Q1 2023 Southern California Real Estate Market Update

May 1, 2023Real Estate,New Home,riverside california,market trends,socal real estate,Home Buyers,Home Sellers,Windermere,Gardner ReportEconomy,Business,market update,Home Buyer,Realtor

The following analysis of select counties of the Southern California real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

Following annual revisions to the data, the Southern California market added only 194,000 jobs in 2022, which was far fewer than the over 676,000 added in 2021. The first two months of data for 2023 showed a net loss of 14,800 jobs. Because the data is not adjusted for seasonality, I am not overly concerned by this decline, but I will be watching as we move through the spring to see if declining job growth is becoming pervasive. Total employment in the counties covered by this report is still 266,400 jobs shy of the pre-pandemic peak. Los Angeles County continues to have the largest shortfall of jobs (-260,000), followed by Orange County (-37,100). Job levels in San Diego County match their pre-pandemic peak, while employment levels in the Riverside and San Bernardino markets are each higher by more than 15,000 jobs. The region’s unemployment rate in February was 4.6%, down from 5% at the same time in 2022. The lowest jobless rates were in Orange County (3.4%) and San Diego County (3.7%). The highest was in Los Angeles County, where 5.3% of the workforce was without a job.

Southern California Home Sales

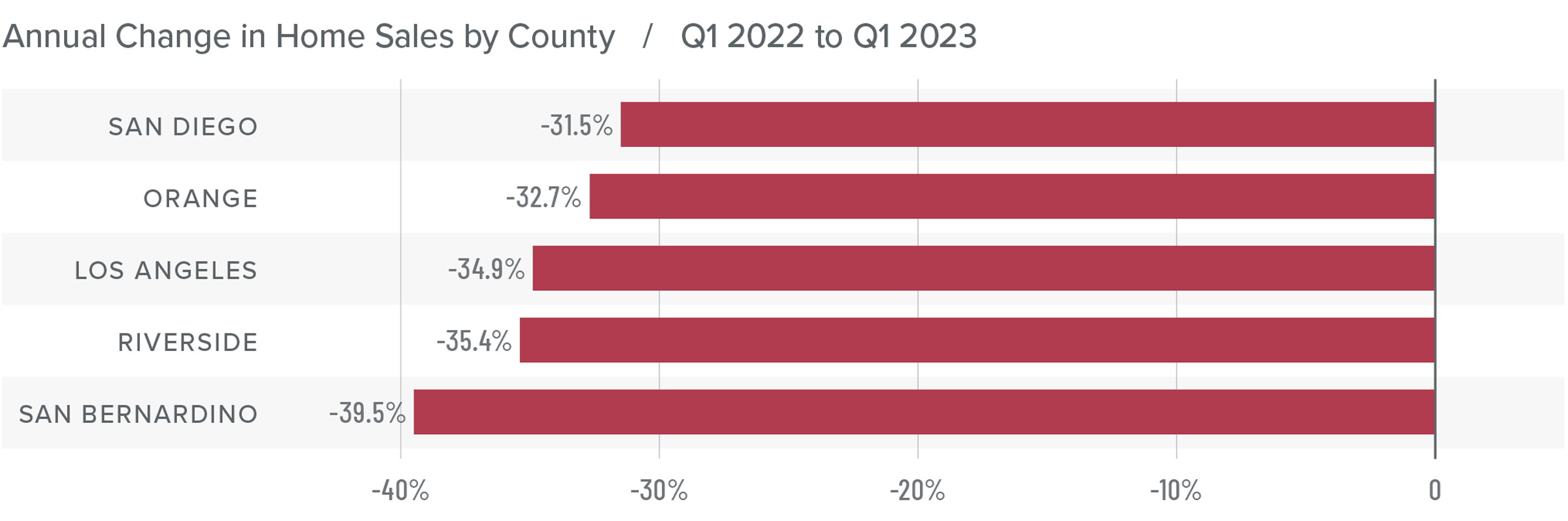

❱ In the first quarter of 2023, 27,577 homes sold, which is down 34.8% from the first quarter of 2022 and is 5.2% lower than in the final quarter of 2022.

❱ Pending home sales, which are an indicator of future closings, were 25.4% higher than in the fourth quarter, suggesting that sales activity in the second quarter of this year may pick up.

❱ On a percentage basis, sales fell the most in San Bernardino County, but all markets pulled back significantly. Compared to the fourth quarter, sales were higher in Riverside County (+7.1%) but fell across the balance of the market.

❱ The drop in sales can mainly be attributed to a lack of inventory: the number of homes for sale was down 27.6% from the final quarter of 2022. Additionally, mortgage rates rose by more than a full percentage point in February, which likely also impacted sales.

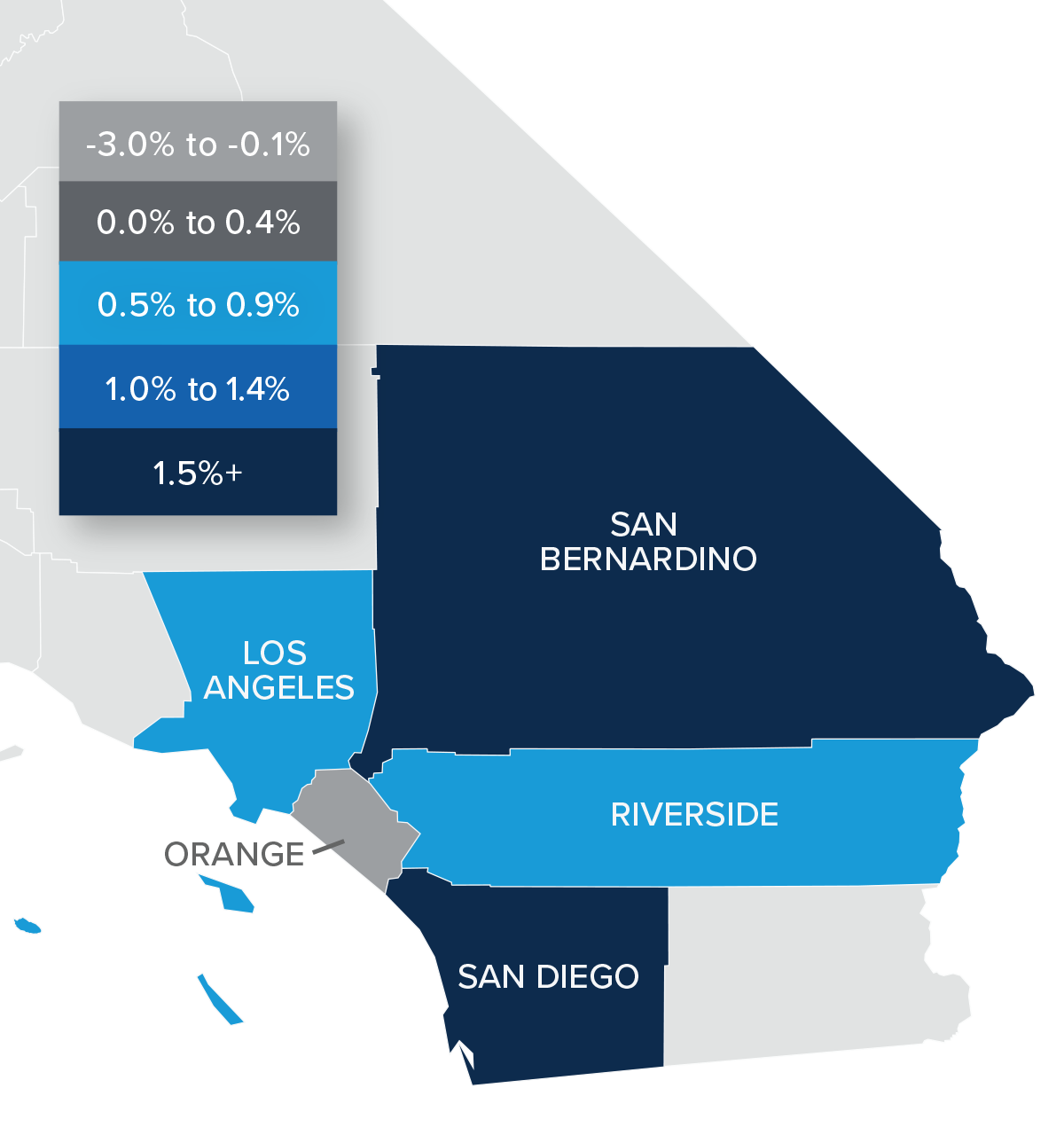

Southern California Home Prices

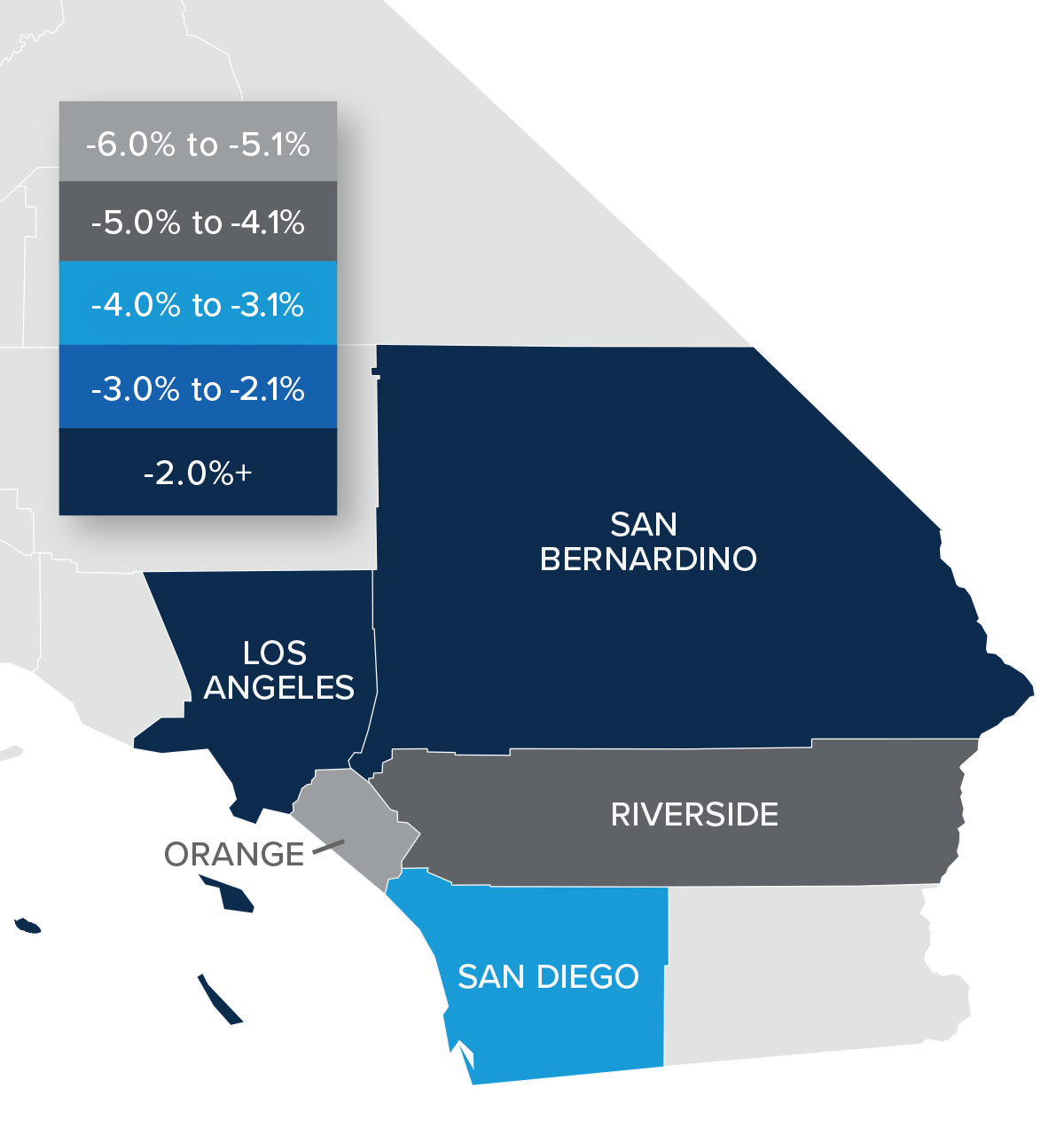

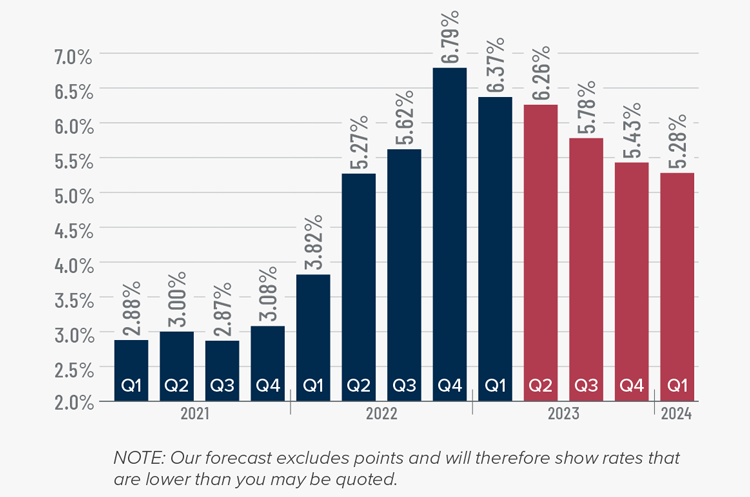

❱ Compared to the same period last year, home prices fell 2.5%. However, prices were 1.9% higher than in the fourth quarter of 2022.

❱ Affordability remains a significant issue, which has been exacerbated by elevated financing costs. That said, median listing prices in the quarter are up in every market other than San Bernardino, which suggests that home sellers may be starting to think that the worst of the price correction is behind them.

❱ Year over year, prices fell across the region but rose in all markets compared to the final quarter of 2022. Of note is that price growth was very solid in San Diego, Riverside, and Orange counties.

❱ While I expect mortgage rates to start stabilizing as we move toward summer, I think there will be some additional downward pressure on home prices. That said, things should start to turn around again in the second half of the year with a return to rising home prices.

Mortgage Rates

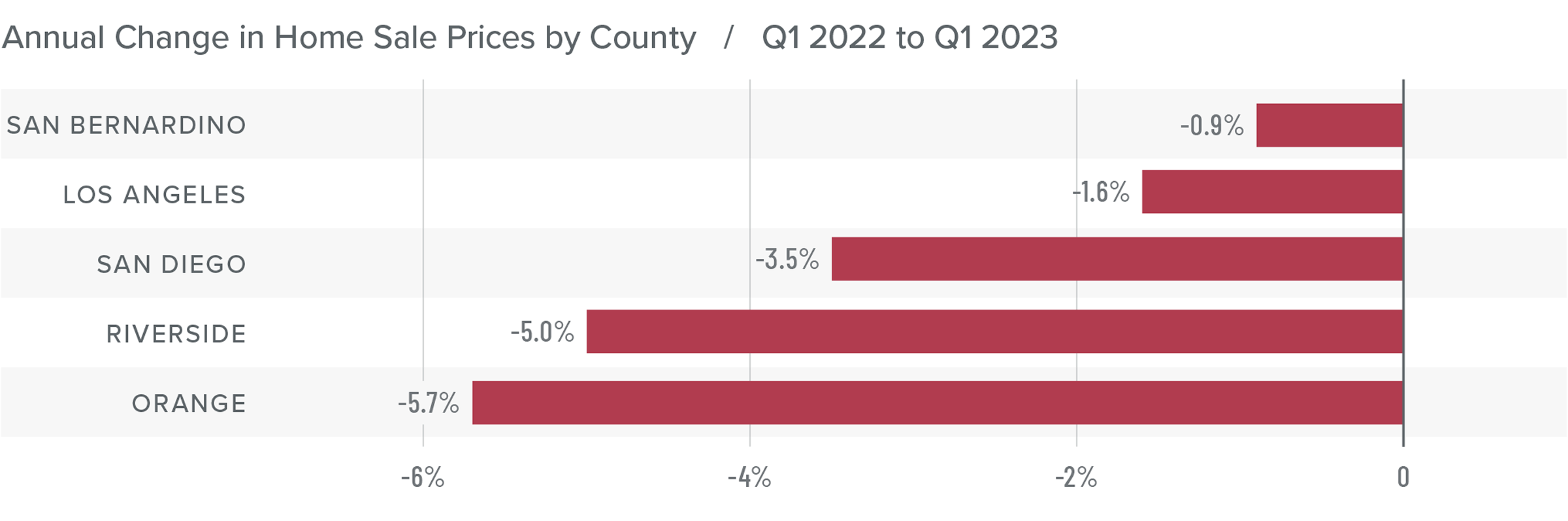

Rates in the first quarter of 2023 were far less volatile than last year, even with the brief but significant impact of early March’s banking crisis. It appears that buyers are jumping in when rates dip, which was the case in mid-January and again in early February.

Even with the March Consumer Price Index report showing inflation slowing, I still expect the Federal Reserve to raise short-term rates one more time following their May meeting before pausing rate increases. This should be the catalyst that allows mortgage rates to start trending lower at a more consistent pace than we have seen so far this year. My current forecast is that rates will continue to move lower with occasional spikes, and that they will hold below 6% in the second half of this year.

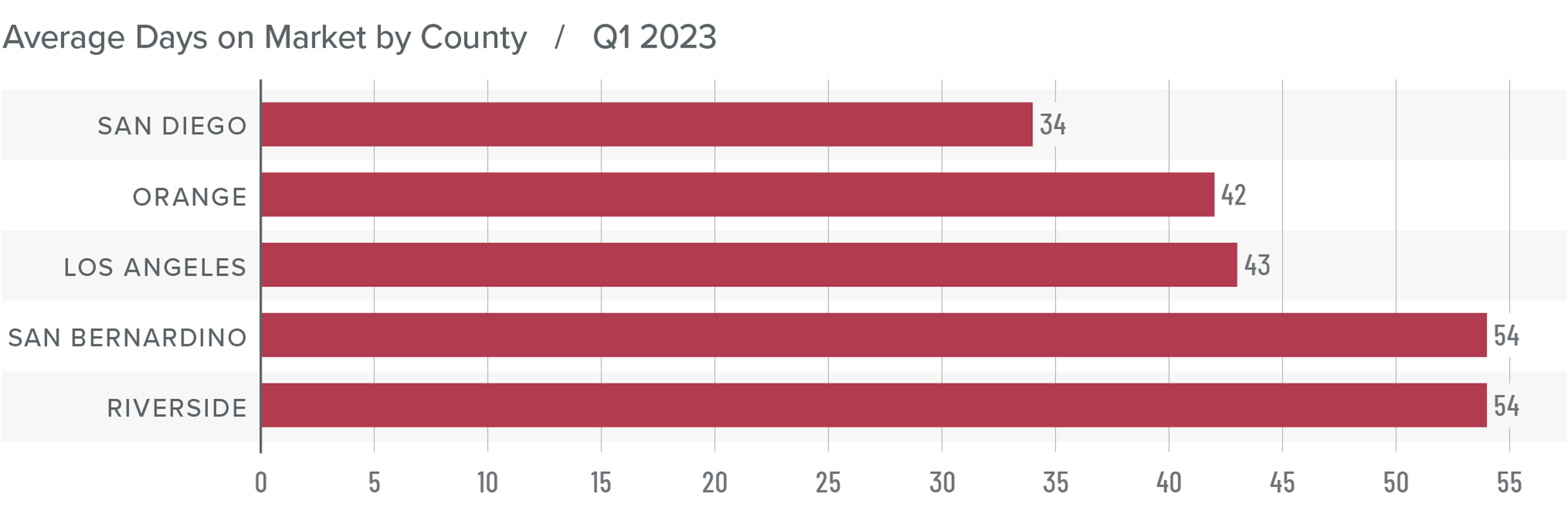

Southern California Days on Market

❱ In the first quarter of 2023, the average time it took to sell a home in the region was 45 days, which is 24 more than in the first quarter of 2022 and 9 more days than in the fourth quarter of last year.

❱ Market time also rose in all counties covered by this report compared to the fourth quarter of 2022.

❱ Homes in San Diego County continue to sell at a faster rate than other markets in the region, but all counties saw market time increase from a year ago.

❱ Higher mortgage rates and lower affordability still have some buyers sidelined. I expect to see increased activity once buyers become confident that mortgage rates have stabilized and that housing values have found a bottom.

Conclusions

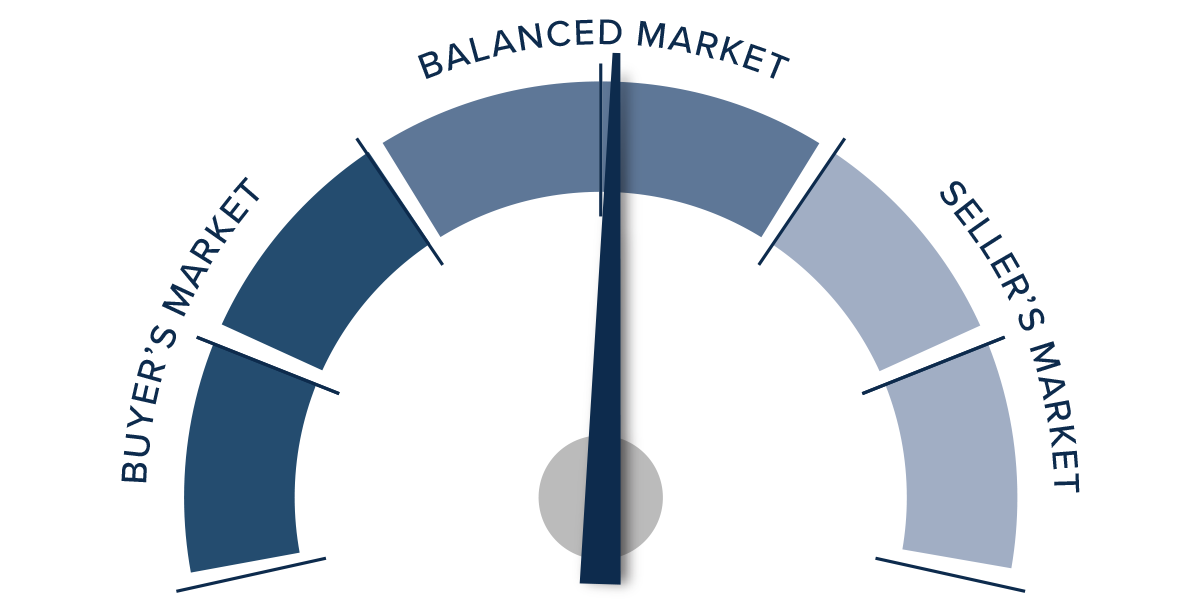

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

The Southern California housing market is still trying to find its footing. Mortgage rates are not only still at elevated levels, but they are also moving erratically depending on events in the broader economy (e.g. inflation, bank failures, etc.) Although sellers seem to be more confident, buyers are remaining cautious, which suggests that the market recovery will take more time.

Lower inventory levels, higher pending sales, higher listing and sale prices, and an improving absorption rate all favor sellers. However, the market is not completely in their favor. As such, I have left the needle in the “balanced” section of the speedometer. I have tilted it slightly toward home sellers though as there continues to be strong demand for appropriately priced, well-located, and well-appointed homes.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Principal and Interest: Defined and Explained

When you take out a mortgage, one of the challenges that people often face is understanding the long list of complicated terms and lingo. Two common terms often used in the world of banking, including mortgages, are principal and interest. First-time home buyers, in particular, may not fully understand how their mortgage payments are determined. Simply put, it all comes down to principal and interest.

Below, we explain the difference between the two and apply these concepts to help you manage your personal finances.

What Is Your Principal Payment?

The principal is the amount of money you borrow when you originally take out your home loan. To determine your mortgage principal, just take the sales price of your home and subtract the amount of your down payment.

For example, if you buy a home for $300,000 with a 20% down payment. In this instance, you would have put down $60,000 toward your loan. Your mortgage lender would then cover the cost of the remaining amount on the loan, which is $240,000, which would be your principal balance. Your principal is the most important factor in deciding how much home you can afford. The principal you borrow accumulates interest as soon as you take it out.

Each month, part of your mortgage payment will go toward lowering your principal balance. It’s important to be aware that the principal starts accumulating interest as soon as you close on your loan.

What Is Your Interest Payment?

The second major part of your monthly mortgage payment is interest. Interest is money you pay to your mortgage lender in exchange for giving you a loan. Lenders charge interest as a way to profit from lending money. That means you have to pay back what you originally borrowed plus some extra. However, the amount of interest lenders charge differs from one lender to the next, as well as between different types of loans.

The amount of interest you pay over the life of your loan will depend on your interest rate. When you apply for a mortgage, your lender will evaluate your eligibility and offer you an interest rate based on factors that include your:

- Credit score

- Income

- Down payment

- Debt-to-income ratio

- Housing market

Interest Rate vs. APR

It is also worth mentioning that the interest rate on your loan is not technically the same as its annual percentage rate (APR). Though these terms are sometimes used interchangeably, they are two different things, and both are important to understand.

- Interest rate on your loan is the cost you pay to borrow the funds from the lender.

- APR reflects the interest rate plus other expenses, like mortgage points, fees and any other charges associated with borrowing the money.

The APR is a broader measure of what it will cost you to pay back the loan, so it is typically higher than the pure interest rate. If you are comparing loan offers from different lenders, be sure to examine the APRs and interest rates separately. Do not compare the interest rate from one lender with the APR of another, for example.

How are Principal and Interest Calculated?

Lenders multiply your outstanding balance by your annual interest rate, but divide by 12 because you’re making monthly payments. So if you owe $300,000 on your mortgage and your rate is 4%, you will initially owe $1,000 in interest per month ($300,000 x 0.04 ÷ 12). The rest of your mortgage payment is applied to your principal.

Is It Better to Pay Off Principal or Interest First?

As a general rule, it is better to pay off your principal first. Although your amortization schedule will outline a plan for paying off your loan, you may be able to pay it off faster and avoid some interest by putting extra money toward your principal. The faster you pay off your loan principal, the less you will pay in interest.

Using a loan principal and interest calculator is a good strategy for helping you make a plan for paying down your principal balance faster. By understanding all of the terms and conditions involved with personal loans, you can get a better idea of the money you’ll ultimately owe.

When you make monthly payments to the lender, everything you pay above the interest payment amount goes toward paying off the principal. The more you deposit into the credit account, the faster you reduce your principal balance, and the less you usually have to pay in interest.

Other Components of Your Monthly Mortgage Payment

While your principal and interest make up most of your monthly mortgage payment, you may also pay money into an escrow account as part of your mortgage payment each month. Your lender will then take the money in your escrow account to pay important mortgage-related expenses on your behalf.

These expenses most often are:

- Property Taxes

All homeowners must pay a property tax, which goes to their local government to fund public services such public schools, roads, recreation fire departments and libraries. Taxes are one of the most overlooked parts of owning a home, and they can also be one of the most expensive. Property taxes go to your local government and fund things like.

The amount you pay in taxes depends on the value of your home and the local amenities your community offers. Part of the reason you get an appraisal when you buy a home is so your local government can correctly calculate your taxes. Taxes can vary from year to year, and your county might require you to get a new appraisal every few years.

- Homeowner’s Insurance

You are not legally required to have homeowner’s insurance to own a home. However, most mortgage lenders will not give you a loan without insurance. Homeowner’s insurance protects you against damage from fires, break-ins and lightning storms, just to name a few examples. You may need an additional policy to protect yourself from damage caused by flooding and earthquakes.

Mortgage insurance is calculated as a percentage of your home loan. The lower your credit score and the smaller your down payment, the higher the lender’s risk, and the more expensive your insurance premiums will be. But as your principal balance falls, your mortgage insurance costs will go down, too.

If the amount you owe in homeowners insurance, property taxes or both changes over the life of your loan, your lender will reassess the amount you pay into escrow each month and raise or lower your monthly payment accordingly to ensure these costs remain covered.

Find the Right Agent

Buying your house should be a fun and fulfilling experience. If you have done your research and evaluated what you can afford and what you truly need, finding a new home can be exciting. Learning more about the purchase process eliminates the fear of the unknown and lets you search for a home with peace of mind.

Windermere’s community of real estate professionals is our greatest asset. We have experts in all areas of real estate, from your typical starter home to condos, luxury properties, and new construction. While residential real estate is the mainstay of our business, Windermere also has offices and associates who specialize in property management, commercial real estate, and relocation services. To further facilitate the home buying process, Windermere has affiliated partners in certain regions to provide mortgage, title, and escrow services.

Call us today with any questions or concerns. Our professional Real Estate Agents will help you through this exciting process. (951) 369-8002

How to Stage Your Home to Sell It Quickly

One of the most important steps of selling a home is proper staging. This takes a little bit of work but could make a huge difference. The way you stage your home truly sets the mood for your entire sale. It is imperative that your staging is harmonious and work well with your surroundings. Making your home as eye-catching as possible will help you stand out in a competitive real estate market and attract motivated buyers.

Below, our expert team has compiled some home staging tips to help you add a one of a kind stage design to your home with a flair of personality.

What is Home Staging?

Simply put, staging is the art of decorating a home to sell quickly and for more money on the real estate market. It includes renovating, rearranging furnishings, adding subtle pieces of décor or even taking some décor away for a cleaner look. Staging a property for sale implies preparing it to appeal to the greatest number of buyers, boosting the chances of selling fast and for a higher price.

As a seller, you have the option of staging your own house, enlisting the assistance of your Realtor, or hiring a professional home stager. Home stagers set the stage for potential home buyers to imagine how they could live in a property and make it their home. This can be as “simple” as rearranging what the home seller already has. Or it can include bringing in new furniture, accessories and art to make the home appeal to more buyers.

Every Detail Counts

To attract more buyers and a higher offer, home staging makes the space visually pleasing and draws attention to the home’s best features.

Home stagers also get rid of clutter and depersonalize the home so that potential buyers will be able to see themselves living there.

Too much and the home looks bland and boring. Too little and potential buyers are distracted by thinking about the people who already live there.

Every detail counts in selling a home for top dollar. From cleanliness to the state of repair. And from furniture placement to lighting, color, art and accessories.

Home stagers attend to all of these details for their home staging clients.

Home Staging Tips

First and foremost homes sell quickly with staging, if you want to sell your house quickly and for the highest potential price in top dollars, staging is one of the simplest methods to do it. Also the value of your home increases.

Staging a house ensures that buyers view it in its best light and may assist demonstrate what a property has to offer without requiring a whole home design overhaul. Potential buyers will be more encouraged to make a competitive offer if they can envision themselves living in the property.

Start With a Deep Cleaning

A clean home shows potential buyers that you have taken good care of the property. Ideally, you should clean every part of the house, from the floors to the ceilings—and everything in between. While some buyers might not care about a little bit of clutter or dust, it could turn others away. If your appliances in the kitchen are older, make sure they are spotless. Likewise, make sure your bathrooms sparkle, from the corners of the tub, to the sink drain, to that spot behind the toilet that you don’t think anyone can see. Your goal should be to make everything look new and exciting.

Declutter

Clutter distracts buyers from your home’s features and it makes the home seem like it has less space. When you are about to put your house on the market, be sure to box up and put into storage the things you do not need on a day-to-day basis (knickknacks, games, papers, seasonal clothes, and messy hobbies). It is also time to get rid of things you no longer need—like the expired food in the back of the cabinets, and the clothes and toys that the kids have long since outgrown. The more empty storage space you have, the better.

Define Rooms

Make sure that each room has a single, defined purpose. And make sure that every space within each room has a purpose. This will help buyers see how to maximize the home’s square footage. If you have a finished attic, stage it as an office. A finished basement can become an entertainment room, and a junk room can be transformed into a guest bedroom.

Even if the buyer does not want to use the room for the same purpose, the important thing is for them to see that every inch of the home is usable space.

Remove Most Personal Items

You do not have to remove every single personal item from your home before you sell it, but the majority of your belongings should be boxed up and stored elsewhere. That includes items like old family photos, family heirlooms, refrigerator art and knick-knacks. Buyers need to be able to envision themselves in your home. Keep clothes hidden away as much as possible, and make sure the bathroom counters are empty (except for hand soap and a towel, of course). Likewise, put away all the toys and anything else that is highly personal or evocative of the home’s current inhabitants.

Stay as Neutral as Possible

Your realtor will most likely going to tell you that you need to keep your furniture and decorations as neutral as possible. Yes, that bright red accent wall really shows off your personality. But you need to tone down the colors. Neutrals are your friends. You will also want to make sure to keep spaces gender-neutral. Your home’s new owners will not necessarily use the rooms (or decorate them) the same way you do. As a general rule, you want potential buyers to be able to walk into a home and envision themselves living there. Having neutral furniture and decorations is going to create a blank canvas for them.

Focus on Fresh

A few potted plants can do wonders to make your home feel fresh and inviting. If you have a lot of plants, space them out strategically so they do not overwhelm any one area. Of course, dead and dying plants do not do much to make your home look well-tended so be sure to prune them back or ditch them altogether.

Another way to make your home seem fresh is to get rid of odors. Pets, kids, last night’s dinner, and many other conditions can make your home smell. Inexpensive tricks for ridding a home of odors and giving it an inviting aroma include baking cinnamon-coated apples or cookies in the oven, or burning some mild scented candles.

And do not forget to take out the trash!

Furniture

Make sure furniture is the right size for the room, and do not clutter a room with too much of it. Furniture that is too big will make a room look small, while too little or too small furniture can make a space feel cold. Arrange the furniture in a way that makes each room feel spacious, homey, and easy to navigate.

Whenever possible, do not use cheap furniture. You do not have to pay a lot of money to switch out your existing furniture—and you may even be able to rent furniture to stage your home. Either way, make sure the furniture looks nice, tidy and cozy. You can use throw pillows to add contrast and a splash of color.

Lighting

One of the easiest and most effective ways to make a home more eye-catching is to improve the lighting. Take advantage of your home’s natural light. Open all curtains and blinds when showing your home. Add fixtures where necessary, and turn on all the lights for showings (including those in the closets).

Make sure that all of the bulbs throughout your home are bright and working correctly. Painting the walls a bright and neutral color is another simple way to improve indoor lighting. This makes your home appear more inviting. If you think your existing fixtures are fine, be sure to dust them and clean off any grime. Otherwise, outdated and broken light fixtures are easy and cheap to replace.

Find the Right Agent

First impressions still matter. Just like with curb appeal, the way you stage your rooms can make or break a buyer’s interest in your home, so it’s important to put your best foot forward. Be sure to add unique touches to make your home feel cozy and welcoming. These steps will go a long way toward helping your home stand out from the crowd.

Windermere’s community of real estate professionals is our greatest asset. We have experts in all areas of real estate, from your typical starter home to condos, luxury properties, and new construction. While residential real estate is the mainstay of our business, Windermere also has offices and associates who specialize in property management, commercial real estate, and relocation services. To further facilitate the home buying process, Windermere has affiliated partners in certain regions to provide mortgage, title, and escrow services.

Call us today with any questions or concerns. Our professional Real Estate Agents will help you through this exciting process. (951) 369-8002

Common Hidden Costs of Buying a Home

A house is often the most expensive investment a person will make in their lifetime. When you buy your first home, it is easy to get caught up in the excitement. When you buy a home, you might be expecting certain costs, such as the earnest money deposit and the actual monthly mortgage payments — but there could also be hidden costs that first-time homebuyers especially may not anticipate.

Mortgage lender requirements, closing costs and other lesser-known fees add up for homebuyers, especially those with little to no experience navigating the real estate market. These hidden costs of buying a home could leave you feeling overwhelmed. And you would not be alone in that feeling. In fact, studies have shown that nearly 20% of buyers underestimated the total expense of owning a home, including taxes, insurance and other unexpected disbursements.

This guide breaks down common hidden costs of buying a home so you can be prepared when it comes to closing on your dream home.

PROCESS COSTS

It takes an average of 45 days to close on a house. Several costs pile up within that nearly two-month window, including:

Earnest Money

When you buy a home, you will pay “earnest money” up front after a seller approves your offer and before you start checking off all the tasks required to buy a home. The earnest money deposit shows the seller that you are serious about your plans to purchase their property. Once the transaction goes through, your earnest money will be applied toward your down payment on your closing date. If you choose to back out of the deal, you may not get your earnest money back. Your contract will outline the rules about your deposit, but earnest money is usually 1% to 3% of the home’s sale price.

Down Payment

The down payment is the part of the home’s purchase price you pay upfront, rather than financing it through a mortgage. If you are buying a $300,000 home, for example, and put 10 percent down, or $30,000, you would be getting a mortgage for $270,000.

If you choose a conventional or FHA loan, a down payment is required. The amount of the down payment that is required is based on the home’s price and property type, as well as the loan product.

For a conventional loan, exactly how much down payment you need depends on the lender and loan type — you might put down 3 percent, 10 percent, 20 percent or more. With an FHA loan, you could be able to put down as little as 3.5 percent.

It is important to note that there are loans without a down payment requirement: USDA loans, for borrowers buying in designated markets (generally rural), and VA loans, for eligible service members and veterans.

Home Appraisal Fees

Your lender will want to ensure that the home you purchase is actually worth what the seller is asking. This requires a home appraisal that you get to pay for.

A designated appraisal management company (AMC) will appoint an appraiser to perform this duty. The total cost of your appraisal will depend upon several factors, including:

- The size and value of the property

- The type of mortgage you are applying for

- The property’s geographical location

Expect to pay at least $300 for an appraisal, but it could be closer to $1,000 depending on your situation.

Home Inspection

While not required, having a property’s systems and overall soundness professionally inspected before a deal goes through is highly recommended and can be worth every penny. Most homebuyers still get an inspection to avoid purchasing a house with serious structural issues. Home inspections save homeowners money on repairs in the long run, but scheduling one will cost you money upfront.

The factors that affect the cost of a home inspection mirror that of a home appraisal — namely, square footage, cost of living, and the state of the housing market. The costs between the two are similar as well, with prices averaging $300–$400 but often costing more depending on where you live and what you are buying.

CLOSING COSTS

You do not want to show up on closing day only to find that you are unprepared for the litany of costs. These costs must be paid before you can take ownership of your house, so come to the table ready to hand over a check.

Loan Origination Fee

Some mortgage lenders will charge a loan origination fee to set up your home loan. Every lender has their own process for how they charge fees, so you may see some lenders split up the origination fee into a processing fee (for reviewing your application and assembling documentation) and an underwriting fee (to determine if you qualify for the mortgage loan).

Lenders base loan origination fees on a certain percentage (usually between 0.5% and 1%) of your total loan amount. If you apply for a $500,000 mortgage and they charge a 1% origination fee, then you’ll need to pay $5,000.

If you come across a lender that does not charge a loan origination fee, take a look at how much interest they charge. More often than not, lenders that do not charge loan origination fees charge higher interest rates which may cost you more in the long run.

Homeowner’s Insurance

During your closing meeting, you will need to prove that you have protected your investment with a homeowner’s insurance policy. Lenders typically require you to have paid for a year of insurance before signing off on your mortgage.

The cost of homeowners’ insurance will vary depending on your location, the type of coverage you’re buying and any discounts you might qualify for, and your insurer.

Broadly speaking, you can expect to pay about $35 a month for every $100,000 in home value. Coverage for rebuilding or repairs after an earthquake or flood is usually not included in standard homeowners’ policies, so you may want to — or in the case of flood insurance, have to — buy a separate policy.

If you are buying with a mortgage, the lender will typically roll the cost of insurance into the monthly mortgage payment and pay the premiums on your behalf.

Property Tax

As a homeowner, you will need to pay property taxes. Property taxes are determined by the township, city, or county in which the home is located. The effective average rate nationwide is 1.1% of the home's assessed value, but it varies widely by state and locality, from an average under 0.4% in Alabama to about 2.2% in New Jersey. Property tax is guaranteed payment in perpetuity. Although you do not have much say in how much it is, as with any tax, strategies exist for lowering it.

Some states, like California, require payments of property taxes in two installments.

Escrow Fees

Sometimes known as closing fees or settlement fees, escrow fees are paid to the title company for handling money, the title transfer, and other paperwork for real estate transactions. These fees vary depending on your area and the title company you choose to work with, and in some cases it may be a percentage of the sale price rather than a flat rate.

Your lender pulls funds from your escrow account, but a third-party escrow company manages and operates it. They do not set it up for free, though. Average escrow fees range between 1% and 2% of a home’s sale price. This cost is often split between the buyer and the seller, though these terms may be negotiated in favor of either party as part of the initial offer.

You might also want to shop around to find a closing services provider with lower fees; your real estate agent can guide you to title and escrow companies they have had success with in the past to get you both a good deal and a smooth transaction.

SITUATIONAL COSTS

Other situations add to your overall home buying cost depending on where and how you are buying your house. These costs do not apply to every purchase situation, which is why they often take homebuyers by surprise.

Homeowner’s Association Fees

Homeowner associations or HOAs are non-profit entities that can establish and enforce rules, provide basic services such as water and tend to the maintenance and repair of community amenities such as pools, roads and landscaping. If you are buying a condo or another kind of home in a community overseen by a homeowner’s association (HOA), you will likely be required to pay a monthly fee, known as an HOA fee. HOA fees are determined by the association, and highly variable. These funds go toward the services the association provides, which may include security, a pool or gym and landscaping and maintenance.

HOAs can also charge occasional special assessment fees for urgent repairs. These financial obligations may be overlooked when buyers tally up the costs of buying a home, but they add up quickly. Dues vary widely, and can change depending on the community needs.

Mortgage Insurance

Mortgage insurance offsets some of the risks a lender takes when it allows people to buy a house without substantial money down. Mortgage companies know that not everyone can afford a sizeable down payment for their homes, but small down payments equal more considerable risks for lenders. If your down payment is less than 20% of your home’s purchase price, your lender will likely require you to purchase mortgage insurance. Mortgage insurance is also always required on FHA loans. This policy protects the lender if you stop making payments on your mortgage loan.

Mortgage insurance is usually a monthly fee that will be included in your mortgage payment, but in some cases it can be a lump sum that will be paid at closing — and with some loans, you will pay both a monthly premium as well as an upfront fee.

Find the Right Agent

Buying your house should be a fun and fulfilling experience. If you have done your research and evaluated what you can afford and what you truly need, finding a new home can be exciting. Learning more about the purchase process eliminates the fear of the unknown and lets you search for a home with peace of mind.

Windermere’s community of real estate professionals is our greatest asset. We have experts in all areas of real estate, from your typical starter home to condos, luxury properties, and new construction. While residential real estate is the mainstay of our business, Windermere also has offices and associates who specialize in property management, commercial real estate, and relocation services. To further facilitate the home buying process, Windermere has affiliated partners in certain regions to provide mortgage, title, and escrow services.

Call us today with any questions or concerns. Our professional Real Estate Agents will help you through this exciting process. (951) 369-8002

Q4 2022 Southern California Real Estate Market Update

January 31, 2023UncategorizedRiverside,Real Estate,New Home,market trends,ca,home seller,market update,so cal,2023 trends,Home Buyer,Realtor

The following analysis of select counties of the Southern California real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

Employment growth in Southern California continues to slow, with only 33,400 jobs added over the past three months. Annual growth also slowed: only 141,100 new jobs were added, which is down from 347,700 added between September 2021 and September 2022. Total employment in the counties covered by this report is still 305,300 shy of the region’s pre-pandemic peak. Los Angeles County still has the largest shortfall (-310,000), followed by Orange County (-36,800) and San Diego County (-19,500). Employment levels in the Riverside and San Bernardino markets remain well above pre-pandemic levels. The region’s unemployment rate in November was 4%, down from 5.4% a year ago. The lowest rates were in Orange County (3%) and San Diego County (3.3%).

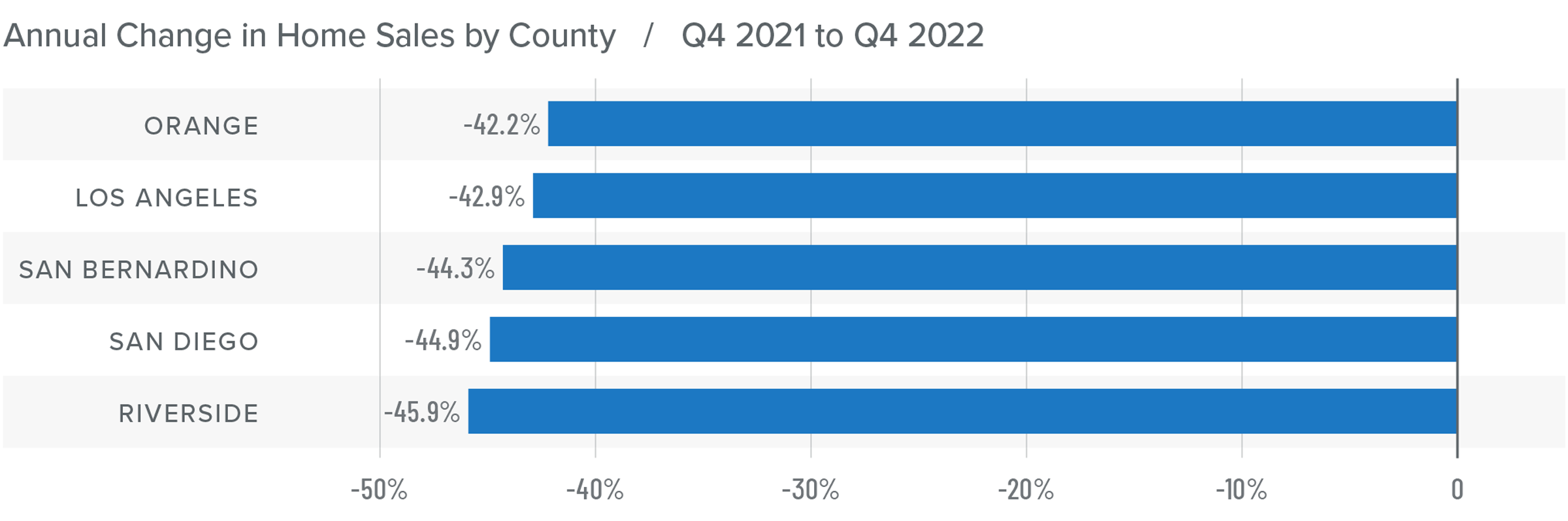

Southern California Home Sales

❱ In the final quarter of 2022, 28,953 homes sold. This is 43.9% lower than the same period the year prior and down 24.5% compared to the third quarter of 2022.

❱ Pending home sales, which are an indicator of future closings, were down 30% from the third quarter, suggesting that sales activity in the first quarter of this year may also be down.

❱ On a percentage basis, sales fell the most in Riverside County, but all markets pulled back significantly. Compared to the third quarter, sales were down 24.5%, or 9,400 units.

❱ Lower number of sales can be attributed to more listings in the market, which were up 83.5% year over year, and higher mortgage rates, which make homes less affordable.

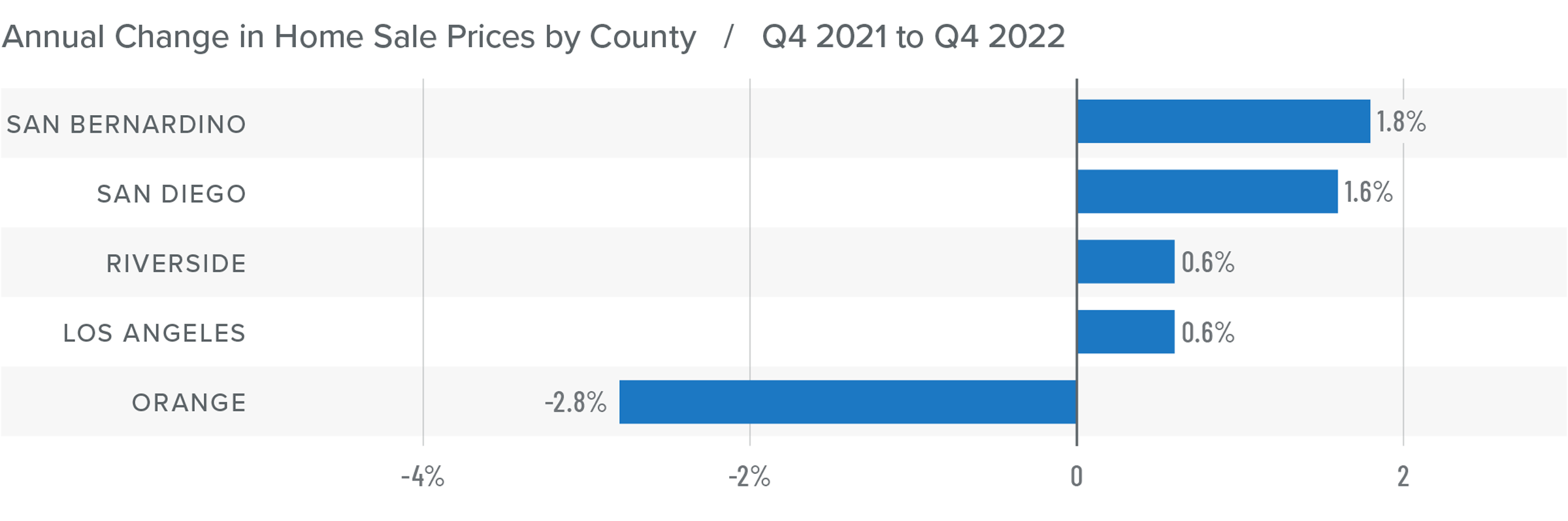

Southern California Home Prices

❱ Fourth quarter home sale prices were .7% higher than the same period the prior year but were 2.5% lower than in the third quarter of 2022.

❱ Mortgage rates, which peaked in October, have impacted both the number of sales and prices. Median listing prices were down 4.9%, which indicates that sellers have been adjusting their expectations, but I believe they will fall further before stability in the market is restored.

❱ The region had very modest price growth in all markets other than Orange County, where prices fell 2.8%. Compared to the third quarter of 2022, prices were lower across all markets other than Los Angeles County, where they rose .2%.

❱ Mortgage rates have started to pull back. If this continues, I am hopeful that the second half of 2023 will be more active, resulting in rising sales and home prices.

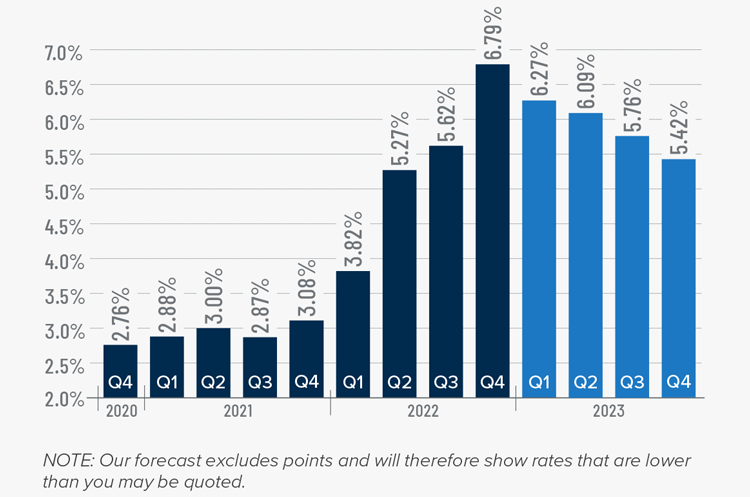

Mortgage Rates

Rates rose dramatically in 2022, but I believe that they have now peaked. Mortgage rates are primarily based on the prices and yields of bonds, and while bonds take cues from several places, they are always impacted by inflation and the economy at large. If inflation continues to fall, as I expect it will, rates will continue to drop.

My current forecast is that mortgage rates will trend lower as we move through the year. While this may be good news for home buyers, rates will still be higher than they have become accustomed to. Even as the cost of borrowing falls, home prices in expensive markets will probably fall a bit more to compensate for rates that will likely hold above 6% until early summer.

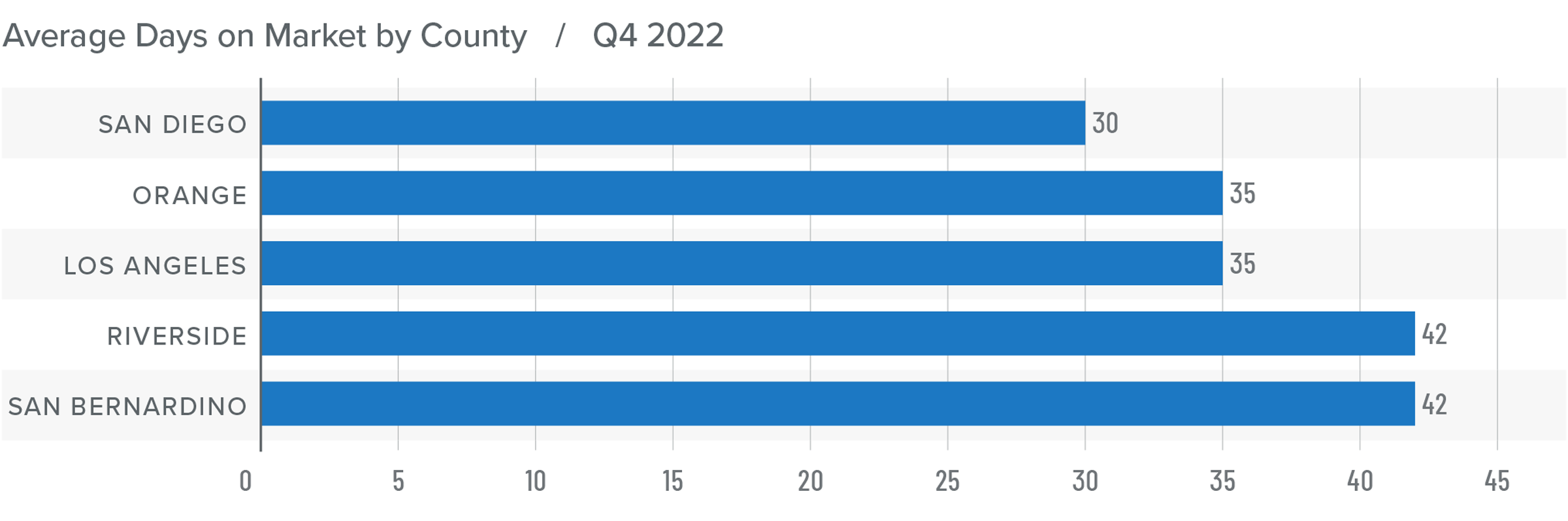

Southern California Days on Market

❱ In the final quarter of 2022, the average time it took to sell a home in the region was 37 days, which was 15 more than the same period the year prior and 11 more than in the third quarter of 2022.

❱ Compared to the third quarter of 2022, market time rose in all counties covered by this report.

❱ Homes in San Diego County continue to sell at a faster rate than other markets in the region, but market time increased in all counties year over year.

❱ More choice and higher mortgage rates appear to be sidelining some buyers. Whether they resume their search for a home in the spring may depend on the direction of mortgage rates and whether prices start to stabilize.

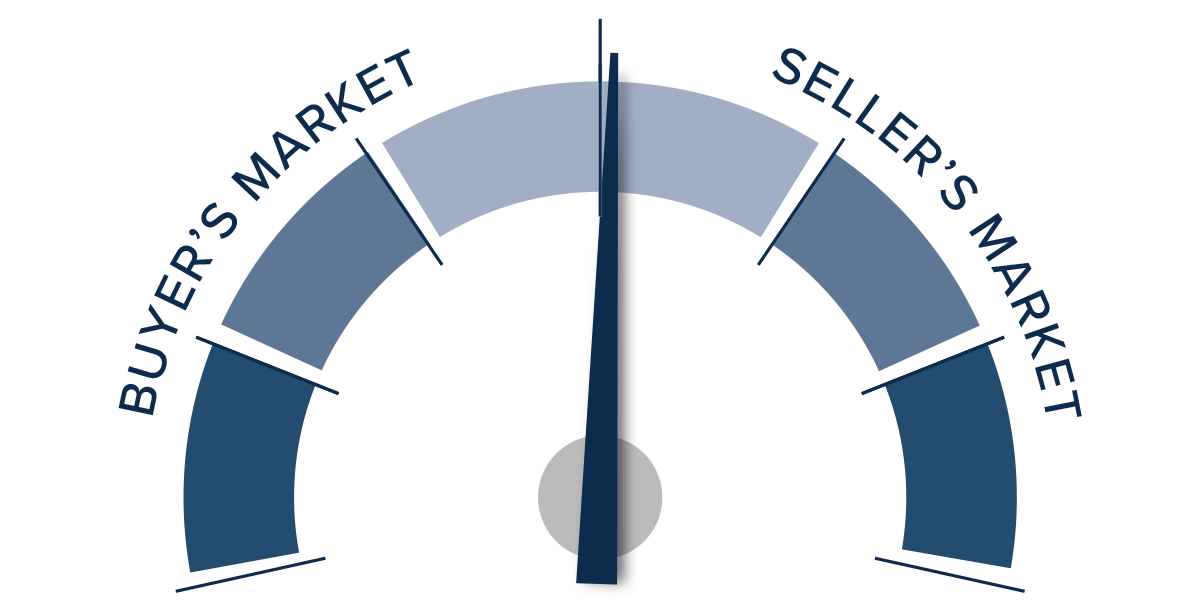

Conclusions

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Job growth has slowed, which may be at least partly attributable to businesses expecting to see the economy slow as we move through this year. The housing market is very susceptible to economic turbulence. This, combined with higher financing costs and softening prices, has caused a lull in the market.

There is no doubt that regional home values are resetting following the frenetic market during the pandemic when mortgage rates were artificially low. I expect prices to move modestly lower this spring before stabilizing and starting to rise again in the second half of the year. All things considered, I have moved the needle to a neutral position, favoring neither buyers nor sellers.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Why Hire a Real Estate Agent When Buying or Selling a Home

January 30, 2023Home Buyers,Home Sellers

You do not technically need a real estate agent to buy or sell a home. You could go it alone. However, the benefits of working with one are significant.

Sellers who sell their home with the help of the realtor generally sell faster and for more money. Buyers who purchase their home with an agent also typically score better prices. But that is just the tip of the iceberg. A qualified agent serves as an advisor in your corner, preparing you for every move in a competitive and often unpredictable real estate market.

Here are our top reasons why you should consider hiring a real estate agent when you’re selling or buying a home.

Why Hire a Real Estate Agent If You Are Selling

1. Help Price Your Home to Sell

Generally, as the seller, your primary goal is to sell your home as quickly as possible at the best price, so you can move on to your next place. But a significant factor in making a quick sale is ensuring that your house is priced appropriately for the market. As the homeowner, it is easy to overvalue your home since you likely did work to it, you loved it for a certain amount of time, but there is likely a bit of subjectivity that goes into your estimate. Real estate agents do not just guess the best price. They use data and market knowledge to set a competitive listing price for your home.

Your listing agent will use a comparative market analysis (CMA) to see what similar houses in your neighborhood have sold for recently. Your listing agent will also consider the unique features of your home when they do a comparative market analysis (renovations, upgrades, and so on) to account for other factors that may raise or lower the price.

2. Likely to Sell Higher

Some sellers believe they can get more money for their property by cutting out the standard agent commission and selling their homes For Sale By Owner (FSBO). However, if the buyer has an agent, the seller will still likely need to pay the buyer’s agent’s commission anyway.

FSBO sellers are walking away from home sales with less, according to a 2021 report by the National Association of Realtors®. When you do the math, homes sold by agents statistically bring in an average of $39,000 more even after accounting for the commission.

3. Likely to Sell Faster

Agents have experience with proven strategies that help sell properties quickly. An expert agent who knows your area will be well-acquainted with the current housing market, knowing what is motivating buyers in your area, and come prepared with a comparative market analysis from similar houses that have recently sold nearby. Some ways agents can help your home sell faster include:

- Setting the right listing price

- Knowledge of area trends

- Suggesting a pre-listing inspection

- Helping prioritize updates, and repairs

- Effective marketing

4. Expert Negotiating Skills

A top real estate agent knows negotiation tactics to help you get the maximum price for your property. But adept negotiation takes knowledge of the current market, research, and expert skill.

“We know the area; we have studied their property, know all the details of the property that makes it go above and beyond for that offer,” explains Dovenbarger. “We can say, hey, this beautiful property has a beautiful yard, beautiful swimming pool, all that. It’s important to say to a buyer it would be to your advantage to pay for the survey and to pay for the closing costs.”

A few other expenses that can be negotiated down include home warranty premiums, repair costs, and cosmetic updates to the home, or the buyer can pay their own closing costs.

One of the trickiest, yet most important, aspects of the selling process is handling negotiations with potential buyers. A good real estate agent will tackle negotiations professionally and work hard to sell your home for the maximum price so you don’t have to give up any additional sale proceeds aside from agent commissions. Real estate agents handle negotiations day in and day out, so you can feel confident in their ability to look out for your best interests.

5. Local Buyer Knowledge

Local listing agents know from experience and research what home features are popular with buyers. This knowledge can end up saving you money when you are preparing your home for sale.

For instance, you might think you need to remodel your bathroom before you list your home. However, your realtor might point out that other houses in the neighborhood are selling quickly as is, so the extra expense might not be worth it.

Conversely, your agent might suggest you repaint some of the rooms in your home with a neutral color to make it more appealing to potential buyers.

If you are selling without an agent, you will not know which home prep projects are most important to local buyers, or you might make the mistake of putting up a for sale sign without preparing your house at all.

6. Access to the MLS

One of the biggest challenges of selling a home without a real estate agent is finding the best way to distribute your home listing to potential buyers. Only licensed real estate agents can list homes on the Multiple Listing Service (MLS) — the online database where houses are listed for sale. Realtors regularly post listings on the MLS, so they will usually include great photographs of your house and a description that piques potential buyers’ interest.

It is vitally important to get your house on the MLS since 97% of all buyers use the internet to search for homes these days.

7. Better Marketing

Marketing your home does not begin and end with the listing. There is much more that goes into it. Successfully marketing a home to potential buyers takes a lot of time and effort. So much effort, in fact, that many people give up. Expert agents are proactive marketers with an arsenal of marketing and sales techniques in their toolbox in which to market properties.

Top agents know how to get more eyeballs on your home with marketing efforts like:

- Advertising on social media

- Hosting an open house

- Hiring a professional photographer

A listing agent wants to make your home look as good as possible for as many people as possible so they can earn commission when it sells.

If you are selling FSBO, it is hard to know how or where to market your home so qualified buyers in your area can see it.

8. Manages the Paperwork

Home sales require dozens of important legal documents, and it can be difficult for inexperienced sellers to keep all of the paperwork straight. It is best (and safest) to have a real estate agent handle the paperwork for you since they know what they are doing and they have the support of a brokerage that can ensure your entire transaction is valid.

Sometimes the industry jargon in contracts and real estate documents can feel like a foreign language. There are financing industry terms, attorney legalese, title company lingo, and real estate vocabulary–– all that can be mind-boggling to sellers as well as buyers.

Real estate agents will take the time to explain the purpose of each document, answer questions you don’t understand, and clarify the terms you’re agreeing to and signing.

Why Hire a Real Estate Agent If You Are Buying

1. No Out-of-Pocket Cost

As a buyer, your real estate agent is paid by the seller using the proceeds of the sale. When you are making one of the largest purchases of your life, it is a huge advantage to be able to work with a professional without getting a bill for it.

2. Find the Right Home Faster

Popular real estate websites like Zillow and Redfin can help you find houses, but the information on these sites can be outdated and the latest listings may not appear on the map.

Your buyer’s agent can notify you of new listings as soon as they hit the market, and they can even tell you about off-market opportunities — houses owned by people who have not officially listed for sale, but who may be open to offers.

Even though you can browse listings online, agents have full MLS access — enabling them to find houses you cannot see with your own search.

3. Helps Create a Competitive Offer

In hot real estate markets, it can be hard to get an offer accepted without overpaying. Buyers sometimes get pressured into submitting offers well above the listing price because they want to outbid everyone else. While it is true that a home purchased with a mortgage loan will be evaluated by an appraiser before all is said and done, there is more to a fair price than a bank’s willingness to loan money.

Real estate pricing varies depending on whether market conditions have created a seller’s market or a buyer’s market. When you are trying to buy a home in a seller’s market, you can expect a limited inventory of available homes and a high likelihood of multiple-offer scenarios when you do find one you would like to purchase.

And this is when it is especially helpful to have a buyer’s agent in your corner — because an agent will have the market expertise to advise you on how to make a competitive offer.

4. Can Spot Red Flags

Unless you are a home improvement professional or an experienced agent, you might miss red flags when viewing a home on your own. Some expensive home repair issues your agent can spot include structural issues, furnace problems, roofing issues, plumbing leaks, mold, and insect infestations. While these issues would likely come up during a home inspection, spotting them early can save a lot of time if these are deal breakers for you.

Find the Right Agent

Windermere’s community of real estate professionals is our greatest asset. We have experts in all areas of real estate, from your typical starter home to condos, luxury properties, and new construction. While residential real estate is the mainstay of our business, Windermere also has offices and associates who specialize in property management, commercial real estate, and relocation services. To further facilitate the home buying process, Windermere has affiliated partners in certain regions to provide mortgage, title, and escrow services.

Call us today with any questions or concerns. Our professional Real Estate Agents will help you through this exciting process. (951) 369-8002

Should You Get A Mortgage Preapproval?

When you start the process of buying a home, the single most important thing you can do is to get a mortgage pre-approval. This step is relatively easy and straightforward, and will give you a clearer picture of your exact budget. But more than that, sellers often look at pre-approval as an indication of how serious the buyer actually is.

In order to get pre-approved for a mortgage, you need to provide your lender with extensive documentation proving your income, assets and debt obligations (we will get into those details later). If you qualify, you will receive a pre-approval letter indicating how much you can borrow to purchase your new home.

Below, we will cover how to get pre-approved for a home loan and why it can be incredibly important.

What Is A Mortgage Pre-Approval?

When a lender preapproves you for a mortgage, it tells you exactly how much they are willing to loan you to pay for a home. The lender makes this determination by reviewing your credit report, income, employment history, assets and debts. Your pre-approval will come in the form of a letter. It will also contain an initial interest rate as well as terms of the loan.

Keep in mind that a pre-approval is not a commitment to lend. Your desired house still has to pass an appraisal to qualify for whichever mortgage option you are requesting. While a mortgage pre-approval is not an ironclad guarantee that your loan will end up closing, having a pre-approval does show sellers that you are serious in your intent to purchase a home and have the financial resources to follow through

Mortgage pre-approval significantly boosts your chances in the housing market. For starters, most real estate agents expect you to be pre-approved for a mortgage before you even request their services. They tend to view it as an affirmation that you are someone they can trust and that you are serious about buying a home. Pre-Approval basically hedges against window shoppers since a lot of time and effort goes into finding and showing properties.

The entire process takes about two-to-four weeks.

What Is A Mortgage Pre-Approval Letter?

If a lender offers you a pre-approval, they will issue you a pre-approval letter. A good pre-approval letter will contain several pieces of information:

- The amount of the pre-approval

- The length of time the letter is valid for

- Which loan option is being used (for example, 30-year conventional)

Is Pre-Qualified the Same as Pre-Approved?

No, a mortgage pre-qualification is not the same as a pre-approval. Pre-approval is a process that includes getting an in-depth review of your finances or a hard credit check. Pre-qualified does not. Pre-qualification offers a relatively informal estimate of how much you can borrow. In a pre-qualification, a lender usually asks for verbal or written estimates of your income and assets to calculate your debt-to-income ratio (DTI) and down payment savings.

When it comes to choosing between getting pre-qualified versus pre-approved, a pre-approval is going to be more comprehensive and give you a more accurate look at the types of mortgages you qualify for.

While pre-qualifications are a good way to come up with a budget and an initial estimate of how much you can afford, in the eyes of sellers and the real estate agents, they do not mean very much because none of the numbers are verified. This can be particularly problematic in markets experiencing low inventory.

How Long Does Pre-Approval Last?

If you are pre-approved, you will receive an approval letter offer that lasts for 60 – 90 days, depending on the lender. After that, you will need to apply again with another credit check and updated paperwork. If there are any major changes to your financial situation, your pre-approval amount might also change.

You can look at a house without pre-approval but getting pre-approved early in the home buying process is most beneficial. This way, you can find out if there are any issues that could prevent you from getting financing.

How to Get Pre-Approved For a Mortgage

In addition to considering your credit score, lenders will want to verify your employment and income. They will also be considering your debt-to-income ratio (DTI), which is a calculation of your total monthly debts, divided by your monthly income. This ratio, expressed as a percentage, helps lenders make sure you have enough income to reasonably cover your debts.

The exact DTI needed for mortgage approval varies by loan type. But generally speaking, you’ll want your debt-to-income ratio to be 50% or lower.

Now that you understand the importance of the mortgage pre-approval, let’s run through the process.

Step 1. Get Financially Ready

If you are looking to buy a home in the near future, your first step should be to make sure you are financially prepared. There are a couple of steps you can take to get ready.

Check Your Credit Score

A good credit score is key to getting pre-approved. Each lender and loan type has a minimum credit score requirement that will apply to both you and any co-applicant. For conventional loans, lenders typically like to see a credit score of 620 or higher. Before applying for a pre-approval, take some time to request a free credit report to ensure there are no errors on your report that could be negatively affecting your score.

Since completing a pre-approval application does affect your credit score, getting a free credit check that will not impact your credit score will give you a rough idea of your current score. You can then use the estimate as a baseline for checking if you meet a lender’s mortgage qualifications.

Pay Down Your Debt

During the mortgage pre-approval process, your lender will also look at your debt-to-income ratio (DTI), which compares your monthly debt obligations to your monthly income. DTI requirements can vary by lender and loan type, but generally speaking, the lower your monthly debt compared to your income, the better. For the best chance of qualification, you want to keep your DTI at 43% or less.

Step 2. Gather Your Documents

Your lender will run a thorough search of your financials. To avoid any future headaches and expedite the process, have the following documents at hand. Keep in mind that this is not an exhaustive list:

- Proof of Identity: You will need to show your driver’s license or government-issued ID, passport, Social Security card and other documents that verify who you are and where your permanent residence is.

- Proof of Employment History: Most mortgage lenders require the last 30 days of pay stubs that also indicate your year-to-date income.

- Tax Documentation: Be sure to bring your last three federal and state tax returns along with your last three W-2 forms. If you are self-employed, you can collect your most recent 1099 forms.

- Bank Statements: Likewise, you will need the last three month’s worth of financial statements for all your accounts. This may include checking, savings, money market, and certificate of deposit (CD) accounts.

- Asset Information: You should also collect statements for brokerage accounts or other taxable investment vehicles. Proving you have assets at hand would serve you well in the mortgage pre-approval process.

- Real Estate Income: If you are earning income from any property, you will need to provide specific paperwork. These documents can include a lease and documentation of rental income for the last three years. You will also need to prove the current market value of the rental property.

Step 3. Shop Around

When you are going through the process of applying for a mortgage loan, shopping around could result in a better rate and higher loan amount. It is not just rates you should be worried about, but also how the lender will treat you, so you need to be comfortable. Do they charge fees for mail-in or phone payments? Will they service your loan after it closes, or will the servicing be sold? Will they proactively reach back out to you if there is an opportunity to get you into a lower rate? All of these things need to be considered.

What to Do After You Get Pre-Approved for a Mortgage?

After a lender pre-approves you for a mortgage, your journey through home buying continues. Pre-Approval usually comes in the form of a letter proving that a lender has verified your information and is willing to give you a specific loan. But remember, you earned pre-approval because you demonstrated your trustworthiness as a responsible borrower. If you fail to in your obligations, your lender may reduce the amount you can borrow, raise your interest rate or revoke the pre-approval if you fail to maintain a good financial standing. Lenders continue to monitor your debt-to-income ratio. So you should avoid making any large purchases without first notifying your lender.

In addition, avoid opening any new lines of credit. Each credit inquiry will knock down your credit score and change your credit capacity. Instead, focus on paying off your current debt and keep paying bills on time to boost your credit score. A different lender may take notice of your improved credit score and offer you a better interest rate.

Once you have found a home you are ready and able to commit to, your lender will move your mortgage pre-approval onto the final application phase. The loan finalizes when an appraisal of the home is completed, and your mortgage is tied to a particular property.

Find the Right Agent

Buying your house should be a fun and fulfilling experience. If you have done your research and evaluated what you can afford and what you truly need, finding a new home can be exciting. Learning more about the purchase process eliminates the fear of the unknown and lets you search for a home with peace of mind.

Windermere’s community of real estate professionals is our greatest asset. We have experts in all areas of real estate, from your typical starter home to condos, luxury properties, and new construction. While residential real estate is the mainstay of our business, Windermere also has offices and associates who specialize in property management, commercial real estate, and relocation services. To further facilitate the home buying process, Windermere has affiliated partners in certain regions to provide mortgage, title, and escrow services.

Call us today with any questions or concerns. Our professional Real Estate Agents will help you through this exciting process. (951) 369-8002

How Important Is School District When Buying A House?

There is so much to think about when choosing a home to buy: location, floor plan, property taxes, whether you will have any nosy neighbors poking around. If you have children, choosing a home in a reputable school district might also be at the top of the list.

But you might not realize that whether or not you’re a parent, school districts can play a major role in your home buying decision. Here’s what you should know about how school districts affect your finances when buying a house.

How to Determine How Good a School District Is

When evaluating a school district, there are a few things to take into consideration. Take a look at the quality, age, and facilities of the schools themselves. Look into how students perform on standardized tests. Check out the student-to-teacher ratio to see how much personalized attention the students receive. The amount of spending per pupil at the school will tell you how much of the budget is allocated for each student.

Most importantly, talk to people who have lived in the area for a while and have children enrolled in the schools. You may even want to schedule an interview with a teacher or administrator at the school. A good school district generally produces good kids. Not only are they academically inclined, but well-behaved as well. As such, areas with good school districts tend to be safer and experience less crime.

Great grades are not all that matter, though. Sometimes the schools that are ranked the highest are the ones with the most rigorous curriculums, and those can sometimes be overly stressful or overwhelming for children or adolescents. For more personalized recommendations, turning back to the community is always a good idea.

If you can, you should check out all of the district’s schools. While your child might be going to elementary school now, he or she will eventually be going to middle school and high school. You want to make sure that they are all suitable for your child.

Understanding School Ratings

According to the National Center for Education Statistics, there have been more than 98,000 public schools in the United States. Even divided by 50 states, that number can feel overwhelming. But each state has School Report Cards, which are federally mandated to be available to the public under the Every Student Succeeds Act (ESSA). These report cards are similar state-to-state.

Although the names of the sections may differ across reports, the information they provide typically is divided into one of five categories:

1. Demographics

This section provides information on the students attending the school. This might be enrollment numbers, teacher and staff information, information on racial or ethnic self-identification, economic standing, learning differences, family backgrounds, and more.

2. Academic Achievement

This broad category covers how students perform on state exams. ESSA allows individual states to set their own parameters for standardized tests. However, to make it easier to compare schools in a consistent way, this section also typically includes performance on nationally standardized exams such as the SAT and ACT.

3. College and Career Readiness

This information might be included within academic achievement, but is often in its own section. Performance in upper-level courses and on national standardized exams is strong indicators here, if they are not covered in in academic achievement.

4. Climate

The Climate section deals with school environment. Many campuses now implement student survey data, asking students their opinion on how high classroom expectations are or whether they feel as though their teachers care about them individually. On a broader scale, this section usually also includes safety and disciplinary information.

5. Accountability

Accountability, another ESSA term, is used to indicate if a school has been identified as needing additional support, and if so, what kind. Often, this information is indicated on the first page of the report, in the “Overview” or “Summary” section. Occasionally, however, this information is given a tab of its own within the report. The accountability score given to schools is determined by individual states, as are the plans of support moving forward.

What a Good School District Means When Buying a Home

If you are in the market for a new home you better be researching local school districts – it could mean all the difference for your family, whether you have children or not. Homes in the best school districts, on average, sell for higher prices than similar homes in less-popular school districts. A simple analysis might say that good schools are wholly responsible for this added value.

Here are four of the main reasons why the quality of school districts is something that you need to keep in mind when you buy your next home.

- Good Neighborhood

A good school district tends to equal a good neighborhood. Great location can mean safer neighborhoods, an abundance of places to eat, ease of access to transportation, proximity to urban, beach or vacation areas and amenities like public parks and services.

- Good Education

If you have children, the biggest reason to buy a home based on the school district is so you can provide them with a quality education. A good district will offer the best education for your children. This is especially important if you have children with unique learning needs. Some districts are more accommodating to children who need additional enrichment or learning opportunities.

- Home Value Stability

Even if you do not have kids, living in a good school district can help increase your home’s value over time. That is because neighborhoods with higher school ratings tend to have higher home values. Homes will go up and down in value, but an outstanding school district can make all the difference during a tough market.

- Higher Resale Potential

Real estate is by nature a venture that carries with it a certain level of risk and never comes with guarantees. While this is true, you do want to do everything in your power to make sure you get the best that you possibly can for your family. Home buyers should think about resale and building home equity when selecting their new home- even if they do not plan to move in the near future.

After all, plans change unexpectedly. You may think a house is your “dream home” and plan to live there forever, but plans change. If you find yourself in a position where you need to move in a few years, you want the resale value to be high.

School Districts Matter Even If You Do Not Have Kids

Even if you do not plan on using the schools, the school district should still be an important part of your home hunt. If you have been browsing online real estate listings or talking with your agent, you have likely seen or heard about local school ratings. School district ratings are one of the neighborhood lifestyle statistics you often find in home-for-sale listings, along with data about walkability, crime, and more.

It might be tempting to skip over this info if you do not have kids, but do not discount this valuable information. If you are not a parent or do not plan to be one, you might still want to consider buying a home in a "kid-friendly" neighborhood with highly-rated schools.

The National Association of Realtors (NAR) found 26% of home buyers said the quality of local schools was important when finding a home and 20% said proximity to schools was a deciding factor. Realtor.com found that homes in good school districts got 26% more online views than comparable homes in average school districts and sold on average eight days faster. When school districts maintain their good rankings, these homes will likely appreciate in resale value.

Find the Right Agent

Choosing a location for a home is dependent on many factors for your individual needs. If you’re looking for better resale value and a safer location for your home, then you should consider buying a home that is located within a high-rated school district. Your realtor can help you choose a home in the perfect location for your needs

Windermere’s community of real estate professionals is our greatest asset. We have experts in all areas of real estate, from your typical starter home to condos, luxury properties, and new construction. While residential real estate is the mainstay of our business, Windermere also has offices and associates who specialize in property management, commercial real estate, and relocation services. To further facilitate the home buying process, Windermere has affiliated partners in certain regions to provide mortgage, title, and escrow services.

Call us today with any questions or concerns. Our professional Real Estate Agents will help you through this exciting process. (951) 369-8002

Benefits of Accepting a Cash Offer on Your House

Every seller's reason for selling their home is uniquely different. Many homeowners want to sell their homes quickly. They do not often want to spend time or effort preparing to sell, which includes completing repairs, handling upgrades and staging and cleaning the house to show it to buyers. These are the types of situations where a seller will reap the benefits of accepting a cash offer on a house, and it is usually the best possible option.

Selling a home requires a lot of work and a stressful ordeal, from the time and effort put in to prepare your house, to the endless amount of cleaning, repairs, and upgrades. The seller might be worried the sale will take too long, that they will not be able to find a quality real estate agent or the costs will be high if they try to sell their home the traditional way.

If you are still wary of accepting a cash offer and only feel comfortable with traditional sales, continue reading through this article, and we will explore exactly what a cash offer is, as well as the main benefits of accepting a cash offer on a house.

What Is a Cash Offer on a House?

As the name indicates, a cash offer on your home means the buyer offers you the amount of money you have listed your home for in cash rather than using financing methods. Having a buyer with enough money to purchase your home outright allows you to avoid several time-consuming and expensive steps that can leave your home on the market longer than you want.

From the owner’s perspective, you might think that this does not make a difference — whether from a bank or from a cash offer, you get your money, right? Well, sort of. If you are working on a tight timeframe, working with buyers getting funding through banks will not be very flexible, even if they want to be. The reality is, cash offers come with non-traditional buyers who are ready to make quick offers, pay cash for a house and avoid all the extra steps that come with a conventional home sale.

How Common Are Cash Offers?

Many believe cash offers on homes are not all that common, but this could not be further from the truth. In reality, cash home sales occur in 22% to 24% of the market for condo and single-family home sales.

Some scenarios make these cash sales more common, including:

- A buyer has just sold their home and needs a place to live immediately.

- Real estate investors want to invest in the property.

- A buyer wants a competitive edge in the market.

- A property needs expensive repairs or renovations.

- Someone wants to sell their home for a fix and flip.

Types of Homes Most Likely to Be “Cash Only”

While everyone’s scenario is unique, some situations just make sense for a cash-only sale. Some of the most common situations that might be best for cash sales include:

Homes Close to Foreclosure

Homeowners at risk of facing foreclosure will find themselves trying to solve their problems. Due to financial circumstances, this means the homeowner can no longer afford to make the mortgage or loan payments on their homes and will feel as though they are running out of options to regain some form of stability.

While there are other options they can take, such as evictions, short sales or bankruptcy, these can have a detrimental impact on the owner's credit score, making it hard for them to seek loans in years to come. A simple cash sale provides an easy way out without harming their credit score. Accepting a cash offer on a property at risk of foreclosure allows the homeowner to avoid eviction, avoid a lowered credit score, and will enable them to move on to the next stage of their life.

Lengthy Repairs

Traditional sales can make it difficult to sell houses that need major repairs, for example, houses with infestations such as mold. Cash buyers do not have to face these issues and can sell their houses as-is or, more commonly known as fixer-uppers, to people willing to pay upfront. This means sellers don't have to stress finding the cash to fix repairs and enjoy a speedy closing.

The amount of money a homeowner spends to keep their home to a good standard or well-maintained can sometimes prove to be a lot to handle for some homeowners. Whether your roof needs replacing or your foundation is cracking, repairing your home can cost you tens of thousands of dollars.

Changes to Life

Suppose homeowners experience key changes to their life, such as a divorce, death in the family retirement, relocation for a new job or personal illness. In that case, they may find themselves wanting to buy a new house or change the area they live in quickly. Such changes may require you to sell your house immediately without any extra stress, just a simple solution to a problem that can be solved quickly.

Types of Cash Home Buyers

There are several types of buyers who pay in cash. Unfortunately, not all of them are honest, so it is vital to know to whom you are selling your house. Several cash home buyers come verified, and they will appraise your house honestly before giving you an offer.

Some cash offers come from house flippers, who intend to purchase your house as-is and sell it for a higher value later on. Some cash offers come from individuals who would rather not get financed by a bank often pull from their savings to make a cash offer on a house.

There are many benefits to this system for both the buyer and the seller, including increased control over the home’s offer and sale price. The home seller might not get market value for their home in this case.

Incentives for Buyers to Pay Cash

It is not hard to see the benefits of accepting a cash offer on a house. It is also not difficult to understand why a home seller might prefer a cash deal: It’s quicker, easier, and with fewer obstacles to maneuver.

The buyer who can pay cash is someone who can present the best possible profile to the seller. This is someone who is likely to be financially stable with a good credit rating. It is also someone who understands the home buying process from start to finish. They have done their research, learned about real estate prices, and come to a reasonable conclusion about what they would like to pay.

If you can afford to buy up front, the advantages are many:

- Sellers are likely to favor buyers who can pay in cash.

- The home price may be reduced for those who pay in full up front.

- All-cash purchases streamline the home-buying process: No loans means less paperwork and no delays for mortgage approval.

- Cash buyers can save money on closing costs, bank appraisals, mortgage applications and fees, title insurance, and so on.

- Cash purchases eliminate the risk of loan denial.

- Cash buyers pay much less for their homes in the long run: No loans means no interest.

- Cash buyers never have to worry about losing their homes because they can’t afford to repay their mortgage loans.

- Cash buyers gain full, immediate equity in their home.

The Benefits of Accepting a Cash Offer

A cash home sale can be a very different experience from a traditional home sale in several ways.

Here is a breakdown of some of the most significant differences.

1) Quick Closing

From start to finish, a cash offer takes less time to finalize. Without a mortgage lender involved, the whole process becomes much faster. There is no underwriting process, for one thing—that process can take a month or two alone. Selling a home through a traditional mortgage lender is time-consuming, taking an average of 47 days to close because lenders require a lengthy underwriting process at the end of the sales process. With an all-cash offer, the average time to close is approximately 2 weeks.

Between the initial pre-approval and the loan finalization, if a buyer’s financial picture changes or they fail to satisfy certain requirements, the lender can decide to decline their loan, resulting in your deal falling through and leaving you back at square one of the selling process.

2) Less Paperwork

The endless paperwork required with selling a house can be confusing and hard to understand. Reading, initialing and signing all that paperwork can be overwhelming, and ensuring you understand everything detailed in the paperwork entirely is essential and a small mistake can create huge problems. A cash buyer who is reputable and can prove they have the funds will sort out paperwork and closing information for you. You should always check reputable cash buyer's reviews or references, as well as proof of funds, before you move forward with a cash sale.

3) Less Risk

As a seller, you might be fielding several offers. Unfortunately, offers from those working through the financing process may not pan out, leaving you with a property longer than you intended and costing you money.