you do not have enough storage, consider renting a storage unit or using creative solutions like under-bed storage containers.

8. Lack of Privacy

One of the quickest turn-offs for any buyer is a lack of privacy when it comes to interior or exterior backyard space. So, if the neighbor’s window looks directly into your yard, or worse, into a bedroom, this can be a huge turn off for a potential buyer. For the most part, privacy issues can be overcome by planting a tree or building a fence. But lack of privacy is usually a red flag.

9. Pools

Do not be mistaken into thinking that your pool is a feature that will attract all buyers. Most buyers will consider a pool to be a major eyesore. This is especially true for above-ground pools which tend to leave dead spots in the grass. Even an in-ground pool is a huge turn-off due to the high maintenance required to care for a pool. Not to mention the liability involved with owning a pool. Having a pool can even increase the homeowner’s insurance premiums that the next homeowner will have to pay.

10. Converted Garage

If you have converted your garage to a home office, an extra bedroom, a personal gym or anything else, then convert it back to a garage. Do this before you begin showing your house. People want a covered parking space so that they have a safe place for their car—especially in areas where street parking is at a premium. Additionally, people often use their garage as storage space.

11. Popcorn Ceilings

The shag carpet from the '70s was replaced long ago. But acoustic popcorn ceilings, another artifact of that era (and of the '80s, too) might remain. They badly date your house.

If you cannot afford the cost or the mess to remove the overhead popcorn, be prepared to credit a buyer in certain markets in order to close a sale. The popcorn acoustic ceiling is a major, major turnoff to buyers these days.

12. Wallpaper

Wallpaper almost always looks tacky. Especially if it has been up there for the better part of the decade. Today's buyer doesn't want wallpaper, no matter how much your grandma liked it. Not only is wallpaper extremely personalized, it is also quite hard to remove.

13. Misrepresented Homes

Nothing angers buyers more than showing up to a home that was misrepresented in ads. Sellers use photos and words to make their homes enticing on the multiple listing service. But sometimes the words and pictures paint a false portrait. Sellers are going to paint the best picture they can but they need to be honest at the same time.

14. You

Along with the pets and kids, most realtors say the homeowners shouldn’t be around, either. It is usually best for homeowners to leave when potential buyers tour the house. Hovering or offering tidbits of information can make buyers feel uncomfortable and even be annoying. As the seller, it is hard to resist the temptation to walk around with the potential buyer and put in your two cents' worth.

Find the Right Agent

First impressions still matter. Just like with curb appeal, the way you stage your rooms can make or break a buyer’s interest in your home, so it’s important to put your best foot forward. Be sure to add unique touches to make your home feel cozy and welcoming. These steps will go a long way toward helping your home stand out from the crowd.

Windermere’s community of real estate professionals is our greatest asset. We have experts in all areas of real estate, from your typical starter home to condos, luxury properties, and new construction. While residential real estate is the mainstay of our business, Windermere also has offices and associates who specialize in property management, commercial real estate, and relocation services. To further facilitate the home buying process, Windermere has affiliated partners in certain regions to provide mortgage, title, and escrow services.

Call us today with any questions or concerns. Our professional Real Estate Agents will help you through this exciting process. (951) 369-8002

Q1 2023 Southern California Real Estate Market Update

The following analysis of select counties of the Southern California real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

Following annual revisions to the data, the Southern California market added only 194,000 jobs in 2022, which was far fewer than the over 676,000 added in 2021. The first two months of data for 2023 showed a net loss of 14,800 jobs. Because the data is not adjusted for seasonality, I am not overly concerned by this decline, but I will be watching as we move through the spring to see if declining job growth is becoming pervasive. Total employment in the counties covered by this report is still 266,400 jobs shy of the pre-pandemic peak. Los Angeles County continues to have the largest shortfall of jobs (-260,000), followed by Orange County (-37,100). Job levels in San Diego County match their pre-pandemic peak, while employment levels in the Riverside and San Bernardino markets are each higher by more than 15,000 jobs. The region’s unemployment rate in February was 4.6%, down from 5% at the same time in 2022. The lowest jobless rates were in Orange County (3.4%) and San Diego County (3.7%). The highest was in Los Angeles County, where 5.3% of the workforce was without a job.

Southern California Home Sales

❱ In the first quarter of 2023, 27,577 homes sold, which is down 34.8% from the first quarter of 2022 and is 5.2% lower than in the final quarter of 2022.

❱ Pending home sales, which are an indicator of future closings, were 25.4% higher than in the fourth quarter, suggesting that sales activity in the second quarter of this year may pick up.

❱ On a percentage basis, sales fell the most in San Bernardino County, but all markets pulled back significantly. Compared to the fourth quarter, sales were higher in Riverside County (+7.1%) but fell across the balance of the market.

❱ The drop in sales can mainly be attributed to a lack of inventory: the number of homes for sale was down 27.6% from the final quarter of 2022. Additionally, mortgage rates rose by more than a full percentage point in February, which likely also impacted sales.

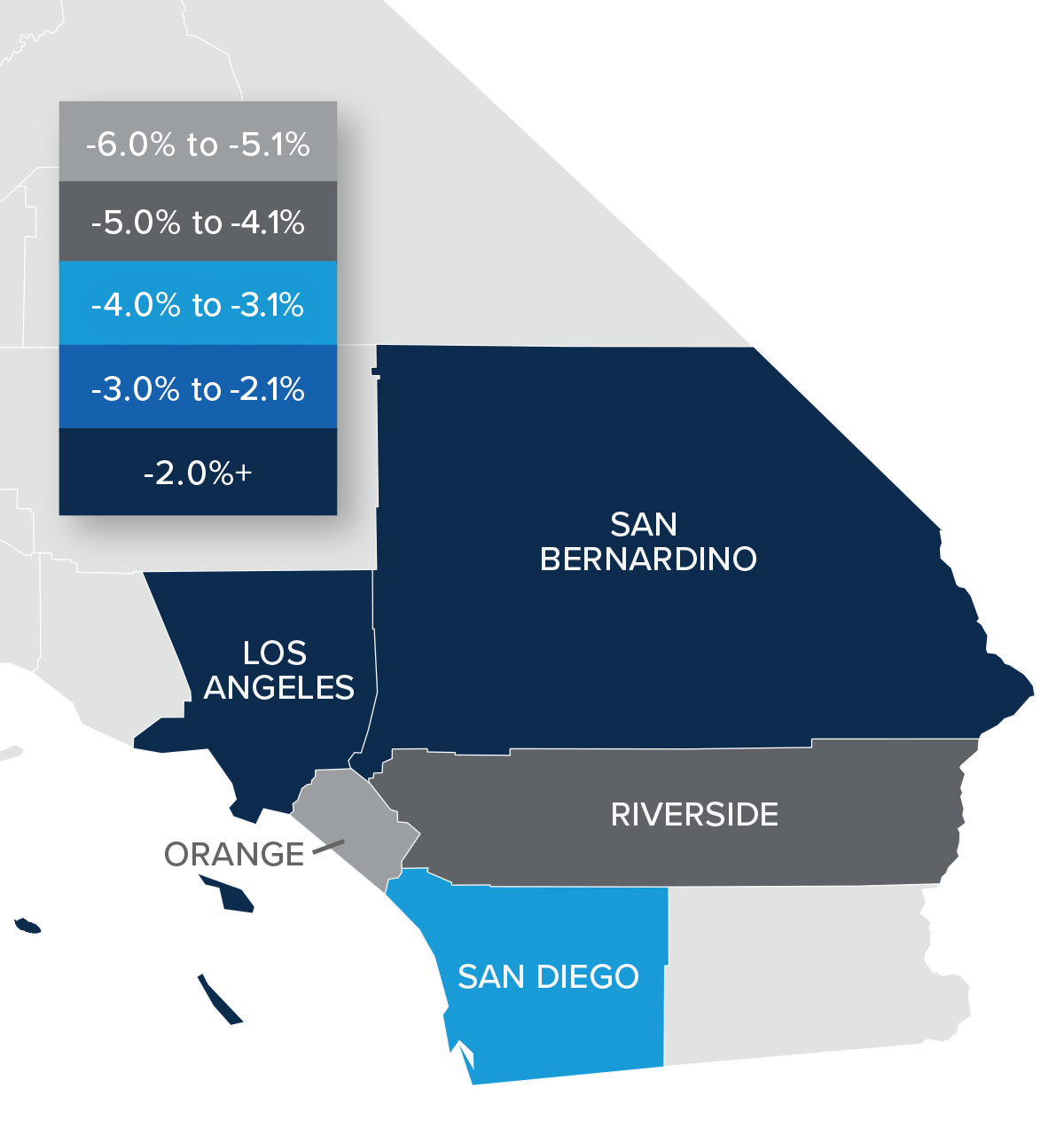

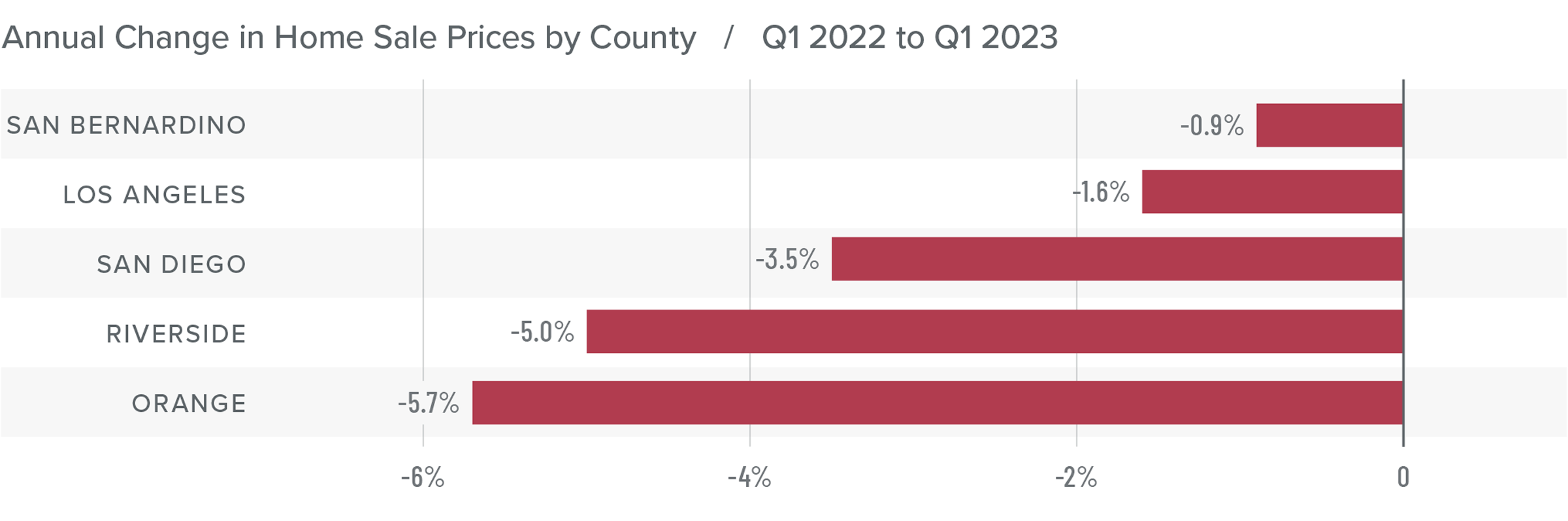

Southern California Home Prices

❱ Compared to the same period last year, home prices fell 2.5%. However, prices were 1.9% higher than in the fourth quarter of 2022.

❱ Affordability remains a significant issue, which has been exacerbated by elevated financing costs. That said, median listing prices in the quarter are up in every market other than San Bernardino, which suggests that home sellers may be starting to think that the worst of the price correction is behind them.

❱ Year over year, prices fell across the region but rose in all markets compared to the final quarter of 2022. Of note is that price growth was very solid in San Diego, Riverside, and Orange counties.

❱ While I expect mortgage rates to start stabilizing as we move toward summer, I think there will be some additional downward pressure on home prices. That said, things should start to turn around again in the second half of the year with a return to rising home prices.

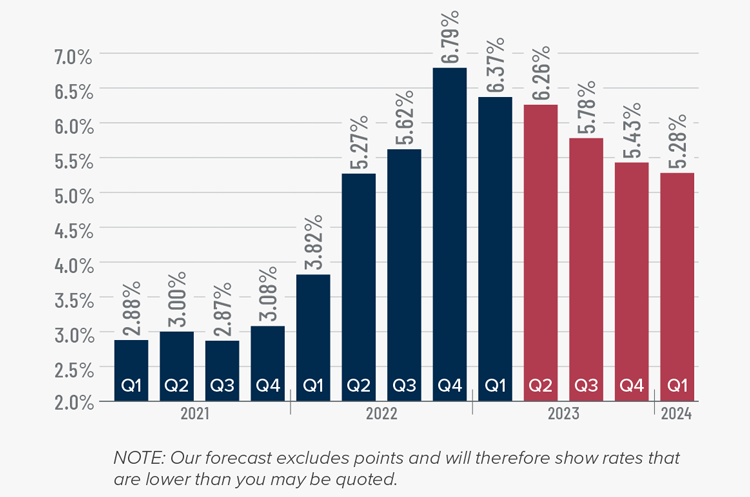

Mortgage Rates

Rates in the first quarter of 2023 were far less volatile than last year, even with the brief but significant impact of early March’s banking crisis. It appears that buyers are jumping in when rates dip, which was the case in mid-January and again in early February.

Even with the March Consumer Price Index report showing inflation slowing, I still expect the Federal Reserve to raise short-term rates one more time following their May meeting before pausing rate increases. This should be the catalyst that allows mortgage rates to start trending lower at a more consistent pace than we have seen so far this year. My current forecast is that rates will continue to move lower with occasional spikes, and that they will hold below 6% in the second half of this year.

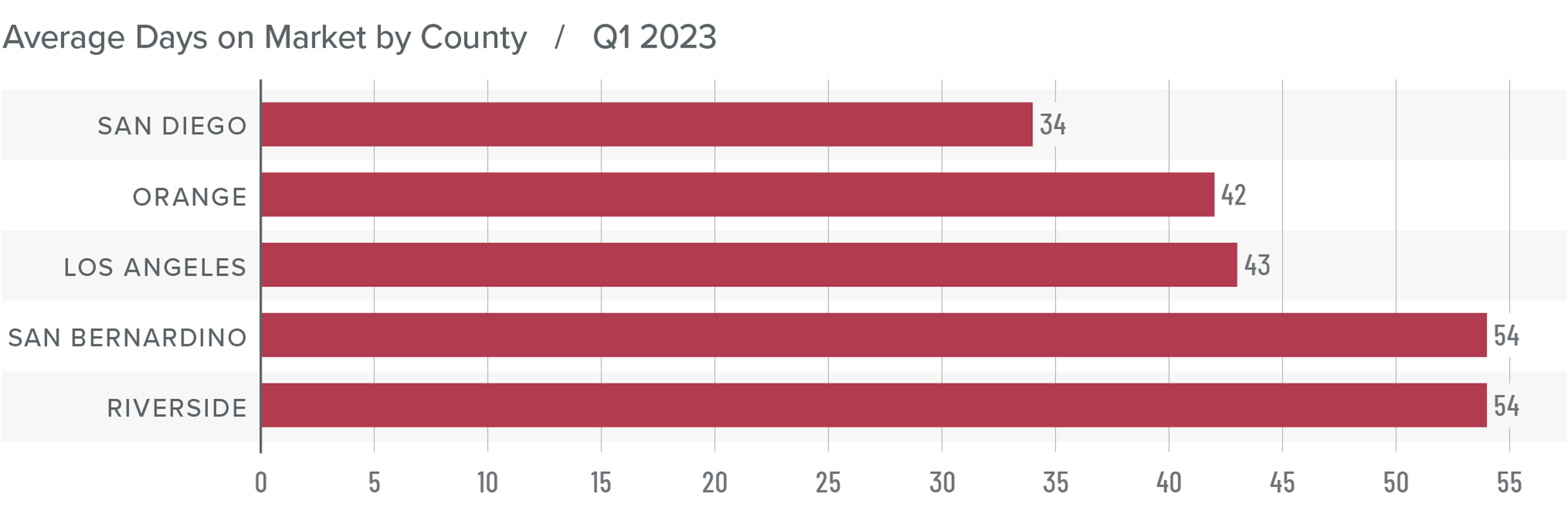

Southern California Days on Market

❱ In the first quarter of 2023, the average time it took to sell a home in the region was 45 days, which is 24 more than in the first quarter of 2022 and 9 more days than in the fourth quarter of last year.

❱ Market time also rose in all counties covered by this report compared to the fourth quarter of 2022.

❱ Homes in San Diego County continue to sell at a faster rate than other markets in the region, but all counties saw market time increase from a year ago.

❱ Higher mortgage rates and lower affordability still have some buyers sidelined. I expect to see increased activity once buyers become confident that mortgage rates have stabilized and that housing values have found a bottom.

Conclusions

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

The Southern California housing market is still trying to find its footing. Mortgage rates are not only still at elevated levels, but they are also moving erratically depending on events in the broader economy (e.g. inflation, bank failures, etc.) Although sellers seem to be more confident, buyers are remaining cautious, which suggests that the market recovery will take more time.

Lower inventory levels, higher pending sales, higher listing and sale prices, and an improving absorption rate all favor sellers. However, the market is not completely in their favor. As such, I have left the needle in the “balanced” section of the speedometer. I have tilted it slightly toward home sellers though as there continues to be strong demand for appropriately priced, well-located, and well-appointed homes.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

How to Stage Your Home to Sell It Quickly

One of the most important steps of selling a home is proper staging. This takes a little bit of work but could make a huge difference. The way you stage your home truly sets the mood for your entire sale. It is imperative that your staging is harmonious and work well with your surroundings. Making your home as eye-catching as possible will help you stand out in a competitive real estate market and attract motivated buyers.

Below, our expert team has compiled some home staging tips to help you add a one of a kind stage design to your home with a flair of personality.

What is Home Staging?

Simply put, staging is the art of decorating a home to sell quickly and for more money on the real estate market. It includes renovating, rearranging furnishings, adding subtle pieces of décor or even taking some décor away for a cleaner look. Staging a property for sale implies preparing it to appeal to the greatest number of buyers, boosting the chances of selling fast and for a higher price.

As a seller, you have the option of staging your own house, enlisting the assistance of your Realtor, or hiring a professional home stager. Home stagers set the stage for potential home buyers to imagine how they could live in a property and make it their home. This can be as “simple” as rearranging what the home seller already has. Or it can include bringing in new furniture, accessories and art to make the home appeal to more buyers.

Every Detail Counts

To attract more buyers and a higher offer, home staging makes the space visually pleasing and draws attention to the home’s best features.

Home stagers also get rid of clutter and depersonalize the home so that potential buyers will be able to see themselves living there.

Too much and the home looks bland and boring. Too little and potential buyers are distracted by thinking about the people who already live there.

Every detail counts in selling a home for top dollar. From cleanliness to the state of repair. And from furniture placement to lighting, color, art and accessories.

Home stagers attend to all of these details for their home staging clients.

Home Staging Tips

First and foremost homes sell quickly with staging, if you want to sell your house quickly and for the highest potential price in top dollars, staging is one of the simplest methods to do it. Also the value of your home increases.

Staging a house ensures that buyers view it in its best light and may assist demonstrate what a property has to offer without requiring a whole home design overhaul. Potential buyers will be more encouraged to make a competitive offer if they can envision themselves living in the property.

Start With a Deep Cleaning

A clean home shows potential buyers that you have taken good care of the property. Ideally, you should clean every part of the house, from the floors to the ceilings—and everything in between. While some buyers might not care about a little bit of clutter or dust, it could turn others away. If your appliances in the kitchen are older, make sure they are spotless. Likewise, make sure your bathrooms sparkle, from the corners of the tub, to the sink drain, to that spot behind the toilet that you don’t think anyone can see. Your goal should be to make everything look new and exciting.

Declutter

Clutter distracts buyers from your home’s features and it makes the home seem like it has less space. When you are about to put your house on the market, be sure to box up and put into storage the things you do not need on a day-to-day basis (knickknacks, games, papers, seasonal clothes, and messy hobbies). It is also time to get rid of things you no longer need—like the expired food in the back of the cabinets, and the clothes and toys that the kids have long since outgrown. The more empty storage space you have, the better.

Define Rooms

Make sure that each room has a single, defined purpose. And make sure that every space within each room has a purpose. This will help buyers see how to maximize the home’s square footage. If you have a finished attic, stage it as an office. A finished basement can become an entertainment room, and a junk room can be transformed into a guest bedroom.

Even if the buyer does not want to use the room for the same purpose, the important thing is for them to see that every inch of the home is usable space.

Remove Most Personal Items

You do not have to remove every single personal item from your home before you sell it, but the majority of your belongings should be boxed up and stored elsewhere. That includes items like old family photos, family heirlooms, refrigerator art and knick-knacks. Buyers need to be able to envision themselves in your home. Keep clothes hidden away as much as possible, and make sure the bathroom counters are empty (except for hand soap and a towel, of course). Likewise, put away all the toys and anything else that is highly personal or evocative of the home’s current inhabitants.

Stay as Neutral as Possible

Your realtor will most likely going to tell you that you need to keep your furniture and decorations as neutral as possible. Yes, that bright red accent wall really shows off your personality. But you need to tone down the colors. Neutrals are your friends. You will also want to make sure to keep spaces gender-neutral. Your home’s new owners will not necessarily use the rooms (or decorate them) the same way you do. As a general rule, you want potential buyers to be able to walk into a home and envision themselves living there. Having neutral furniture and decorations is going to create a blank canvas for them.

Focus on Fresh

A few potted plants can do wonders to make your home feel fresh and inviting. If you have a lot of plants, space them out strategically so they do not overwhelm any one area. Of course, dead and dying plants do not do much to make your home look well-tended so be sure to prune them back or ditch them altogether.

Another way to make your home seem fresh is to get rid of odors. Pets, kids, last night’s dinner, and many other conditions can make your home smell. Inexpensive tricks for ridding a home of odors and giving it an inviting aroma include baking cinnamon-coated apples or cookies in the oven, or burning some mild scented candles.

And do not forget to take out the trash!

Furniture

Make sure furniture is the right size for the room, and do not clutter a room with too much of it. Furniture that is too big will make a room look small, while too little or too small furniture can make a space feel cold. Arrange the furniture in a way that makes each room feel spacious, homey, and easy to navigate.

Whenever possible, do not use cheap furniture. You do not have to pay a lot of money to switch out your existing furniture—and you may even be able to rent furniture to stage your home. Either way, make sure the furniture looks nice, tidy and cozy. You can use throw pillows to add contrast and a splash of color.

Lighting

One of the easiest and most effective ways to make a home more eye-catching is to improve the lighting. Take advantage of your home’s natural light. Open all curtains and blinds when showing your home. Add fixtures where necessary, and turn on all the lights for showings (including those in the closets).

Make sure that all of the bulbs throughout your home are bright and working correctly. Painting the walls a bright and neutral color is another simple way to improve indoor lighting. This makes your home appear more inviting. If you think your existing fixtures are fine, be sure to dust them and clean off any grime. Otherwise, outdated and broken light fixtures are easy and cheap to replace.

Find the Right Agent

First impressions still matter. Just like with curb appeal, the way you stage your rooms can make or break a buyer’s interest in your home, so it’s important to put your best foot forward. Be sure to add unique touches to make your home feel cozy and welcoming. These steps will go a long way toward helping your home stand out from the crowd.

Windermere’s community of real estate professionals is our greatest asset. We have experts in all areas of real estate, from your typical starter home to condos, luxury properties, and new construction. While residential real estate is the mainstay of our business, Windermere also has offices and associates who specialize in property management, commercial real estate, and relocation services. To further facilitate the home buying process, Windermere has affiliated partners in certain regions to provide mortgage, title, and escrow services.

Call us today with any questions or concerns. Our professional Real Estate Agents will help you through this exciting process. (951) 369-8002

Why Hire a Real Estate Agent When Buying or Selling a Home

You do not technically need a real estate agent to buy or sell a home. You could go it alone. However, the benefits of working with one are significant.

Sellers who sell their home with the help of the realtor generally sell faster and for more money. Buyers who purchase their home with an agent also typically score better prices. But that is just the tip of the iceberg. A qualified agent serves as an advisor in your corner, preparing you for every move in a competitive and often unpredictable real estate market.

Here are our top reasons why you should consider hiring a real estate agent when you’re selling or buying a home.

Why Hire a Real Estate Agent If You Are Selling

1. Help Price Your Home to Sell

Generally, as the seller, your primary goal is to sell your home as quickly as possible at the best price, so you can move on to your next place. But a significant factor in making a quick sale is ensuring that your house is priced appropriately for the market. As the homeowner, it is easy to overvalue your home since you likely did work to it, you loved it for a certain amount of time, but there is likely a bit of subjectivity that goes into your estimate. Real estate agents do not just guess the best price. They use data and market knowledge to set a competitive listing price for your home.

Your listing agent will use a comparative market analysis (CMA) to see what similar houses in your neighborhood have sold for recently. Your listing agent will also consider the unique features of your home when they do a comparative market analysis (renovations, upgrades, and so on) to account for other factors that may raise or lower the price.

2. Likely to Sell Higher

Some sellers believe they can get more money for their property by cutting out the standard agent commission and selling their homes For Sale By Owner (FSBO). However, if the buyer has an agent, the seller will still likely need to pay the buyer’s agent’s commission anyway.

FSBO sellers are walking away from home sales with less, according to a 2021 report by the National Association of Realtors®. When you do the math, homes sold by agents statistically bring in an average of $39,000 more even after accounting for the commission.

3. Likely to Sell Faster

Agents have experience with proven strategies that help sell properties quickly. An expert agent who knows your area will be well-acquainted with the current housing market, knowing what is motivating buyers in your area, and come prepared with a comparative market analysis from similar houses that have recently sold nearby. Some ways agents can help your home sell faster include:

- Setting the right listing price

- Knowledge of area trends

- Suggesting a pre-listing inspection

- Helping prioritize updates, and repairs

- Effective marketing

4. Expert Negotiating Skills

A top real estate agent knows negotiation tactics to help you get the maximum price for your property. But adept negotiation takes knowledge of the current market, research, and expert skill.

“We know the area; we have studied their property, know all the details of the property that makes it go above and beyond for that offer,” explains Dovenbarger. “We can say, hey, this beautiful property has a beautiful yard, beautiful swimming pool, all that. It’s important to say to a buyer it would be to your advantage to pay for the survey and to pay for the closing costs.”

A few other expenses that can be negotiated down include home warranty premiums, repair costs, and cosmetic updates to the home, or the buyer can pay their own closing costs.

One of the trickiest, yet most important, aspects of the selling process is handling negotiations with potential buyers. A good real estate agent will tackle negotiations professionally and work hard to sell your home for the maximum price so you don’t have to give up any additional sale proceeds aside from agent commissions. Real estate agents handle negotiations day in and day out, so you can feel confident in their ability to look out for your best interests.

5. Local Buyer Knowledge

Local listing agents know from experience and research what home features are popular with buyers. This knowledge can end up saving you money when you are preparing your home for sale.

For instance, you might think you need to remodel your bathroom before you list your home. However, your realtor might point out that other houses in the neighborhood are selling quickly as is, so the extra expense might not be worth it.

Conversely, your agent might suggest you repaint some of the rooms in your home with a neutral color to make it more appealing to potential buyers.

If you are selling without an agent, you will not know which home prep projects are most important to local buyers, or you might make the mistake of putting up a for sale sign without preparing your house at all.

6. Access to the MLS

One of the biggest challenges of selling a home without a real estate agent is finding the best way to distribute your home listing to potential buyers. Only licensed real estate agents can list homes on the Multiple Listing Service (MLS) — the online database where houses are listed for sale. Realtors regularly post listings on the MLS, so they will usually include great photographs of your house and a description that piques potential buyers’ interest.

It is vitally important to get your house on the MLS since 97% of all buyers use the internet to search for homes these days.

7. Better Marketing

Marketing your home does not begin and end with the listing. There is much more that goes into it. Successfully marketing a home to potential buyers takes a lot of time and effort. So much effort, in fact, that many people give up. Expert agents are proactive marketers with an arsenal of marketing and sales techniques in their toolbox in which to market properties.

Top agents know how to get more eyeballs on your home with marketing efforts like:

- Advertising on social media

- Hosting an open house

- Hiring a professional photographer

A listing agent wants to make your home look as good as possible for as many people as possible so they can earn commission when it sells.

If you are selling FSBO, it is hard to know how or where to market your home so qualified buyers in your area can see it.

8. Manages the Paperwork

Home sales require dozens of important legal documents, and it can be difficult for inexperienced sellers to keep all of the paperwork straight. It is best (and safest) to have a real estate agent handle the paperwork for you since they know what they are doing and they have the support of a brokerage that can ensure your entire transaction is valid.

Sometimes the industry jargon in contracts and real estate documents can feel like a foreign language. There are financing industry terms, attorney legalese, title company lingo, and real estate vocabulary–– all that can be mind-boggling to sellers as well as buyers.

Real estate agents will take the time to explain the purpose of each document, answer questions you don’t understand, and clarify the terms you’re agreeing to and signing.

Why Hire a Real Estate Agent If You Are Buying

1. No Out-of-Pocket Cost

As a buyer, your real estate agent is paid by the seller using the proceeds of the sale. When you are making one of the largest purchases of your life, it is a huge advantage to be able to work with a professional without getting a bill for it.

2. Find the Right Home Faster

Popular real estate websites like Zillow and Redfin can help you find houses, but the information on these sites can be outdated and the latest listings may not appear on the map.

Your buyer’s agent can notify you of new listings as soon as they hit the market, and they can even tell you about off-market opportunities — houses owned by people who have not officially listed for sale, but who may be open to offers.

Even though you can browse listings online, agents have full MLS access — enabling them to find houses you cannot see with your own search.

3. Helps Create a Competitive Offer

In hot real estate markets, it can be hard to get an offer accepted without overpaying. Buyers sometimes get pressured into submitting offers well above the listing price because they want to outbid everyone else. While it is true that a home purchased with a mortgage loan will be evaluated by an appraiser before all is said and done, there is more to a fair price than a bank’s willingness to loan money.

Real estate pricing varies depending on whether market conditions have created a seller’s market or a buyer’s market. When you are trying to buy a home in a seller’s market, you can expect a limited inventory of available homes and a high likelihood of multiple-offer scenarios when you do find one you would like to purchase.

And this is when it is especially helpful to have a buyer’s agent in your corner — because an agent will have the market expertise to advise you on how to make a competitive offer.

4. Can Spot Red Flags

Unless you are a home improvement professional or an experienced agent, you might miss red flags when viewing a home on your own. Some expensive home repair issues your agent can spot include structural issues, furnace problems, roofing issues, plumbing leaks, mold, and insect infestations. While these issues would likely come up during a home inspection, spotting them early can save a lot of time if these are deal breakers for you.

Find the Right Agent

Windermere’s community of real estate professionals is our greatest asset. We have experts in all areas of real estate, from your typical starter home to condos, luxury properties, and new construction. While residential real estate is the mainstay of our business, Windermere also has offices and associates who specialize in property management, commercial real estate, and relocation services. To further facilitate the home buying process, Windermere has affiliated partners in certain regions to provide mortgage, title, and escrow services.

Call us today with any questions or concerns. Our professional Real Estate Agents will help you through this exciting process. (951) 369-8002

Benefits of Accepting a Cash Offer on Your House

Every seller's reason for selling their home is uniquely different. Many homeowners want to sell their homes quickly. They do not often want to spend time or effort preparing to sell, which includes completing repairs, handling upgrades and staging and cleaning the house to show it to buyers. These are the types of situations where a seller will reap the benefits of accepting a cash offer on a house, and it is usually the best possible option.

Selling a home requires a lot of work and a stressful ordeal, from the time and effort put in to prepare your house, to the endless amount of cleaning, repairs, and upgrades. The seller might be worried the sale will take too long, that they will not be able to find a quality real estate agent or the costs will be high if they try to sell their home the traditional way.

If you are still wary of accepting a cash offer and only feel comfortable with traditional sales, continue reading through this article, and we will explore exactly what a cash offer is, as well as the main benefits of accepting a cash offer on a house.

What Is a Cash Offer on a House?

As the name indicates, a cash offer on your home means the buyer offers you the amount of money you have listed your home for in cash rather than using financing methods. Having a buyer with enough money to purchase your home outright allows you to avoid several time-consuming and expensive steps that can leave your home on the market longer than you want.

From the owner’s perspective, you might think that this does not make a difference — whether from a bank or from a cash offer, you get your money, right? Well, sort of. If you are working on a tight timeframe, working with buyers getting funding through banks will not be very flexible, even if they want to be. The reality is, cash offers come with non-traditional buyers who are ready to make quick offers, pay cash for a house and avoid all the extra steps that come with a conventional home sale.

How Common Are Cash Offers?

Many believe cash offers on homes are not all that common, but this could not be further from the truth. In reality, cash home sales occur in 22% to 24% of the market for condo and single-family home sales.

Some scenarios make these cash sales more common, including:

- A buyer has just sold their home and needs a place to live immediately.

- Real estate investors want to invest in the property.

- A buyer wants a competitive edge in the market.

- A property needs expensive repairs or renovations.

- Someone wants to sell their home for a fix and flip.

Types of Homes Most Likely to Be “Cash Only”

While everyone’s scenario is unique, some situations just make sense for a cash-only sale. Some of the most common situations that might be best for cash sales include:

Homes Close to Foreclosure

Homeowners at risk of facing foreclosure will find themselves trying to solve their problems. Due to financial circumstances, this means the homeowner can no longer afford to make the mortgage or loan payments on their homes and will feel as though they are running out of options to regain some form of stability.

While there are other options they can take, such as evictions, short sales or bankruptcy, these can have a detrimental impact on the owner's credit score, making it hard for them to seek loans in years to come. A simple cash sale provides an easy way out without harming their credit score. Accepting a cash offer on a property at risk of foreclosure allows the homeowner to avoid eviction, avoid a lowered credit score, and will enable them to move on to the next stage of their life.

Lengthy Repairs

Traditional sales can make it difficult to sell houses that need major repairs, for example, houses with infestations such as mold. Cash buyers do not have to face these issues and can sell their houses as-is or, more commonly known as fixer-uppers, to people willing to pay upfront. This means sellers don't have to stress finding the cash to fix repairs and enjoy a speedy closing.

The amount of money a homeowner spends to keep their home to a good standard or well-maintained can sometimes prove to be a lot to handle for some homeowners. Whether your roof needs replacing or your foundation is cracking, repairing your home can cost you tens of thousands of dollars.

Changes to Life

Suppose homeowners experience key changes to their life, such as a divorce, death in the family retirement, relocation for a new job or personal illness. In that case, they may find themselves wanting to buy a new house or change the area they live in quickly. Such changes may require you to sell your house immediately without any extra stress, just a simple solution to a problem that can be solved quickly.

Types of Cash Home Buyers

There are several types of buyers who pay in cash. Unfortunately, not all of them are honest, so it is vital to know to whom you are selling your house. Several cash home buyers come verified, and they will appraise your house honestly before giving you an offer.

Some cash offers come from house flippers, who intend to purchase your house as-is and sell it for a higher value later on. Some cash offers come from individuals who would rather not get financed by a bank often pull from their savings to make a cash offer on a house.

There are many benefits to this system for both the buyer and the seller, including increased control over the home’s offer and sale price. The home seller might not get market value for their home in this case.

Incentives for Buyers to Pay Cash

It is not hard to see the benefits of accepting a cash offer on a house. It is also not difficult to understand why a home seller might prefer a cash deal: It’s quicker, easier, and with fewer obstacles to maneuver.

The buyer who can pay cash is someone who can present the best possible profile to the seller. This is someone who is likely to be financially stable with a good credit rating. It is also someone who understands the home buying process from start to finish. They have done their research, learned about real estate prices, and come to a reasonable conclusion about what they would like to pay.

If you can afford to buy up front, the advantages are many:

- Sellers are likely to favor buyers who can pay in cash.

- The home price may be reduced for those who pay in full up front.

- All-cash purchases streamline the home-buying process: No loans means less paperwork and no delays for mortgage approval.

- Cash buyers can save money on closing costs, bank appraisals, mortgage applications and fees, title insurance, and so on.

- Cash purchases eliminate the risk of loan denial.

- Cash buyers pay much less for their homes in the long run: No loans means no interest.

- Cash buyers never have to worry about losing their homes because they can’t afford to repay their mortgage loans.

- Cash buyers gain full, immediate equity in their home.

The Benefits of Accepting a Cash Offer

A cash home sale can be a very different experience from a traditional home sale in several ways.

Here is a breakdown of some of the most significant differences.

1) Quick Closing

From start to finish, a cash offer takes less time to finalize. Without a mortgage lender involved, the whole process becomes much faster. There is no underwriting process, for one thing—that process can take a month or two alone. Selling a home through a traditional mortgage lender is time-consuming, taking an average of 47 days to close because lenders require a lengthy underwriting process at the end of the sales process. With an all-cash offer, the average time to close is approximately 2 weeks.

Between the initial pre-approval and the loan finalization, if a buyer’s financial picture changes or they fail to satisfy certain requirements, the lender can decide to decline their loan, resulting in your deal falling through and leaving you back at square one of the selling process.

2) Less Paperwork

The endless paperwork required with selling a house can be confusing and hard to understand. Reading, initialing and signing all that paperwork can be overwhelming, and ensuring you understand everything detailed in the paperwork entirely is essential and a small mistake can create huge problems. A cash buyer who is reputable and can prove they have the funds will sort out paperwork and closing information for you. You should always check reputable cash buyer's reviews or references, as well as proof of funds, before you move forward with a cash sale.

3) Less Risk

As a seller, you might be fielding several offers. Unfortunately, offers from those working through the financing process may not pan out, leaving you with a property longer than you intended and costing you money.

A cash offer, on the other hand, is guaranteed money on the spot. It might be a lower offer, but there is little chance of complications due to an outside party, meaning you can complete your sale more quickly and with less expense.

4) No Appraisal Necessary

Traditional home sales involving mortgage lenders means someone will have to conduct an official appraisal of your property and decide its value. If your home doesn't appraise at the list price or higher, the lender can refuse to approve the buyer’s mortgage loan. Or, the lender may agree to finance the home, but the buyer would be responsible for fronting the difference. Oftentimes, buyers do not have the financial means or are unwilling to cover the difference. If that's the case, the buyer can rescind their offer.

A cash sale removes the appraisal from the process. No mortgage lender means no appraisal requirement.

5) Selling “As Is”

A home inspection may bring up the need for various—sometimes expensive—repairs.

Cash sales, however, tend to be “as is,” meaning the buyer has agreed to purchase the home without you having to make any repairs or changes. You also get to skip the cleaning and staging steps as well. If you want to move on making the sale quickly, selling “as is” is ideal.

Inspection contingencies can often put buyers and sellers at an impasse:

- If a buyer does not want to invest any further money into the property before selling, a potential buyer could back out of a sale if their lender refuses to approve a loan for the property.

- If a buyer does not agree with a seller’s reduced price to account for the buyer’s future investment in repairs, the seller could reject the offer and move on to the next one.

6) More Confidence in Closing

Working with a home buyer requires numerous stages—pre-approval, inspections, surveys, appraisals, and insurance verification. All of these steps present opportunities for a sale to fall through since a mortgage lender could take issue with any of the respective reports and refuse to approve a buyer’s loan.

Entertaining a cash offer gives you more confidence that the sale will close. Cash buyers either have the money to invest in your property or they don’t, and while they can certainly purchase inspections, appraisals, and other due diligence efforts if they wish, buyers are more likely to spend their money on the commodity in which they’re investing—a new home.

Find the Right Agent

Buying your house should be a fun and fulfilling experience. If you have done your research and evaluated what you can afford and what you truly need, finding a new home can be exciting. Learning more about the purchase process eliminates the fear of the unknown and lets you search for a home with peace of mind.

Windermere’s community of real estate professionals is our greatest asset. We have experts in all areas of real estate, from your typical starter home to condos, luxury properties, and new construction. While residential real estate is the mainstay of our business, Windermere also has offices and associates who specialize in property management, commercial real estate, and relocation services. To further facilitate the home buying process, Windermere has affiliated partners in certain regions to provide mortgage, title, and escrow services.

Call us today with any questions or concerns. Our professional Real Estate Agents will help you through this exciting process. (951) 369-8002

Ways To Increase Your Home’s Value

When you make the decision to put your house on the market, your first concern will be how much money you can get for it. You will then ask yourself how you can increase that number. Understanding how home values increase is how savvy homeowners get the most they can when it is time to sell.

Even if you are not thinking of selling anytime soon but just want to make some home improvements, knowing how to increase home value will help you make the right renovations. After all, increasing the value of your home does not only benefit you when you sell it. Understanding how to increase home value for appraisal can help with getting a loan as well.

Regardless of your motivations for upgrading and renovating your house, knowing how to increase your home’s value is a good idea. Here are some great ideas to consider that will make your home more valuable while you live in it and when it is time to sell.

Home Value Factors You Can – And Cannot – Control

There is only so much you can control when trying to sell your house, such as the general appearance, what it might be missing, and whether everything is in working order. You can usually improve your house’s “curb appeal” with some paint or landscaping, to make the best first impression as buyers arrive. You could consider upgrading the kitchen appliances. And you definitely should fix any broken cabinet doors.

Yet you are unlikely to have control over some of the biggest price factors in housing, such as your home’s location or whether you are in a seller’s market or a buyer’s market. But even with these obstacles, you can apply some smart sales practices to increase the value of your home.

Whatever upgrades you choose to do, the impact will vary with location, age of your home, price range, and a few other factors. You may not directly recoup the total cost of any home improvement but each improvement packaged together can help your house meet your buyer’s expectations and lead to a quicker sale. Real estate agents and home renovation contractors can help you decide what is worth spending your time and money on.

Ways To Increase Home’s Value

1. Boost Curb Appeal

Curb appeal is that undefinable something that draws you to a home at a glance. It is a combination of visual charm, good upkeep and attention to detail. It is the general attractiveness of your home and its surrounding property visible from the front sidewalk, street and/or lawn.

Options include planting new flowers along your walkway, painting the front door, replacing the mailbox, installing new lighting or changing out the drab patio furniture.

Keep in mind that these projects can easily jump from a few thousand dollars to tens of thousands, so it is important to determine which project will give your home the greatest value to your dollars spent on upgrades.

Home Exterior

As you contemplate improvements, stay true to your home’s style and avoid being tempted by trends. Adding or improving curb appeal can be expensive, depending on the scope of the project and the size of your front yard, so some things might just have to be repurposed or cleaned up. Luckily, exterior home improvements usually offer a strong return on investment depending on the preferences of buyers in your market. At the very least, an investment in curb appeal will help you attract buyers and possibly sell sooner.

Pay attention to detail, because potential buyers (and sometimes even guests) will be paying close attention too. Remember, this is the first impression of your home, so you need to make sure it sparkles.

Spruce Up Front Door and Porch