Why Fall Is A Great Time To Buy A Home!

Here are four great reasons to consider buying a home today instead of waiting.

1. Prices Will Continue to Rise

CoreLogic’s latest Home Price Insights report reveals that home prices have appreciated by 6.2% over the last 12 months. The same report predicts that prices will continue to increase at a rate of 5.1% over the next year.

Home values will continue to appreciate for years. Waiting no longer makes sense.

2. Mortgage Interest Rates Are Projected to Increase

Freddie Mac’s Primary Mortgage Market Survey shows that interest rates for a 30-year mortgage have already increased by half of a percentage point, to around 4.5% in 2018. Most experts predict that rates will rise over the next 12 months. The Mortgage Bankers Association, Fannie Mae, Freddie Mac and the National Association of Realtors are in unison, projecting that rates will increase by half a percentage point to around 5.1% by this time next year.

An increase in rates will impact your monthly mortgage payment. A year from now, your housing expense will increase if a mortgage is necessary to buy your next home.

3. Either Way, You Are Paying a Mortgage

There are some renters who have not yet purchased homes because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that unless you are living with your parents rent-free, you are paying a mortgage – either yours or your landlord’s.

As an owner, your mortgage payment is a form of ‘forced savings’ that allows you to build equity in your home which you can then tap into later in life. As a renter, you guarantee your landlord is the person building that equity.

Are you ready to put your housing cost to work for you?

4. It’s Time to Move on with Your Life

The ‘cost’ of a home is determined by two major components: the price of the home and the current mortgage rate. It appears that both are on the rise.

But what if they weren’t? Would you wait?

Look at the actual reason you are buying and decide if it is worth waiting. Whether you want to have a great place for your children to grow up, you want your family to be safer, or you just want to have control over renovations, maybe now is the time to buy.

If the right thing for you and your family is to purchase a home this year, buying sooner rather than later could lead to substantial savings.

Source: Keeping Current Matters

Windermere Living Fall 2018

The Fall 2018 issue of Windermere Living showcases a number of fantastic articles, including an exposé on small-town living in the San Juan Islands, autumn-inspired design trends, an exclusive interview with California designer Nathan Turner, as well as pages upon pages of beautiful homes!

Windermere Living is the exclusive listings magazine published by Windermere Real Estate. Read the online version by clicking on the image below.

Southern California Real Estate Market Update - Q2 2018

The following analysis of the Southern California real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

ECONOMIC OVERVIEW

The counties covered by this report—Los Angeles, San Diego, San Bernardino, Orange, and Riverside—added 110,200 new jobs between May 2017 and May 2018. As a result, the unemployment rate dropped from 4.2% to 3.6%. Employment growth in Southern California continues to outperform the nation as a whole, and I am confident this will continue as we move through the balance of the year.

HOME SALES ACTIVITY

- There were 51,320 home sales in the second quarter of 2018. This was 6.8% lower than the same period in 2017 but 32.6% higher than the first quarter of this year.

- Pending home sales (an indicator of future closings) were 3.2% lower than during the same period a year ago, which suggests that third quarter closings may not show much improvement.

- Home sales dropped across the board. The most noticeable decline was in San Diego County, which fell 8.8%. I continue to believe that the decline in sales is directly related to the very low levels of inventory.

- There was an average of 35,238 active listings in the second quarter—well below what is needed to get to a balanced market.

HOME PRICES

- Year-over-year, average prices in the region rose by 7% and were 5.6% higher than in the first quarter of 2018.

- Affordability continues to be an issue, which, in concert with limited inventory, is pushing home prices higher. New construction activity is not meeting the needs of new households, which puts further pressure on home prices.

- Price increases across the region were fairly level, with Orange County showing the greatest annual appreciation in values (+8.1%). The slowest appreciation was in San Diego County, which still saw a respectable 6.6% increase.

- Based on the data in this report, I believe it is highly likely that prices will continue rising at above-average rates for at least the balance of 2018.

DAYS ON MARKET

- The average time it took to sell a home in the region was 37 days. This is a drop of four days compared to the second quarter of 2017, and seven fewer days than in the first quarter of this year.

- The biggest drop in days on market was in San Bernardino County, where it took six fewer days to sell a home compared to the same period last year.

- Homes in San Diego County continue to sell at a faster rate than other markets in the region. In the second quarter, it took an average of only 24 days to sell a home, which is one day less than it took a year ago.

- All five counties saw a drop in the amount of time it took to sell a home compared to the second quarter of 2017.

CONCLUSIONS

The speedometer reflects the state of the region’s real estate market using housing inventory,

price gains, home sales, interest rates, and larger economic factors.

The Southern California economy continues to add jobs at a very healthy rate, which increases demand for all housing types. Mortgage rates—although rising— are still very favorable when compared to historic averages, and low inventory continues to drive prices higher. The number of homes for sale in the region remains well below the levels needed for a balanced market. Given all of these factors, I have moved the needle a little more in favor of sellers.

Mr. Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics, and has more than 30 years of professional experience both in the U.S. and U.K.

Homebuyers Willing To Sacrifice ‘Must-Haves’ In Favor Of Good School Districts

It should come as no surprise that buying a home in a good school district is important to homebuyers. According to a report from Realtor.com, 86% of 18-34 year-olds and 84% of those aged 35-54 indicated that their home search areas were defined by school district boundaries.

What is surprising, however, is that 78% of recent home buyers sacrificed features from their “must-have” lists in order to find homes within their dream school districts.

The top feature sacrificed was a garage at 19%, followed closely by a large backyard, an updated kitchen, the desired number of bedrooms, and an outdoor living area. The full results are shown in the graph below.

Buyers are attracted to schools with high test scores, accelerated academic programs, art and music programs, diversity, and before and after-school programs.

Test scores were the factor most often selected by buyers as a hallmark of a good school (59 percent), followed by having accelerated programs (53 percent), arts and music (49 percent), diversity (43 percent), and before- and after-school programs (41 percent).

Younger buyers were more likely than older buyers to cite diversity as a factor that makes for a good school — 49 percent for 18-34 year-olds, compared to 37 percent for 55-plus. More older buyers placed importance on whether a school has accelerated programs — 62 percent for 55-plus vs. 50 percent for buyers under 55.

With a limited number of homes available to buy in today’s real estate market, competition is fierce for homes in good school districts. Danielle Hale, Chief Economist for Realtor.com, explained further,

“Most buyers understand that they may not be able to find a home that covers every single item on their wish list, but our survey shows that school districts are an area where many buyers aren’t willing to compromise.

For many buyers and not just buyers with children, ‘location, location, location,’ means ‘schools, schools, schools.’”

For buyers across the country, the quality of their children’s (or future children’s) education ranks highest on their must-have lists. Before you start the search for your next home, meet with a local real estate agent who can explain the market conditions in your area.

Info Source: Keeping Current Matter

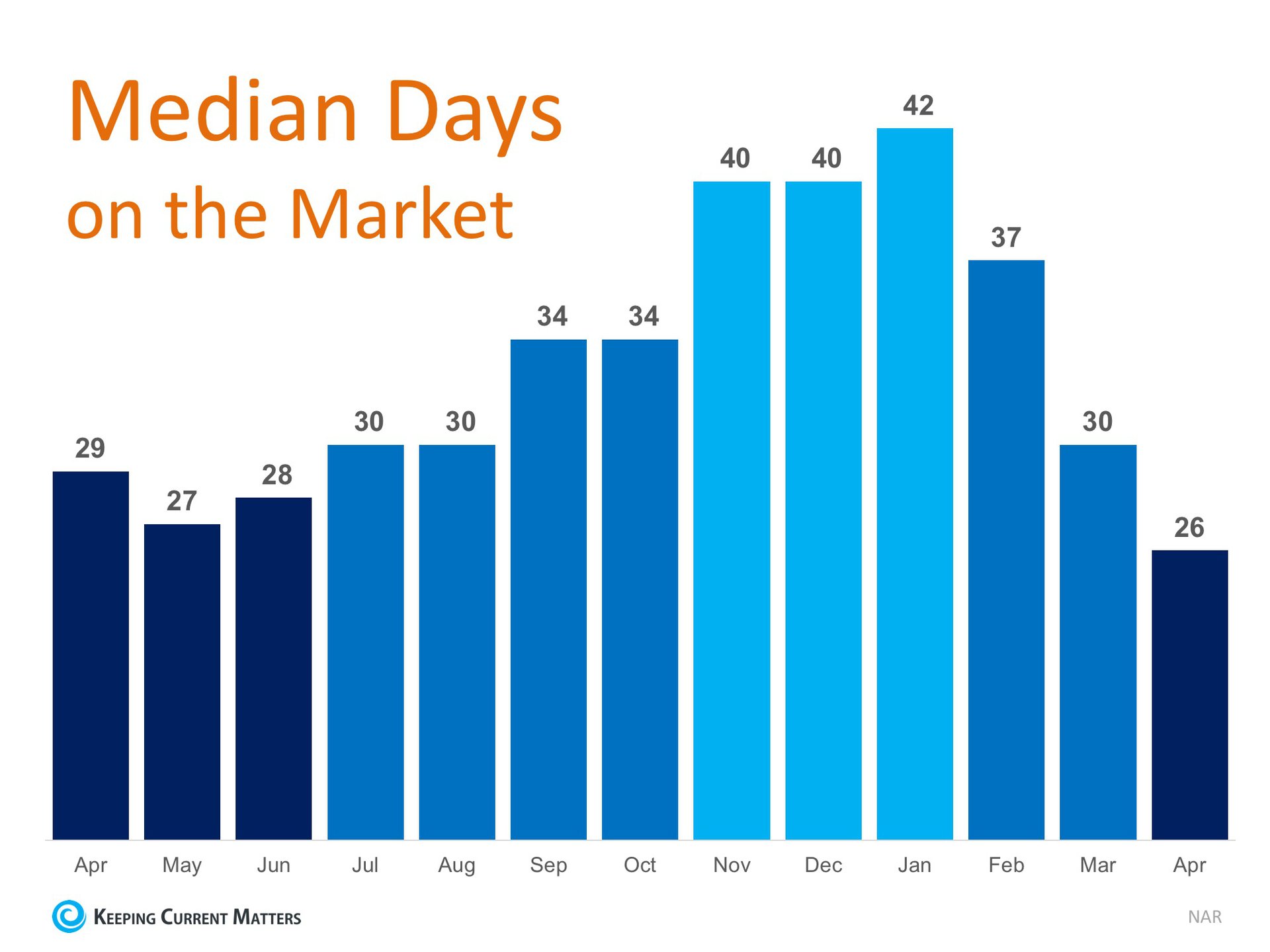

Days On The Market Drops To New Low In April

According to recently released data from the National Association of Realtors (NAR), the median number of days that a home spent on the market hit a new low of 26 days in April, as 57% of homes were on the market for under a month.

NAR’s Chief Economist, Lawrence Yun, had this to say,

“What is available for sale is going under contract at a rapid pace. Since NAR began tracking this data in May 2011, the median days a listing was on the market was at an all-time low in April, and the share of homes sold in less than a month was at an all-time high.”

Strong buyer demand, a good economy, and a low inventory of new and existing homes for sale created the perfect storm to accelerate the time between listing and signing a contract.

The chart below shows the median days on the market from April 2017 to April 2018:

If you are a homeowner who is debating whether or not to list your home for sale, know that national market conditions are primed for a quick turnaround! Meet with a local real estate agent who can explain to you exactly what’s going on in your area, today!

Source: Keeping Current Matters

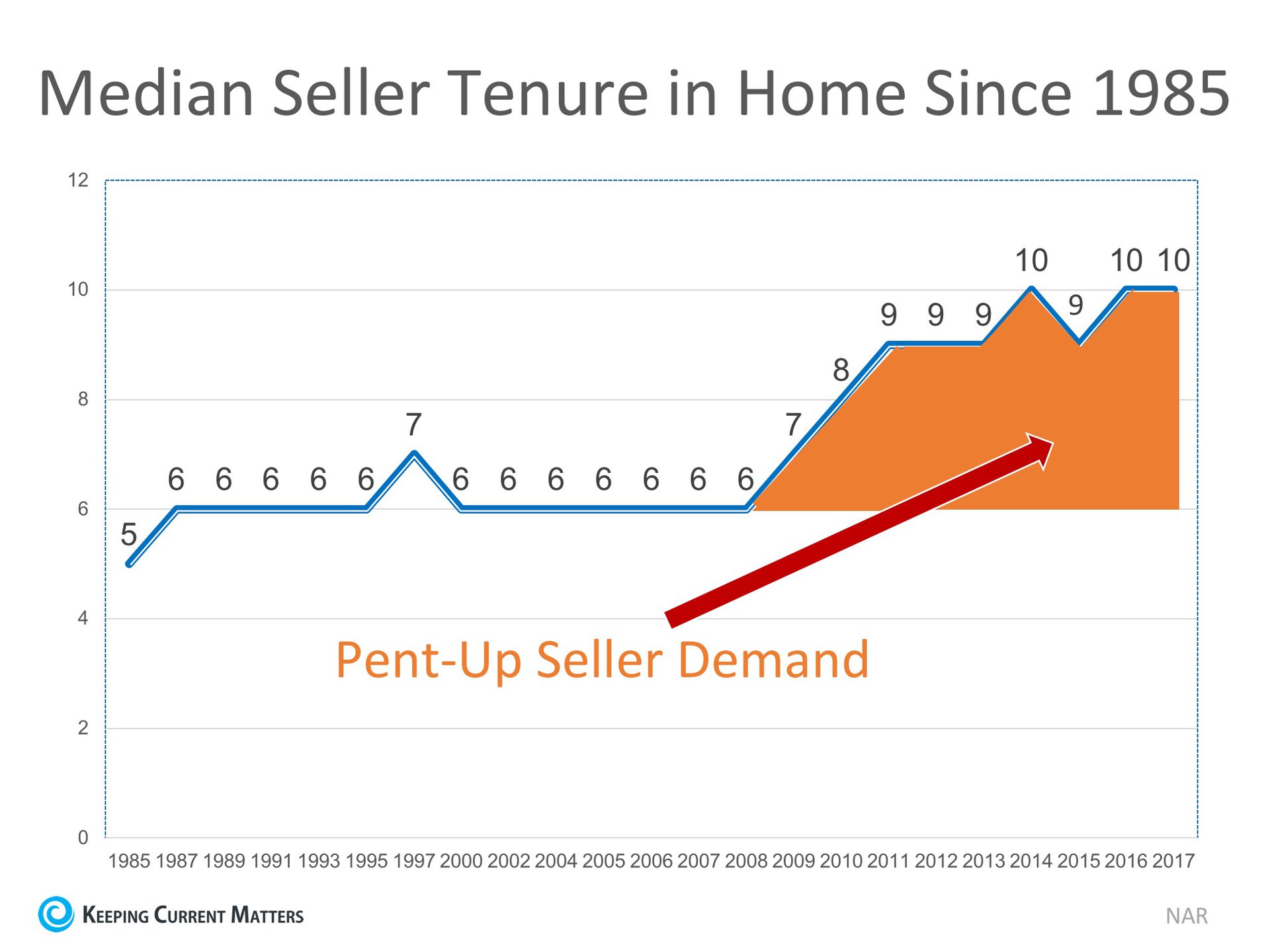

How Long Do Most Families Live In A House?

The National Association of Realtors (NAR) keeps historical data on many aspects of homeownership. One of their data points, which has changed dramatically, is the median tenure of a family in a home, meaning how long a family stays in a home prior to moving.

As the graph below shows, over the last twenty years (1985-2008), the median tenure averaged exactly six years. However, since 2014, that average is almost ten years – an increase of almost 50%.

Why the dramatic increase?

The reasons for this change are plentiful!

The fall in home prices during the housing crisis left many homeowners in a negative equity situation (where their home was worth less than the mortgage on the property). Also, the uncertainty of the economy made some homeowners much more fiscally conservative about making a move.

With home prices rising dramatically over the last several years, 95.3% of homes with a mortgage are now in a positive equity situation, according to CoreLogic.

With the economy coming back and wages starting to increase, many homeowners are in a much better financial situation than they were just a few short years ago.

One other reason for the increase was brought to light by NAR in their 2018 Home Buyer and Seller Generational Trends Report

. According to the report,

“Sellers 37 years and younger stayed in their home for six years…”

These homeowners, who are either looking for more space to accommodate their growing families or for better school districts to do the same, are likely to move more often (compared to typical sellers who stayed in their homes for 10 years). The homeownership rate among young families, however, has still not caught up to previous generations, resulting in the jump we have seen in median tenure!

What does this mean for housing?

Many believe that a large portion of homeowners are not in a house that is best for their current family circumstance; they could be baby boomers living in an empty, four-bedroom colonial, or a millennial couple living in a one-bedroom condo planning to start a family.

These homeowners are ready to make a move, and since a lack of housing inventory is still a major challenge in the current housing market, this could be great news.

Source: Keeping Current Matters

Spring Home Selling Tips

It is that time of year when flowers begin to bud, birds sing and the sun shines a little brighter. As spring starts to blossom it is also a time when lots of people consider buying a home. If you are in the market to sell your home we have lots of information designed to help you prepare your home for spring selling season. The following spring home selling tips are grouped by topic in order to help you apply this to your own situation.

It may seem obvious, but the best practices used for selling a home during the bustling winter months or the color explosion of the fall months are drastically different from selling a home in the Spring.

Spring Cleaning is Top of the List

Many people take advantage of the better weather and longer days in order to tackle their list of cleaning chores. Listed below are some of the most important parts of your home that need special attention when preparing to sell the property.

Main Entry

- Give a thorough dusting to the lights as well as the actual switches that control the light

- Clean the entire door along with the trim around the door. Then clean the floor, ceiling and the walls.

- Shine up the door knob, on both sides, with appropriate cleaning solution

Living Room

- With a cleaning cloth or duster, wipe the walls, ceiling, electrical outlets and switches for the lights

- Thoroughly clean each window as well as the surrounding sill

- If the room has carpet, vacuum the entire carpet and then have the carpet steam cleaned

- If the room has hardwood floors, check with the instructions from the manufacturer and clean accordingly

- If the windows have blinds, use a gentle cleaning solution to clean away dust or other dirt from the blinds

- Vacuum and clean any dirty spots on couches, chairs, recliners and ottomans

Bathroom

- Deep clean any and all vanities along with the supporting cabinets

- Organize all objects on and near the sink. Clear out as much clutter as possible

- Deep clean both the outside and inside of the commode. If you are handy with tools, remove the actual commode seat in order to clean around the bolt areas.

- Clean the liner for the shower/tub. It may be necessary to replace the liner

- Deep clean the tub and/or shower.

- Use cleaning solution to clean the mirrors, light switches and the light fixtures

Kitchen

- Deep clean the sink and counter tops. Remove as much clutter from counters as possible

- Go through the refrigerator and clean out any old items. Thoroughly clean the inside of the fridge. Don’t forget to clean the tip top of the fridge too!

- Do the same cleaning for the freezer

- Deep clean the stovetop and the oven. Pay particular attention to the glass section on the oven door

- Wipe down the walls, floors, and ceilings

- Pull out all of the appliances away from the wall and clean

- Clean up any dust or grime along the coils of the refrigerator

- Clean every light

- Clean out the dishwasher and then run a complete cycle without any dishes to ensure cleanliness

Lawn Care and Other Outdoor Ideas

Many people will look at pictures of your home online or drive by the property and take a quick peek. Since the lawn, walkway, front door and shrubs are available for all to see, it is important to make these areas look as good as you can. Developing a good impression with the yard will improve your chances of getting that important showing of the house. Here are just a few ideas to help improve your property’s curb appeal.

Gutters – Clean out all of the gutters. Also, go over each section of the gutter to see if there are any types of leaks. Clear out any debris that may be blocking the downspouts.

Clear away dead leaves – With the end of a long winter, there are bound to be some leaves in the yard. Remove the leaves in order to give the grass time to grow and shine. It will also give any fertilizer a better chance to work.

Trim the lawn, shrubs and low branches – It goes without saying, but now is the time to give the grass a fresh mowing and trim any shrubs. It is also a good idea to cut back any low hanging branches that may obscure a vision of the home from the road.

Clean up the walkway and driveway – If you have a pressure washer, or do not mind renting one, clean the driveway as well as the walkway leading to the front door. Making these areas look fresh and clean will really improve the appeal of the home.

Pay attention to colors – If you wish to plant flowers, use a pattern of colors that complements the exterior of your home. Make the scheme of colors uniform throughout the garden.

Inspect the roof – Make sure there are no missing shingles from the roof. While inspecting the roof, look for signs of potential leaks and have those addressed by a professional contractor. Be sure to know your roofing options as well.

Choosing a Real Estate Agent

Readying yourself and your home for a sale includes choosing a real estate agent. The agent will be responsible for various things throughout the selling process so it is important that you choose wisely. Here are some guidelines for picking an agent.

Listing a Home at the Correct Time

In order to get your home sold during the spring, your agent will need to list it at the correct time. If the home is listed too soon in the spring, there may not be enough interest in your property. Conversely, if the home is listed too late in the season then you may miss your potential buyer.

Picking the Right Price

Choosing the correct sales price takes a bit of work. The real estate agent will need to factor in things like

- Recent home sales in your neighborhood/area

- The similarity of your home with the homes recently sold

- Distinguishing characteristics of your property that make your home more valuable

- Outside variables that affect price (school district, proximity to shopping, condition of roads, crime rate)

It may seem that the best bet would be to price the home a bit high and simply wait for the right buyer to come along and negotiate. However, not all buyers are willing to haggle. It is wiser to consult with your agent and get their input before settling on a price.

What Happens Next?

After you have sold your current home, what happens next? Do you plan to buy another home in the same general area or do you plan to move out of state? Are you depending on the proceeds from the first sale to facilitate the purchase of your next property? If you are in need of a contingency, then you will definitely want to explain this to your agent. Your agent can present a sales contract in such a way that protects your best interests while also moving the sale along.

As you can see, there are a lot of items that need your attention when it comes time for selling your property.

Keep in mind that this is a process, almost like a marathon, that will take dedication. It is a good idea to write out a plan of all the things you wish to complete and tackle them one at a time.

Our goal with this article is to provide you with not only a big picture view of selling your property but also some practical actionable items that can be put to use right away.

We hope this information will be of use as you prepare to sell your home in the upcoming spring home selling season.

St. Patrick's Day Fun

Happy St. Patrick's Day from Windermere Tower Properties!

Here at Windermere Tower Properties we are all for a good mix of work, having fun & success! This year we threw a St. Patrick's Day Irish Party here at the office which included Irish themed trivia, Gold toss, corned beef sandwiches and green libations & more!

We had a blast!

Thinking of Making an Offer?

So you've been searching for that perfect house to call a "home," and you finally found one! The price is right, and in such a competitive market that you want to make sure you make a good offer so that you can guarantee your dream of making this dream house of yours come true!

Here are 4 tips that will help your offer be highly desirable:

- Understand How Much You Can Afford

"While it's not nearly as fun as house hunting, fully understanding your finances is critical in making an offer."

As we've mentioned before, getting pre-approved is one of many steps that will show home sellers that you are serious about buying, and will allow you to make your offer with the confidence of knowing that you have already been approved for a mortgage for that amount. You will also need to know if you are prepared to make any repairs that may need to be made to the house. (For Example: new roof, new furnace).

- Act Fast

"Even though there are fewer investors, the inventory of homes for sale is also low and competition for housing continues to heat up in many parts of the country."

According to the latest Existing Home Sales Report, the inventory of homes for sale is currently at a 3.6-month supply; This is well below the 6-month supply that is needed for a 'normal' market. Buyer demand has continued to outpace the supply of homes for sale, causing buyers to compete with each other for their dream homes.

Make sure that as soon as you decide that you want to make an offer, you work with your agent to present is as soon as possible.

- Make a Solid Offer

"Your strongest offer will be comparable with other sales and listings in the neighborhood. A licensed real estate agent active in the neighborhoods you are considering will be instrumental in helping you put in a solid offer based on their experience and other key considerations such as recent sales of similar homes, the condition of the house and what you can afford."

Consider ways of making your offer stand out! Many buyers write a personal letter to the seller letting them know how much they would love to be the new homeowners. Your agent will be able to help you determine if there any other ways your offer could stand out above the rest.

- Be Prepared to Negotiate

"It's likely that you'll get at least one counteroffer from the sellers so be prepared. The two things most likely to be negotiated are the selling price and closing date. Given that, you'll be glad you did your homework first to understand how much you can afford. Your agent will also be key in the negotiation process, giving you guidance on the counteroffer and making sure that the agreed-to contact terms are met."

If your offer is approved, Freddie Mac urges you to "always get an independent home inspection, so you know the true condition of the home." If the inspection uncovers undisclosed problems or issues, you can discuss any repairs that may need to be made, with the seller.

Whether buying your first home or your fifth, having a local professional on your side who is an expert in their market is your best bet to make sure the process goes smoothly. Windermere Tower Properties can help!

Happy House Hunting!

Getting Pre-Approved Should Always Be Your First Step

In many markets across the country, the number of buyers searching for their dream homes greatly outnumbers the number of homes for sale. This has led to a competitive marketplace where buyers often need to stand out. One way to show you are serious about buying your dream home is to get pre-qualified or pre-approved for a mortgage before starting your search.

Even if you are in a market that is not as competitive, understanding your budget will give you the confidence of knowing if your dream home is within your reach.

Freddie Mac lays out the advantages of pre-approval in the ‘My Home’ section of their website:

“It’s highly recommended that you work with your lender to get pre-approved before you begin house hunting. Pre-approval will tell you how much home you can afford and can help you move faster, and with greater confidence, in competitive markets.”

One of the many advantages of working with a local real estate professional is that many have relationships with lenders who will be able to help you with this process. Once you have selected a lender, you will need to fill out their loan application and provide them with important information regarding “your credit, debt, work history, down payment and residential history.”

Freddie Mac describes the ‘4 Cs’ that help determine the amount you will be qualified to borrow:

- Capacity: Your current and future ability to make your payments

- Capital or cash reserves: The money, savings, and investments you have that can be sold quickly for cash

- Collateral: The home, or type of home, that you would like to purchase

- Credit: Your history of paying bills and other debts on time

Getting pre-approved is one of many steps that will show home sellers that you are serious about buying, and it often helps speed up the process once your offer has been accepted.

Many potential home buyers overestimate the down payment and credit scores needed to qualify for a mortgage today. If you are ready and willing to buy, you may be pleasantly surprised at your ability to do so.