The Power of Mortgage Pre-Approval

Buying a house in any market is a big decision but entering today’s housing market can feel intimidating. You want to do it right and you want the process to be as stress-free and uncomplicated as possible.

One thing you can do to help you prepare is to get pre-approved.

Getting pre-approved for a home loan is an easy process that provides a realistic picture of what you can qualify for so you do not end up falling in love with a property outside of your budget. It will also help you move more quickly when you find that perfect place, giving you a better chance of scoring your dream home before someone else has the chance.

If you are considering buying a home this year, take the first step and get pre-approved today, or read more about what is involved.

Understanding the Difference: Pre-Qualification vs. Pre-Approval

Pre-Qualification

Pre-qualification is the first step in your mortgage application process. It will help you to understand the approximate loan amount you can expect to qualify for. You will begin by sharing your financial information—debt, income, assets, etc.—with your bank or lender. After reviewing the information, the bank or lender will give a loan estimate. The process is relatively simple, only taking a few business days to process.

Keep in mind that while pre-qualification gives you a rough idea of the mortgage amount you may qualify for, it is not a guarantee. It is more of an informal conversation and does not involve a thorough analysis of your financial documents.

Pre-Approval

On the other hand, pre-approval is a more comprehensive and formal process. Essentially, pre-approval is a snapshot of what you’re likely able to borrow for a home. It’s based largely on information you provide to a lender, so the final amount could change somewhat once you’ve gone through the full underwriting process, where an underwriter verifies all of the necessary information to understand what you’ll be able to comfortably borrow. Pre-approval also usually involves a credit check so the information is more solidly based.

What to Expect During the Mortgage Pre-Approval Process

Pre-approval is the closest you can get to actually taking out a loan without firm commitments on either side (you are not committing to borrow anything, and the lender is not committing fully to lending you anything—yet). So, to get a pre-approval letter that sellers will take seriously, the lender needs to see enough details about your situation to make an accurate estimate of how much they are able to offer you.

The exact personal information you will need to provide may vary, but generally, here’s what you will need to have handy:

- Your full name, address, and contact information

- Employment information, including your employer's name and contact information, job title, and income

- Information about your monthly expenses, including any outstanding debts or other financial obligations

- Documentation of your income, such as pay stubs, W-2s, and tax returns

- Documentation of any assets you have, such as bank statements, investment accounts, or retirement accounts

What Documentation You Need

To get pre-approved, you will need to provide a mortgage lender with a good amount of paperwork. For the typical home buyer, this includes the following:

- Pay stubs from the past 30 days showing your year-to-date income

- Two years of federal tax returns

- Two years of W-2 forms from your employer

- 1099s if you are self-employed

- Bank statements for the past two to three months

- Statements (for the past quarter or 60 days) of all of your asset accounts, including checking and savings, as well as any investment accounts (e.g., CDs, IRAs, and other stocks or bonds)

- Any other current real estate holdings

- Residential history for the past two years, including landlord contact information if you rented

- Proof of funds for the down payment, such as a bank account statement

Why Is Pre-Approval So Powerful?

It is not just about getting a piece of paper. Here are five key benefits that will empower you as a buyer:

- Know Your Budget, Avoid Wasting Time:Knowing how much home you can afford helps you focus on the houses that fit in your budget, saving you time during your house hunt. A lender will review your application and let you know how much they are willing to loan based on your verified income and assets.

- Navigating Multiple-Offer Scenarios:With more buyers than available homes, multiple-offer scenarios are common. Pre-approval becomes your secret weapon, giving you an edge over other buyers. It not only helps you zero in on the right price range but also positions you favorably in the eyes of sellers.

- Speed Up the Process, Close Faster: Once your offer is accepted, you’ll be counting down the days to move in. Unfortunately, the closing process can often drag on, leaving buyers feeling like they’re in post-purchase limbo. Pre-approval will speed up the closing process, since the mortgage approvals have already been taken care of, allowing you to focus on next steps like appraisals and inspections.

- Secure Better Rates, Save Money: Getting preapproved means it's unlikely you'll fail to get financing, and it may also help you pay less in mortgage interest rates. Locking in a favorable interest rate during pre-approval can save you thousands of dollars over the life of your loan, especially if rates are expected to rise. Think of it as an investment in your future financial stability.

How Your Finances Can Affect Your Pre-Approval

When it comes to getting pre-approved for a mortgage, there are several factors that lenders consider, including:

Income: Your lender will check your income to assess the likelihood that you’ll be able to afford the mortgage payment. In general, your lender likely wants to see that your housing costs don’t exceed 28% of your gross income.

Debt: When determining how much you can borrow, a lender will compare your monthly debt payments to your gross monthly income to determine your debt-to-income ratio (DTI). If you have an extensive monthly debt burden – for example, a high DTI ratio – your preapproval amount will be lower. But if you can eliminate some of these debts – such as credit cards or personal loans – from your books, then a lender may be willing to increase your preapproval amount.

Assets: Your assets, such as savings accounts, investment accounts, and retirement accounts, can also impact pre-approval; that’s because lenders want to see that you have enough savings to cover your down payment and closing costs and that you have a financial cushion in case of unexpected expenses.

Credit History: Your credit scores and history help a lender determine whether you qualify for a mortgage within its underwriting structure, as well as the mortgage rate you’ll receive.

Employment History and Income: Your employment history is one part of your background that helps a lender discern your ability to repay the loan. The lender will ask for your employer's name and contact information, your job title, and dates of employment. They may also request a verification of employment from your employer to confirm your income and employment status.

Find the Right Agent

Windermere’s community of real estate professionals is our greatest asset. We have experts in all areas of real estate, from your typical starter home to condos, luxury properties, and new construction. While residential real estate is the mainstay of our business, Windermere also has offices and associates who specialize in property management, commercial real estate, and relocation services. To further facilitate the home buying process, Windermere has affiliated partners in certain regions to provide mortgage, title, and escrow services.

Call us today with any questions or concerns. Our professional Real Estate Agents will help you through this exciting process. (951) 369-8002

Buying a Fixer-Upper: What You Need to Know

If you are relatively handy and do not mind the extra work, buying a fixer-upper could be a great way to save money during the homebuying process. In fact, buying a house that needs work may help you score a home in your ideal location, but be sure the amount of repairs and cost of renovations work for you.

While the process of buying and renovating fixer-upper homes has increased in popularity due to home improvement TV shows, these types of major renovation projects are not for everyone. After all, buying a fixer-upper involves moving into the least desirable home on the block and overseeing its transformation.

So, whether you are considering a fixer-upper as an investment — and you plan to flip it immediately after construction is complete — or you are fixing up a home to make it your own, there is a lot to consider when buying a fixer-upper.

What Is a Fixer-Upper Home?

Fixer-upper homes are houses that are in a livable condition but need some work. The amount of work varies by home and the buyer's intent, although needed repairs are significant enough to warrant a lower sale price. You should note that fixer-upper homes are often listed "as-is" on the market.

Investors buy fixer-uppers to repair and flip them for a profit, while traditional homebuyers may find that the lower sale price is a bargain, provided they budget for repairs and have some DIY plans.

Things to Consider When Buying a Fixer Upper

With that in mind, here’s what it takes to make the purchase of a fixer-upper pay off.

- Cost Analysis

Each home renovation is unique. If you buy a fixer-upper house, the price of rehabbing it can vary tremendously. One house might need new appliances, the walls painted, and the floors sanded. Another might need a new roof and a cracked foundation fixed and maybe even an electrical upgrade. The size of the home, its age, its location, and condition will all impact how much you will need to spend.

It is imperative that you add up all the costs of potential renovations before you buy a fixer-upper house. You do not want the dream of wanting your own home to cloud your judgment about the work that is needed.

Consider the following:

- Assess the upfront cost of the home and add up all potential material and labor needs —plumbers, electricians, roofers, carpenters, all the way down to any new doorknobs you will buy along the way. Then, subtract that from the home’s renovated market value. Would this still be a profitable venture?

- Remember that inflation is currently running high so prices could get higher than what you believe they will cost during the time you are renovating.

- Allow wiggle room in your budget and your timeline for overages. It is not uncommon for home renovations to cost more and take longer than anticipated.

- Pick Projects That Pay

The ideal fixer-uppers are those that require mostly cosmetic improvements — paint touchups, drywall repairs, floor refinishing — which generally cost much less than what they return in market value. It is essential to understand what work should be done for safety reasons and to prevent costly challenges down the road. The best way to do this is to have a professional assess your newly purchased home and use that insight to develop a game plan.

Hire an inspector to look for potential issues or hazards with electrical, plumbing, and the roof. It is a good idea to start with the structure and take care of items like electrical, which can be a potential fire hazard, as well as plumbing issues so that you don't end up with major problems or damage in the future. You will not see a great transformation, but it brings peace of mind.

Once you have finished the safety concerns, choose projects that will give you the biggest bang for your buck. Whether you are flipping it or planning on living in it, things like a fresh coat of paint, new flooring, new appliances and some landscaping will be the biggest and most rewarding changes.

- DIY Whenever Possible

One of the things to consider is how much of the work you are able to do yourself. If you love to work on old houses, you are a step ahead. But those with no DIY skills may be locked into overseeing contractors for every renovation. That can cause some headaches and will certainly cost more than if you can do the work yourself.

Fixer-uppers can be a great investment and allow you to customize a home to your specific needs. But it’s best to have a sense of what you’re signing up for! With some strategic due diligence upfront, you can purchase and remodel your new home with confidence.

- Financing

One of the most challenging aspects of buying a fixer-upper is paying for the renovation. Understandably, most people do not typically have much extra cash after making the down payment and paying closing costs, so coming up with additional money to cover repairs or remodeling can be difficult.

A fixer-upper loan may be a good option to buy a house that needs some TLC and pay for the repairs needed to turn it into your dream home. These loans are designed to give you the money you need to buy and renovate the home at the same time. Understanding how the different fixer-upper loans work will help you decide the best way to finance your fixer-upper.

Benefits of Buying a Fixer Upper

Most often, people buy fixer-upper homes because the cost of purchasing the home plus renovation costs may total less than what they’d pay for a comparable home in good condition.

Here are some of the key reasons buyers decide on buying a fixer-upper:

- Reduced price

- Customizable improvements

- Older home charm

- Make a profit

- Tax incentives

What to Look For When Buying a Fixer-Upper

When shopping for a fixer-upper, prioritize the things you cannot change about a home (like its location), or things that would be too costly to change (like significant structural renovations).

Here are key factors to consider:

- Location

Location is always the most important thing to look for with real estate, because it cannot be changed. Look for a fixer-upper in a desirable or an up-and-coming neighborhood in order to maximize potential resale value. Finding the right location will also ensure that you are happy in the home. Pay attention to things that might be important to you, like school ratings, nearby parks and restaurants and commute times.

The home’s location will also play a part in determining your renovation budget and estimating the home’s post-renovation value. The quality of finishes and upgrades you select should be in line with comparable homes in the same neighborhood if your goal is to recoup costs on resale.

- Layout and Size

A logical layout is important in any home, but it’s especially critical when you are looking at an old home. Older homes are often divided into small rooms, but many people in this decade favor an open floor plan. If you envision needing to knock down walls to create a more open, airy interior, know that the job can be expensive, time-consuming and dusty.

- Strong Structural Elements

A solid structure is ideal for any home, but it is especially critical when you are buying a fixer-upper. If the home has a crumbling foundation or serious roof problems, you will have to decide if you are willing to pay to repair this type of damage.

These are the five important structural elements:

- Roof

- Heating, ventilation, and air conditioning (HVAC)

- Plumbing

- Electrical

- Foundation

Find the Right Agent

Buying your house should be a fun and fulfilling experience. If you have done your research and evaluated what you can afford and what you truly need, finding a new home can be exciting. Learning more about the purchase process eliminates the fear of the unknown and lets you search for a home with peace of mind.

Windermere’s community of real estate professionals is our greatest asset. We have experts in all areas of real estate, from your typical starter home to condos, luxury properties, and new construction. While residential real estate is the mainstay of our business, Windermere also has offices and associates who specialize in property management, commercial real estate, and relocation services. To further facilitate the home buying process, Windermere has affiliated partners in certain regions to provide mortgage, title, and escrow services.

Call us today with any questions or concerns. Our professional Real Estate Agents will help you through this exciting process. (951) 369-8002

The Truth About Down Payments

Many people feel like they are stuck renting because saving enough money for a down payment to buy a house seems unattainable to them. While many people still believe it is necessary to put down 20% when buying a home, that is not always the case. In fact, lower down payment programs are making homeownership more affordable for new home buyers. In some cases, you might even be able to purchase a home with zero down.

What Is a Down Payment?

A down payment is the cash you pay upfront to make a large purchase, such as a home. When making a large purchase, many buyers will pay some of that cost upfront in the form of a down payment in order to reduce the amount of money to be financed. A down payment can significantly reduce the amount the borrower owes to the lender, the amount of interest they will pay over the life of the loan, and monthly payment amounts.

Why Do You Need a Down Payment?

A down payment is typically required on a home to reduce the lender's risk, demonstrate the buyer's commitment, and lower the loan amount, leading to better loan terms and a smaller mortgage. Traditionally, a mortgage down payment is at least 5% of a home's sale price. House down payments are often, but not always, part of the normal homebuying process. If a buyer puts 10-20% down, the theory is that they may be more committed to the home and less likely to default. If there is more equity in the property, the lender is more likely able to recover its loss in the event of foreclosure.

Do You Need to Put 20% Down On a House?

You may have heard that a 20% down payment is always required when buying a home. In fact, that number is really just the threshold many lenders use for requiring mortgage insurance on a conventional loan. When lenders issue mortgages with down payments of less than 20%, nearly all require borrowers to buy private mortgage insurance (PMI) on the loans. Because loans of more than 80% of a home's purchase price are considered risky, lenders require PMI to guard against losing money in case a borrower defaults and they must seize and resell the property.

Just keep in mind that making a lower down payment can help you achieve your goal of homeownership more quickly. However, a higher down payment brings down the principal (and lifetime interest payments), which might cost you less throughout the life of the loan. Weigh the pros and cons to decide what’s best for you.

In 2023, the typical down payment for first-time home buyers was 8%, according to the National Association of Realtors. The typical down payment was 19% for repeat buyers.

Type of Loans

Different strokes for different folks, right? Well, the same goes for loans. Here are the most common loan types to know about and how much each requires for a downpayment:

- FHA loans: Perfect for those with less saved up or lower credit scores, you can go as low as 3.5% down.

- Conventional loans: Typically, these start at 3% down for first timers.

- VA and USDA loans: If you're a veteran or buying in certain rural areas, you might qualify for zero down.

- Jumbo Loans: These loans are for properties that exceed the county's threshold amount for a conventional loan. They typically require 10% to 20% down.

How Credit Score Impacts Your Down Payment

Your credit scores and overall financial situation can significantly impact the homebuying process. Lower credit scores may limit how much money you can borrow and could lead to higher interest rates or PMI premiums. A strong credit score also means lenders are more likely to be lenient in areas where you may not be as strong, such as your house down payment. Your credit score shows you have a proven history of making payments on time and that you’re less of a risk. In these instances, they might allow you to get a great interest rate while making a smaller down payment.

Before you begin the homebuying process, check your credit reports and credit scores to get an idea of our credit health, as well as to review the information being reported by lenders and creditors. Allow yourself enough time to address any information on your credit reports you believe may be inaccurate or incomplete. Some advance planning may make a big difference when it is time to purchase a home.

Benefits of a Larger Down Payment

Larger down payments can seem like a high priority because they typically result in paying less interest over time and eliminating private mortgage insurance (PMI) fees on a conventional loan (assuming the down payment amounts to at least 20% of the purchase price).

But making a larger down payment has advantages that include:

- A better mortgage interest rate. Lenders may shave a few percentage points off your interest rate if you make a larger down payment.

- More equity in your home right away. Your home equity is your home's value minus the amount you owe on your mortgage.

- A lower monthly mortgage payment. Borrowing less of your home's price lowers your principle, which also means you will pay less interest over the life of the loan.

Considerations to Determine Your Down Payment

How much do you need for a down payment, then? Use an affordability calculator to figure out how much you should save before purchasing a home. You can estimate the price of a home by putting in your monthly income, expenses and mortgage interest rate. You can adjust the loan terms to see additional price, loan and down payment estimates.

Here are some steps you can take before determining how much home you can afford and how much you can put down on a house:

Determine how much you can afford

The first step is to figure out how much money you have available for upfront home costs. If you haven’t already, gather your most recent savings and investment statements so you start with an accurate number. As you decide how much you can spend, make sure you still have enough money available for emergency savings, other savings goals, and closing costs.

You might be tempted to put down the maximum down payment that you can afford. However, it’s important to have emergency savings and cash on hand to pay for unexpected expenses and critical home maintenance. A good goal is to build up an emergency fund with at least three months of living expenses before you move in.

Type of Mortgage

The type of mortgage you choose can also impact how much money you put down, because some have down payment requirements. VA loans, for example, can offer zero money down. Some conventional loans can go as low as 3%, while FHA loans can go as low as 3.5%. Jumbo loans typically require a 10% down payment or more.

The size of your down payment will also be influenced by whether this house will be your primary residence or a vacation or investment property.

Consider Your Options

After evaluating your budget and what you need from your home, it is time to consider all your options. You might need to look for a loan option that allows a smaller down payment, or you might want to give yourself more time to save up for a larger down payment on a house.

It can be beneficial to work with someone who knows the answers to all these questions. A home lending advisor can help you understand the different types of mortgages available and go over down payment requirements for each type of loan to find the right one for your financial situation.

Future Goals

Consider your future goals and aspirations. Will a larger down payment deplete your savings and hinder other financial plans? Finding the right balance between homeownership and other financial goals is crucial.

Find the Right Agent

Windermere’s community of real estate professionals is our greatest asset. We have experts in all areas of real estate, from your typical starter home to condos, luxury properties, and new construction. While residential real estate is the mainstay of our business, Windermere also has offices and associates who specialize in property management, commercial real estate, and relocation services. To further facilitate the home buying process, Windermere has affiliated partners in certain regions to provide mortgage, title, and escrow services.

Call us today with any questions or concerns. Our professional Real Estate Agents will help you through this exciting process. (951) 369-8002

Q3 2023 Southern California Real Estate Market Update

November 2, 2023Home Buyers,Home Sellers,Windermere,Gardner Report

The following analysis of select counties of the Southern California real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

The Southern California market areas contained in this report have been experiencing a fairly significant slowdown in job growth. That said, the region has added 164,700 jobs since the third quarter of 2022, representing a growth rate of 1.7%. The end of the writers’ strike will add a little boost to the Los Angeles area, which has still added over 89,000 jobs over the past 12 months. Orange County employment has grown by 34,100 jobs; San Diego County is higher by 31,400; and employment was up 9,700 jobs in Riverside.

The region’s unemployment rate in August was 5.2%, which was up from 4.2% in the third quarter of 2022. The lowest jobless rate was in San Diego County, where it was 4.3%. The highest rate was in Los Angeles County, where 5.8% of the workforce was without a job.

Southern California Home Sales

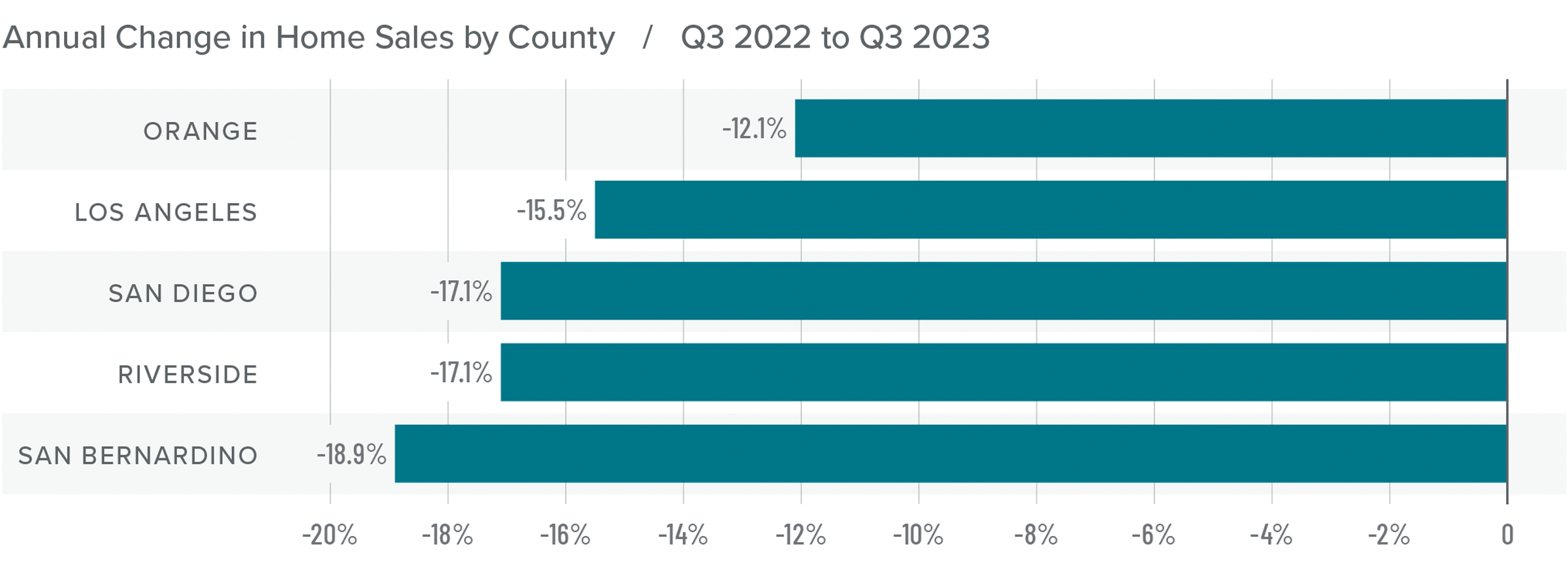

❱ In the third quarter of 2023, 32,398 homes sold, which was 16% lower than in the third quarter of 2022 and down 8.6% compared to the second quarter of this year.

❱ Pending home sales, which are an indicator of future closings, were 8.2% lower than in the second quarter, suggesting that closing numbers may be down in the final quarter of 2023.

❱ Compared to the third quarter of 2022, sales fell the most in San Bernardino County, though there was a significant decline in all markets. The quarter-over-quarter decline was disconcerting given that the number of homes for sale rose more than 14%. Rising mortgage rates are clearly taking their toll on the market.

❱ It’s discouraging that there were fewer sales despite rising inventory levels. Mortgage rates are definitely hobbling the market and until they start to drop, I think things will continue to be lackluster. List prices have started to pull back in response, as sellers realize that the market is not what it once was.

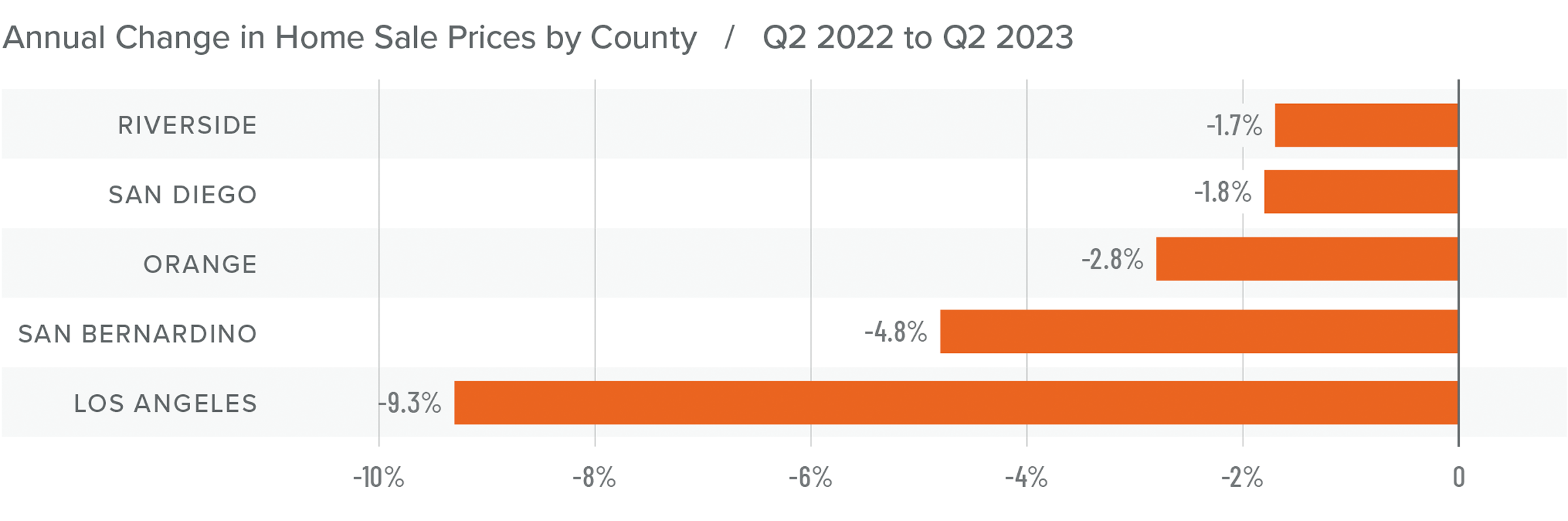

Southern California Home Prices

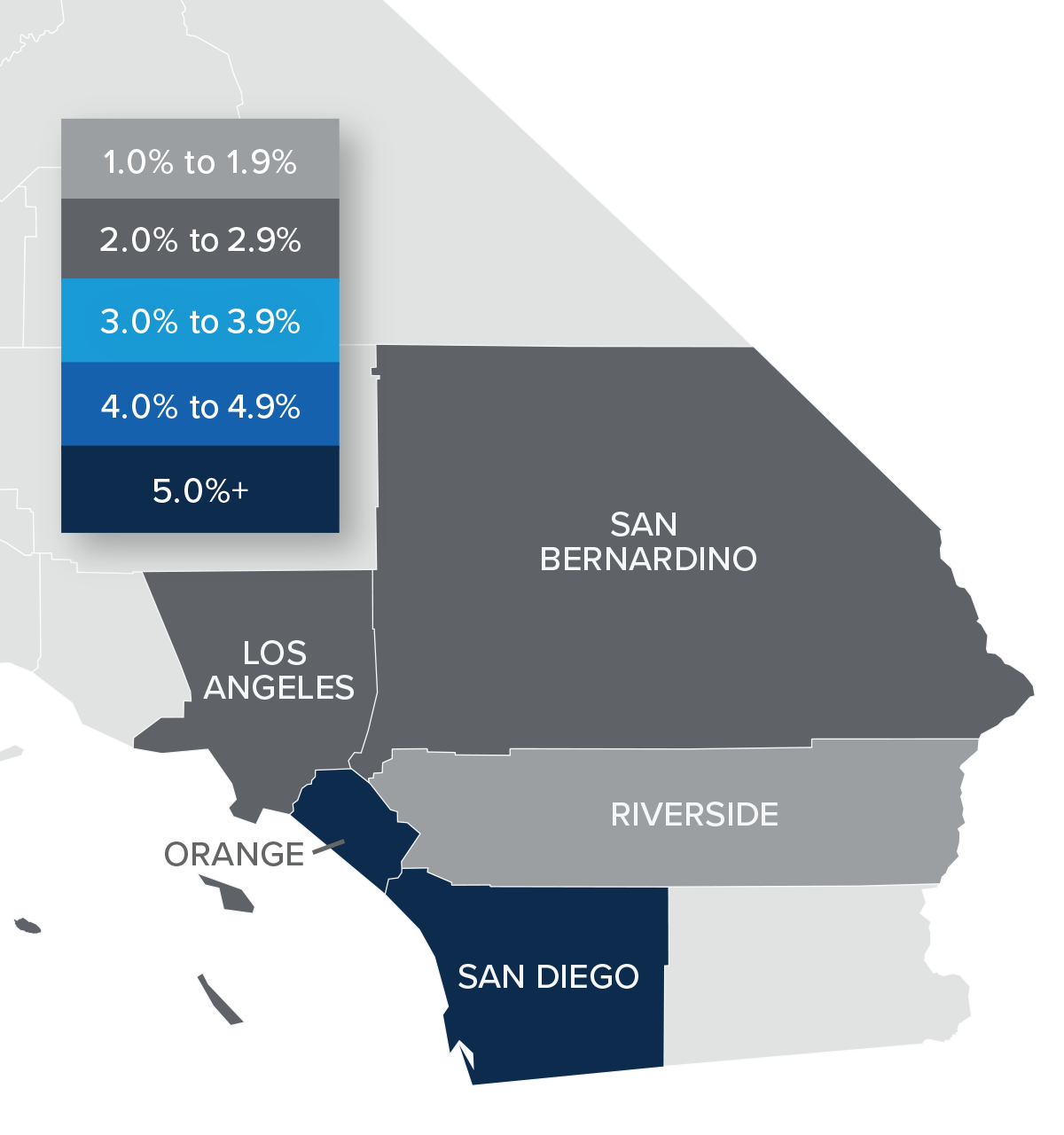

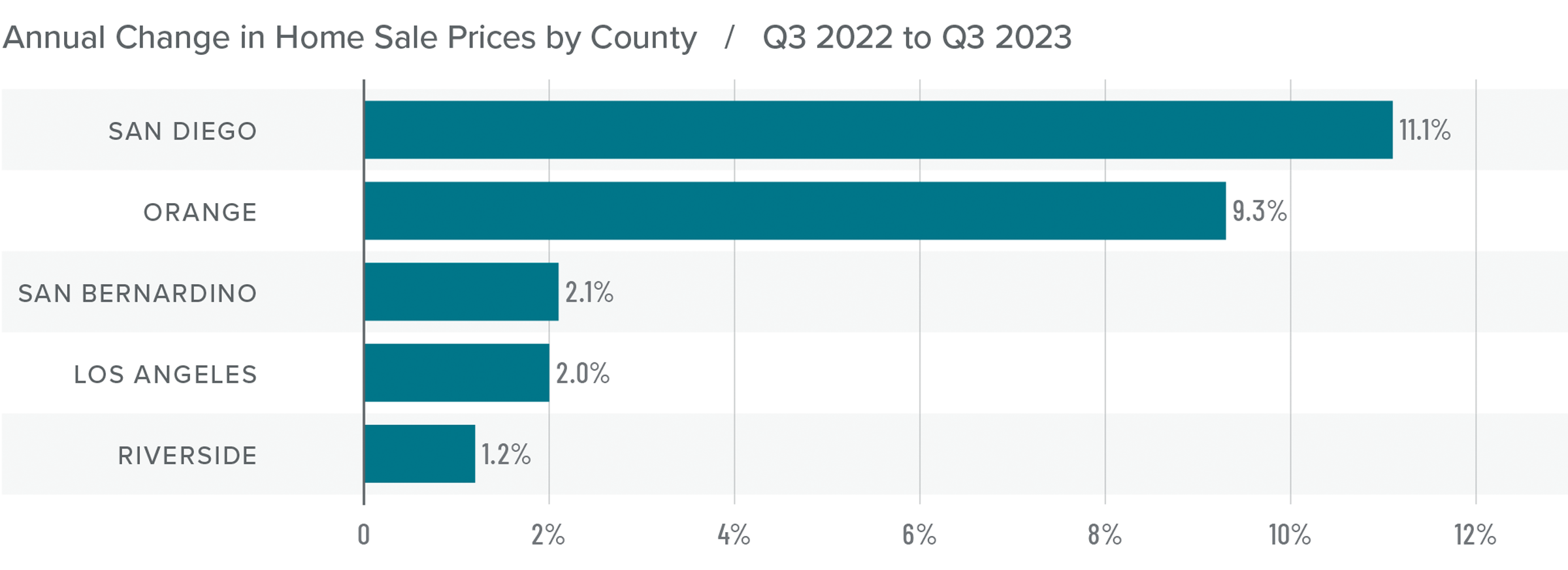

❱ Home sale prices were up 5.7% from the third quarter of 2022 and were 3.8% higher than in the second quarter of 2023.

❱ Affordability continues to be a major constraint in the region, which is being magnified by persistently high mortgage rates. Prices are holding, but growth has slowed significantly.

❱ Year over year, prices rose in all the markets contained in this report, with significant increases in San Diego and Orange counties. Compared to the second quarter of 2023, Riverside County saw prices fall by 5.8%, but they rose in the balance of the market areas.

❱ I expect price growth in Southern California to hold at or near the current pace. However, it’s very possible that home sale prices could drop a little if list prices fall further.

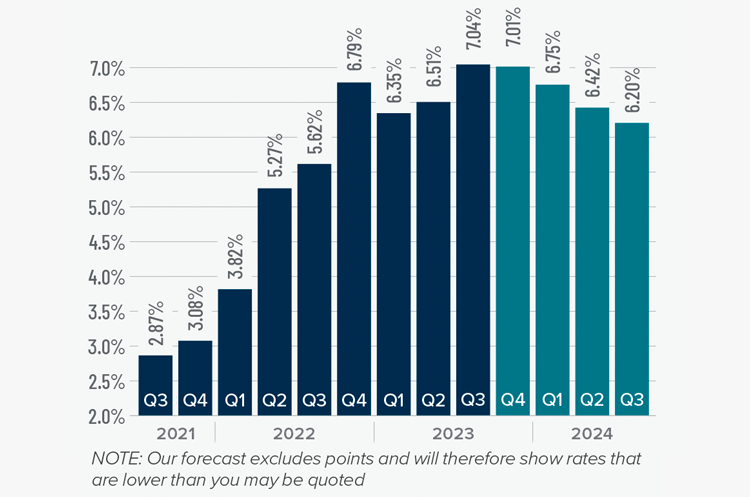

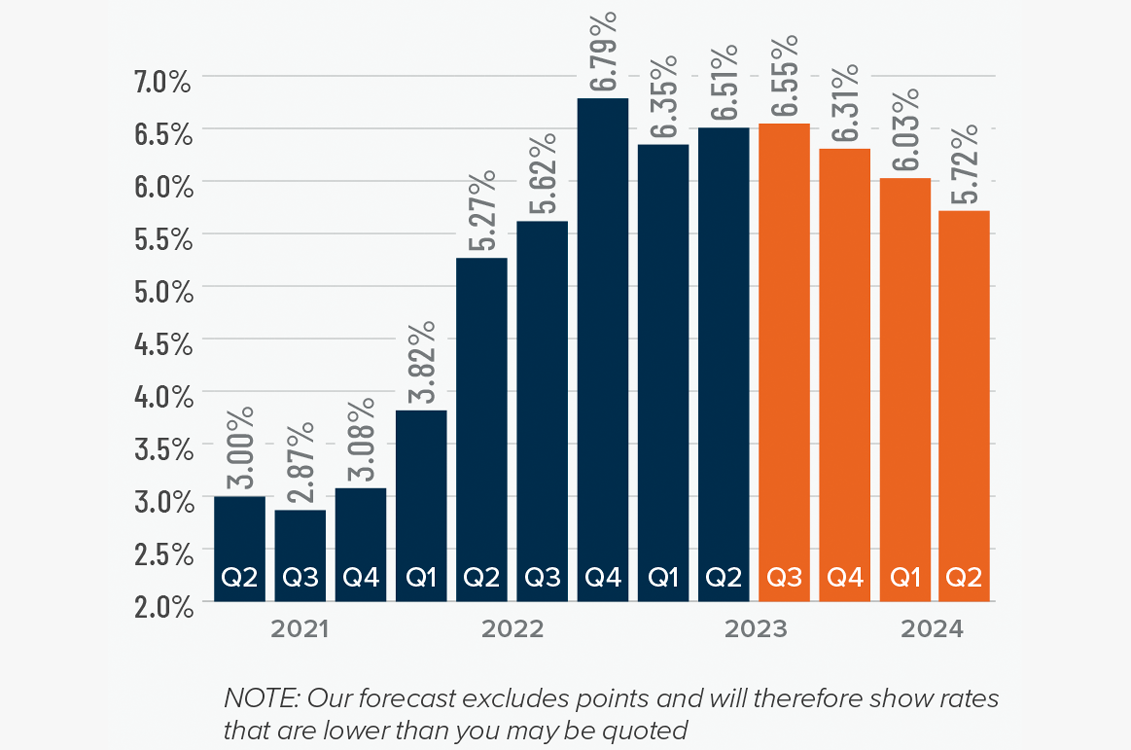

Mortgage Rates

Mortgage rates continued trending higher in the third quarter of 2023 and are now at levels we have not seen since the fall of 2000. Mortgage rates are tied to the interest rate (yield) on 10-year treasuries, and they move in the opposite direction of the economy. Unfortunately for mortgage rates, the economy remains relatively buoyant, and though inflation is down significantly from its high, it is still elevated. These major factors and many minor ones are pushing Treasury yields higher, which is pushing mortgage rates up. Given the current position of the Federal Reserve, which intends to keep rates “higher for longer,” it is unlikely that home buyers will get much reprieve when it comes to borrowing costs any time soon.

With such a persistently positive economy, I have had to revise my forecast yet again. I now believe rates will hold at current levels before starting to trend down in the spring of next year.

Southern California Days on Market

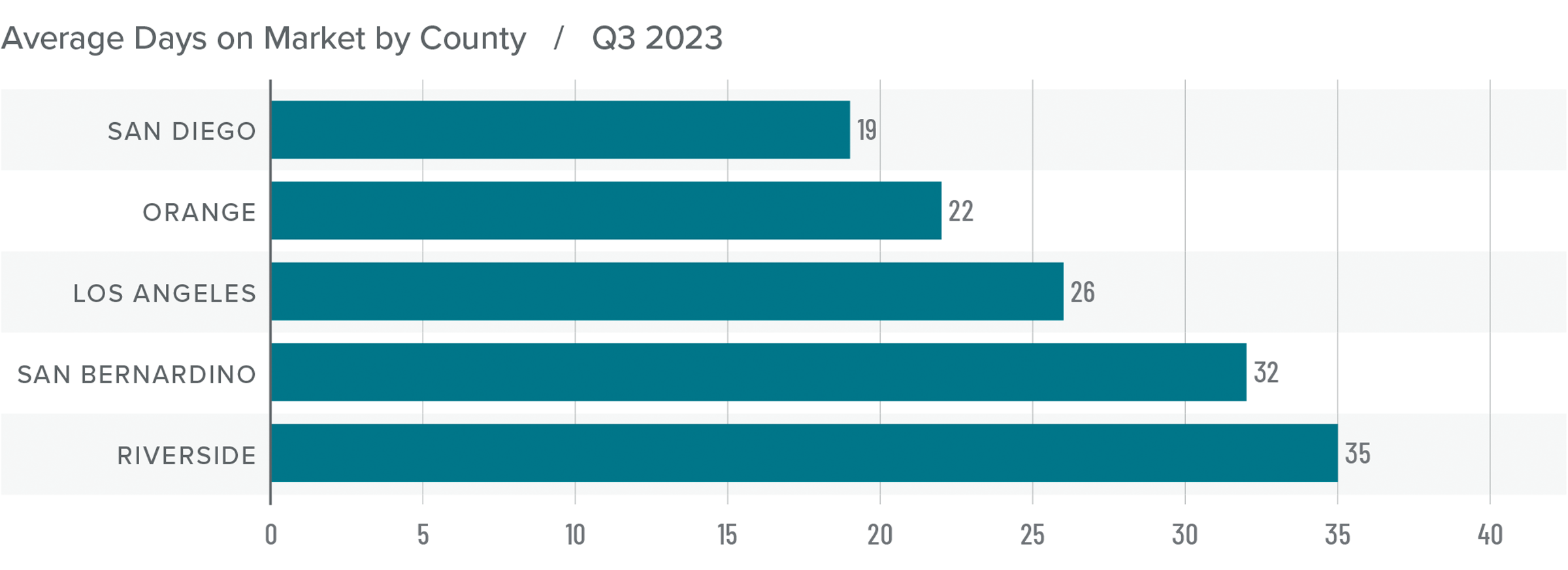

❱ In the third quarter of 2023, the average time it took to sell a home in the region was 27 days. This was up two days compared to the same period of 2022.

❱ Compared to the second quarter of 2023, market time fell six days and was lower across all counties covered by this report.

❱ Homes in San Diego County continue to sell at a faster rate than other markets in the region, but it took two fewer days to sell a home than it did in the third quarter of 2022. Orange County saw days on market fall by one day compared to the third quarter of 2022, but market time rose everywhere else.

❱ Homebuyers saw rising inventories, and those who chose to make offers did so relatively quickly, even though the total number of sales fell. If the number of homes for sale continues to rise, it may also cause market time to rise as buyers become more selective.

Conclusions

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

With inventory levels rising, and sales and asking prices falling, it would be easy to suggest that home buyers have the upper hand. However, home prices are still rising, albeit slowly, which tends to favor sellers.

The quandary really comes down to the fact that while inventory levels have risen, they remain remarkably low compared to historic averages. It’s also likely that the buyers who are still in the market are looking to move more from necessity than desire, which makes sense given today’s high mortgage rates.

That has put us in a very unusual situation. Although sellers are being a little more competitive, as evidenced by the drop in list prices, they have not totally capitulated. Taking all these factors into consideration, I have moved the needle back to the middle of the speedometer. I simply don’t see either side as having the upper hand at the present time.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

8 Signs You Are Ready to Buy a House

We have all heard the saying that renting is like flushing your money down the toilet. Well, we have heard that nonsense too. The truth is, not everyone should buy a house. Homeownership is a major milestone that many people dream of reaching one day. However, there are a variety of factors to consider when making one of the biggest financial decisions of your life.

So, if you have been thinking about becoming a homeowner, but are not sure if you’re prepared, you’ve come to the right place. We’ve laid out 8 questions to help you decide if you are ready to get the ball rolling on buying a house.

8 Signs You Are Ready to Buy a House

Do you frequently find yourself wondering whether to keep renting or buy a home? Here are eight signs that you are ready to make the switch from renter to homeowner.

1. You Have Dependable Income

Regular, dependable income and stable employment is critical to qualifying for a mortgage. A home is a long-term investment, so your source of income is one of the main factors mortgage lenders look at when assessing your eligibility for a loan. If you do not have proof of steady income or have a shaky employment history, you may find it difficult to qualify.

But even if you can demonstrate financial stability on paper, you should only buy a house if you think your income will remain steady for the foreseeable future.

2. Your Debt-to-Income Ratio is Low

You do not have to be completely debt-free to buy a home. Between car payments, student loan debt and other bills, most lenders understand that it is unrealistic to expect borrowers to be totally debt-free these days. Essentially, they want to know that you will be able to afford your mortgage payment based on how much money you have coming in versus what you need to pay out to other debts.

To figure this out, lenders look at your debt-to-income ratio, or DTI, to determine whether you can afford to take on a new loan in addition to your existing debt. The higher your DTI, the more likely you will be stretched too thin financially.

Your debt-to-income ratio (DTI) is the percentage of your monthly debt compared to your monthly gross income. Credit card payments and loan payments and the payments on your new home are examples of the debts lenders include in your DTI calculations. Your DTI should ideally be below 40% when you include your proposed mortgage payment. Some lenders have stricter requirements. The lower your debt in comparison to your income, the better chance you have of qualifying for a mortgage.

So, before you buy a house, knock out a good portion of your debt as fast as possible. Once debt is under control, get busy stockpiling money in an emergency fund. Then your budget will be secure and you can focus on saving up a down payment.

3. You Have a Good Credit Score

Some renters cannot make the leap to homeownership because they do not qualify for a mortgage. Low credit scores are a common reason why: A history of late payments or too much debt will hurt your score. Your credit score is a number that represents your creditworthiness. Credit scores typically range from 350 to 850 with higher numbers representing better credit. Your credit score is calculated with information from your credit report, including payment history, debt and the length of your credit history.

One of the most common questions first-time buyers ask is, “what credit score is needed to buy a house?” While there is no set number for this, you will likely need a minimum credit score of 600 for approval. Although borrowers with a credit score as low as 500 can qualify for some home loans, they will be required to make bigger down payments and pay higher rates. A good credit score gets you better interest rates and loan terms. To qualify for the most favorable rate, however, work on improving your credit score and wait until you have a score of 700 or higher.

4. You Have a Good Down Payment

It can take a long time to save up enough money for a down payment on a home. Although the common perception is that first-time homebuyers need to have a 20% down payment to purchase a home, that is simply not the case. Depending on the lender and type of home loan, you may be required to put down at least 3% (FHA loans, however, typically require at least 3.5%). For instance, a home that costs $300,000 with a 3% down payment requirement will require you to put down at least $9,000.

It is important to remember that the larger your down payment, however, the lower your monthly payments will be and the less interest you will pay during the life of your loan. Do not forget to factor in closing costs, which can be anywhere from 2 to 5% of the purchase price.

5. You Can Cover the Additional Costs of Buying a Home

When you think about buying a home, many only think about their down payment and monthly mortgage payments. But buying a home carries additional costs you need to factor into your budget. Some of these costs are one-time expenses that you won't have to think about again, while others need to be paid regularly.

Other financial aspects of homeownership may include:

- Property taxes: Local governments raise money through property taxes to fund things like schools, law enforcement, fire departments and (supposedly) fixing potholes.

- Homeowners insurance: Sure, homeowners insurance adds more dollar signs to your house payment. But paying for coverage will be way less expensive than trying to replace all your stuff out of pocket if your house ever burned down. Plus, your mortgage lender will require you to have it.

- Private mortgage insurance (PMI): Remember: You can avoid PMI if your down payment is 20% or more. But if you make a smaller down payment, expect to pay around $75 a month per $100,000 that you borrow.

- Homeowners’ association (HOA) fees: Houses located in specific neighborhoods or gated communities sometimes have homeowner's associations (HOA). Almost all condominiums and townhouses have HOAs. When you belong to an HOA, you pay fees for the services and amenities the association provides. The amount and frequency of HOA payments varies.

6. You Have Savings to Cover Maintenance and Repairs

Owning a home means you will have to maintain your property. While you may have enough to purchase a home, you will need to make sure you can also cover the costs of owning one. When a pipe bursts or the air conditioner goes out in a rental unit, you do not have to worry about paying for it: That is the landlord’s responsibility. The same goes for property taxes and routine maintenance expenses. When you are the owner, though, all those costs are your responsibility — so you need to have enough extra money to handle the added expenses.

Many realtors and insurance companies recommend following the one-percent rule. Tuck away one percent of the value of the home you intend to buy each year to cover maintenance and unexpected repairs.

7. You Plan on Staying Put for a While

Another thing to think about is whether you are at a place in life where you are ready to stay in your city for more than a few years. It takes time to build equity in your home through paying down your loan and home price appreciation. If you plan to move too soon, you may not recoup your investment.

8. You Have an Expert Real Estate Agent You Can Trust

It can sometimes be difficult to find a house you love that is also within your budget, but it is a whole lot easier when you have a top-notch real estate agent on your side. Plus, working with a buyer’s agent brings two other big benefits:

- Saving money: In most cases, the home seller pays the commission for your agent—so you pay nothing to get expert help! Even better, a buyer’s agent can save you thousands of dollars on your dream home by fighting for your best interests at the negotiation table.

- Saving time: Without an agent, you’ll have piles of paperwork to wade through. Life’s too busy for that! Let an expert who knows all the laws and regulations specific to your city take care of the red tape for you.

Find the Right Agent

Buying your house should be a fun and fulfilling experience. If you have done your research and evaluated what you can afford and what you truly need, finding a new home can be exciting. Learning more about the purchase process eliminates the fear of the unknown and lets you search for a home with peace of mind.

Windermere’s community of real estate professionals is our greatest asset. We have experts in all areas of real estate, from your typical starter home to condos, luxury properties, and new construction. While residential real estate is the mainstay of our business, Windermere also has offices and associates who specialize in property management, commercial real estate, and relocation services. To further facilitate the home buying process, Windermere has affiliated partners in certain regions to provide mortgage, title, and escrow services.

Call us today with any questions or concerns. Our professional Real Estate Agents will help you through this exciting process. (951) 369-8002

Q2 2023 Southern California Real Estate Market Update

August 1, 2023southern california,real estate market,socal real estate,Home Buyers,Home Sellers,Windermere,Gardner Report,EconomyBusiness,Local Real Estate News,Housing Market,market update,Economy Report

The following analysis of select counties of the Southern California real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

The Southern California market areas contained in this report added 222,700 jobs over the past 12 months, representing a decent growth rate of 2.4%. Although layoffs in the tech sector and the writers’ strike have been dominating headlines, payrolls in Southern California continue to expand. The Los Angeles market has added over 60,000 jobs through the first five months of this year. This was followed by Orange County, which added 19,000 jobs. San Diego County added 16,600 jobs, and employment grew by 6,700 jobs in Riverside County. The region has seen the pace of employment growth slow, but this appears to be more an issue of labor supply rather than a lack of demand. The region’s unemployment rate in May was 4.3%, up from 3.7% in the same quarter of 2022. The lowest jobless rates were in Orange County (3.2%) and San Diego County (3.5%). The highest rate was in Los Angeles County, where 4.8% of the workforce was without a job.

Southern California Home Sales

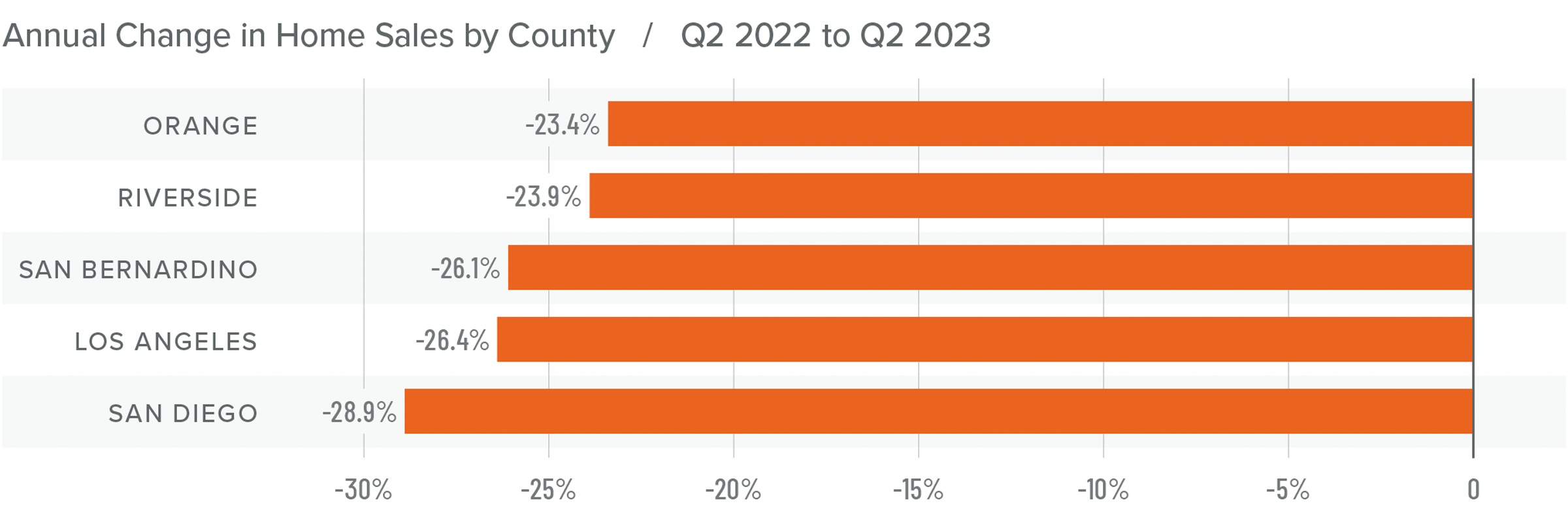

❱ In the second quarter of 2023, 35,381 homes sold, which was 25.9% lower than in the second quarter of 2022 but up an impressive 27.7% compared to the first quarter of 2023.

❱ Pending home sales, an indicator of future closings, were 13.9% higher than in the first quarter, suggesting that sales activity has room to rise further as we move into the second half of the year.

❱ Compared to the same quarter in 2022, sales fell across the board. However, the market heated up in the second quarter compared to the first quarter of 2023: sales were up 36% in Orange County, 29.6% in Los Angeles County, 28.4% in San Bernardino County, 24.3% in Riverside County, and 20.5% in San Diego County.

❱ The growth in sales was even more impressive given significantly rising financing costs in the second quarter.

Southern California Home Prices

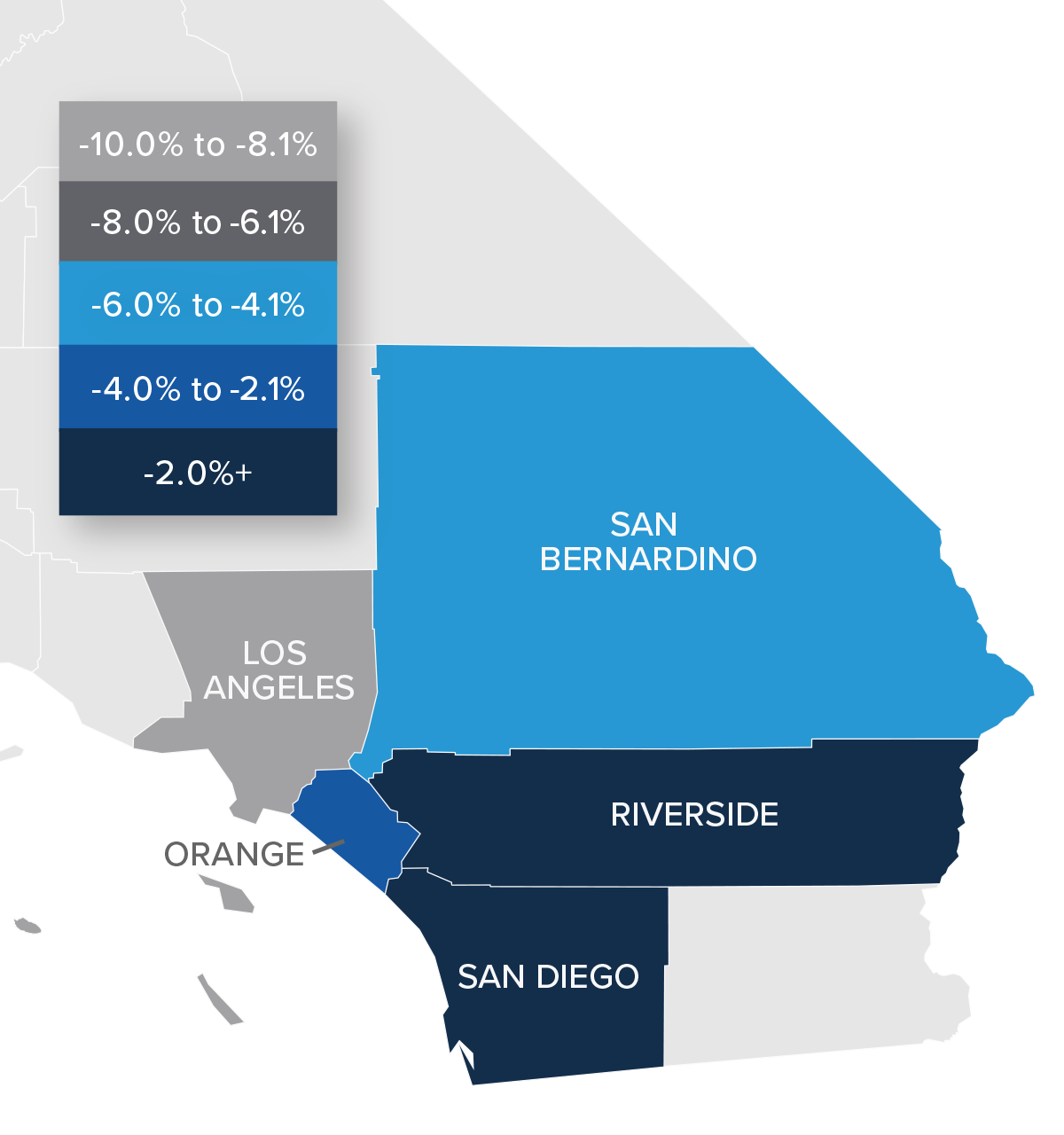

❱ Compared to the second quarter of 2022, home sale prices were 5.5% lower. However, they were 2.1% higher than in the first quarter of 2023.

❱ Affordability continues to be a significant constraint in the region. With median list prices rising 21% in San Diego County and 20% in Los Angeles County compared to the first quarter, it appears that sellers’ confidence levels continue to rise, which will further impact housing affordability.

❱ Year over year, prices pulled back across the region, with a significant drop in Los Angeles County. Compared to the first quarter of 2023, Los Angeles prices fell 4.1%. Closed sale prices rose in the rest of the market areas.

❱ The region has demonstrated significantly more resilience to higher financing costs than expected. As we move through the balance of 2023, I expect prices to rise further, but at a very modest pace.

Mortgage Rates

Although they were less erratic than the first quarter, mortgage rates unfortunately trended higher and ended the quarter above 7%. This was due to the short debt ceiling impasse, as well as several economic datasets that suggested the U.S. economy was not slowing at the speed required by the Federal Reserve.

While the June employment report showed fewer jobs created than earlier in the year, as well as downward revisions to prior gains, inflation has not sufficiently slowed. Until it does, rates cannot start to trend consistently lower. With the economy not slowing as fast as expected, I have adjusted my forecast: Rates will hold at current levels in third quarter and then start to trend lower through the fall. Although there are sure to be occasional spikes, my model now shows the 30-year fixed rate breaking below 6% next spring.

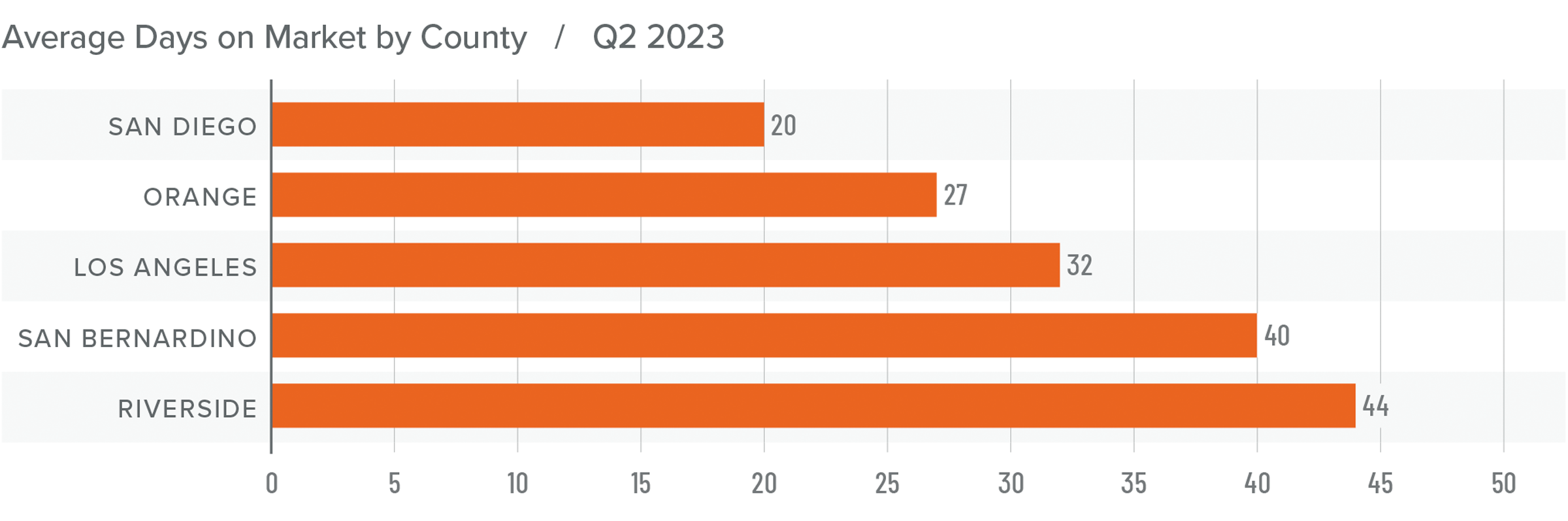

Southern California Days on Market

❱ In the second quarter of 2023, the average time it took to sell a home in the region was 32 days, which was 16 more than in the second quarter of 2022 but 13 fewer days than in the first quarter of 2023.

❱ Compared to the first quarter of 2023, market time fell in all counties covered by this report.

❱ Homes in San Diego County continue to sell at a faster rate than other markets in the region, but all counties saw market time increase from a year ago.

❱ Home buyers appear to be resigned to the fact that supply levels are unlikely to improve any time soon and believe that prices are not going to fall further. This is leading them to pursue buying a home even if mortgage rates remain very high, with the hope they will be able to refinance when rates eventually fall.

Conclusions

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Home prices have stabilized and are starting to trend higher again. This is counterintuitive, especially given that mortgage rates are higher than the market has seen in over 15 years. However, the reason for this is straightforward: a lack of supply is bolstering home values. It will only be when supply levels rise to match demand that we will start to move toward a more balanced market. The issue, though, is that 85.7% of California homeowners with a mortgage have an average interest rate below 5%, and 30% have rates at or below 3%. I find it highly unlikely that homeowners will give up their current rate unless they absolutely have to, which is holding back supply.

Homeowners who do decide to sell are aware of this and are increasingly confident in their ability to sell their homes regardless of mortgage rates. Given these factors, I have moved the needle into the seller’s sector of the speedometer.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Understanding Seller’s Disclosures in Real Estate

When you are buying a house, you need to be aware of any potential issues with the property. The seller has an obligation to disclose any issues they are aware of. Proper disclosure means the buyer gets a more comprehensive view of the property, and the seller lessens their chance of getting sued by the new owner for hiding information.

A seller’s disclosure is a document that sellers are legally required to provide buyers. This piece of paperwork will include all the undisclosed details related to the property that negatively affect its value.

Familiarizing yourself with the seller’s disclosure form will benefit all parties—buyer and seller alike.

What is a Seller’s Disclosure?

A seller’s disclosure statement form is a standard checklist form containing material defects and features of the property. It provides information about the property that may negatively affect the value of the house.

If there are material defects in a property that may impact the value of the property AND the seller is aware of them, the seller should disclose them. However, sellers should report these defects to the best of their knowledge and in good faith. From pest infestation to pending legal issues, you should disclose any known information. This will help you avoid future disputes.

Remember, every state has different seller’s disclosure laws. So, it is advisable to review the form with your real estate agent or lawyer as per the statutes in your state. Usually, the disclosure form is completed along with the listing paperwork – especially in the Multiple Listing Service (MLS) provided by the listing agent.

Seller Disclosure Basics

Here are four important things to know about property disclosure statements.

They Differ From One State To The Next

While a few disclosures are federally required, most disclosure requirements are state-specific and vary from one state to the next. Therefore, an experienced real estate agent should be familiar with the state's disclosure laws.

They Must Be Written

Real estate disclosures, like all documentation related to the sale or purchase of your home, must be submitted in writing

Inspection Reports Are Not Made From Disclosure Statements

Although disclosure statements are required by law, not all sellers conduct a pre-inspection, and not all buyers opt to have a home inspection.

Disclosures Do Not Require Investigation

You must report all defects or issues in your home. However, you do not have an obligation to search for them. Instead, check the state laws to ensure you understand the details.

Why is a Seller’s Disclosure Important?

A seller’s disclosure protects the buyer by informing them of any issues or defects the home and surrounding property may have. It also safeguards the seller from being sued by the buyer after the transaction if the seller’s disclosure was completed correctly.

For buyers

The goal of the seller’s disclosure is to inform the buyer of the property’s history so buyers can make an informed decision. If the seller’s disclosure reveals a major issue with the home, buyers can back out of the deal without losing earnest money. Any problems documented in the seller’s disclosure can also give the buyer some negotiating power, such as the price of the home or requesting the seller make any necessary repairs.

For sellers

The seller’s disclosure can only protect the seller if done accurately and honestly. If done correctly, this document will protect the seller from being held legally liable for any issues that may develop with the home in the future. This is only the case if the seller made the buyer fully aware of all home defects before the completed purchase. The seller only needs to disclose what is required by their state.

What Should a Seller’s Disclosure Include?

A seller’s property disclosure should include a full list of issues. The exact issues that need to be listed vary from state to state, so make sure to find out your state’s requirements. Some general problems with seller’s disclosures issues across the country include:

- HVAC

- Mold

- Pest infestations

- Water damage

- Leaks

- Foundational integrity issues

- Lead paint

- Asbestos

- Additions and improvement projects (without a permit)

- Any major repairs made by the seller or previous owners

- Insurance claims made

When Do You Receive the Seller’s Disclosure?

In many cases, you will get the seller’s disclosure form before you make an offer on the property. The form will be ready for all prospective buyers. But in some states, the seller must provide the disclosure a certain number of days after your offer is accepted or a certain number of days before closing.

Review the seller’s disclosure notice carefully and talk it over with your real estate agent. Before you move forward, you will need to sign the property disclosure statement acknowledging that you received it.

Can the Buyer Walk Away After Receiving the Seller’s Disclosure?

In many cases, yes — but state law may have a say. You generally have a chance to back out of the sale within a certain number of days after receiving the seller disclosure statement. Also, if you don’t get a seller’s disclosure and the sale doesn’t fall under one of your state’s exemptions, you may be able to cancel the purchase without penalty.

What if the Seller Lies?

If your seller lied on the property disclosure statement, and you have already closed, you need to be ready to prove that information was intentionally withheld in a court of law. The buyer can sue for damages sustained due to omitted information bear in mind that there is a statute of limitations. If too much time has elapsed, you no longer have a case, although you may still be able to sue for fraud.

As a seller, keep in mind that you can be held liable for damages and repair costs if you are caught lying on the seller’s closing disclosure.

Check your state’s guidelines and stay informed. Familiarize yourself with the laws and requirements and do your best to purchase from a reputable seller.

Get a Home Inspection Even With a Seller’s Disclosure

In addition to the seller’s disclosures, the buyer should always have an inspection done. No matter how thorough or trustworthy the seller may be, a seller’s disclosure is no substitute for a thorough home inspection by a licensed and qualified professional. Most buyers are not trained to look for and identify the issues that can affect the average home. Before you buy, it is in your best interest to get an inspection.

Find the Right Agent

Windermere’s community of real estate professionals is our greatest asset. We have experts in all areas of real estate, from your typical starter home to condos, luxury properties, and new construction. While residential real estate is the mainstay of our business, Windermere also has offices and associates who specialize in property management, commercial real estate, and relocation services. To further facilitate the home buying process, Windermere has affiliated partners in certain regions to provide mortgage, title, and escrow services.

Call us today with any questions or concerns. Our professional Real Estate Agents will help you through this exciting process. (951) 369-8002

12 Common Things That Fail a Home Inspection

Once you have a buyer for your home, you may start thinking the home selling process is basically over, except for finalizing paperwork. But you still have a big step ahead of you. The home inspection!

A home inspection examines the parts of a home, from the roof to the foundation. Inspections are often requested by buyers interested in a property, sellers who opt to do a pre-sale home inspection and homeowners who want some peace of mind. Inspections are not mandatory but recommended for buyers to ensure they are not purchasing a home with major, costly issues.

A home inspector can reveal things that fail a home inspection that may affect the house’s safety, functionality, and value. By being aware of these potential issues, buyers can approach the home buying process with confidence and make informed decisions about their investment.

How Does A Home Inspection Work?

A home inspector should take several hours to complete a detailed walk-through of the home in question. During that time, the inspector will take notes and pictures. Most importantly, the inspector will provide an objective opinion on the home’s condition. A home inspector does not necessarily determine whether your home is compliant with local building codes.

They also will not comment on anything aesthetic, unless it suggests that a larger problem lies beneath. Although inspectors should have a keen eye for detail, they will not be able to detect the unseen. That means hidden pests, asbestos, mold or other potentially hazardous substances might go unnoticed.

Areas that are not readily accessible, like the septic tank, will not be covered, either. Those sorts of issues can require specialized evaluations.

12 Common Home Inspection Fails

These are the 12 most common things that fail a home inspection. Some may surprise you:

1. Foundation Problems

A foundation inspection is when a structural or foundation engineer inspects your home’s foundation. They will walk around your home, checking out key areas that may be showing signs of foundation issues. The goal of this inspection is for the inspector to make you aware of any foundation damage they are seeing in the home, how it could affect your safety and what can be done to rectify the situation. Inspectors will also be aware of any relevant building codes and if the home’s foundation is properly up to code.

What to look for:

- Cracks on the exterior walls of the home

- Leaning or tilting chimney

- Sagging or uneven floors

- Cabinets separating from the wall

- Windows and doors that don’t open or shut properly

- Cracks in interior walls and ceilings

- Bowing walls

2. Roofing Issues

One of the most common things that can result in a failed home inspection is the condition of the roof. If your roof is in bad shape, it can be a major problem for potential buyers. Leaks, missing shingles, and other damage are often signs that the roof needs to be replaced, which is a major expense.

If you are selling your home and you know that the roof needs to be replaced, it is best to replace it before putting your home on the market. This will give you a much better chance of passing the home inspection, and it will also make your home more appealing to buyers.

If you are buying a home and the roof needs to be replaced, you can attempt to negotiate with the seller to have them replace the roof before you close on the house. If they are unwilling to do this, you may be able to get them to give you a credit that you can use to pay for the roof replacement.

What to look for:

- Damage to the shingles

- Missing shingles

- Missing flashing

- Signs of water damage on the roof and in the attic

- Decay

- Signs of sagging or weak spots

3. Water Damage

One of the most serious and financially damaging issues in a home inspection is water damage. It can cause significant problems such as foundation damage and mold growth. Water damage and high humidity can lead to mildew and mold issues in your home. Unfortunately, black mold is expensive to fix and highly dangerous to your health and the health of anyone moving into your home.

What to look for:

- Visible leaks coming from exposed pipes

- Signs of water, including stains and mildew

- Sounds of running water or dripping

- Low water pressure

- A rise in your water bills, but not in your usage

4. Electrical Issues

Safety is perhaps the most important factor when buying a home, and electrical issues can threaten that safety immediately. Home inspectors will typically look for electrical problems that may cause fires, though they cannot always check ceiling interiors. In fact, most house fires are caused by bad electrical wiring. The bad news is that it can cost a massive amount of money to fix. Good inspectors will notate any code violation found during the inspection along with spliced wires which are more easily fixable. If an inspector cites issues, you should hire an electrician to give an estimate.

What to look for:

- Faulty, damaged or exposed wiring

- Outdated or damaged electrical panel

- Overloaded breakers

- Switches or outlets that don’t work

5. Plumbing Problems

Plumbing issues and leaking pipes are frequent reasons for a home inspection to fail. These difficulties might be as basic as a slow drain or a leaking faucet, or they can be more complex, such as cross-connection problems (where water from another source contaminates domestic water).

In some situations, pipes will have to be replaced altogether. Plumbing is a major source of concern because if a hidden leak is left unattended, it can result in mold spreading throughout the home.

To locate leaks, the home inspector will look for signs of mil damage, and fractures around pipes throughout the home. Additionally, they will inspect the ceiling for wet stains or fractures.

What to look for:

- Mold growth on cabinets or walls

- Brown spots on the ceiling

- Unpleasant smells coming from the drains

6. HVAC Problems

HVAC systems and ductwork should be in working order to ensure proper air quality and temperature regulation in the home. Certain HVAC issues can fail a home inspection due to a matter of safety. Your inspector will want to know your system is working properly, has proper ventilation and isn’t leaking carbon monoxide, refrigerant or any other harmful toxins.

What to look for:

- Refrigerant leaks

- Cracks in ductwork

- Loose electrical connections

- Squeaks, noises or bangs coming from your unit

- The smell of gas

- The presence of carbon monoxide (using a detector)

7. Mold

Not all mold is a major health concern, but certain types are: including black mold. If an inspector finds black mold on the property, it is going to become a major issue with completing the sale. Black mold is most commonly detected within crawlspace or basements which can make it go unnoticed to the untrained eye. Aside from the potential health threat, mold can also be symptomatic of structural issues or even plumbing issues. In either case, the source of the problem must be addressed. Depending on the depth of the issue, this process can be a very expensive ordeal.

What to look for:

- Standing water

- Musty smells

- Actual, physical mold

8. Termites and Other Pests

Infestations by pests like termites can cause significant damage to the structure of a home and require costly repairs. According to the University of Kentucky, the estimated annual cost of termite damage is in the billions.

What to look for:

- Rodent droppings

- Scratching and rustling noises

- Nest materials

- Holes or gnaw marks in your wood

- Swarming

- Buckling wood

- Swollen floors or ceilings

- Visible tunnels in your wood

- Mold or mildew smells

9. Windows and Doors Issues

It is important for the windows and doors in your home to function properly for safety’s sake, including making sure that they all open, close, and lock properly. Foundation issues can cause doors and windows to become unstable and unreliable, but other issues might have a hand in this too, such as cracks in the wall or problems with the framework.

While it is not always expensive to replace doors and windows, it becomes a much bigger job if the structure of the home causes the issue. Bear in mind that if a home inspector tells you there’s something wrong with them—you’re likely not seeing the root cause.

What to look for:

- Difficulty opening or shutting doors and windows

- Broken or malfunctioning locks

- Large, uneven spacing at top of closed doors

- Broken windows

- Windows letting in outside air or water

10. Building Code Violations

Building code violations are another common problem that can raise red flags for potential buyers. These violations can range from minor things, like not having the proper permits for your renovations, to major issues, like not having the proper supports in place for your deck.

If you are buying a home that has building code violations, you need to be aware of the potential risks. You may be liable for the costs of repairing the violations, or you may be forced to demolish the offending structure.

Home inspectors are not building code inspectors. However, they tend to find secondary defects in the structures that were not installed properly. Items such as improper electrical or windows too high for emergency situations. It is recommended that buyers check for any permits on alterations or structures that were added prior to the close of escrow.

If you are selling a home with building code violations, you need to disclose them to potential buyers. You may also need to get the violations corrected before you can close on the sale.

What to look for:

- Permits for any additions or other projects done on the home

- Violations based on your specific city’s codes and ordinances

11. Structural Issues

Many houses sustain some, albeit usually minor, structural damage from problems in one or more of the other categories, such as foundation walls, floor joists, rafters, or window and door headers. These issues are more prevalent in older homes.

What to look for:

- Sagging floors, rafters or roof

- Sloping floor

- Cracks in exterior brick or mortar

- Wood rot

- Cracks on walls or around windows and door frames

- Damp subfloors

12. Drainage Problems

This issue is frequently associated with water damage, as improperly graded homes prevent water from draining properly.

The inspector might notice spongy earth around the home’s foundation and basement leaks. Different circumstances can result in a variety of concerns around the house.

When the terrain surrounding the home slopes downward toward the house, this might result in moist or wet crawl spaces, foundation movement, or foundation cracking. Should water wick up the house’s foundation, it can cause rot and mold in the walls.

What to look for:

- Overflowing gutters

- Flooding in your yard

- Water pooling near the home

- Water leaking into the basement

- Musty smells

- Mold and mildew

- Efflorescence on your basement walls

Do You Have To Fix Every Problem Found During A Home Inspection?

A home inspection report is not a to-do list; you do not need to fix everything a home inspector thinks could stand for improvement. Basically inspection repairs fall into three categories: fixes that are pretty much required, according to the inspector; fixes that typically aren’t required; and fixes that are up for debate. Here’s how to know which is which.

There are some repairs that will be required by lenders before they will release funds to finance a buyer’s home purchase. Typically these address costly structural defects, building code violations, or safety issues—sometimes in the attic, crawl spaces, and basement—and others related to the chimney or furnace.

An inspector will also check whether your septic system and heater are in good condition and verify whether there’s a possible radon leak or the presence of termites (homeowners tend to have many questions on these topics). Other conditions of the home that an inspector may report on include those related to the roof, electrical systems, and plumbing lines and the condition of your HVAC system.

If a home inspection reveals such problems, odds are you’re responsible for fixing them. Start by getting some bids from contractors to see how much the work will cost. From there, you can fix these problems or—the more expedient route—offer the buyers a credit so they can pay for the fixes themselves. This might be preferable, as you won’t have to oversee the process; you can move out and move on with your life.

Find the Right Agent

Buying your house should be a fun and fulfilling experience. If you have done your research and evaluated what you can afford and what you truly need, finding a new home can be exciting. Learning more about the purchase process eliminates the fear of the unknown and lets you search for a home with peace of mind.

Windermere’s community of real estate professionals is our greatest asset. We have experts in all areas of real estate, from your typical starter home to condos, luxury properties, and new construction. While residential real estate is the mainstay of our business, Windermere also has offices and associates who specialize in property management, commercial real estate, and relocation services. To further facilitate the home buying process, Windermere has affiliated partners in certain regions to provide mortgage, title, and escrow services.

Call us today with any questions or concerns. Our professional Real Estate Agents will help you through this exciting process. (951) 369-8002

How to Improve Your Home’s Value

If you are looking to increase the value of your home to sell, or are just looking to make some upgrades you will need to know the improvements that will hold their value.

Many of the tips are DIY, while others require some professional assistance. But whichever route you decide to go, select the options that make the most sense for you and your home. Last thing you want is to spend more on improvements than you will get back when you sell.

Below you will find some of the most cost-effective things you can do to improve your home’s value, while also ensuring a healthy return on your investment.

1. Increase Useable Square Footage

Adding to the square footage of your home is another way to increase your value, although consulting with a professional will ensure you make the right addition and yield the best return on your investment. When real estate agents and prospective buyers pull comps (comparable sales) to see if the home’s value aligns with the asking price, this is a significant factor.

Here are options to consider:

- Accessory dwelling unit: This could be an additional living space on your property, such as a garage or shed that has been converted into a guest living quarters, an additional room for a large family, an office or a rental unit.

- Finished basement: Turning your basement into finished habitable living space for guests, as a recreational room, gym or office can significantly boost value and eye-appeal for prospective buyers.

- Finished attic: Just like the basement, turning your attic into a habitable space can increase your home’s value.

- Bedroom addition: The more bedrooms you have, the higher the price of the house. Depending on how much space you have to work with, add another room or rooms to match preferences and trends in your local housing market.

- Bathroom addition: Likewise, the more bathrooms, the greater the property’s appeal, especially for families. An additional bathroom or half-bath is worth it, particularly if you only have one bathroom.

2. Small Changes Can Add Up to a Big Difference

The little things matter. Compared to remodeling your kitchen or installing hardwood floors, it’s relatively inexpensive to:

- Add a new coat of paint or change loud paint colors

- Stain your deck, fence, cabinets, or any other area where wood is looking worn

- Update dated light fixtures, knobs, ceiling fans, and hooks

- Plant a tree or some flowers near the walkway to the house

- A new mailbox is inviting and feels homey

3. Improve Your Outdoor Space

When people talk about adding value to your home, you often hear curb appeal, but don’t forget the backyard (or the sides). Your property is another opportunity to expand its living space. Adding a deck or patio, with room for seating and a built-in or freestanding grill, is a way to create a defined space for outdoor living on a large or small scale.

But whatever you do, really weigh the pros and cons before you add expensive features like a swimming pool. While buyers in some markets see pools as a major plus, others do not want the added expense, ongoing maintenance, or potential liability.

4. Update the Bathrooms

Bathrooms are one of the most critical rooms in a home. If your bathroom is over 10 years old, a facelift is necessary if you want to make your home more attractive to prospective buyers, or sell it at a higher price.

Upgrades like a fresh coat of paint; replacing the cabinets, faucets, showerheads and countertop; or installing a new sink or tiles can go a long way. Many of these ideas, you can also do yourself for a few hundred dollars.

5. Remodel Your Kitchen

Many buyers narrow in on the kitchen as the central feature of a home, so if yours is outdated, it can ultimately affect how much you garner from a sale. If updating your entire kitchen is too big of an undertaking, a minor remodel could still have an impact on your home’s value — think coordinating appliances and installing modern hardware on your cabinets. Talk with a real estate agent about what makes the most sense and what will command the most dollars from prospective buyers.

Before embarking on a kitchen remodelling project, speak to an interior design or real estate professional to understand what features will help your house sell or enhance its value. They will also be able to tell you the types of kitchen trends that customers prefer now, and are willing to pay more for. That way you can avoid wasting your money.

6. Do a Deep Cleaning

It should go without saying, but you can increase the value of your home with only a little elbow grease plus the cost of some sponges, gloves, and cleaner. And now more than ever, homebuyers want a home that feels clean and safe.

Move furniture and appliances. Take out personal items and clean out drawers.

7. Making the Home Energy Efficient

Lowering your home's energy costs will save you money for as long as you live there and is expected to be a major selling point down the line. Indeed, "energy-efficient" was second only to "safe community" on the list of attributes that would most influence a purchase decision.

Things That Do Not Actually Increase Value

Before we dive into how to improve home value, it’s important to be aware of some myths about what increases home value, so you can avoid spending too much on upgrades that don’t typically boost home value.

These home value improvement myths include:

- over the top landscaping

- water features

- bridges

- pergolas

- fancy electrical wiring e.g. copper pipes

- swimming pools

- hot tubs

- saunas

- white appliances

- solar panels

Find the Right Agent

Home improvements that add value mean more money when you sell and more joy while you live in your home. When you understand how to increase the value of your home, you are setting yourself up for success now and in the future. Be sure to add unique touches to make your home feel cozy and welcoming. These steps will go a long way toward helping your home stand out from the crowd.

Windermere’s community of real estate professionals is our greatest asset. We have experts in all areas of real estate, from your typical starter home to condos, luxury properties, and new construction. While residential real estate is the mainstay of our business, Windermere also has offices and associates who specialize in property management, commercial real estate, and relocation services. To further facilitate the home buying process, Windermere has affiliated partners in certain regions to provide mortgage, title, and escrow services.

Call us today with any questions or concerns. Our professional Real Estate Agents will help you through this exciting process. (951) 369-8002

14 Features of Your Home That Turn Off Potential Buyers

Homebuyers can be fickle and a bit snobby. You will see them turning their noses up at the smallest things simply because the house does not fit every point on a dream home checklist.

Once your house goes on the market, you essentially begin living in a museum that needs to stay perfect in case a last minute showing is scheduled. Making sure everything is in place and the staging will attract buyers can help ensure that the house sells fast so you can move on to the next phase. Open houses and private showings are inconvenient and intense for the whole family. If you do not properly prepare for it, odds are good you will not get any offers, or the offers will be for less than you wanted.

Not every home for sale will suit every buyer’s wish list or needs. However, home sellers can take steps to make their property more attractive to potential buyers.

The following are fourteen of the top turn-offs for home buyers you should avoid when putting your home up for sale:

1. Clutter

Decluttering is the first thing we recommend doing before you put your house on the market because it can have an enormous effect on the presentation. Clutter makes any space appear smaller, dirtier, and overall less appealing to buyers. While it’s easy to think buyers can just look past the clutter, it has a subconscious effect on how buyers feel in a space and actually distracts from the positives that are buried beneath it. When a potential buyer walks through the door - or first looks at the listing photos online - you want them to see their home, not your home.

Take the time to declutter the entire house, clearing off all the surfaces, thinning out the decor, and even paring down on how much furniture is in the home to encourage a nice, easy traffic flow and serene setting.

2. Carpet

While carpet reigned supreme for many decades, today’s homebuyer generally prefers hardwood flooring. They are very easy to clean and do not retain dirt like carpets do. Even newer carpet can appear dingy and cheap, especially in high traffic areas.

While lush carpeting feels great underfoot and keeps the room warmer during winter, the majority of buyers now want to see hardwood. They will always be in style, and work with any decor scheme.

3. Bold or Distracting Colors